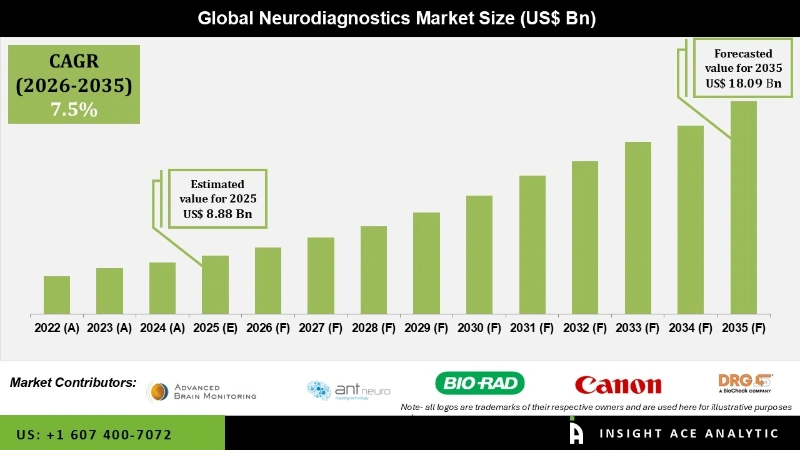

The Global Neurodiagnostic Market Size is valued at USD 8.88 billion in 2025 and is predicted to reach USD 18.09 billion by the year 2035 at a 7.5% CAGR during the forecast period for 2026 to 2035.

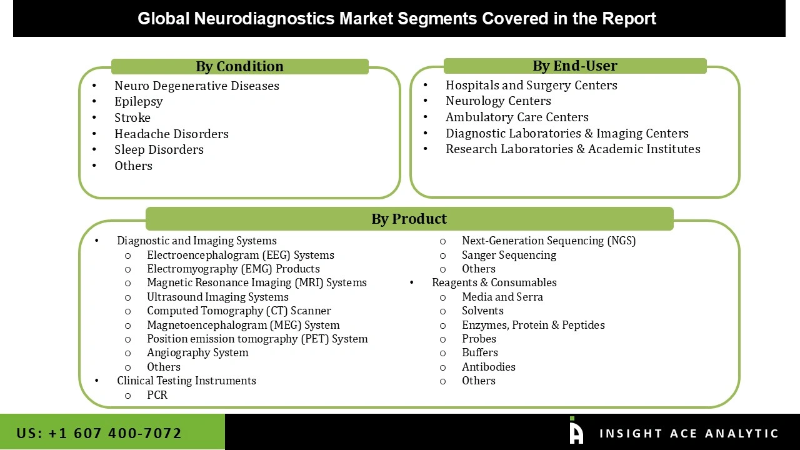

Neurodiagnostics Market Size, Share & Trends Analysis Report By Product (Diagnostic and Imaging Systems, Clinical Testing Instruments, Reagents & Consumables), By Condition (Neuro Degenerative Diseases, Epilepsy, Stroke), By End-Use, By Region, And Segment Forecasts, 2026 to 2035.

Neurodiagnostic equipment is used to diagnose neurological problems. Neurodiagnostics can diagnose disorders such as stroke, migraine, epilepsy, Parkinson's disease, and stroke. Diagnostic and imaging systems, as well as in-vitro diagnostics, are characteristics of neurodiagnostic products. CT, MRI, and PET scanners are examples of diagnostic and imaging systems. The growing elderly population, rising neurological illness incidence rates, and the existing healthcare expenditure load on society and government are driving the neurodiagnostic market expansion.

However, the COVID-19 epidemic put a significant burden on the whole healthcare system. The COVID-19 outbreak was hampered by a shortage of medical services, and more persons were infected regularly. As a result, healthcare facilities began to invest in respiratory support systems such as life support machines, oxygen generators, ventilators, personal protective equipment (PPE) kits, masks, and gloves, among other things. As a result, demand for the neurodiagnostic market declined precipitously, weighing heavily on the worldwide neurodiagnostic industry. Additionally, lockdown and social distance measures impeded the construction of such gadgets, resulting in huge costs for the producers.

