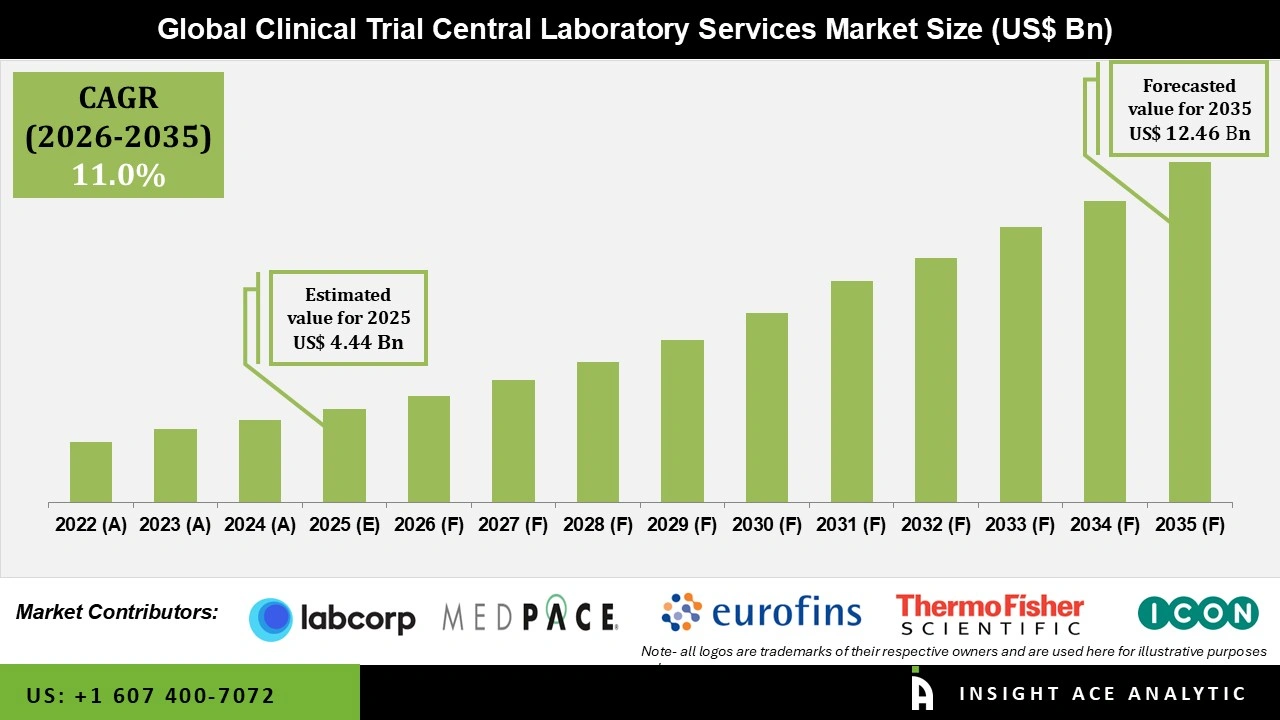

Global Clinical Trial Central Laboratory Services Market Size is valued at USD 4.44 Billion in 2025 and is predicted to reach USD 12.46 Billion by the year 2035 at a 11.0% CAGR during the forecast period for 2026 to 2035.

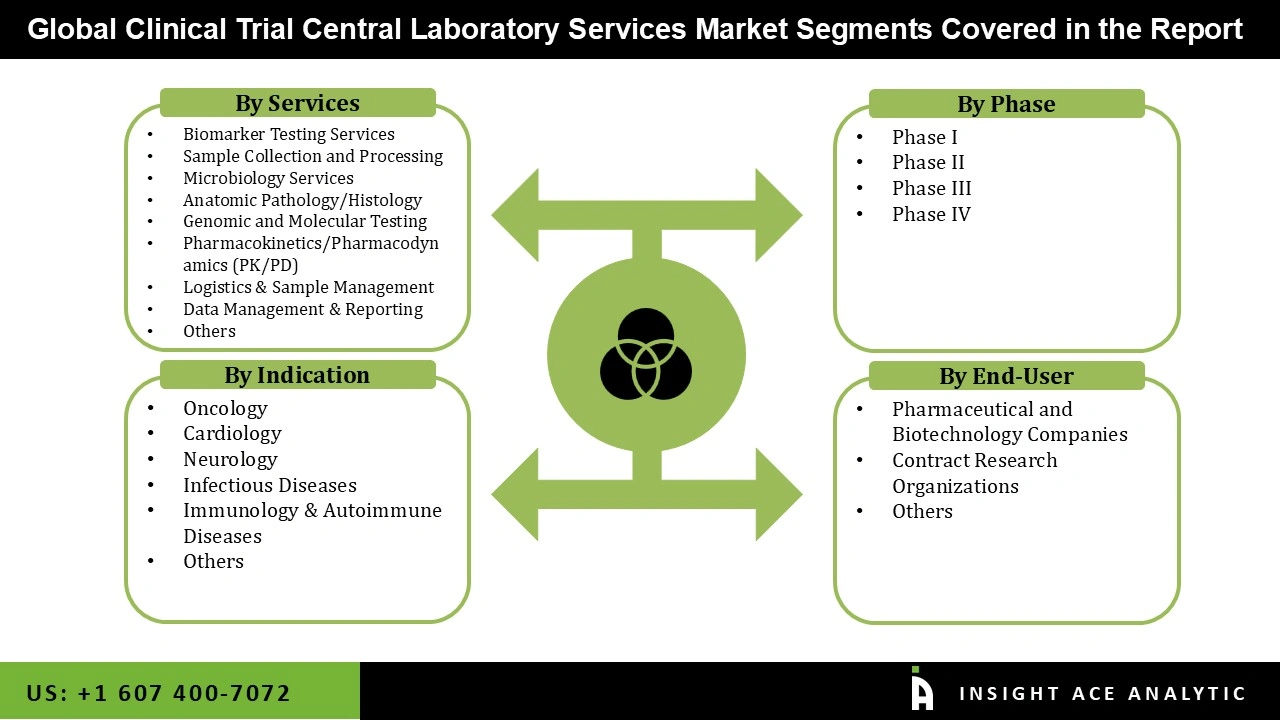

Clinical Trial Central Laboratory Services Market Size, Share & Trends Analysis Report By Services (Biomarker Testing Services, Sample Collection and Processing, Microbiology Services, Anatomic Pathology/Histology, Genomic and Molecular Testing, Pharmacokinetics/Pharmacodynamics (PK/PD), Logistics & Sample Management, Data Management & Reporting), By Phase (Phase I, Phase II, Phase III, Phase IV), By Indication (Oncology, Cardiology, Neurology, Infectious Diseases, Immunology & Autoimmune Diseases), By End-User, By Region, and By Segment Forecasts, 2026 to 2035.

Clinical Trial Central Laboratory Services are specialized laboratory services that support clinical trials by providing centralized and uniform testing, analysis, and data management. By ensuring accuracy and consistency in laboratory testing across several trial locations, these services aid in maintaining adherence to regulatory requirements and research protocols. Using central labs for a range of functions, including pharmacokinetics, safety testing, biomarker analysis, and specialist tests, researchers can assess the effectiveness and safety of medications. The market is expanding as a result of rising chronic disease incidence, increased demand for innovative treatment alternatives, precision medication breakthroughs, and biomarker-driven clinical trials. Additionally, the market is growing due to the rapid improvements in data analytics, artificial intelligence, laboratory automation, harmonization of regulations, and the expansion of clinical trials into international markets.

Moreover, the rising occurence of chronic illnesses and the growing need for novel therapies both support the expansion of the clinical trial central laboratory services sector. Pharmaceutical and biotechnology firms accelerated drug research in response to rising rates of cancer, heart disease, and uncommon genetic illnesses. In order to guarantee standardized sample analysis, biomarker testing, and genetic sequencing, this increase in clinical trials prompted a significant need for centralized lab services.

• Labcorp

• ICON plc

• Eurofins Scientific

• Thermo Fisher Scientific Inc.

• Medpace

• Q² Solutions

• Syneos Health

• Charles River Laboratories

• SGS

• LabConnect

• Other Market Players

The Clinical Trial Central Laboratory Services market is segmented based on services, phase, indication, and end-user. As per the services, the market is further segmented into Biomarker Testing Services, Sample Collection and Processing, Microbiology Services, Anatomic Pathology/Histology, Genomic and Molecular Testing, Pharmacokinetics/Pharmacodynamics (PK/PD), Logistics & Sample Management, Data Management & Reporting, and Others. By phase, the market is segmented into Phase I, Phase II, Phase III, and Phase IV. By indication, the market is segmented into Oncology, Cardiology, Neurology, