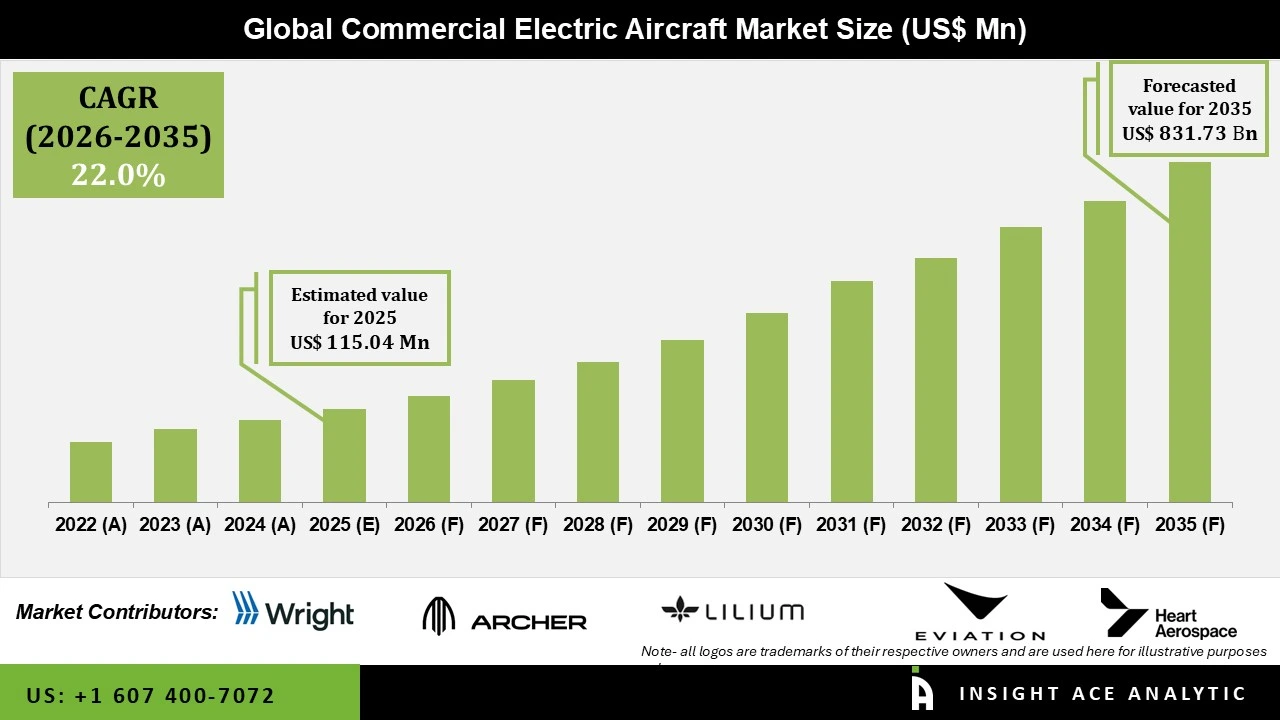

Global Commercial Electric Aircraft Market Size is valued at USD 115.04 Mn in 2025 and is predicted to reach USD 831.73 Mn by the year 2035 at a 22.0% CAGR during the forecast period for 2026 to 2035.

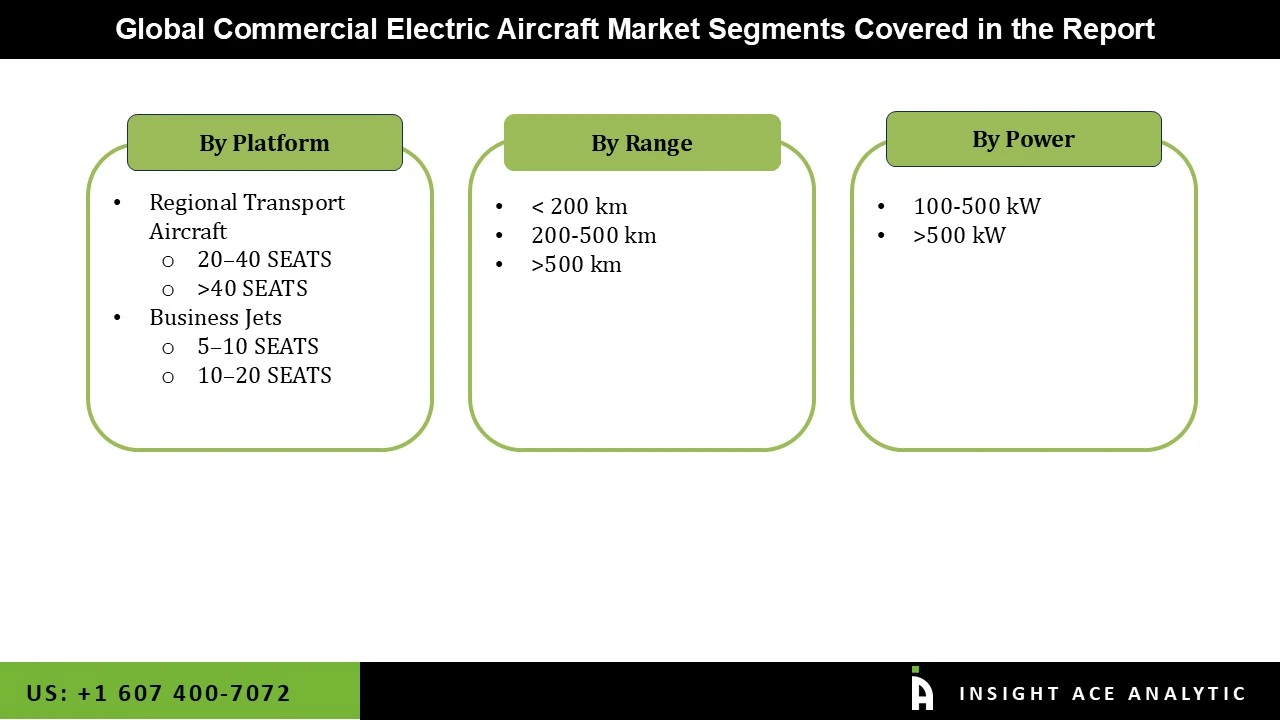

Commercial Electric Aircraft Market Size, Share & Trends Analysis Report By Platform (Regional Transport Aircraft (20-40 SEATS, >40 SEATS), Business Jets (<5 SEATS, 5-10 SEATS, 10-20 SEATS), By Range (< 200 km, 200-500 km, >500 km), By Power (100-500 kW, >500 kW), By Region, And By Segment Forecasts, 2026 to 2035

Commercial electric aircraft are an emerging innovation in aviation, designed to reduce environmental impact by using electric motors for propulsion instead of traditional combustion engines. Powered by batteries, hydrogen fuel cells, or hybrid systems, these aircraft aim to offer energy-efficient, low-emission, and quieter alternatives for air travel. Initially, electric aircraft were the most viable for short-haul flights, urban air mobility applications like air taxis, and pilot training or light aircraft due to current limitations in energy storage and range. The development and adoption of electric aircraft face challenges such as advancing battery technology, building necessary infrastructure, and establishing regulatory frameworks. However, the potential advantages in terms of reduced carbon emissions and operational costs make electric aviation a promising area for future growth in the industry.

The Commercial Electric Aircraft Market is witnessing rapid growth due to escalating environmental concerns and advancements in electric propulsion technology. With an emphasis on reducing carbon emissions, airlines and manufacturers invest heavily in electric aircraft development. The COVID-19 pandemic affected air passenger traffic globally, reducing flight activity and impacting airline cash flows. The economic downturn impacted by the pandemic led to decreased demand for air travel and constrained budgets for research and development. This resulted in delays in the development and deployment of electric aircraft projects. However, as the aviation industry seeks to recover and address sustainability concerns, there is renewed interest in electric aircraft as a long-term solution. Investments and innovations are expected to increase as the industry becomes more environmentally friendly.

The Commercial Electric Aircraft Market is segmented based on Platform, Range and Power. By Platform segment is divided into Regional Transport Aircraft (20–40 SEATS, >40 SEATS) and Business Jets (500 km. As per the Power, the market categorises into 100-500 kW, >500 kW.

Based on the Platform, the Business Jet segment is projected to lead in the highest market growth share in the Commercial Electric Aircraft Market. This is due to the increasing demand for sustainable and efficient air travel solutions among high-net-worth individuals, corporate executives, and charter operators. Electric propulsion systems offer distinct advantages for business jets, including reduced operating costs, lower environmental impact, and quieter operations, aligning with customers' preferences. Technological advancements in Technology and electric motor efficiency enable fully commercial electric business jets to achieve the performance metrics required for long-range travel, further enhancing their appeal in the market. Key players in this segment invest in developing electric-powered business jets to meet the growing demand.

