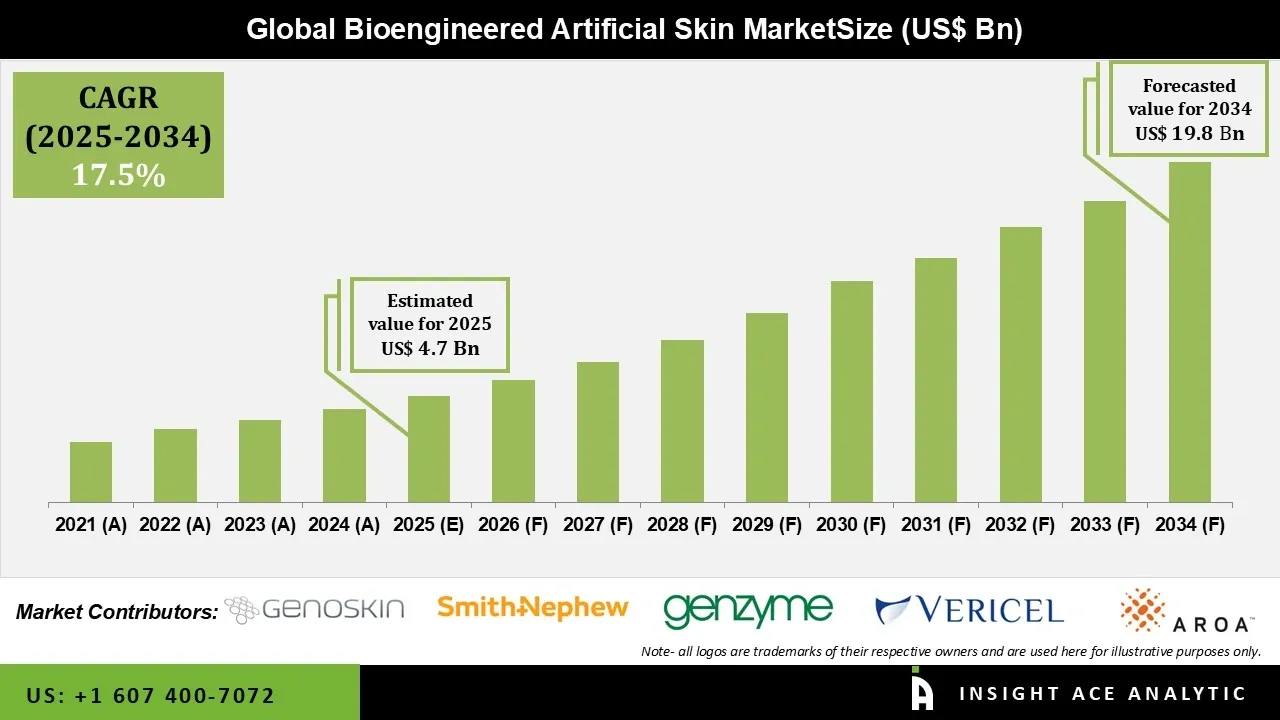

Bioengineered Artificial Skin Market Size is valued at USD 4.7 Bn in 2025 and is predicted to reach USD 19.8 Bn by the year 2034 at a 17.5% CAGR during the forecast period for 2025 to 2034.

Bioengineered Artificial Skin Market Size, Share & Trends Analysis Distribution by Type (Bilayered Bioengineered Artificial Skin, Trilayered Bioengineered Artificial Skin, and Others), Application (Acute Wounds, Chronic Wounds, and Others), End-user (Hospitals, Clinics, and Others), and Segment Forecasts, 2025 to 2034

For medical and research purposes, bioengineered artificial skin is a skin substitute created in a lab that mimics the composition and functionality of normal human skin. In order to construct one or more layers that resemble the epidermis and dermis, biomaterials, living cells (such as fibroblasts and keratinocytes), and sophisticated tissue-engineering techniques are usually combined.

Severe burns, persistent wounds, diabetic ulcers, and skin deformities, when natural healing is compromised or insufficient, are the main conditions for which bioengineered skin is utilized. These artificial skin substitutes aid in wound protection, cell regeneration, fluid retention, infection prevention, and healing. The bioengineered artificial skin market is being driven by substantial growth factors, including the rise in burns, chronic wounds, and other skin injuries, as well as biotechnology breakthroughs.

Additionally, as medical professionals look for more efficient treatment choices that shorten healing times and enhance patient outcomes, the need for advanced wound care solutions has increased. The growing number of elderly people, who are more prone to wounds and skin damage, drives the bioengineered artificial skin market expansion as the demand for efficient skin replacement products rises.

