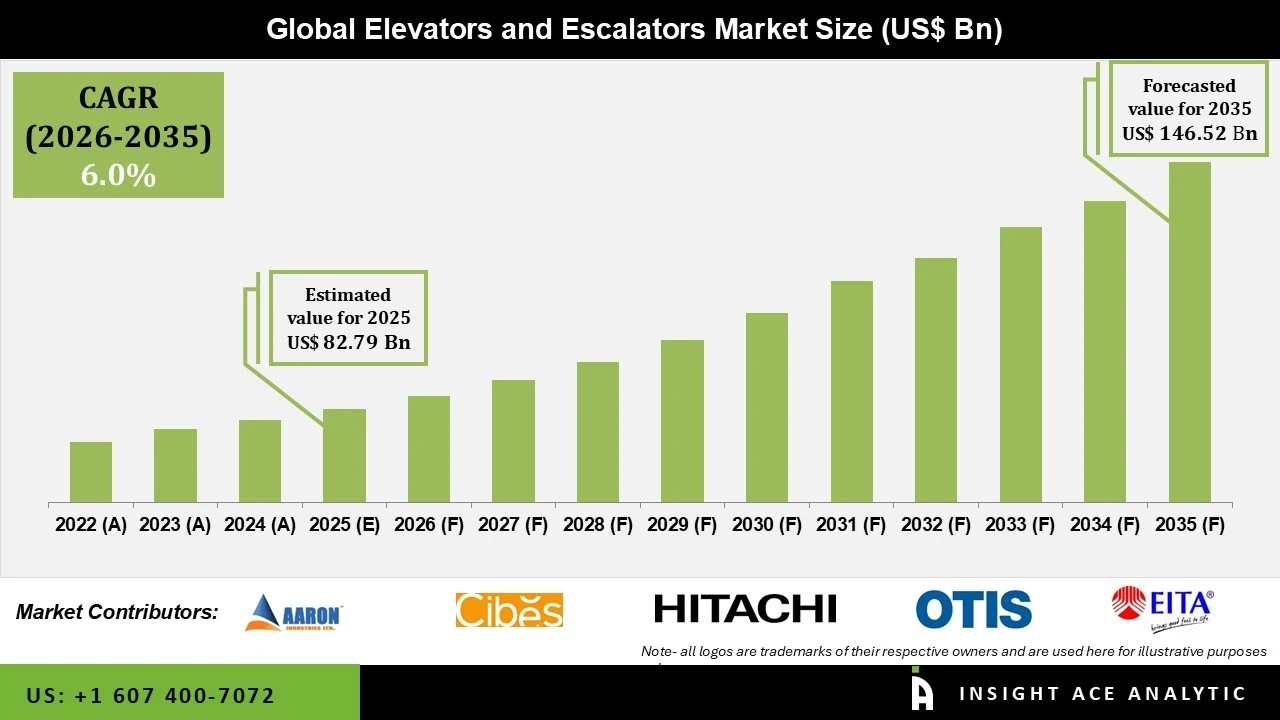

Elevators And Escalators Market Size is valued at USD 82.79 Billion in 2025 and is predicted to reach USD 146.52 Billion by the year 2035 at a 6.0% CAGR during the forecast period for 2026 to 2035.

