Global Nucleic Acid Therapeutics CDMO Market Size is valued at USD 2,540.9 Million in 2024 and is predicted to reach USD 8,688.2 Million by the year 2034 at an 13.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Nucleic acids are now recognized as the third most crucial platform for drug discovery, following small molecules and antibodies. Through gene inhibition, addition, replacement, or modification, nucleic acid therapeutics implement synthetic oligonucleotides to achieve curative or enduring effects.The science of nucleic acid therapeutics provides promise for treating disorders that cannot be managed with the drugs that are now available.

Nucleic acid therapeutics deal with nucleic acids (DNA and RNA) or other related chemical compounds. The nucleic acid therapeutics CDMO market is estimated to show high growth over the next few years, driven by the high application potential of nucleic acids for a variety of medical conditions. In addition, the increasing preference for personalized medicine also propels the market growth. Furthermore, continued research and development activities for manufacturing innovative nucleic acid therapeutics are forcing pharmaceutical companies to expand their businesses. Most companies focus on partnerships, acquisitions, collaborations, and mergers with contract development and manufacturing organizations (CDMOs) to seamlessly scale oligonucleotides from research to commercial manufacturing. Therefore, scaling up the products cost-effectively and efficiently from research to commercial quantities is a key challenge to CDMOs.

Other driving factors of the nucleic acid therapeutics CDMO market include the growing demand for nucleic acid therapeutics and the high prevalence of chronic and genetic diseases. Furthermore, advancements in nucleic acid technologies, a rise in R&D investments, increasing FDA approvals of nucleic acid therapeutics, and growing CDMO partnerships and acquisitions are expected to escalate the nucleic acid therapeutics CDMO market growth over the forecast years. However, mass production at low cost, lack of expertise in developing nucleic acid therapeutics, and supply chain challenges are anticipated to hinder the industry growth.

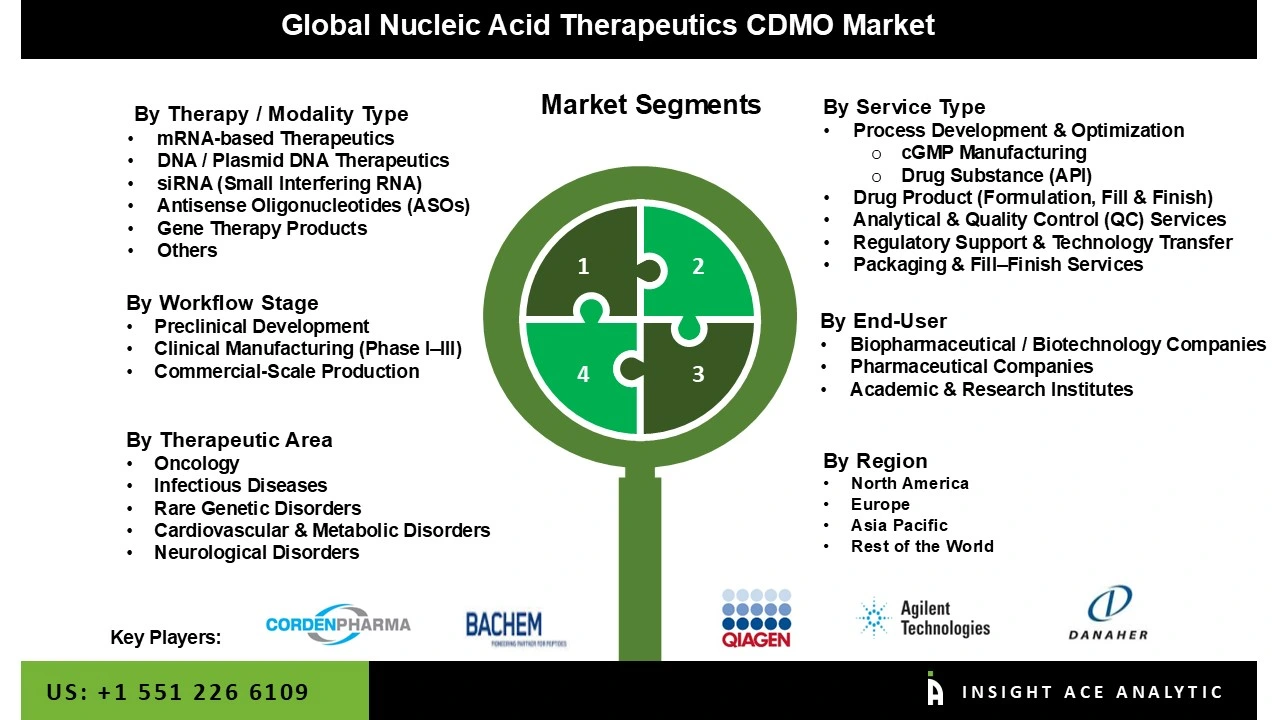

The nucleic acid therapeutics CDMO market is segmented by technology (Column-Based Method and Microarray-Based Method), products (Standard Nucleic Acid, Micro-Scale Nucleic Acid, Large-Scale Nucleic Acid, Custom Nucleic Acid, Modified Nucleic Acid, Primers, Probes, Other Nucleic Acid, and Other Services), end-users (Pharmaceutical Companies, Academic Research Institute, Diagnostic Laboratories), and geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa). North America holds the highest share of this market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2,540.9 Million |

| Revenue Forecast In 2034 | USD 8,688.2 Million |

| Growth Rate CAGR | CAGR of 13.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$Mn,and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Therapy / Modality Type, Service Type, Workflow Stage, End-User and Therapeutic Area |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies, Inc., Bachem AG, Ajinomoto Bio-Pharma Services, BioSpring GmbH, Exothera SA, Helix Biotech, LGC Group / Axolabs GmbH, Thermo Fisher Scientific Inc. (Patheon), Danaher Corporation (Aldevron), WuXi AppTec Co., Ltd., Merck KGaA (MilliporeSigma Life Science), Curia Global, Inc. (formerly AMRI), KNC Laboratories Co., Ltd., Univercells / Univercells Technologies, Integrated DNA Technologies (IDT, Danaher subsidiary), Evonik Industries AG (Health Care Business Line), Ology Bioservices (now part of National Resilience, Inc.), TriLink BioTechnologies (Maravai LifeSciences), AGC Biologics, Inc., Aurigene Pharmaceutical Services Ltd., PolyPeptide Group AG, Eurofins Scientific SE (Eurofins Genomics Division), Kaneka Eurogentec S.A., Nitto Denko Avecia Inc., ST Pharm Co., Ltd., Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Nucleic Acid Therapeutics CDMO Market By Therapy / Modality Type-

Nucleic Acid Therapeutics CDMO Market By Service Type-

Nucleic Acid Therapeutics CDMO Market By Workflow Stage-

Nucleic Acid Therapeutics CDMO Market By End-User-

Nucleic Acid Therapeutics CDMO Market By Therapeutic Area-

Nucleic Acid Therapeutics CDMO Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.