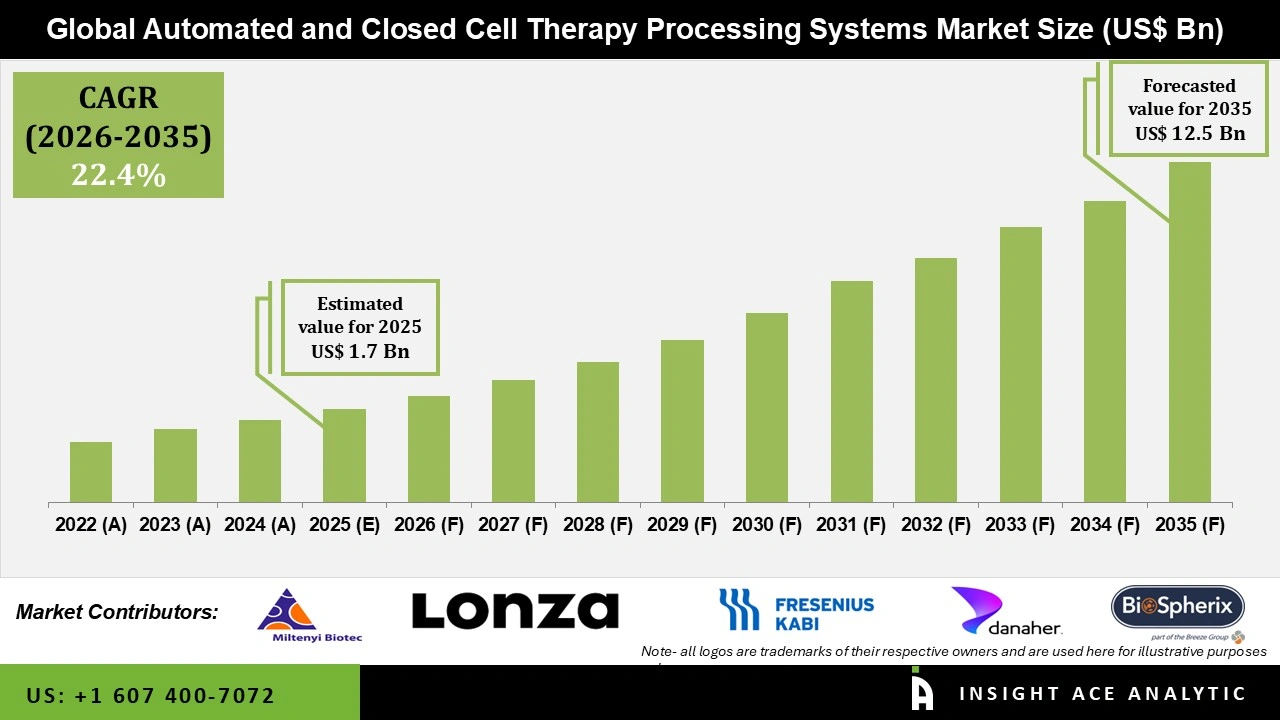

Automated and Closed Cell Therapy Processing Systems Market Size is valued at USD 1.7 Bn in 2025 and is predicted to reach USD 12.5 Bn by the year 2035 at a 22.4% CAGR during the forecast period for 2026 to 2035.

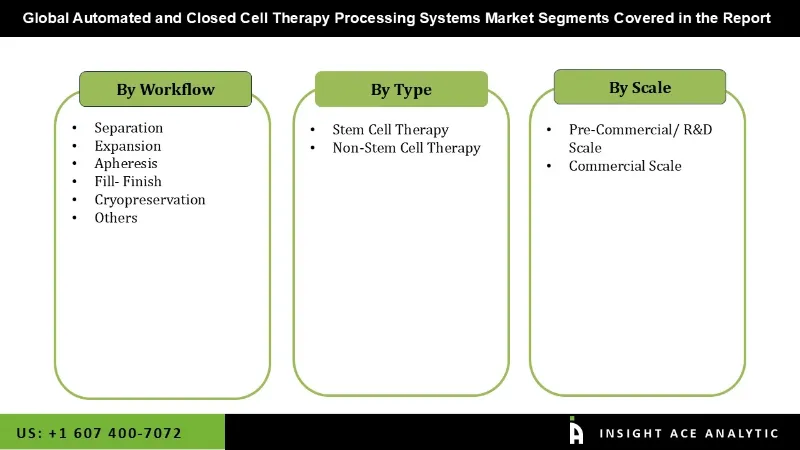

Automated and Closed Cell Therapy Processing Systems Market Size, Share & Trends Analysis Distribution By Type (Stem Cell Therapy and Non Stem Cell Therapy), By Workflow (Separation, Cryopreservation, Expansion, Fill- Finish, Apheresis, and Others), By Scale (Pre-Commercial/ R&D Scale and Commercial Scale), and Segment Forecasts, 2026 to 2035

