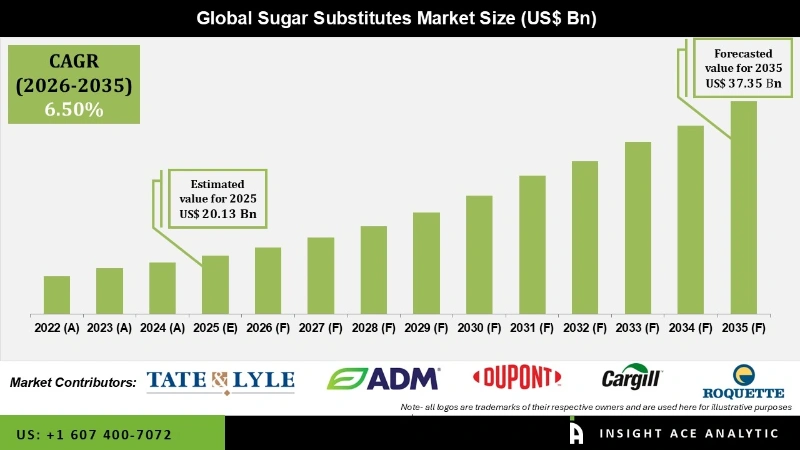

The Sugar Substitutes Market Size is valued at USD 20.13 Billion in 2025 and is predicted to reach USD 37.35 Billion by the year 2035 at a USD 6.50 % CAGR during the forecast period for 2026 to 2035.

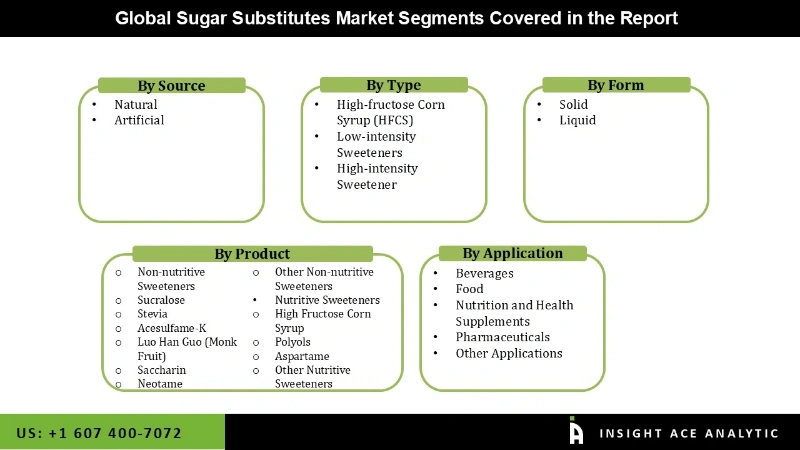

Sugar Substitutes Market Size, Share & Trends Analysis Report By Source (Natural, Artificial), By Product (High-fructose Corn Syrup (HFCS), Low-intensity Sweeteners, High-intensity Sweetener), By Type, By Form, By Application, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Food additives known as sugar substitutes have the same flavour as sugar but less food energy than other sugar-based sweeteners. These sugar substitutes are widely utilized as a substitute for sugar in food products by food makers. The main driver of the sugar substitute market's expansion is the increased consumer awareness of sugar alternatives and the rising demand for zero-calorie or low-calorie goods. The increasing demand for bakery goods and beverages strongly impacts the global sugar substitute market. The primary use of sugar substitutes is to lower costs and use less sugar in the production of food items, which expands R&D prospects and gives manufacturers a competitive edge. Manufacturers of sugar substitutes could benefit from fluctuations in the price of sugar.

The producers and manufacturers' increased expenditure in the market's R&D division will aid in securing a more significant share during the forecasted time. However, the strict government regulations and the negative health impacts of sugar replacements will partially restrain the expansion of this market.

The sugar substitute market is segmented by source, type, product, form and application. Based on source, the market is segregated into Natural and Artificial. Based on type, the market is segregated into High-fructose Corn Syrup (HFCS), Low-intensity Sweeteners and High-intensity Sweeteners. Based on product, the market is segregated into Non-nutritive Sweeteners (Sucralose, Stevia, Acesulfame-K, Luo han guo (Monk Fruit), Saccharin, Neotame and Other Non-nutritive Sweeteners) and Nutritive Sweeteners (High Fructose Corn Syrup, Polyols, Aspartame and Other Nutritive Sweeteners). Based on form, the market is segregated into Solid and Liquid. Based on application, the market is segmented into Beverages, Food, Nutrition and Health Supplements, Pharmaceuticals and Other Applications.

The high-intensity sweeteners sector is anticipated to have the highest growth. The main reasons influencing the demand for high-intensity sweeteners are the vast range of uses, cheap production costs, simplicity of handling, and low cost compared to other sugar alternatives. Additionally, this area includes the most popular low-calorie artificial sweeteners, contributing to its growth.

The natural segment is projected to increase in the global sugar substitute market. The highest growth in this market may be mainly attributable to rising consumer knowledge of the benefits of eating foods with natural ingredients, increasing consumer demand for clean-label and healthy products, and rising adoption of stevia and other natural sugar alternatives by top food and beverage firms., especially in countries such as the US, Germany, UK, China, and India.

The Asia Pacific regional market is registering the highest market share in revenue shortly. The high proportion of the region is due to the rising prevalence of diabetes and obesity, the growing interest in health and wellbeing, the region's well-established food and beverage industry, and the high demand for sugar-free goods.

North American region market held a significant revenue share in the market. The rise in patients with lifestyle disorders like diabetes, obesity, and cardiovascular conditions, as well as rising consumer awareness of value-added food products, are all contributing factors to the market expansion. Additionally, the trend toward leading a healthy lifestyle and the rise in demand for low-calorie food items are the other significant reasons boosting the sugar substitute market's expansion.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 20.13 Billion |

| Revenue Forecast In 2035 | USD 37.35 Billion |

| Growth Rate CAGR | CAGR of 6.50 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Source, Product, Type, Form, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Tate & Lyle PLC (U.K.), Roquette Frères (France), Archer Daniels Midland Company (U.S.), Dupont De Nemours, Inc.(U.S.), Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), JK Sucralose Inc. (China), Ajinomoto Co. (Japan), The NutraSweet Co. (U.S.), Sandsucker AG (Germany), Guilin Lain Natural Ingredients Corp. (China), Hucheng Haitian Pharm Co., Ltd. (China), HSWT France SAS (France), and Stevia lite Holding (Colombia) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Source-

By Type-

By Product-

By Form-

By Application-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.