The Neurodiagnostics Market is segmented based on product, condition, and end-use. Based on product, the market is segregated into diagnostic and imaging systems (electroencephalogram systems, electromyography products, magnetic resonance imaging systems, ultrasound imaging systems, computed tomography scanners, magnetoencephalogram systems, positron emission tomography systems, angiography systems, and others), clinical testing instruments (next-generation sequencing, sanger sequencing, others), and reagents & consumables (media and serra, enzymes, solvents, protein & peptides, probes, buffers, antibodies, others).

The condition segment includes neurodegenerative diseases, epilepsy, stroke, headache disorders, sleep disorders, and others. By end-use, the market is segmented into hospitals and surgery centers, neurology centers, ambulatory care centers, diagnostic laboratories & imaging centers, and research laboratories & academic institutes.

The diagnostic and imaging systems category is predicted to maintain a major share of the global neurodiagnostic market in 2021. The increasing prevalence of neurological illnesses, the rising adoption of advanced medical imaging technologies, and the growing elderly population are the primary factors driving the diagnostic and imaging segment's rise. The elevated prevalence of neurological illnesses among individuals is driving up demand for neurodiagnostic gadgets, which will boost segment expansion over the predicted period.

The hospitals and surgery centers segment is anticipated to develop at a rapid rate in the global neurodiagnostic market owing to the enormous patient volume admitted to these hospitals. Hospitals with the financial resources to do so can purchase complex and modern neurological equipment, increasing revenue potential and leveraging prospects.

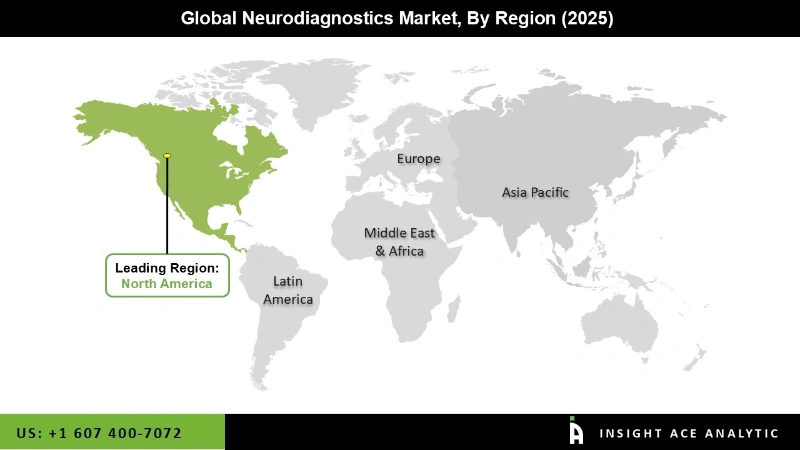

The North America Neurodiagnostics Market is expected to register the highest market share in terms of revenue in the near future. Due to the presence of robust healthcare infrastructure, increasing prevalence of neurological disorders, high healthcare expenditure, and presence of significant market players constantly growing and launching advanced diagnostics devices in the region. Furthermore, growing diagnostic product launches in the Asia Pacific are boosting market growth over the forecast period.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 8.88 Bn |

| Revenue forecast in 2035 | USD 18.09 Bn |

| Growth rate CAGR | CAGR of 7.5 % from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, Condition, And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | GE HealthCare, Koninklijke Philips N.V., Siemens Healthcare GmbH, Hitachi, Ltd., Canon Inc., Lifelines Neuro, Natus Medical Incorporated, F. Hoffmann-La Roche Ltd, FUJIFILM Holdings Corporation, and Mitsar Co. LTD. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Neurodiagnostics Market By Product-

Neurodiagnostics Market By Condition-

Neurodiagnostics Market By End-Use-

Neurodiagnostics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.