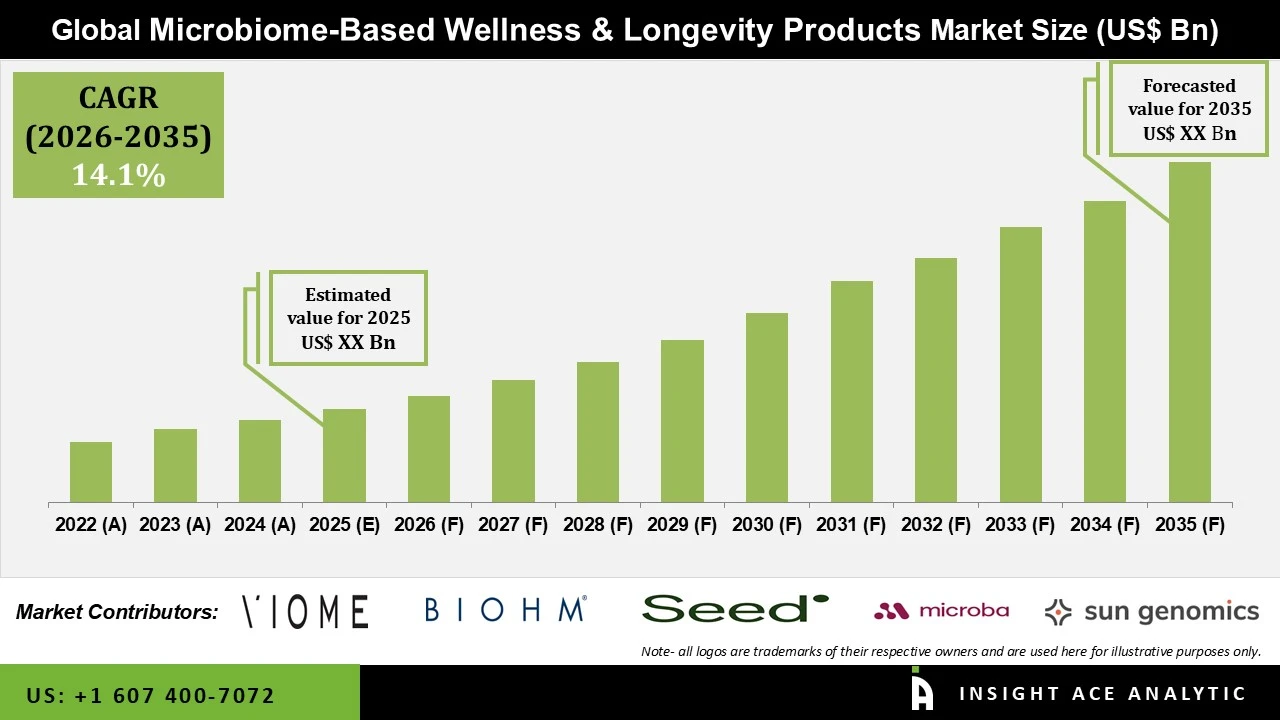

Microbiome Based Wellness and Longevity Products Market Size is predicted to grow at a 14.1% CAGR during the forecast period for 2026 to 2035.

