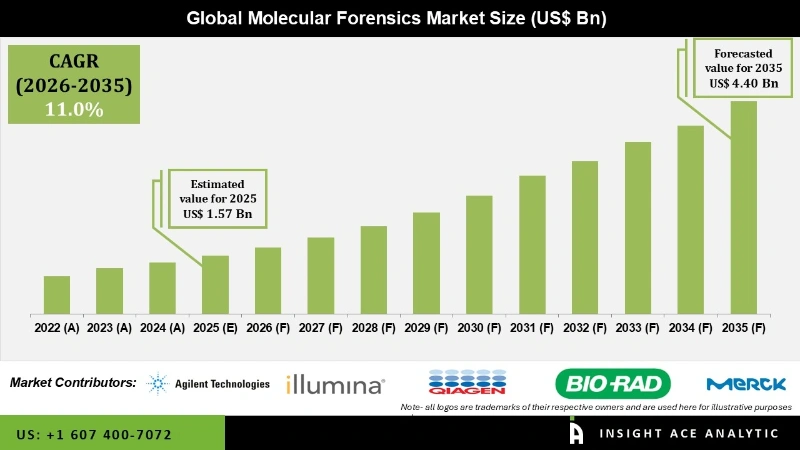

The Molecular Forensics Market Size is valued at 1.57 Bn in 2025 and is predicted to reach 4.40 Bn by the year 2035 at a 11.0 % CAGR during the forecast period for 2026 to 2035.

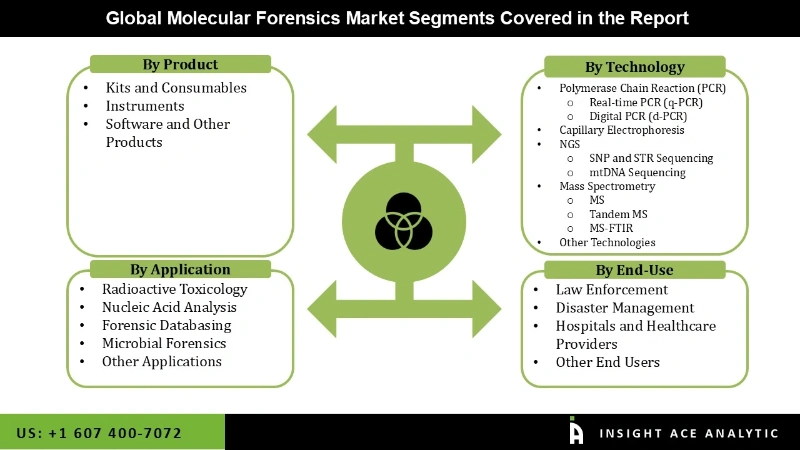

Molecular Forensics Market Size, Share & Trends Analysis Report By Product (Kits and Consumables, Instruments, Software and Other Products), By Technology, By Application, By End-User, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The crucial scientific field of molecular forensics provides a thorough treatment of the value of molecular analysis in forensic research. It entails using forensic examination to implement molecular analysis technology. The investigation and establishment of relevant facts regarding criminal, administrative, and civil hearings are frequently done using molecular forensics. The market for molecular forensics is predicted to expand significantly due to rising security concerns, technological advancements in diagnostics, and growing awareness of the catastrophic consequences of forensics use.

The market for molecular forensics is expected to grow significantly as a result of increased security concerns at both domestic and foreign borders and ports, an increase in crimes like sexual assault, terrorist attacks, kidnapping, gun violence, and homicides, and a shortage of industry players to meet the rising consumer demand. The molecular forensic market is undergoing significant research and development and new product introductions, and this motivates producers to use efficient and effective methods to meet the rising client demand. Additional factors anticipated to propel market expansion in the future include a strong focus on enhancing human forensic case-work, increased investments in R&D activities, and government initiatives to assist forensic research.

However, over the projected period, constraints like high beginning costs, a lack of skilled workforce to handle sophisticated techniques, and uncertainty regarding the accuracy of outcomes from present technologies may restrain market expansion to some extent. The implementation of the legislation in several nations is being hampered by concerns about the provision of permission, the collecting of samples, the chain of custody, and privacy issues. Therefore, one of the main barriers to the molecular forensic market is the lack of consistency in regional government legislation.