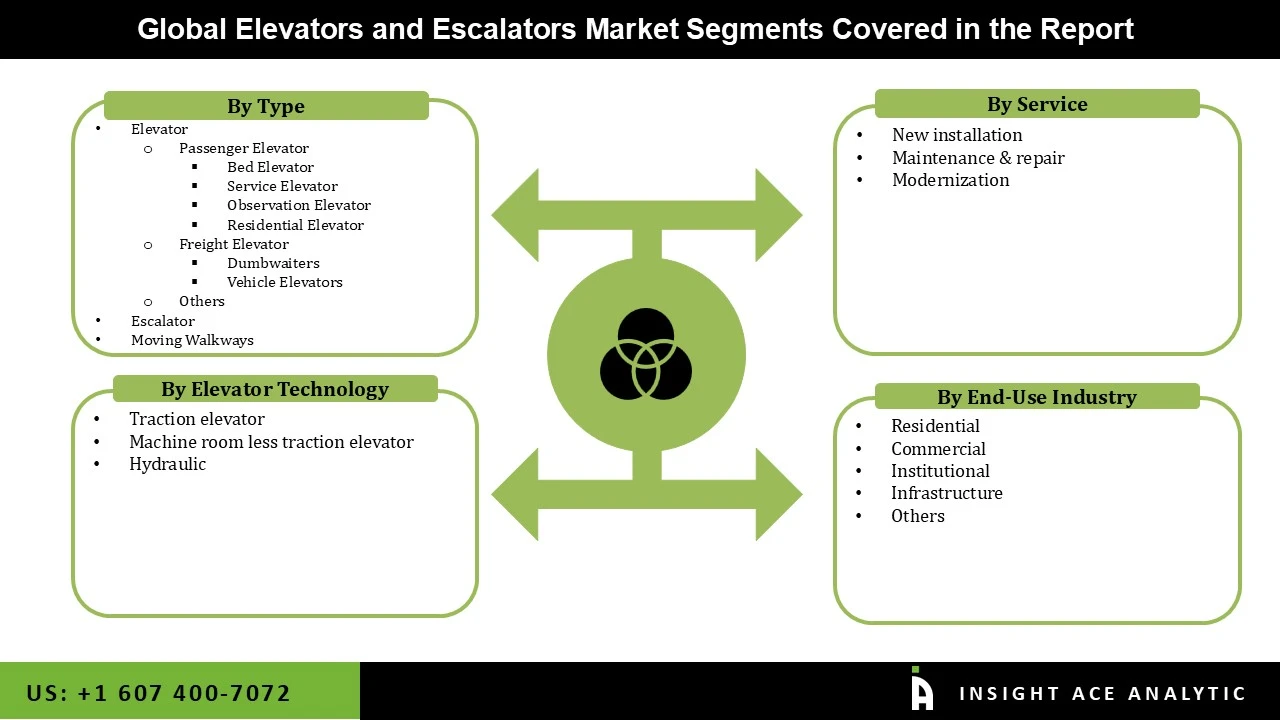

Elevators and Escalators Market Size, Share & Trends Analysis Report By Type (Elevators, Escalators, Moving walkways), Service (New installation, Maintenance & Repair, and Modernization), Elevator Technology (Traction, Machine-Room-Less, & Hydraulic), By Region, And Segment Forecasts, 2026 to 2035

In any building, elevators are used to transport people and things between the various levels or floors. On the other hand, an escalator is a moving staircase that transports people between levels in a public structure and comprises a belt of steps that circulates. In growing nations like China and India, demand for elevators and escalators is rising dramatically.

Key Industry Insights & Findings from the Report:

The primary growth factors for the worldwide elevators and escalators industry are escalating urbanization, changing demographics, and rising safety concerns. Due to the rising construction sector, the market will have development possibilities during the projected period. Due to the various regional legislations governing this topic, the maintenance and modernization segment of the global elevators and escalators market is also anticipated to expand throughout the forecast period. Additionally, elevators and escalators are predicted to have a considerable increase in demand as a result of the uptick in urbanization, which is producing more and more contemporary retail establishments and metro train stations.

In the upcoming years, the elevators and escalators market may also see growth prospects due to the growing acceptance of green building rules and energy-efficient goods. The market for elevators and escalators may face more challenges in the near future due to compliance with standards and guidelines.

The elevators and escalators market is segmented on the type, service, elevator technology and end-use industry. Based on type, the market is segregated into elevators, escalators and moving walkways. Based on service, the market is segregated into new installation, maintenance & repair and modernization. Based on elevator technology, the elevators and escalators market is segmented into traction elevators, machine room-less traction elevator and hydraulic. Based on end-use industry, the market is segregated into residential, commercial, institutional, infrastructure and others.

The escalator category seized the highest revenue share, and it is projected that it will continue to maintain that position during the anticipated time. The increased demand from commercial infrastructures, such as shopping centres, business parks, and others, is to blame for this. Additionally, the need for escalators and moving walkways is increasing as a result of the expanding aircraft infrastructure development. For instance, the $775 million redevelopment of Stansted Airport in the United Kingdom is anticipated to be finished by 2021. Furthermore, due to their widespread market penetration, the need for elevators is anticipated to expand steadily.

During the projected period, the commercial category is predicted to expand at a high rate. Elevators and escalators are often used in commercial buildings, including shopping malls, office buildings, and co-working spaces. The rising trend towards eco-efficiency, flexible design, and safety drives the commercial sector. Additionally, during the past several years, the demand for numerous co-working spaces has increased due to the rise in self-employment. Therefore, changing office space investments are anticipated to support market expansion.