Moreover, the technological developments that result in the creation of more efficient and adaptable bioengineered artificial skin are driving the market's growth. Compared to conventional therapies, these alternatives provide better healing results, lowering the risk of infection, hospital stays, and scarring. The large investments in research and development are further spurring innovation, with a focus on creating bioengineered artificial skin with enhanced biocompatibility and integration with the patient's own tissues.

Although the bioengineered artificial skin market is expected to develop, there are some obstacles to overcome. These alternatives can be difficult to obtain because of high production and development costs, especially in developing nations. Furthermore, the market release of bioengineered artificial skin substitutes may be slowed by regulatory obstacles and the protracted approval procedures for new products. This may discourage investment in R&D, which would prevent the bioengineered artificial skin market from growing. However, numerous opportunities are emerging as the market continues to change.

A possible approach is the creation of customized bioengineered artificial skin, which can enhance patient satisfaction and recovery rates. The creation of artificial skin is being revolutionized by technologies like 3D bioprinting, which enable the creation of skin that closely resembles natural tissue. The prospective sector for 3D bioprinting in healthcare is anticipated to expand significantly, providing businesses involved in the bioengineered artificial skin market with great growth prospects.

• Integra LifeSciences Corp

• Genoskin

• Genzyme Biosurgery

• Vericel Corporation

• Smith and Nephew Inc.

• Avita Medical

• MiMedx Group, Inc.

• AROA BIOSURGERY LIMITED

• COOK BIOTECH

• Mölnlycke Health Care AB

• Organogenesis Holdings Inc.

The growing number of burn cases is one of the primary factor driving the market for bioengineered artificial skin, since patients need specialized care to heal their wounds. The World Health Organization (WHO) estimates that burn injuries cause over 180,000 fatalities annually, impacting millions of people who need medical care. Natural disasters, industrial mishaps, and domestic occurrences are the causes of these injuries.

Additionally, the healthcare professionals are increasingly using bioengineered artificial skin products for better treatment of their patients as awareness of the need for sophisticated wound care solutions grows. As older persons are more susceptible to serious burns, there is a growing demand for solutions targeted at this demographic. Since it takes a long time to recover from severe burns, bioengineered artificial skin products are becoming more and more necessary as burn cases increase and medical technology progresses.

The limited acceptance of bioengineered artificial skin in different regions may be due to cultural attitudes and beliefs about medical treatments. Traditional healing methods are common in some areas, which makes people skeptical of cutting-edge medical advancements like artificial skin.

According to a World Health Organization research, almost 70% of medical professionals in low- and middle-income nations said that patients frequently favor traditional remedies over cutting-edge therapies like artificial skin solutions. Even when new technologies are accessible, this inclination may make people less inclined to adopt them. Additionally, these opinions are reinforced by a lack of knowledge and understanding of the advantages of bioengineered artificial skin, which makes it difficult for companies to market their goods successfully.

The chronic wounds segment held the largest share in the bioengineered artificial skin market in 2024. A crucial application area is chronic wound care, which includes ailments including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The demand for improved wound care solutions is being driven by the rising prevalence of chronic wounds, especially among the elderly and those with underlying medical disorders like diabetes. BecausWound Healinge they can speed up wound healing and lower the risk of complications, bioengineered artificial skin solutions are becoming more and more popular in the bioengineered artificial skin market.

In 2024, the hospitals segment dominated the bioengineered artificial skin market since the number of procedures performed worldwide is increasing. The main reasons propelling the bioengineered artificial skin market are the rising incidence of venous leg ulcers and diabetic foot ulcers. Additionally, the market is being driven by an increase in surgical wound cases as a result of more surgeries. Hospitals are the main consumers of bioengineered skin products due to the availability of cutting-edge medical equipment, qualified medical personnel, and comprehensive care facilities.