The molecular forensics market is segmented on the basis of products, technology, applications, and end-users. Based on product, the market is segmented as kits and consumables, instruments, software and other products. Based on technology, the market is characterized by polymerase chain reaction (PCR) (Real-time PCR (q-PCR) and Digital PCR (d-PCR)), capillary electrophoresis, NGS (SNP and STR Sequencing and mtDNA Sequencing), mass spectrometry (MS, Tandem MS and MS-FTIR) and other technologies. Based on applications, the market is characterized by radioactive toxicology, nucleic acid analysis, forensic databasing, microbial forensics, and other applications. Based on end-users, the market is characterized by law enforcement, disaster management, hospitals and healthcare providers, and other end users.

The vast DNA sequencing methods that support genomic research are referred to as next-generation sequencing (NGS). Along with ongoing technological improvements in sequencers, the widespread adoption of Next-Generation Sequencing (NGS) technologies due to their low cost and remarkable efficiency are some factors fostering the expansion of next-generation sequencing (NGS). In the coming years, it is also projected that growing technological developments in next-generation sequencing (NGS) equipment and technologies will significantly boost the segment's size. Through increased investment in next-generation sequencing (NGS) technologies worldwide, next-generation sequencing (NGS)-related R&D has risen to unprecedented heights. More demand for genome mapping programs and increased next-generation sequencing (NGS) use drive the segment expansion.

The idea of nucleotide conservation for genomic sequences across distinct strains is the foundation for nucleic acid detection diagnostics, which enables the detection using multiple assays. Messenger RNA is a useful source for specimen examination in forensics with tissue-specific patterns for many transcripts. The primary drivers of the worldwide nucleic acid analysis sector are the rise in PCR kit demand and technological development in the research and healthcare sectors. The demand for technologically advanced diagnostic tools and rising government and commercial agency investment in developing novel biotechnological diagnostic procedures are anticipated to support the expansion of nucleic acid testing.

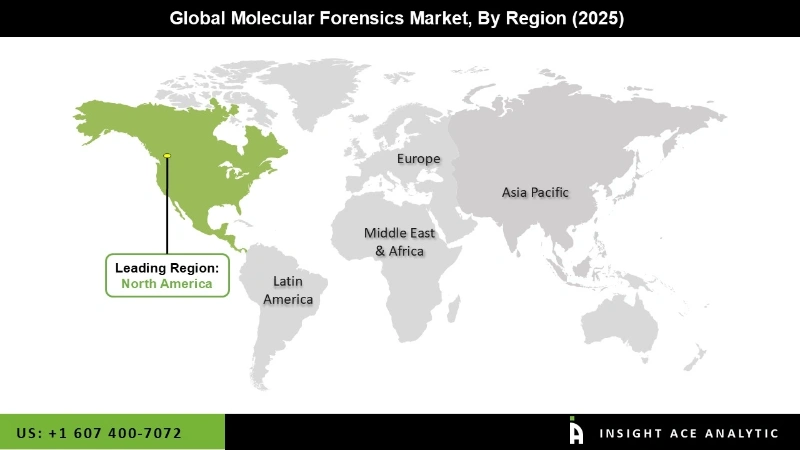

During the projected period, North America is anticipated to have the most significant revenue share in the global market. Rising investments in molecular forensic research, increased criminal cases throughout the region, rapid adoption of improved PCR-based techniques, and extensive use of molecular forensic testing for criminal investigation can all contribute to revenue growth. Technological developments in the forensic sciences, rising investigation consent for sophisticated forensic processes like DNA profiling, and biometric analysis methods are driving the market expansion of molecular forensics in North America. With the availability of advanced forensic laboratories outfitted with cutting-edge forensic technologies, the market in North America has been expanding. In addition, the Asia Pacific region of the world's molecular forensic market is growing at the fastest rate. The demand for molecular forensics has grown significantly in recent years due to regulatory approval of tests in China, Australia, Japan, and other Asia Pacific countries. The technology will gain popularity as more innovative advancements are achieved in this field, and the government promotes using the method in the investigation process.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.57 Bn |

| Revenue Forecast In 2035 | USD 4.40 Bn |

| Growth Rate CAGR | CAGR of 11.0 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, Technology, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies, Inc., Illumina, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Promega Corporation, Eurofins Scientific SE, General Electric Company, Merck KGaA, LGC Limited, and Thermo Fisher Scientific Inc.. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product

By Technology

By Application

By End User

By Region-

Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.