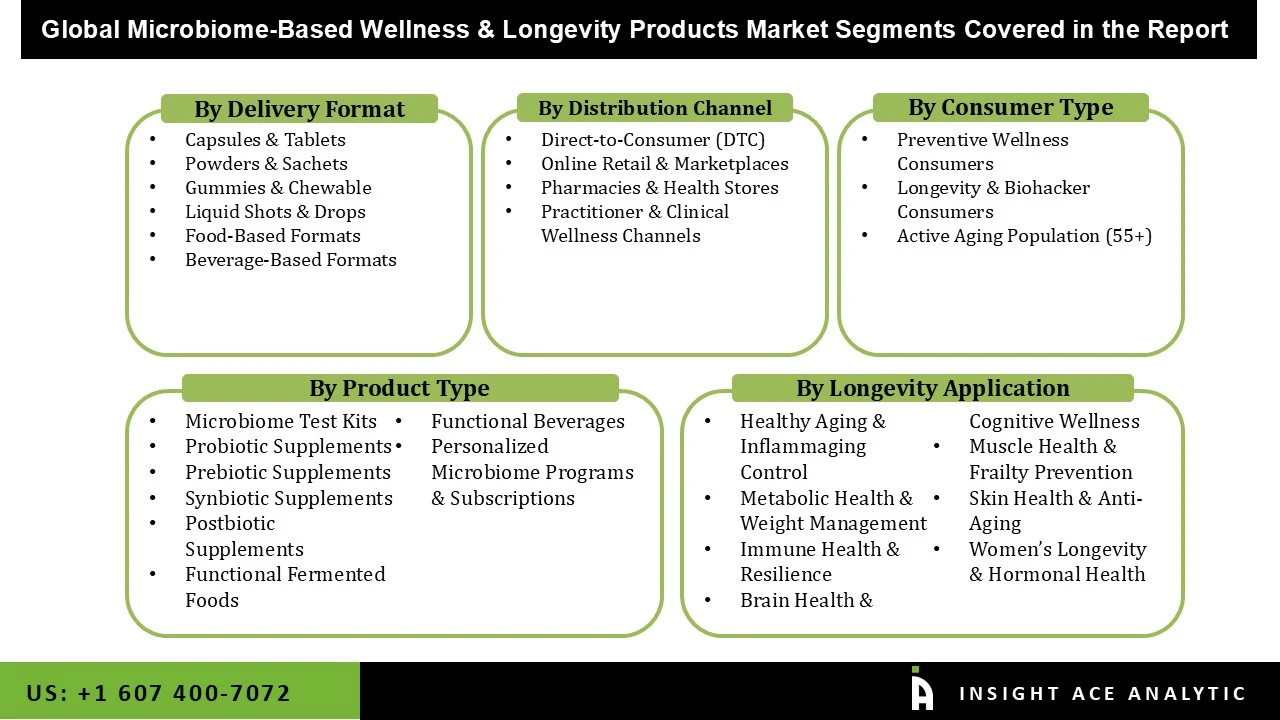

Microbiome Based Wellness and Longevity Products Market Size, Share & Trends Analysis Distribution by Product Type (Microbiome Test Kits, Probiotic Supplements, Prebiotic Supplements, Synbiotic Supplements, Postbiotic Supplements, Functional Fermented Foods, Functional Beverages, Personalized Microbiome Programs & Subscriptions), By Delivery Format (Capsules & Tablets, Powders & Sachets, Gummies & Chewables, Liquid Shots & Drops, Food-Based Formats, Beverage-Based Formats), By Distribution Channel (Direct-to-Consumer (DTC), Online Retail & Marketplaces, Pharmacies & Health Stores, Practitioner & Clinical Wellness Channels), By Longevity Application (Healthy Aging & Inflammaging Control, Metabolic Health & Weight Management, Immune Health & Resilience, Brain Health & Cognitive Wellness, Muscle Health & Frailty Prevention, Skin Health & Anti-Aging, Women’s Longevity & Hormonal Health), By Consumer Type, By Region and Segment Forecasts, 2026 to 2035

Microbiome-based wellness & longevity products refer to a broad range of solutions designed to support long-term health by improving the balance and function of the human gut microbiome. This market includes microbiome test kits that analyze gut bacteria and generate personalized health insights; probiotic, prebiotic, synbiotic, and postbiotic supplements that help restore and maintain beneficial microbes; functional fermented foods and beverages that naturally support digestive health; and personalized microbiome programs that combine testing, nutrition guidance, and targeted supplementation. These products are increasingly used to support healthy aging, metabolic balance, immune resilience, cognitive well-being, skin health, and hormonal health. They are critical because growing scientific evidence shows that the gut microbiome plays a central role in inflammation control, nutrient absorption, immunity, and overall longevity, making microbiome optimization a key pillar of preventive and personalized wellness.

These solutions are widely adopted to improve daily well-being, reduce the risk of chronic lifestyle-related conditions, and promote sustainable, preventive healthcare rather than symptom-based treatment. Market growth is being driven by rising consumer awareness of gut health, increasing interest in personalized nutrition and longevity science, and the global shift toward proactive health management. Demand is further supported by busy lifestyles, aging populations, and greater acceptance of functional foods and supplements.

However, market expansion is moderated by the relatively high cost of advanced microbiome testing and personalized programs, which can limit accessibility for price-sensitive consumers. In addition, varying regulatory frameworks across regions for health claims, supplements, and diagnostic tests create compliance challenges for companies operating in this space. Another key challenge is the gap between emerging microbiome science and consumer understanding, as complex test results and personalized recommendations may be difficult for some users to interpret without professional guidance, potentially affecting long-term engagement and trust.

