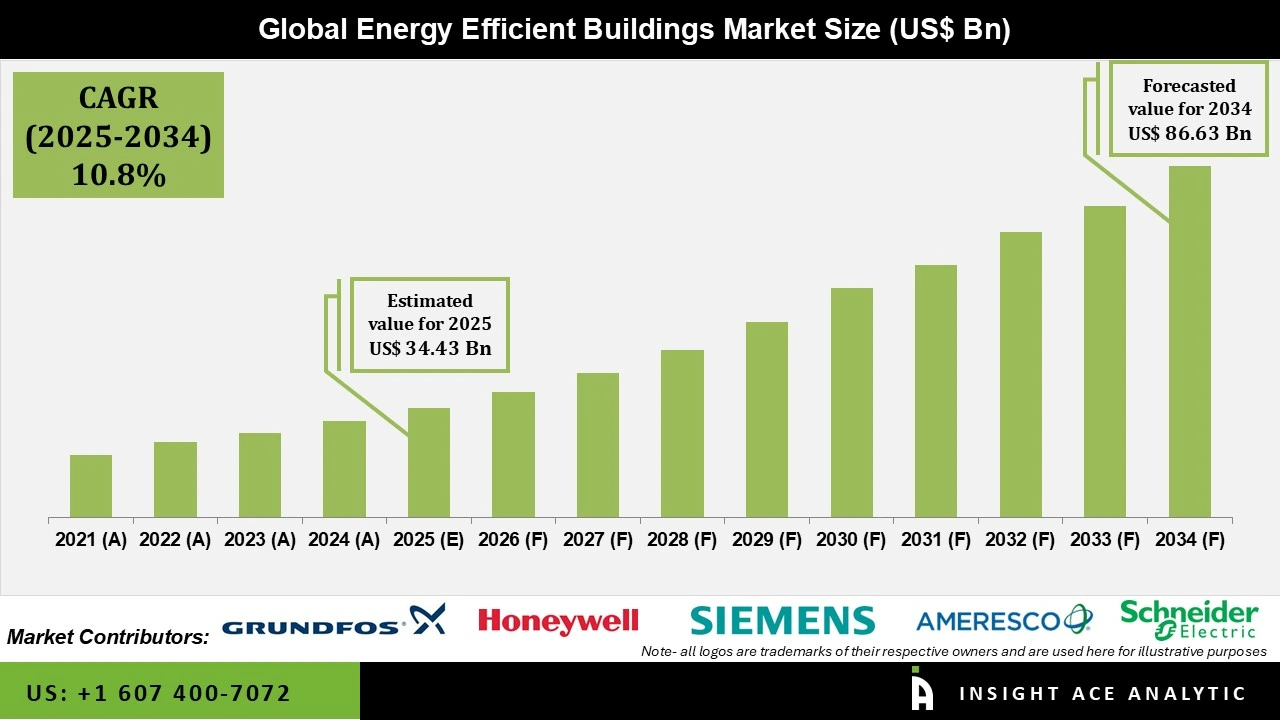

Global Energy Efficient Buildings Market is valued at US$ 34.53 Bn in 2025 and it is expected to reach US$ 86.63 Bn by 2034, with a CAGR of 10.8% during the forecast period of 2025-2034.

Energy-efficient buildings save energy, reduce electricity bills, and improve indoor air quality. They use smart insulation, natural light, efficient heating/cooling systems, and solar power to stay comfortable while using much less energy. These buildings help cities cut pollution and handle growing energy needs. They make spaces affordable, healthy, and eco-friendly. The global energy-efficient buildings market is growing fast as energy prices rise and governments push for greener construction.

Rising electricity costs drive demand for energy-efficient buildings. Businesses and homeowners want long-term savings through smart designs and upgrades. For example, the U.S. government invested $2 billion in 150 federal building projects across 39 states using sustainable materials. Stricter building codes, climate change concerns, and corporate sustainability goals also boost adoption. Companies and developers see energy efficiency as both a cost-saver and a competitive advantage.

High initial costs for insulation, smart systems, and solar panels remain a major barrier. However, these investments pay back through lower utility bills within 3-7 years. Government incentives make projects more affordable. New technologies—AI building controls, advanced windows, and energy-storing materials—are becoming cheaper and more effective. As costs drop and benefits become clearer, energy-efficient buildings will become standard worldwide.

