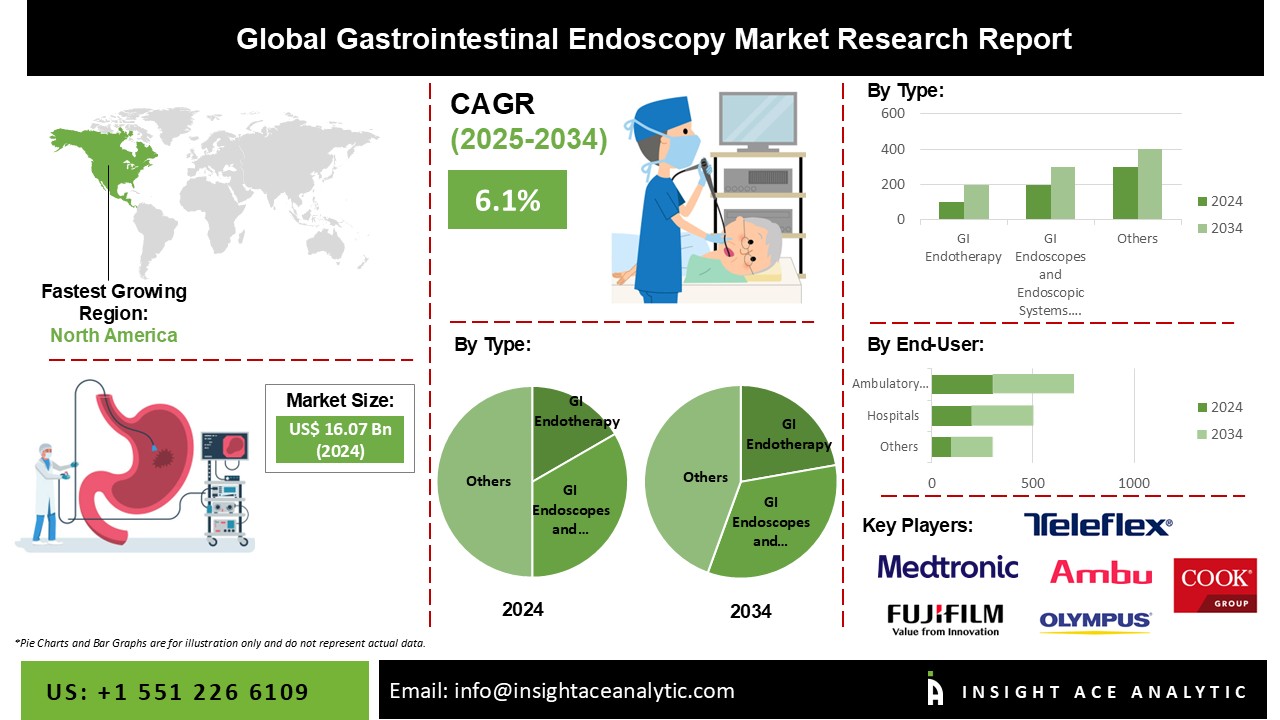

Gastrointestinal Endoscopy Market Size is valued at USD 16.07 billion in 2024 and is predicted to reach USD 28.74 billion by the year 2034 at a 6.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

A gastrointestinal endoscopy, also known as gastroscopy or digestive endoscopy, is a diagnostic and therapeutic procedure for illnesses of the upper digestive tract. The oesophagus, stomach, and duodenum form the upper digestive system (the first part of the small intestine). The endoscope device is introduced through the mouth, and the acquired images are presented on the monitor in real-time and/or recorded as the endoscope moves through the body. Endoscopy is occasionally performed with other procedures, such as an ultrasound. Attaching an ultrasound probe to the endoscope creates images of the oesophagus or stomach wall. Endoscopic ultrasound can also be used to create images of inaccessible organs, such as the pancreatic. Newer endoscopes utilise high-definition video to provide images with greater clarity. Numerous endoscopes employ a narrow band imaging technology that uses specialised light to improve the detection of precancerous diseases like Barrett's oesophagus. Modern endoscopy has shown to be immensely valuable in many fields of medicine because it entails relatively few risks, produces detailed images, and is rapid to do.

The gastrointestinal endoscopy market will be driven by factors such as an increasing need for endoscopy, the progress of new technologies, an increase in investments and funding, an increasing number of cases of gastrGlobal Gastrointestinal Endoscopy Market ointestinal illnesses, and increasing demand for procedures that are minimally invasive. Also, new device approvals will play an essential role in developing gastrointestinal endoscopy. In Feb 2022, Ambu announced that the FDA had approved their Ambu® aScopeTM Gastro and Ambu® aBoxTM 2 Single-Use Gastroscope and Next-Generation Display Unit. Ambu's solution addresses the current drawbacks of reusable endoscopes with advanced technology, portability, and cost-effectiveness, making it a suitable alternative for customers looking to perform gastroscopies in a variety of care settings (including endoscopy unit, OR, ICU, ER, ASC).

However, the high cost of endoscopic operations, adverse healthcare development, and limited reimbursement will hinder the growth of the market for gastrointestinal endoscopy. However, the expanding healthcare market in emerging nations and the development of gastrointestinal endoscopic devices will create several growth prospects for the gastrointestinal endoscopy market throughout the forecasting period.

· Olympus Corporation (Japan)

· Boston Scientific Corporation (USA)

· Medtronic plc (Ireland / USA)

· FUJIFILM Corporation (Japan)

· KARL STORZ SE & Co. KG (Germany)

· HOYA Corporation (Japan) — PENTAX Medical Division

· Johnson & Johnson (USA) — Ethicon / J&J MedTech

· Cook Medical (USA)

· Stryker Corporation (USA)

· B. Braun Melsungen AG (Germany)

· CONMED Corporation (USA)

· Smiths Group plc (UK)

· Ambu A/S (Denmark)

· Richard Wolf GmbH (Germany)

· STERIS plc (USA)

· Arthrex, Inc. (USA)

· EndoTheia, Inc. (USA)

· SteriView Technologies (USA)

· Solos Endoscopy, Inc. (USA)

· Dome Medical Technologies (USA)

· Lazurite Corporation (USA)

· CapsoVision, Inc. (USA)

· SonoScape Medical Technology Co., Ltd. (China)

