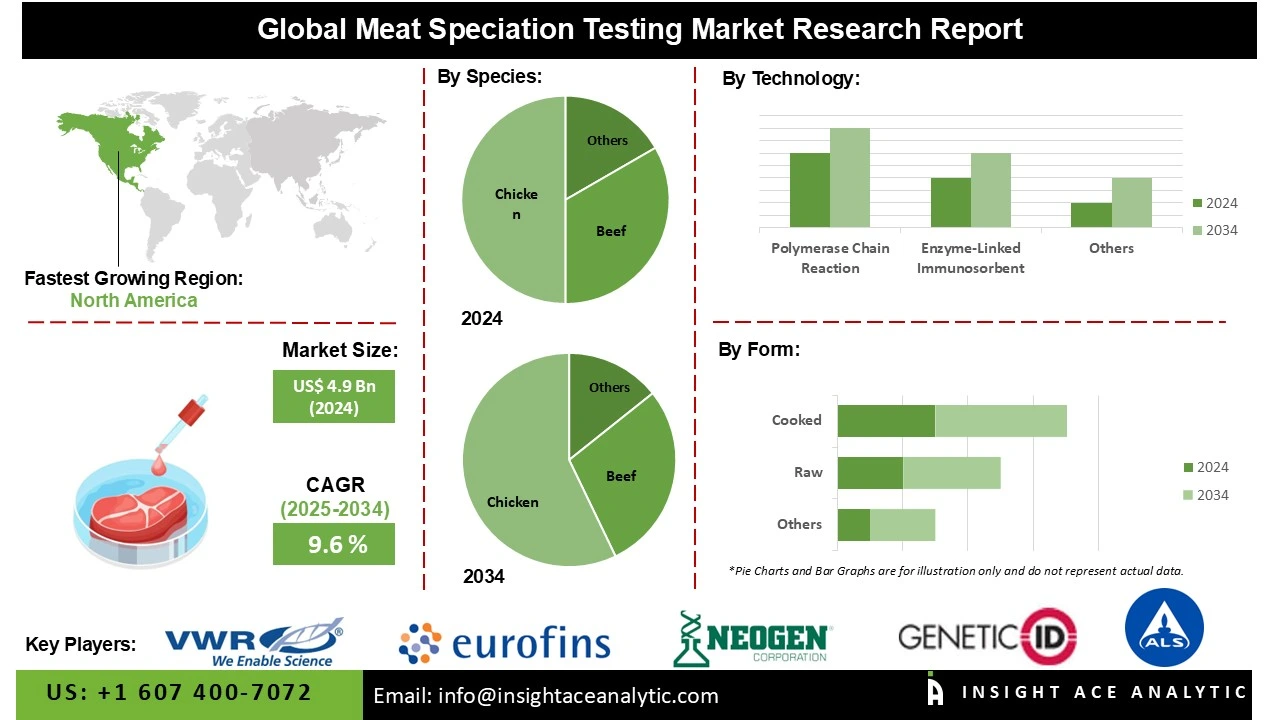

Meat Speciation Testing Market Size is valued at US$ 4.9 Bn in 2024 and is predicted to reach US$ 11.8 Bn by the year 2034 at an 9.6% CAGR during the forecast period for 2025-2034.

Meat speciation testing is done to identify animal species for a number of reasons, such as safety, economic, or ethnic considerations. ELISA (Enzyme Linked Immunosorbent Assay) and qualitative PCR analysis methods are among the products used in meat speciation testing. In a range of food and feed matrices, these techniques are employed to determine the animal species present in both raw and cooked goods.

Meat speciation testing is highly necessary due to the rise in unethical behaviors and fraudulent situations involving meat and meat products. The market for meat specification testing is expanding due to stricter regulations, improved supply chain monitoring, and growing consumer awareness of safety and quality.