Some of the Key Players in the Energy Efficient Buildings Market:

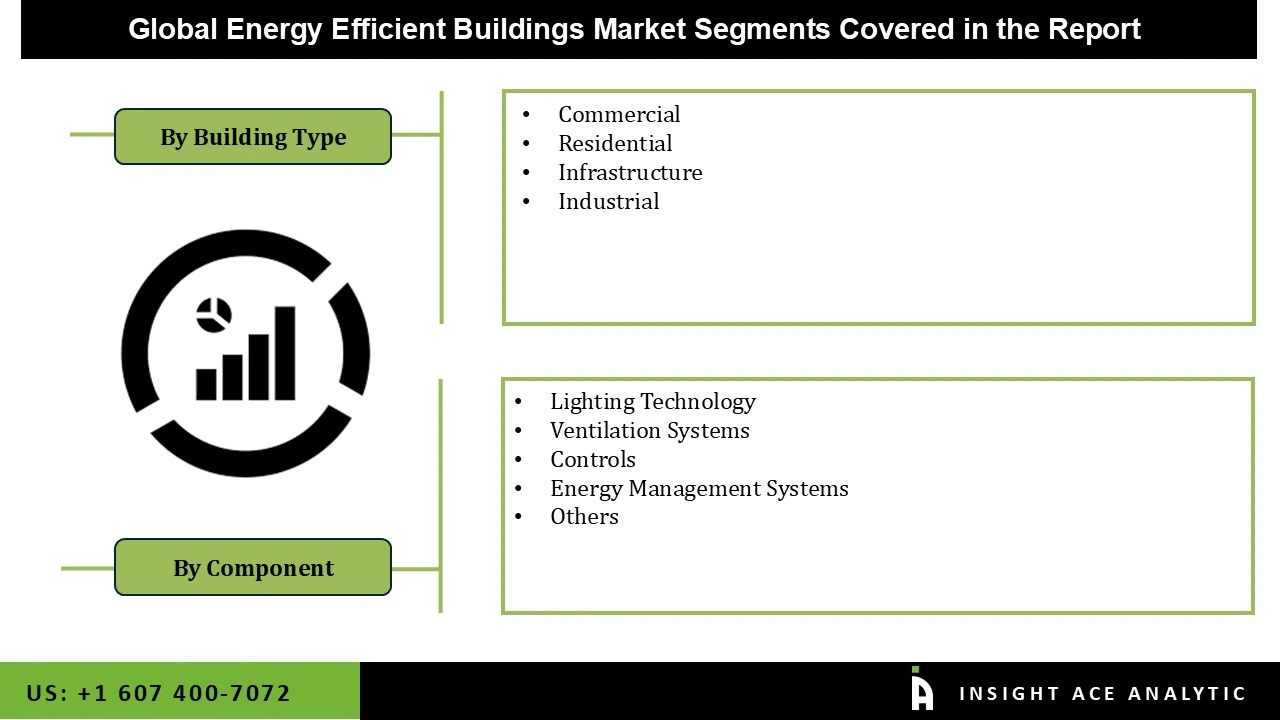

The energy efficient buildings market is segmented by building type and component. By building type, the market is segmented into commercial, residential, infrastructure, and industrial. By component, the market is segmented into lighting technology, ventilation systems, controls, energy management systems, and others.

The Commercial category led the Energy Efficient Buildings market in 2024. In order to accomplish sustainability objectives and lower carbon emissions, governments and regulatory agencies around the world have come to understand the significance of energy efficiency in commercial buildings. Commercial building owners and developers have been motivated to invest in energy-efficient technologies & practices by strict building requirements, energy efficiency standards, and financial incentives. Additionally, energy-efficient solutions offer significant long-term operational benefits, and commercial building owners and operators frequently seek cost savings.