• Viome

• BIOHM Health

• Seed Health

• Pendulum

• Sun Genomics

• Microba

• Biomesight

• Tiny Health

• Invivo Healthcare

• Enbiosis

• Living Alchemy

• BioGaia

• PrecisionBiotics

• Novonesis

• dsm-firmenich

• Chr. Hansen

• Yakult Honsha

The microbiome-based wellness and longevity market is being strongly driven by the growing shift toward preventive and personalized healthcare. Consumers today are no longer waiting for health issues to arise before taking action; instead, they are proactively investing in solutions that help maintain long-term well-being and support healthy aging. This mindset change has increased interest in understanding individual health profiles, particularly the gut microbiome, which is now widely recognized as a foundation of overall health. As a result, demand for personalized microbiome testing, tailored nutrition plans, and targeted probiotic, prebiotic, and postbiotic products has risen significantly. People are looking for solutions that are customized to their unique biology rather than one-size-fits-all supplements. This shift has positioned microbiome-based products as an essential part of daily wellness routines, preventive care strategies, and longevity programs, making personalization one of the most influential forces shaping the market’s growth.

The high cost and limited accessibility associated with advanced testing and personalized solutions remain major challenges that influence market growth. Wide-ranging microbiome tests involve sophisticated sequencing technologies, data analysis, and expert-driven personalization, which often results in premium pricing. For many consumers, especially in price-sensitive markets, these costs can make adoption difficult and limit usage to higher-income or urban populations. In addition, personalized programs frequently require ongoing subscriptions, follow-up testing, and tailored supplement regimens, further increasing long-term expenses. This can reduce consumer commitment and slow repeat adoption, even among health-conscious users. As a result, while demand for personalized gut health solutions continues to rise, affordability and scalability remain key hurdles that companies must address to expand market reach and make microbiome-based wellness more accessible to a broader audience.

Microbiome test kits are considered as a foundational product segment in the microbiome-based wellness and longevity market, providing consumers with clear insights into their gut health. These kits typically allow users to collect a simple at-home sample, which is then analyzed using advanced sequencing technologies to identify the composition and diversity of gut bacteria. The results enable individuals to understand how their microbiome may be influencing digestion, immunity, metabolism, inflammation, and overall well-being. What makes microbiome test kits especially valuable is their ability to enable personalization. Instead of relying on generic wellness advice, consumers receive tailored dietary, lifestyle, and supplement recommendations based on their unique microbiome profile. This personalized approach has made test kits highly appealing to preventive wellness users, longevity-focused consumers, and those managing specific health concerns. As awareness of gut health continues to grow, microbiome test kits are increasingly seen as the starting point for long-term, data-driven wellness and healthy aging strategies.

Women’s longevity and hormonal health represent a leading and fast-growing application within the microbiome-based wellness and longevity market. Growing awareness of the strong connection between gut health, hormones, metabolism, and immune function has encouraged more women to seek targeted, science-backed solutions that support their health across different life stages. From menstrual health and fertility to pregnancy, menopause, and healthy aging, the microbiome is increasingly recognized as a key factor influencing hormonal balance and overall well-being. Microbiome-based products in this segment include personalized gut health tests, tailored probiotic and synbiotic formulations, and nutrition programs designed to support estrogen metabolism, reduce inflammation, improve digestive comfort, and enhance energy levels. These solutions appeal to women looking for preventive, natural, and personalized approaches to long-term health rather than one-size-fits-all treatments. As conversations around women’s health become more open and research in this area continues to expand, demand for microbiome-driven solutions supporting hormonal balance and longevity is expected to remain strong.