The need for trustworthy testing techniques is being driven by the increased emphasis on food safety, growing consumer awareness of food authenticity, and the rise in meat adulteration cases globally. Further driving market expansion are technological developments in DNA-based testing methods and the enforcement of strict regional food safety regulations.

Adoption of meat species identification testing technologies is further accelerated by the growth in the global meat trade and the requirement for openness in the food supply chain. However, the market for meat speciation testing would be constrained by the lack of technological modernity as well as the disarray and complexity of developing areas' food systems.

Some of the Key Players in Meat Speciation Testing Market:

· Eurofins Scientific SE

· VWR International LLC

· AB Sciex LLC

· ALS Limited

· International Laboratory Services Ltd.

· Scientific Analysis Laboratories Ltd

· LGC Science Group Ltd.

The meat speciation testing market is segmented by form, species, and technology. By form, the market is segmented into cooked, raw, and processed meat. By species, the market is segmented into chicken, beef, swine, sheep, horse, and others. By technology, the market is segmented into enzyme-linked immunosorbent assay, polymerase chain reaction, and others.

In 2024, the global meat speciation testing market saw chicken as the leading sector because of its high inclusion in processed and ready-to-eat meat products, low cost, and broad consumption. Due to its widespread use as a protein source in various cultures and dietary preferences, chicken is frequently substituted or adulterated. Since the inclusion of non-chicken DNA might result in regulatory non-compliance and public reaction, there is a particularly strong need for species identification in markets that are halal-certified and sensitive to allergies. Furthermore, the necessity for regular chicken speciation testing to guarantee authenticity, safety, and confidence has been exacerbated by the explosive expansion of the worldwide poultry trade.

The capacity of Polymerase Chain Reaction (PCR) to detect even small amounts of DNA in complicated and processed meat products, along with its high accuracy and sensitivity, made it the dominating segment of the global meat differentiation testing market in 2024. A lot of food testing labs use PCR technique because it is reliable for identifying species, especially when there is adulteration or mislabeling. It is a preferred option for food manufacturers and regulatory agencies due to its ability to produce results quickly and consistently. Advances like multiplex PCR and real-time PCR have also improved testing efficiency by allowing the simultaneous detection of different meat species in a single test.

In 2024, Europe held the most market share. Ensuring food safety and protecting consumers from food fraud are significant concerns for European regulatory bodies and consumers. To make sure that meat labels are accurate, meat speciation is used to test for undeclared or adulterated meat species. The need for such testing is motivated by the need to preserve consumer confidence, avoid labeling errors, and address public health risks. Furthermore, both national and EU rules require meat products to be properly labeled and traceable. Legal compliance and the prevention of unethical behavior in the food industry depend on meat speciation testing.

Moreover, it is expected that the Asia Pacific region will grow at the highest CAGR throughout the course of the projected decade. Increasing meat consumption in countries such as China, India, and others is the cause of the region's growth. It is also influenced by changing food patterns among the expanding middle class and stricter regulations. The introduction of fifty new National Food Safety Standards in China has increased demand for automated extraction systems and high-throughput PCR equipment, which require better methods for evaluating meat authenticity. Due to this technological advancement, testing facilities throughout the region have been modernized.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.9 Bn |

| Revenue Forecast In 2034 | USD 11.8 Bn |

| Growth Rate CAGR | CAGR of 9.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Form, By Species, By Technology, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Eurofins Scientific SE, VWR International LLC, AB Sciex LLC, ALS Limited, International Laboratory Services Ltd., Scientific Analysis Laboratories Ltd, and LGC Science Group Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Meat Speciation Testing Market by Form-

· Cooked

· Raw

· Processed Meat

Meat Speciation Testing Market by Species -

· Chicken

· Beef

· Swine

· Sheep

· Horse

· Others

Meat Speciation Testing Market by Technology-

· Enzyme-Linked Immunosorbent Assay

· Polymerase Chain Reaction

· Others

Meat Speciation Testing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.