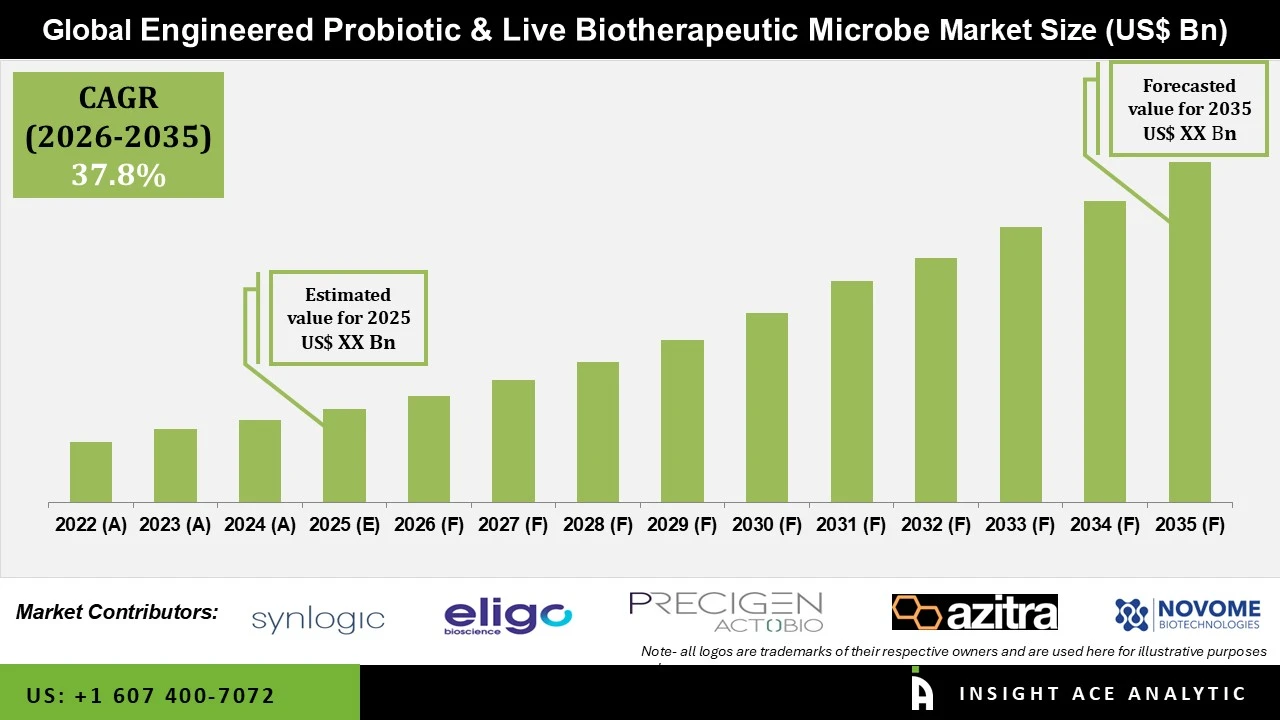

Engineered Probiotic and Live Biotherapeutic Microbe Market Size is predicted to witness a 37.8% CAGR during the forecast period for 2026 to 2035.