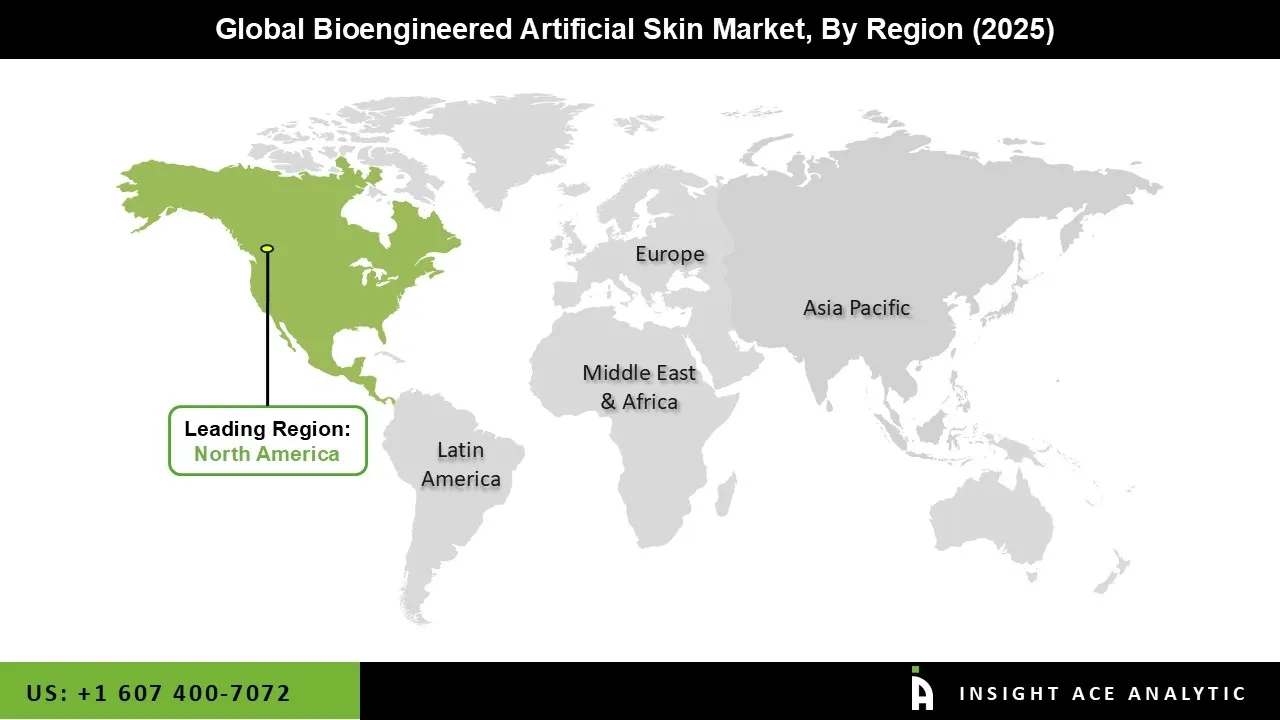

The bioengineered artificial skin market was dominated by the North America region in 2024. The region's high healthcare spending, sophisticated healthcare infrastructure, and robust presence of major industry players are important drivers propelling the bioengineered artificial skin market expansion. With its many research projects and technological developments in tissue engineering and regenerative medicine, the United States, in particular, makes a significant contribution.

Furthermore, the adoption of bioengineered artificial skin products is further supported by the region's emphasis on lowering healthcare costs and improving patient outcomes. Additionally, partnerships between biotech firms and academic institutions are promoting the creation of novel and enhanced products, which are boosting the North American bioengineered artificial skin market.

October 2023: For the first time, scientists at Wake Forest University bioengineered a nearly flawless human skin duplicate to aid in the regeneration of flesh for the most serious wounds.

August 2023: Kerecis was purchased by the Danish healthcare firm Coloplast A/S for an unknown sum. By utilizing Kerecis' cutting-edge fish-skin-based regenerative technology, bolstering its position in biological wound care solutions, and meeting the rising demand for efficient wound healing treatments worldwide, Coloplast hopes to increase its market share in the advanced wound care sector. A US-based business called Kerecis Limited produces bioengineered artificial skin substitutes made from fish skin with a focus on tissue regeneration and wound healing.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 4.7 Bn |

| Revenue forecast in 2034 | USD 19.8 Bn |

| Growth Rate CAGR | CAGR of 17.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Treatment Duration, By End-user, By Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Integra LifeSciences Corp, Genoskin, Genzyme Biosurgery, Vericel Corporation, Smith and Nephew Inc., Avita Medical, MiMedx Group, Inc., AROA BIOSURGERY LIMITED, COOK BIOTECH, Mölnlycke Health Care AB, and Organogenesis Holdings Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Bioengineered Artificial Skin Market by Type

• Bilayered Bioengineered Artificial Skin

• Trilayered Bioengineered Artificial Skin

• Others

Bioengineered Artificial Skin Market by Application

• Acute Wounds

• Chronic Wounds

• Others

Bioengineered Artificial Skin Market by End-user

• Hospitals

• Clinics

• Others

Bioengineered Artificial Skin Market-By Region

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.