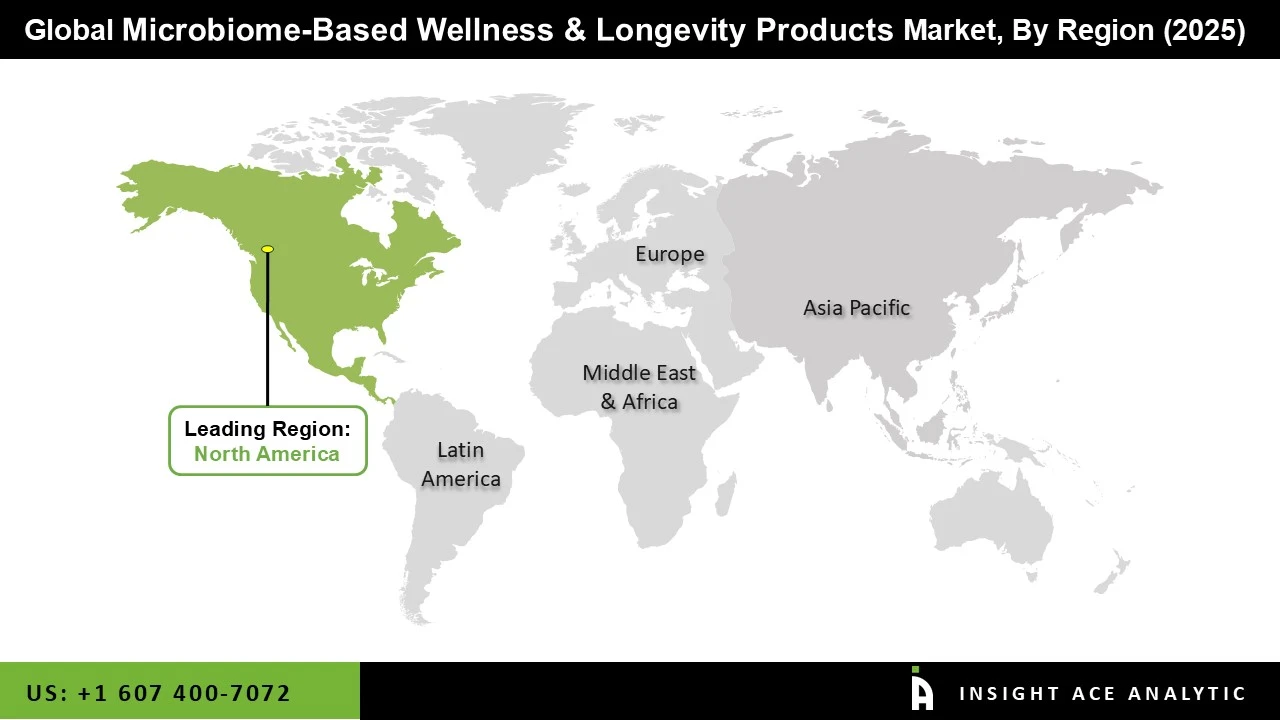

North America leads the market for microbiome-based wellness and longevity products because people there are very aware of preventive healthcare and personalized nutrition. Consumers in this region pay close attention to gut health, immunity, aging, and overall wellness, making them open to microbiome testing, custom supplements, and science-based foods. The area also has a strong wellness and healthcare system, with top research centers, biotech companies, and digital health services. Many major microbiome companies are based in North America, which helps speed up new product development and clinical testing. Higher incomes and the popularity of direct-to-consumer health products have also boosted demand for premium, personalized options. All these factors have helped North America become a leader in this market.

• In January 2025, Biohm upgraded its microbiome test kit with a new AI‑powered Longevity Gut Report that used machine learning to provide deeper insights into how the gut microbiome influenced aging and healthy lifespan. This enhancement added predictive longevity analysis to traditional microbiome testing, making it more personalized and clinically relevant.

• In August 2025, Yakult Honsha Co., Ltd. launched a new Yakult 1000 Chewable probiotic format, which provided high CFUs to support digestive health and help manage stress. This product targeted consumers seeking convenient, science-backed gut health solutions, aligning with trends in microbiome-based wellness and longevity.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 14.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Delivery Format, Distribution Channel, Longevity Application, Consumer Type and Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Viome, BIOHM Health, Seed Health, Pendulum, Sun Genomics, Microba, Biomesight, Tiny Health, Invivo Healthcare, Enbiosis, Living Alchemy, BioGaia, PrecisionBiotics, Novonesis, dsm-firmenich, Chr. Hansen, Yakult Honsha |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Microbiome Test Kits

• Probiotic Supplements

• Prebiotic Supplements

• Synbiotic Supplements

• Postbiotic Supplements

• Functional Fermented Foods

• Functional Beverages

• Personalized Microbiome Programs & Subscriptions

• Capsules & Tablets

• Powders & Sachets

• Gummies & Chewables

• Liquid Shots & Drops

• Food-Based Formats

• Beverage-Based Formats

• Direct-to-Consumer (DTC)

• Online Retail & Marketplaces

• Pharmacies & Health Stores

• Practitioner & Clinical Wellness Channels

• Preventive Wellness Consumers

• Longevity & Biohacker Consumers

• Active Aging Population (55+)

• Healthy Aging & Inflammaging Control

• Metabolic Health & Weight Management

• Immune Health & Resilience

• Brain Health & Cognitive Wellness

• Muscle Health & Frailty Prevention

• Skin Health & Anti-Aging

• Women’s Longevity & Hormonal Health

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.