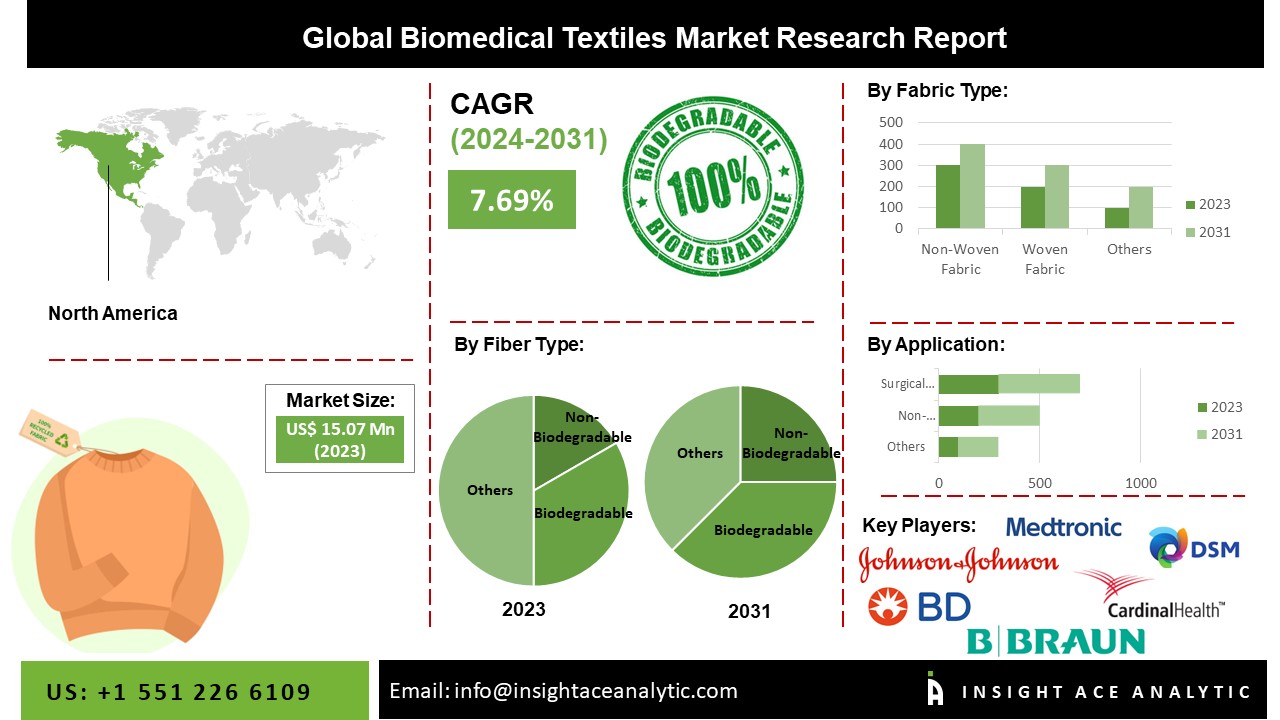

The Biomedical Textiles Market Size is valued at USD 15.07 Billion in 2023 and is predicted to reach USD 26.85 Billion by the year 2031 at a 7.69 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the report:

Fibrous textiles, called biomedical textiles, are used for biological and medical purposes. The biocompatibility textiles are used in surgeries, first aid, and to keep a space sterile. To function properly, such fabrics must be biocompatible with biological tissues and fluids. The rise in the older population, increased healthcare spending, and high demand for biomedical textiles and sophisticated wound dressings are the main factors propelling market revenue development. In addition, biomedical textiles are frequently used to produce first-aid items like bandages and wound dressings because of their remarkable characteristics like filtration, lightness, and absorption.

Additionally, a significant element propelling the market's revenue growth over the anticipated period is the ongoing development of smart biomedical textiles and medical technology improvements. A growing number of techniques, particularly for less invasive surgical operations, are being developed due to the quick advancement of medical knowledge. Modern medical advances have used biomedical textiles to replace damaged tissues or organs. Orthopedic surgeons more frequently utilize non-woven non-woven fiber mats with Teflon and graphite to promote tissue formation around orthopedic implants. While these implants replace bones and joints, fixation plates stabilize fractured bones. It is anticipated that these elements will increase demand for biomedical textiles.

The biomedical textiles market is segmented on fiber, fabric, and application. Based on fiber type, the market is segmented into non-biodegradable and biodegradable. Based on application, the biomedical textiles market is segmented into surgical sutures and non-implantable. Based on the fabric type, the biomedical textiles market is segmented into non-woven, non-woven and woven.

The non-woven non-woven market is anticipated to increase steadily throughout the projected period. As they work to avoid cross-contamination and the spread of infection in a medical or surgical environment, the non-woven non-woven fabric offers essential safety qualities, including prevention against infections and diseases. Non-wovens-wovens are also increasingly employed in creating intelligent wound care solutions, including encouraging moist wound healing conditions, lowering skin adhesion, and regulating vapor transfer. Several biomedical textiles use non-woven non-woven fabrics, including sheets, tubes, gowns, face masks, scrub suits, shoe covers, head covers, sponges, wipes, and plugs. Non-woven-woven fabrics are frequently used in surgical dressings, bandages, and implant applications.

The non-biodegradable market is anticipated to expand quickly throughout the forecast period. The production of biomedical textiles, intended to close open wounds and remove them once the wound has fully healed, is increasingly using non-biodegradable fibers, causing this segment's income to expand. Surgical sutures, bandages, extracorporeal devices, and soft and hard tissue implants treat wounds. Polypropylene, viscose, polyester, polyethylene, and polyamide are non-biodegradable fibers that prevent bacteria from colonizing sutures.

The North American market is anticipated to have the greatest revenue share in the global market due to an increase in home healthcare services. The rapid increase in elderly people and the demand for services to diagnose diabetes are anticipated to propel market revenue growth in this area over the forecast year. Besides, the Asia Pacific market to experience a very high rate of revenue growth over the upcoming years due to the rise in chronic wounds and surgical treatments is likely to cause. Additionally, rising healthcare spending and the swift expansion of the healthcare sector in developing nations like China and India fuel the market's revenue growth.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 15.07 Billion |

| Revenue Forecast In 2031 | USD 26.85 Billion |

| Growth Rate CAGR | CAGR of 7.69 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Fiber Type, By Fabric Type, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Paul Hartmann (Germany), BSN Medical (Sweden), Royal DSM (Netherlands), Covidien (Ireland), Integra Life Sciences (US), Johnson & Johnson (US), Smith & Nephew (UK), Medline Industries (US), B.Braun Melsungen (Germany), and Cardinal Health (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Fiber Type

By Fabric Type

By Application:

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.