The key accelerators for the growing trend in the 200-500 km range are the advancements in electric propulsion technology, which result in enhanced performance and efficiency. An increasing number of airlines and operators are recognizing that electric aircraft can offer cost-effective and environmentally friendly choices for trips spanning 200–500 km. This recognition is driving investment and fostering innovation in this industry.

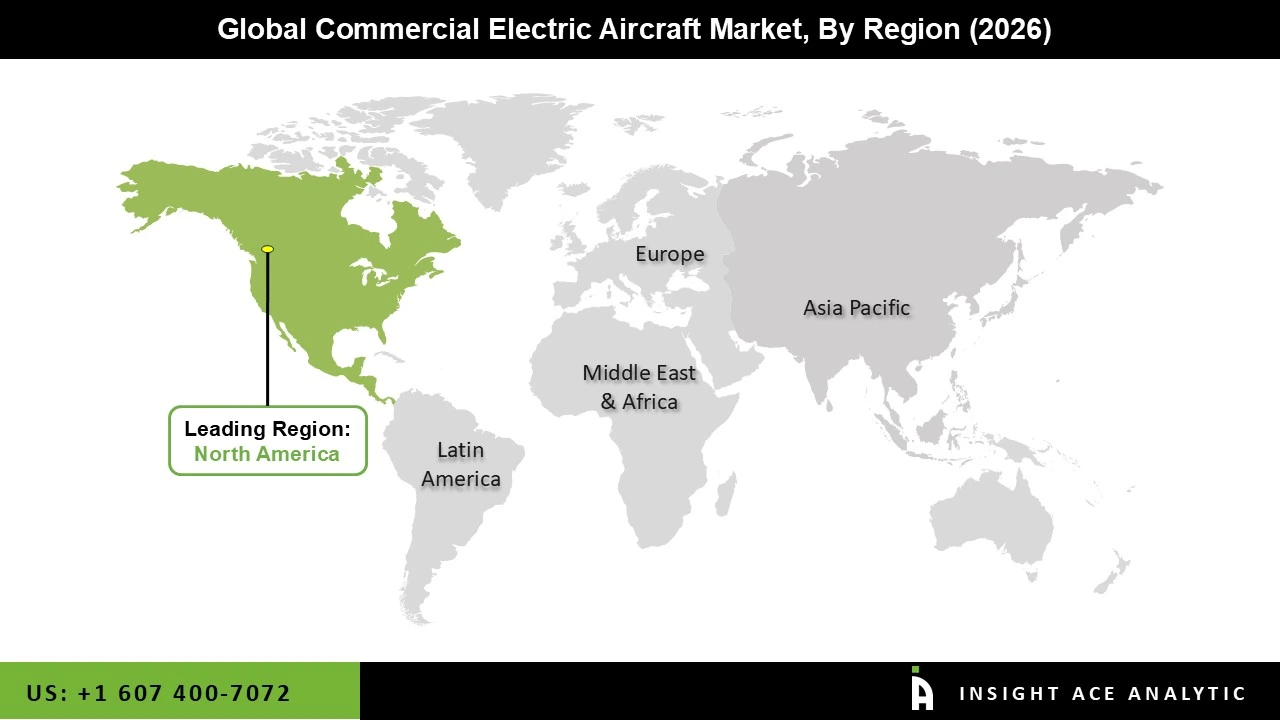

North America is the most dominant market due to the region's strong industrial infrastructure. This growth trajectory is fueled by several factors, including the region's strong aerospace industry, technological innovation, supportive regulatory environment, and increasing emphasis on sustainability.

North America boasts a robust ecosystem of aerospace manufacturers, research institutions, and startups dedicated to advancing electric aviation technology. Additionally, government initiatives and incentives to promote clean energy and reduce carbon emissions drive investment in fully electric aircraft development and deployment.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 115.04 Mn |

| Revenue Forecast In 2035 | USD 831.73 Mn |

| Growth Rate CAGR | CAGR of 22.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Range, Platform, and Power |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Heart Aerospace, Thales, Wright Electric Inc., Eviation, magniX, Joby Aviation, Electric Aviation Group, Embraer, Lilium, Vertical Aerospace, ARCHER AVIATION INC., Leonardo S.p.A., Wisk Aero LLC., SCYLAX GmbH, Overair, Inc., Supernal, LLC. And other market players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.