The largest and fastest-growing Component is Lighting Technology, a trend driven by the rapid technological developments that have occurred in the lighting business, especially since LED (Light Emitting Diode) technology has become widely used. Compared to conventional incandescent and fluorescent lighting, LED lighting is more ecologically friendly, long-lasting, and energy efficient. The use of energy-efficient lighting systems has increased as a result. Additionally, governments all around the world have put laws and incentives in place to encourage energy-efficient lighting. T

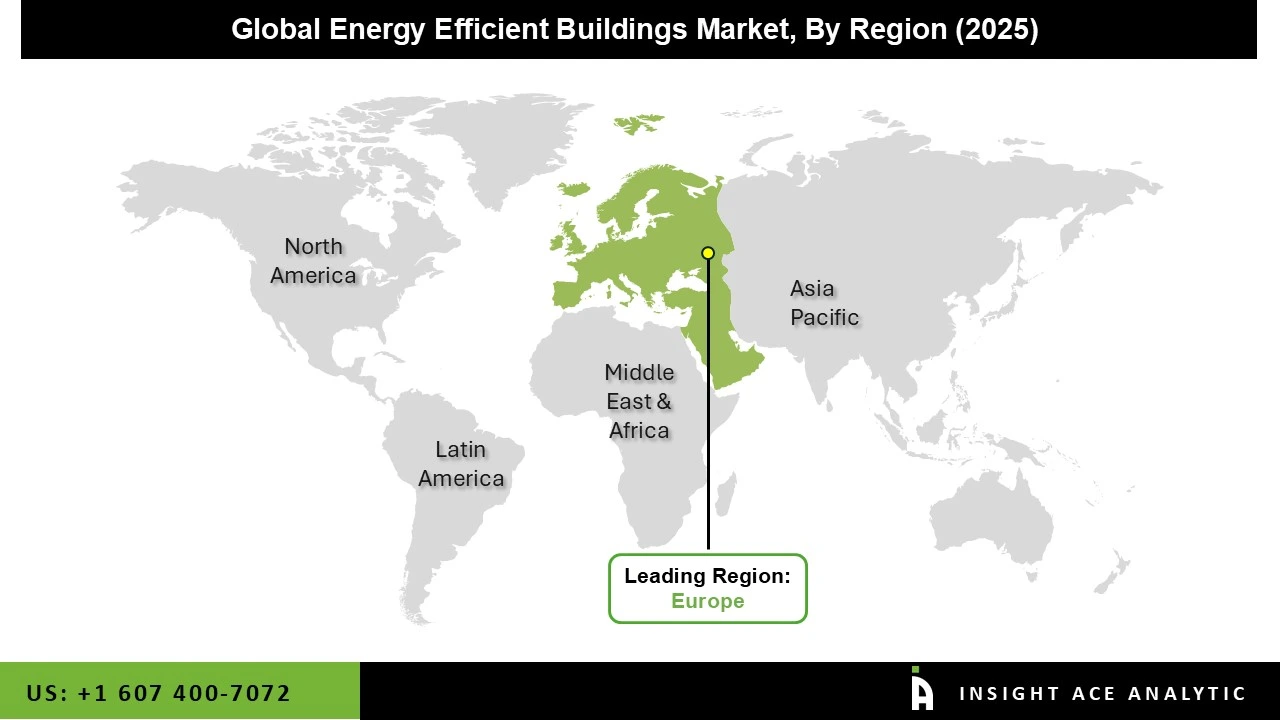

Europe led the energy-efficient buildings market in 2024 due to strict construction laws and energy regulations. The Energy Performance of Buildings Directive (EPBD) sets high standards for energy efficiency, pushing developers to use smart designs and materials from the planning stage. European countries prioritize sustainable practices, ensuring buildings reduce energy use and environmental impact. This strong regulatory framework makes Europe the global leader in energy-efficient construction.

Asia-Pacific is the fastest-growing energy-efficient buildings market, driven by rapid urbanization, rising energy costs, and government policies. Cities like Singapore, China, and India face huge energy demands from new construction, forcing developers to adopt smart building technologies. Cost savings from lower utility bills and strict green building codes accelerate adoption. Governments invest heavily in energy-efficient infrastructure, making the region a growth leader.

· In March 2024, Grundfos Holding A/S launched the "Grundfos iSOLUTIONS" platform with new AI-driven energy optimization features for commercial building circulator pumps. The updated platform uses real-time data and predictive algorithms to automatically adjust pump speed and system pressure, reducing a building's HVAC energy consumption by up to 20% compared to standard pumps.

Energy Efficient Buildings Market by Building Type-

· Commercial

· Residential

· Infrastructure

· Industrial

Energy Efficient Buildings Market by Component -

· Lighting Technology

· Ventilation Systems

· Controls

· Energy Management Systems

· Others

Energy Efficient Buildings Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.