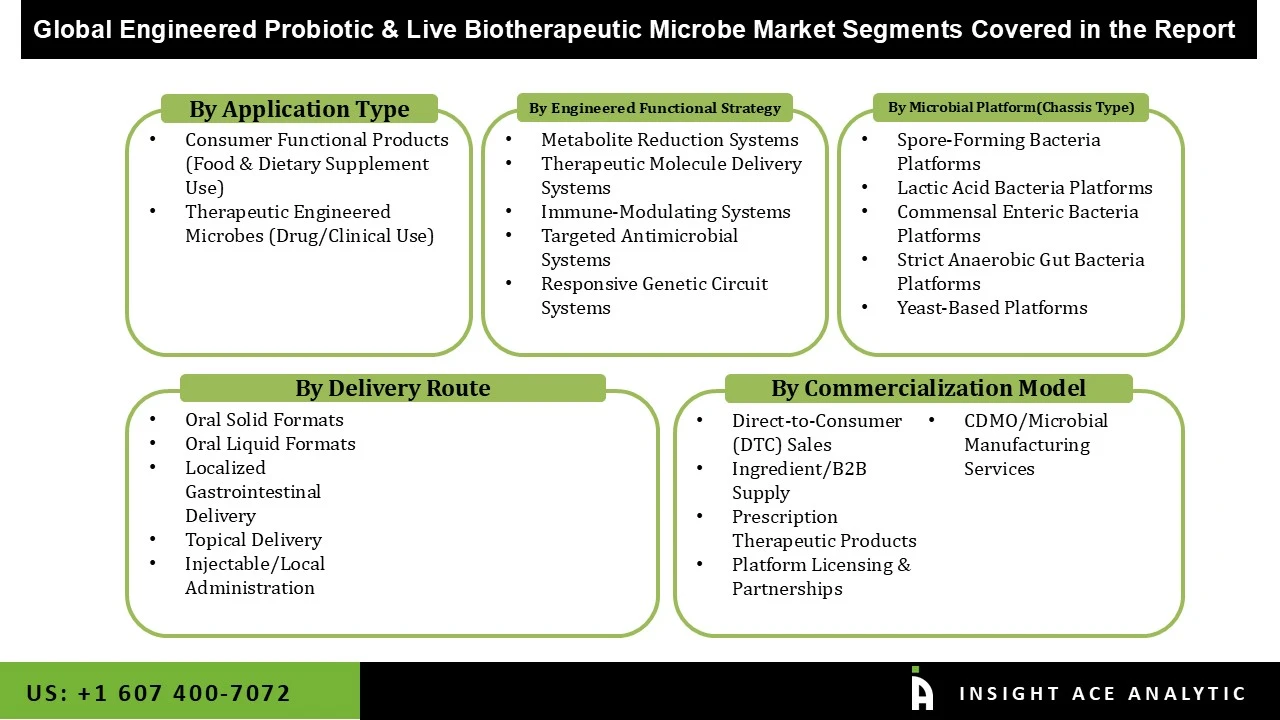

Engineered Probiotic and Live Biotherapeutic Microbe Market Size, Share & Trends Analysis Distribution By Application Type (Consumer Functional Products (Food & Dietary Supplement Use), Therapeutic Engineered Microbes (Drug/Clinical Use), By Engineered Functional Strategy (Metabolite Reduction Systems, Therapeutic Molecule Delivery Systems, Immune-Modulating Systems, Targeted Antimicrobial Systems, Responsive Genetic Circuit Systems), By Microbial Platform (Chassis Type)(Spore-Forming Bacteria Platforms, Lactic Acid Bacteria Platforms, Commensal Enteric Bacteria Platforms, Strict Anaerobic Gut Bacteria Platforms, Yeast-Based Platforms), By Delivery Route (Oral Solid Formats, Oral Liquid Formats, Localized Gastrointestinal Delivery, Topical Delivery, Injectable/Local Administration), By Commercialization Model (Direct-to-Consumer (DTC) Sales, Ingredient/B2B Supply, Prescription Therapeutic Products, Platform Licensing & Partnerships, CDMO/Microbial Manufacturing Services) and Segment Forecasts, 2026 to 2035

Engineered probiotics and live biotherapeutic microbes represent a new generation of microbiome-based solutions designed to go beyond traditional “good bacteria.” Unlike conventional probiotics that mainly support general digestive health, these advanced microbes are specifically designed or optimized to perform targeted functions inside the body. They can be programmed to produce beneficial compounds, regulate metabolic activities, support immune balance, or help control harmful microorganisms, offering more precise and measurable health benefits. These solutions are being developed for both everyday wellness applications and clinical use.

On the consumer side, engineered probiotics are increasingly used in functional foods and dietary supplements aimed at gut health, immunity, and overall well-being. On the medical side, live biotherapeutic microbes are emerging as a promising class of therapies for conditions such as gastrointestinal disorders, metabolic diseases, and immune-related illnesses. With strong backing from scientific research, biotechnology innovation, and growing interest in personalized healthcare, engineered probiotics and live biotherapeutic microbes are shaping the future of microbiome-driven health solutions.

These solutions are increasingly adopted to improve health outcomes, enhance treatment effectiveness, reduce dependence on conventional drugs, and support long-term wellness through precision microbiome modulation. Market growth is driven by rising consumer awareness of gut health and immunity, rapid advances in synthetic biology and microbiome research, and growing demand for personalized and preventive healthcare solutions.

