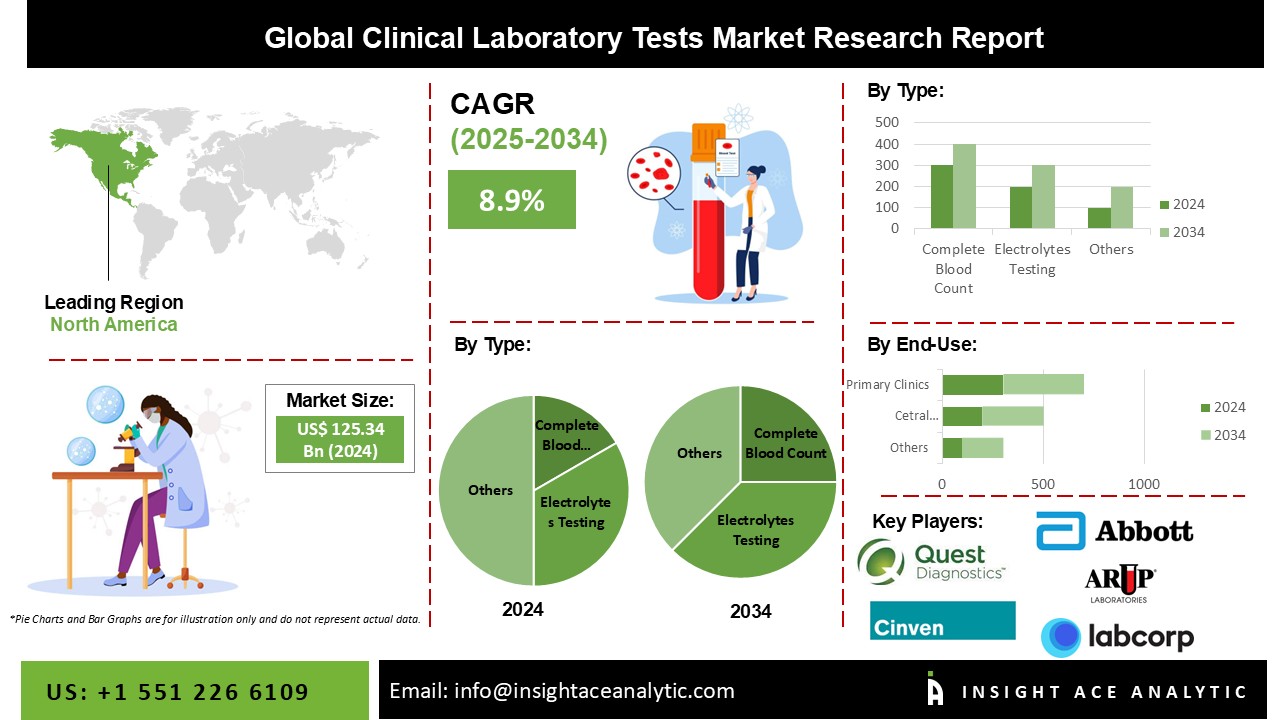

Global Clinical Laboratory Tests Market Size is valued at USD 125.34 billion in 2024 and is predicted to reach USD 291.98 billion by the year 2034 at an 8.9% CAGR during the forecast period for 2025 to 2034.

Clinical Laboratory Tests Market Size, Share & Trends Analysis Report By Type (Complete Blood Count, HGB/HCT Testing, Basic Metabolic Panel Testing, BUN Creatinine Testing, Electrolytes Testing, HbA1c Testing, Comprehensive Metabolic Panel Testing, Liver Panel Testing, Renal Panel Testing, Lipid Panel Testing, and Cardiovascular Panel Tests), By End-use (Central Laboratories, Primary Clinics), By Region, And Segment Forecasts, 2025 to 2034

The market for clinical laboratory tests is expanding due to factors like an aging population, an expansion in the prevalence of target diseases, and the development of creative solutions to suit the market's increased need for clinical testing. The spread of COVID-19 has significantly impacted the healthcare and testing industries.

The pandemic's negative consequences have been seen in the market for clinical laboratory tests. For instance, LabCorp saw an 8.9% decrease in total sales in 2020. This is also because fewer people underwent routine medical examinations during the pandemic, which decreased the number of clinical chemistry tests performed. However, the frequency of tests has returned to normal, suggesting that the COVID-19 epidemic has no impact in the long term.

The WHO reports that in most industrialized economies, the average life expectancy has surpassed 80 years. Aging is a significant risk factor for the emergence of infectious diseases due to the interaction of various environmental and genetic factors that impact immunity and metabolism, changing the function of organs. Hence, diagnostics and screening might be crucial in treating general health. Therefore, as the elderly population grows, so does the demand for acute and long-term healthcare, fueling the expansion of the global market.

The Clinical Laboratory Tests market is segmented based on type and end-use. Based on type, the market is segmented as Complete Blood Count, HGB/ HCT testing, Basic Metabolic Panel Testing, BUN Creatinine Testing, Electrolytes Testing, HbA1c Testing, Comprehensive Metabolic Panel Testing, Liver Panel Testing (Hepatitis, Bile Duct Obstruction, Liver Cirrhosis, Liver Cancer, Bone Disease, Autoimmune Disorders, Others) Renal Panel Testing, Lipid Panel Testing, and Cardiovascular Panel Testing. By end-use, the market is segmented into Central Laboratories, and Primary Clinics.

The segment for HbA1c tests held the largest market share. Although patients with fluctuating levels of HbA1c run a higher risk of developing problems from diabetes, it is projected that the growing number of patients with diabetes and aberrant cholesterol levels will fuel market expansion. Furthermore, the introduction of more recent laboratory testing is anticipated to further fuel market expansion. For instance, OmegaQuant introduced the HbA1c Test in May 2022 to measure the level of blood sugar in the body. A home collection device for diabetes risk testing called LabCorp on demand was also introduced by LabCorp in May 2022. Such fresh launches provide accessibility to a variety of lab tests for determining blood sugar levels.

Over the projected period, the central laboratories sector is anticipated to extend at the fastest rate. The intense market penetration and procedure volumes are credited with the segment's growth. Another significant factor projected to propel the market is the rising number of efforts undertaken by governments to provide various services, such as reimbursement for clinical laboratory testing. For the integration of many tests, including microbiology testing, several healthcare organizations are collaborating with laboratories. Furthermore, a sizable portion comes from a huge number of laboratories in developing and emerging countries. Regulatory agencies are also enhancing laboratory services and simplifying the diagnosing process.

The region with the biggest market share is anticipated to hold onto that position during the projection period. This might be linked to the region's growing senior population, increased chronic illness prevalence, including cancer, and intense market penetration of cutting-edge diagnostic techniques. One of the substantial causes of death in North America, according to the American Cancer Society, is cancer. Prostate cancer in males and breast cancer in women are the two most frequently diagnosed cancers. The regional market is anticipated to be driven by factors like rising patient awareness and a growing inclination for novel techniques.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 125.34 Bn |

| Revenue forecast in 2034 | USD 291.98 Bn |

| Growth rate CAGR | CAGR of 8.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | By Type And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Quest Diagnostics Incorporated.; Abbott; Cinven; Laboratory Corporation of America Holdings; ARUP Laboratories; OPKO Health, Inc.; UNILABS; Clinical Reference Laboratory, Inc.; Synnovis Group LLP; Sonic Healthcare Limited. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Clinical Laboratory Tests Market By Type-

Clinical Laboratory Tests Market By End-Use-

Clinical Laboratory Tests Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.