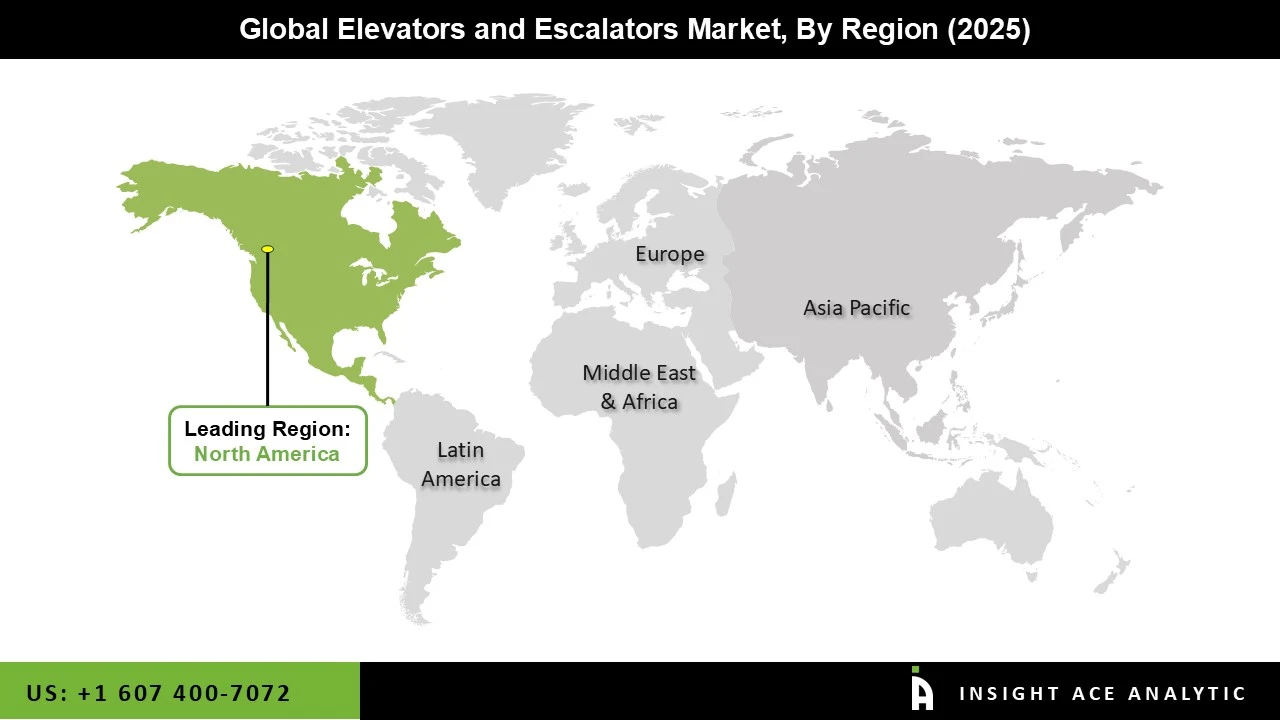

The North America elevators and escalators market is expected to record the highest market share in revenue shortly. A significant factor in the industry's growth, particularly in the United States, is the efforts made by international manufacturers to establish their presence in the local market. Through smart mergers and acquisitions of the leading domestic players, several well-established global market players are attempting to advance their operations and build a robust regional client base.

In addition, the Asia Pacific is projected to grow rapidly in the global elevators and escalators market because of a sharp increase in demand from significant economies and growing regions like India and Southeast Asia. According to the results of the regional study, China has made a substantial contribution to the rise in market revenue and currently maintains a sizable market share for elevators and escalators.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 82.79 Billion |

| Revenue forecast in 2035 | USD 146.52 Billion |

| Growth rate CAGR | CAGR of 6.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Thousand Units) and CAGR from 2025 to 2034 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Service, Elevator Technology And End-Use Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Schindler Group (Switzerland), Otis Elevator (US), Thyssenkrupp AG (Germany), KONE Corporation (Finland), and Hitachi Ltd. (Japan), amongst others. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Elevators and Escalators Market By Type

Elevators and Escalators Market By Service

Elevators and Escalators Market By Elevator Technology

Elevators and Escalators Market By End-Use Industry

Elevators and Escalators Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.