The goal of an automated and closed cell therapy processing system is to optimize the handling, preparation, and assessment of cellular therapies in a secure environment. This procedure enhances the effectiveness and uniformity of the manufacturing process for cell-based treatments while lowering the possibility of contamination. In the production of cell therapies, the automated and closed cell therapy processing system is essential for maximizing both productivity and safety. The automation reduces the possibility of human error and upholds a high level of quality control, both of which are critical for guaranteeing patient safety. The growing requirement for scalable and contamination-free cell therapy manufacturing solutions, the expanding emphasis on process standardization, and the increasing demand for sophisticated cell-based therapies are the main factors driving the automated and closed cell therapy processing systems market's notable expansion.

The expanding focus on regenerative medicine and the increasing incidence of chronic diseases are important factors driving the automated and closed cell therapy processing systems market growth. These elements are hastening the deployment of automated technologies that guarantee scalable and reliable cell therapy production. Additionally, the market is seeing a rise in R&D spending, which promotes innovation and the launch of next-generation processing systems.

Furthermore, the market for automated and closed cell therapy processing systems is expanding rapidly due to rising demand for personalized medicine and technology improvements. The application of machine learning and artificial intelligence to cell therapy procedures is a significant trend that improves accuracy and productivity. The need to simplify complicated processes and lower human error, which will improve patient outcomes and save expenses, is what is driving this movement.

In addition, the expansion of clinical applications is essential for the automated and closed cell therapy processing systems market growth. The use of cell treatments has expanded beyond a small number of specialized uses. An increasing number of clinical disorders are being investigated for them.

The need for automated and closed cell therapy processing systems is rising along with the number of clinical studies and authorized treatments. These technologies make it possible to produce a variety of cell therapy products in an efficient and scalable manner, meeting a wide range of medical requirements. Additionally, the alliances and cooperation between healthcare providers, biotechnology businesses, and academic institutions are growing. These partnerships enable resource pooling, information exchange, and faster cell therapy technology development.

• Thermo Fisher Scientific Inc.

• Miltenyi Biotec

• Lonza

• Fresenius Kabi AG

• Terumo Corporation

• Sartorius AG

• Danaher Corporation

• BioSpherix, LLC

• ThermoGenesis Holdings, Inc.

• CELLARES

The automated and closed cell therapy processing systems market's primary driver of expansion is the rising need for cell therapy products. Cell treatment is becoming more and more popular as chronic illnesses become more common. The immune cells, stem cells, and CAR T-cells are examples of cell therapy products that are transplanted into patients to replace or repair damaged tissue or cells. These treatments can target any of the hundreds of genes in the body and can reduce or stop such illplasmanesses. Cell therapy development is aided by favorable government funding and growing investments in cell therapy research. The introduction of new products also boosts market expansion. Between 2023 and May 2024, the US Food and Drug Administration approved about ten cell and gene therapy products. Five of them are products used in cell treatment, such as CAR T-cells and stem cells.

Several steps in the overall cell therapy manufacturing process call for starting materials. Raw materials required for good medical practice (GMP) are in short supply due to the growing demand for automated and closed cell therapy processing systems worldwide. The automated and closed-cell therapy processing systems market is experiencing a bottleneck in the supply of plasmids and viral vectors, which are proven GMP-based raw materials needed in the cell therapy process, as a result of the quick rise in cell treatments and the rise in chronic diseases. Additionally, the market's expansion is hampered by the difficulties in acquiring raw materials, including bone marrow, blood, and apheresis. Therefore, the global automated and closed-cell therapy processing systems market is being constrained by the lack of raw materials.

The apheresis segment held the largest share in the automated and closed cell therapy processing systems market in 2025 because of the growing need for medical treatments that call for the separation of blood components like platelets and plasma. In the context of cell treatments, this procedure is essential because it enables the focused collection of particular cells while eliminating undesirable elements. Healthcare professionals are progressively implementing automated and more efficient apheresis systems as a result of technological improvements to enhance patient outcomes and optimize workflows. Apheresis is now the most popular workflow in this market because of this trend, an increase in chronic illnesses, and an increase in cancer patients in need of cellular therapies.

In 2025, the pre-commercial/ R&D scale segment dominated the automated and closed cell therapy processing systems market. This stage is critical for the creation and improvement of cell treatments, where exact control over the production process is vital. Early-stage clinical trials and research greatly benefit from automated and closed systems because they offer controlled settings that reduce human interaction, guaranteeing consistency and avoiding contamination. By preserving cell integrity and guaranteeing excellent results for proof-of-concept research, these methods aid in the improvement of cell treatments. The pre-commercial scale is leading the market due to the emphasis on innovation and research as well as the increasing demand for precision in the early phases of development. However, as therapies progress toward higher production levels, the commercial scale is anticipated to rise significantly.

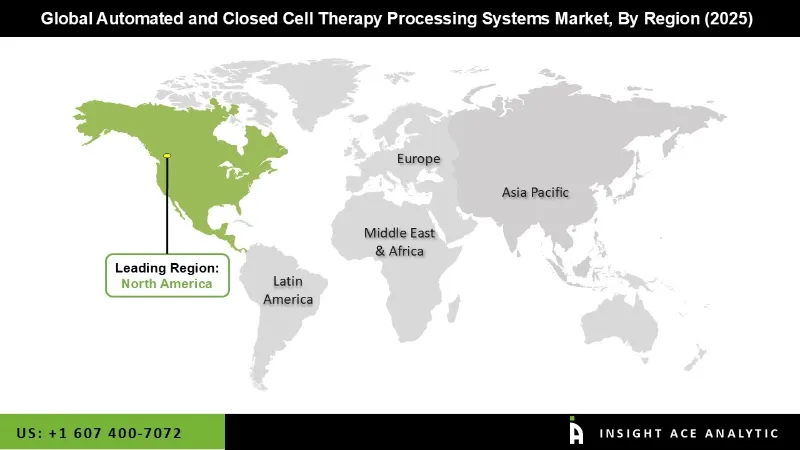

The automated and closed cell therapy processing systems market was dominated by North America region in 2025. This supremacy is ascribed to cutting-edge biotech and regulatory support that encourages creativity and makes it easier to develop novel treatments. Significant investment in cell therapy technologies is fueled by the region's strong healthcare system and emphasis on research and development. Notably, agencies like the U.S. Food and Drug Administration (FDA) have expedited approval procedures, accelerating the introduction of novel treatments into the market.

Additionally, the region's economic potential is further enhanced by the expanding emphasis on sustainable healthcare solutions and the growing consumer desire for individualized medication. The market for automated and closed cell therapy processing systems is dominated by the United States, which also serves as the sector's anchor in North America. Rapid developments in cell therapies are made possible by the nation's distinct regulatory environment, which is typified by the FDA's supportive regulations.

September 2024: Targeting commercial CAR-T therapy production applications, Miltenyi Biotec introduced the CliniMACS Prodigy T-Pro system, an integrated platform for automated T-cell processing that improves cell recovery rates while reducing manufacturing time by 40%.

May 2024: Astellas Pharma Inc. and YASKAWA ELECTRIC CORPORATION partnered to develop a cutting-edge cell therapy platform that blends pharmaceutical and robotic technology. By streamlining the transition from research to large-scale production, our partnership aims to enhance the stability and quality of manufacturing processes.

April 2024: The Laboratory for Cell and Gene Medicine (LCGM) at Stanford Medicine and Multiply Labs established a collaboration to showcase automation technology's potential for cell therapy production.

January 2023: The acquisition of Xellbio, a business that specializes in automated cell processing technology, was announced by Sartorius AG. The goal of this calculated action is to improve Sartorius' capacity to provide all-inclusive solutions in the rapidly expanding cell and gene therapy markets.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 1.7 Bn |

| Revenue forecast in 2035 | USD 12.5 Bn |

| Growth Rate CAGR | CAGR of 22.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Workflow, Scale, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Thermo Fisher Scientific Inc., Miltenyi Biotec, Lonza, Fresenius Kabi AG, Terumo Corporation, Sartorius AG, Danaher Corporation, BioSpherix, LLC, ThermoGenesis Holdings, Inc., and CELLARES. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.