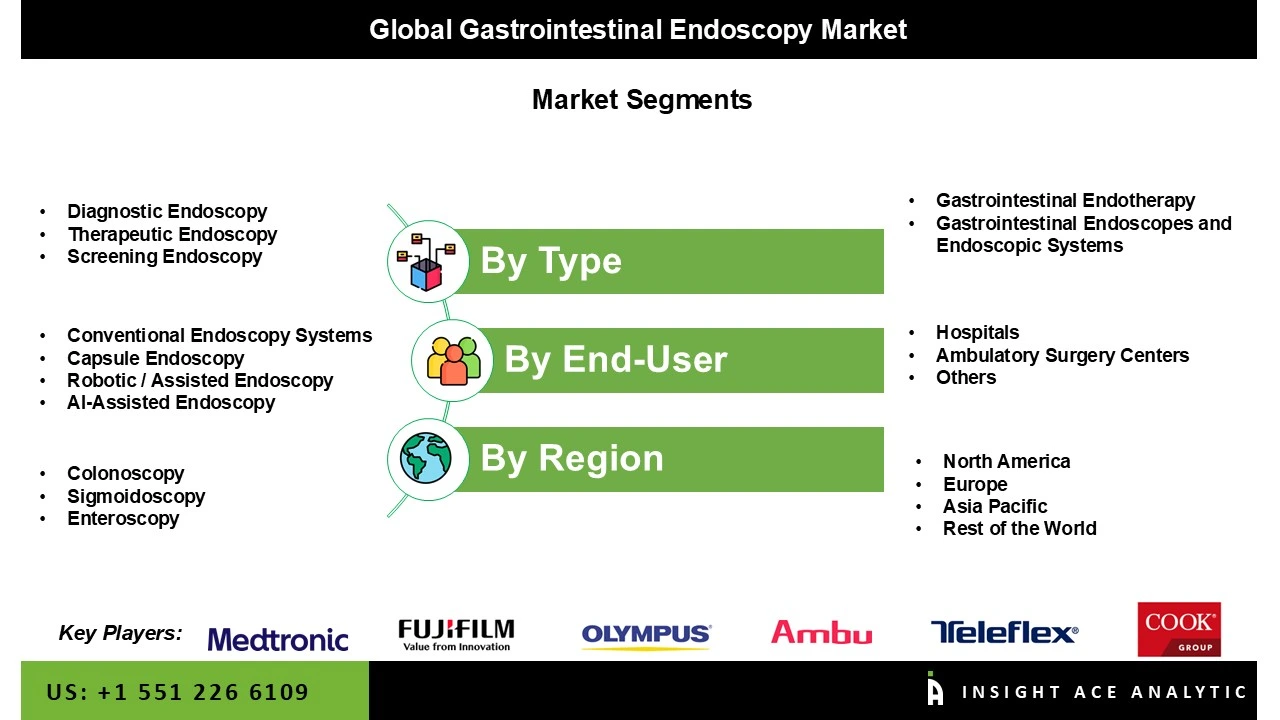

The Gastrointestinal Endoscopy Market is segmented into two major segments Types and End-User. By type, the market is widely classified. First is Gastrointestinal Endotherapy, which includes ERCP Devices, Gastrointestinal Stents, Balloon Dilators, Ultrasound Endoscopes, Biopsy Devices, Hemostasis Devices, Retrieval Devices, and Others. The gastrointestinal Stents category is subdivided into Esophageal Stents, Biliary Stents, and Pancreatic Stents. In comparison, the Biopsy Devices category is again divided into Biopsy Forceps, Polypectomy Snares, and Other Biopsy Devices. The second is Gastrointestinal Endoscopes and Endoscopic Systems, which contains three sub-divisions: Gastrointestinal Videoscopes, Visualization Systems, and Capsule Endoscopes. The sub-division Gastrointestinal Videoscopes comprises Gastroscopes, Colonoscopes, Duodenoscopes, Sigmoidoscopes, Enteroscopes and Anoscopes. The second significant segment, the End-User segment, includes, Hospitals, Ambulatory Surgery Centers, and Others.

In 2021, North America dominated the market. The introduction of new endoscopic devices will fuel market growth in North America. In addition, the increased prevalence of gastrointestinal illnesses, cancer, and other chronic conditions, as well as the rising desire for minimally invasive procedures, will increase North America's global market share.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 16.07 Bn |

| Revenue forecast in 2034 | USD 28.74 Bn |

| Growth rate CAGR | CAGR of 6.1% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Type, By Application, By Technology, By Disease and End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Boston Scientific Corporation, Medtronic plc, KARL STORZ SE & Co. KG, Ambu A/S, Teleflex Incorporated, HOYA Corporation, Olympus Corporation, FUJIFILM Holdings Corporation, Cook Group Inc, SonoScape Medical Corp., EndoMed Systems GmbH, CapsoVision, Inc., HuiZhou Xzing Technology Co., Ltd., Endogene Ltd., Envaste Limited |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Type

· Gastrointestinal Endotherapy Devices

o ERCP Devices

o Gastrointestinal Stents

§ Esophageal Stents

§ Biliary Stents

§ Pancreatic Stents

o Balloon Dilators

o Hemostasis Devices

o Biopsy Devices

§ Biopsy Forceps

§ Polypectomy Snares

§ Other Biopsy Instruments

o Retrieval Devices

o Other Endotherapy Devices

· Gastrointestinal Endoscopes & Endoscopic Systems

o Gastrointestinal Videoscopes

§ Gastroscopes

§ Colonoscopes

§ Duodenoscopes

§ Sigmoidoscopes

§ Enteroscopes

§ Anoscopes

o Ultrasound Endoscopes (EUS)

o Capsule Endoscopes

· Visualization Systems

o Video Processors

o Cameras (HD / 3D / 4K)

o Light Sources

o Monitors & Recording Systems

By Application

· Diagnostic Endoscopy

· Therapeutic Endoscopy

· Screening Endoscopy

By End-User

· Hospitals

· Ambulatory Surgical Centers (ASCs)

· Specialty Clinics / Diagnostic Centers

By Technology

· Conventional Endoscopy Systems

· Capsule Endoscopy

· Robotic / Assisted Endoscopy

· AI-Assisted Endoscopy

· Single-Use / Disposable Endoscopy

By Disease / Procedure Area

· Esophagogastroduodenoscopy (EGD)

· Colonoscopy

· Sigmoidoscopy

· Enteroscopy

· Endoscopic Retrograde Cholangiopancreatography (ERCP)

· Endoscopic Ultrasound (EUS)

Global Gastrointestinal Endoscopy Market, by Region,

North America Gastrointestinal Endoscopy Market, by Country,

Europe Gastrointestinal Endoscopy Market, by Country,

Asia Pacific Gastrointestinal Endoscopy Market, by Country,

Latin America Gastrointestinal Endoscopy Market, by Country,

Middle East & Africa Gastrointestinal Endoscopy Market, by Country,

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.