In addition, pharmaceutical and biotechnology companies are actively investing in engineered microbial platforms as next-generation therapeutics, further accelerating market expansion. However, market development faces challenges like High research, development, and manufacturing costs particularly for clinically engineered live biotherapeutics can limit accessibility and slow commercialization, especially for smaller companies. Stringent and region-specific regulatory pathways for genetically modified or live microbial products also create approval complexities and longer time-to-market. Despite these constraints, the engineered probiotic and live biotherapeutic microbe market continues to gain momentum, supported by strong clinical pipelines, increasing partnerships, and the growing need for targeted, sustainable, and biology-based health solutions.

• Synlogic

• Eligo Bioscience

• Precigen ActoBio

• Azitra

• Novome Biotechnologies

• ZBiotics

• Unlocked Labs

• Solarea Bio

• Ginkgo Bioworks

• Igenbio

• Ostia Sciences

The market’s growth is largely driven by a clear shift toward personalized and preventive healthcare. Today, consumers are more aware of how lifestyle, diet, and gut health directly impact long-term well-being, and they are actively looking for solutions that go beyond treating symptoms after they appear. Instead of generic supplements or therapies, there is growing interest in products that are tailored, proactive, and supported by science. Engineered probiotics and live biotherapeutic microbes meet this need by working in a targeted way within the body supporting gut balance, strengthening immunity, and helping manage health conditions before they become severe. This ability to deliver precise, preventive benefits makes these solutions especially appealing to both consumers and healthcare providers in an increasingly prevention-focused healthcare environment.

One of the biggest challenges affecting the market is the high cost involved in research, development, and manufacturing. Creating engineered probiotics and live biotherapeutic microbes requires advanced scientific expertise, long development timelines, and highly controlled manufacturing facilities to ensure safety, stability, and effectiveness. These factors significantly increase overall costs, making it difficult for smaller companies to scale up or bring products to market quickly. As a result, commercialization can be slower, and product availability may be limited, even when demand and clinical interest are strong.

The therapeutic engineered microbes (drug/clinical use) segment plays the most influential role in shaping the engineered probiotic and live biotherapeutic microbe market. This segment attracts the highest level of attention from pharmaceutical and biotechnology companies because it focuses on treating or managing diseases through precisely engineered microbial therapies. Unlike consumer wellness products, these therapies are developed with strong clinical evidence, clear medical outcomes, and long-term treatment potential, which makes them highly valuable and strategically important.

As a result, this segment drives major investments, fuels innovation in synthetic biology and microbiome engineering, and encourages partnerships between biotech firms, research institutions, and large pharmaceutical players. Although development timelines are longer and regulatory requirements are more complex, successful clinical programs create strong credibility for the entire market. This clinical momentum not only advances therapeutic pipelines but also builds confidence in microbiome-based solutions overall, positively influencing adoption across both medical and consumer applications.

The consumer functional products segment, which includes food and dietary supplements, is an important driver of the engineered probiotic and live biotherapeutic microbe market. This segment focuses on delivering everyday health benefits to consumers in an accessible and convenient way, such as improving gut health, boosting immunity, and supporting overall wellness. Unlike clinical therapies, these products are widely available and cater to the growing demand for preventive and lifestyle-focused healthcare. Rising health awareness, changing dietary habits, and a preference for natural, science-backed wellness solutions are fueling the adoption of these products. By making advanced microbiome science accessible to everyday consumers, the Consumer Functional Products segment not only drives market growth but also helps build trust and familiarity with engineered probiotics and live biotherapeutic microbes, paving the way for broader acceptance of more advanced therapeutic applications in the future.

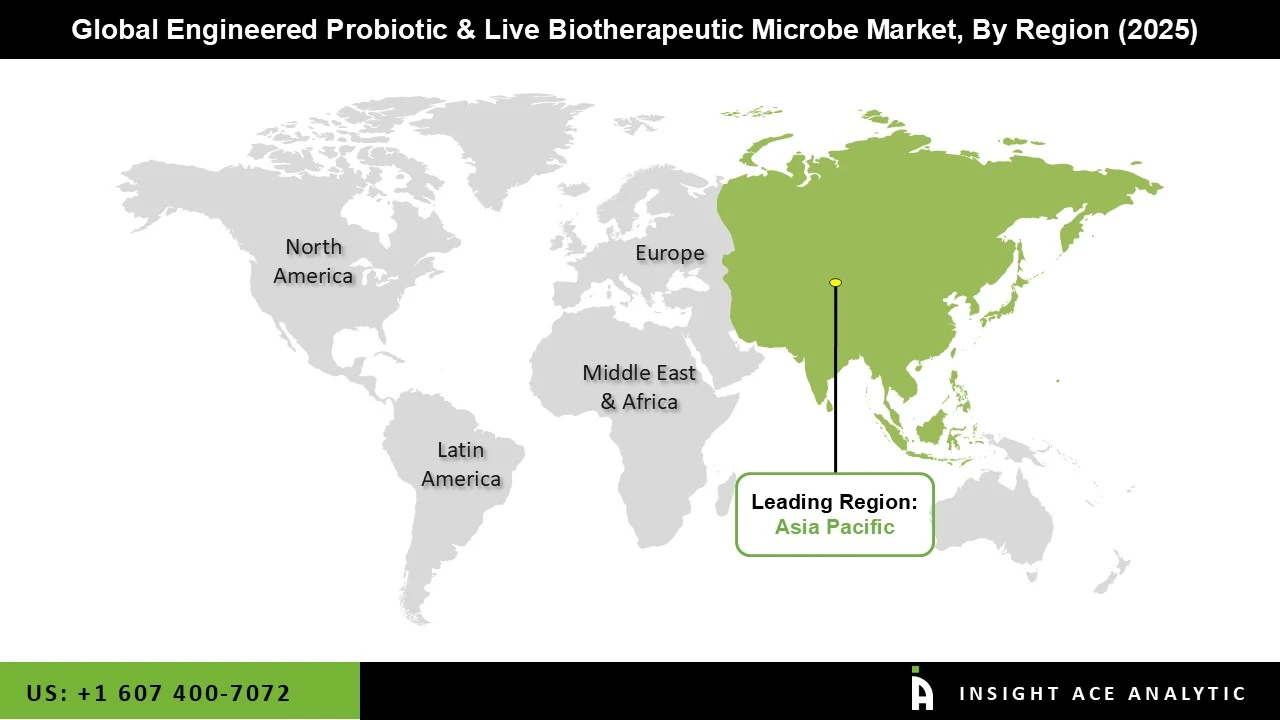

Asia Pacific has emerged as a leading market for engineered probiotics and live biotherapeutic microbes due to a combination of growing health awareness, increasing disposable incomes, and a strong focus on preventive and personalized healthcare. Consumers in the region are becoming more conscious of gut health, immunity, and overall wellness, which is driving demand for both functional foods and advanced therapeutic microbial products. The region also benefits from a rapidly expanding healthcare and biotechnology ecosystem, with significant investments in research, clinical trials, and microbial innovation. Additionally, countries like China, Japan, and India have large populations with rising acceptance of science-backed wellness products, making them key markets for both consumer-focused and clinical applications. Favorable government initiatives, growing pharmaceutical collaborations, and increasing access to modern healthcare infrastructure have further strengthened Asia Pacific’s position as a leader in this emerging market.

• In February 2024, Synlogic advanced its synthetic biotic pipeline for live biotherapeutic treatments, including its lead program SYNB1934 for PKU, which entered a Phase 3 study but was discontinued early, leading the company to scale back operations and reassess its engineered microbial programs

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 37.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2021 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Application Type, Engineered Functional Strategy, Farming System, Microbial Platform(Chassis Type), Commercialization Model, Delivery Route and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Synlogic, Eligo Bioscience, Precigen ActoBio, Azitra, Novome Biotechnologies, ZBiotics, Unlocked Labs, Solarea Bio, Ginkgo Bioworks, Igenbio, Ostia Sciences. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Consumer Functional Products (Food & Dietary Supplement Use)

• Therapeutic Engineered Microbes (Drug/Clinical Use)

• Metabolite Reduction Systems

• Therapeutic Molecule Delivery Systems

• Immune-Modulating Systems

• Targeted Antimicrobial Systems

• Responsive Genetic Circuit Systems

• Spore-Forming Bacteria Platforms

• Lactic Acid Bacteria Platforms

• Commensal Enteric Bacteria Platforms

• Strict Anaerobic Gut Bacteria Platforms

• Yeast-Based Platforms

• Oral Solid Formats

• Oral Liquid Formats

• Localized Gastrointestinal Delivery

• Topical Delivery

• Injectable/Local Administration

• Direct-to-Consumer (DTC) Sales

• Ingredient/B2B Supply

• Prescription Therapeutic Products

• Platform Licensing & Partnerships

• CDMO/Microbial Manufacturing Services

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.