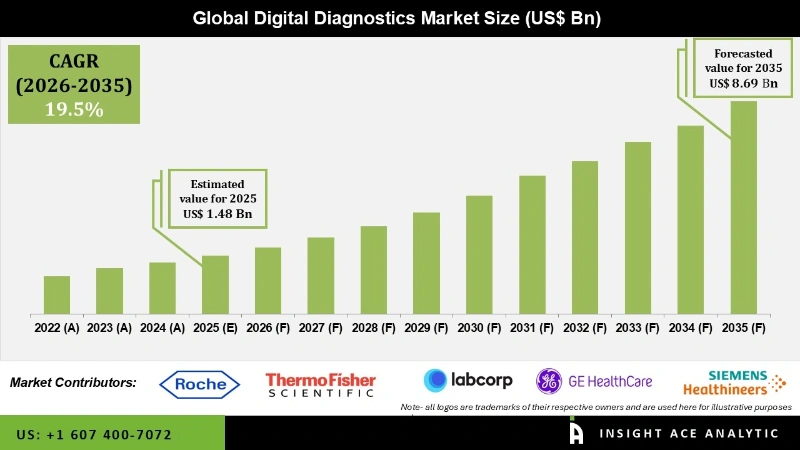

Global Digital Diagnostics Market Size is valued at USD 1.48 Bn in 2025 and is predicted to reach USD 8.69 Bn by the year 2035 at an 19.5% CAGR during the forecast period for 2026 to 2035.

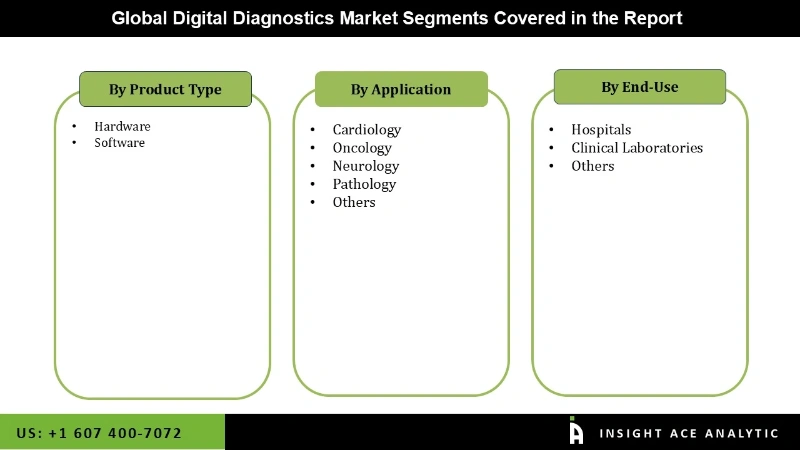

Digital Diagnostics Market Size, Share & Trends Analysis Report By Application (Cardiology, Oncology, Neurology, Pathology), End-User (Hospitals, Clinical Laboratories), And Product (Hardware And Software), Region And Segment Forecasts, 2026 to 2035.

Using a standardized tool, digital diagnostics enables quick issue isolation and resolution, facilitating collaboration throughout the application lifecycle. By improving the accuracy and precision of diagnostic results, this innovative technology aids in the advancement of the healthcare system. During the forecast period, the worldwide digital diagnostics market is anticipated to increase at a solid rate driven by growing healthcare expenditure, technical improvements, and increased attention.

The need for improved diagnostic technologies that can offer individualized insights and treatment plans is being driven by rising healthcare costs, a growing understanding of the value of early diagnosis, and a move toward customized medicine. However, there are issues that must be resolved, like expensive implementation costs and worries about data privacy. With ongoing technological breakthroughs and rising acceptance of digital health solutions, the market for digital diagnostics appears to have a bright future overall.

The Digital Diagnostics Market is segmented on the basis of product , application, and end-user. Product segment includes Hardware and Software. Application segment includes Cardiology, Oncology, Neurology, Pathology, and Others. End-user segment includes Hospitals, Clinical Laboratories, and Others.

The oncology category is expected to hold a major share in the global digital diagnostics market in 2022. The reason for this growth is the rising global prevalence of cancer. The market is also growing due to factors such as the increasing adoption of Digital Diagnostics platforms for cancer screening, technical innovation, and the surge in the introduction of new product releases. Furthermore, during the projection period, the Radiology category is anticipated to boost at the fastest CAGR. The benefits of digital radiography, such as instantaneous evaluation, editing, and magnification of the result, contrast and luminosity adjustment to produce the best image of the object under study, and the ability to preserve the result electronically or in print, would drive this expansion.

The hospital segment is projected to evolve at a rapid rate in the global digital diagnostics market. The widespread use of digital pathology and radiography in hospitals, clinics, and other digital diagnostic tools is driving this growth. Hospitals have access to CT scanners and computer-aided diagnosis systems. Another factor driving this market's expansion is the creation of artificial intelligence platforms that integrate with the healthcare system.

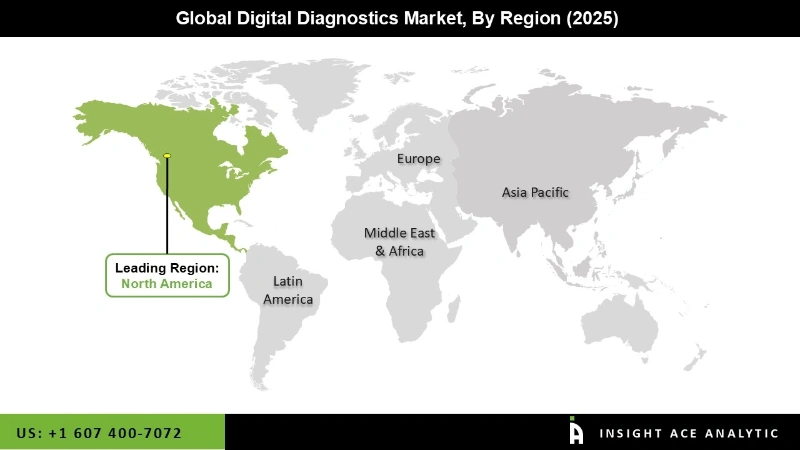

The North American digital diagnostics market is foreseen to exhibit the largest market share in terms of revenue in the near future. The increasing number of chronic illness cases in the North American region is driving this region's expansion. The Digital Diagnostics Industry Outlook in the North American region is being further enhanced by the rapidly increasing number of product debuts. In addition, Asia Pacific is anticipated to rise rapidly in the global digital diagnostics market. A few factors contributing to this growth are the rising costs of computer-aided diagnostics in healthcare in the Asia-Pacific area. The Asia-Pacific digital diagnostics market is expanding owing to the rising awareness of the benefits of these technologies.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.48 Bn |

| Revenue Forecast In 2035 | USD 8.69 Bn |

| Growth Rate CAGR | CAGR of 19.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Application, and End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Riverain Technologies, Hoffmann-La Roche Ltd., GE Healthcare, Digital Diagnostics Inc., Siemens Healthcare GmbH, ThermoFisher Scientific Inc., Laboratory Corporation of America Holdings.VUNO Inc., AliveCor,Inc., Behold.ai, Brainomix, Healthy.io, Canon Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Diagnostics Market By Product-

Digital Diagnostics Market By Application-

Digital Diagnostics Market By End-User-

Digital Diagnostics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.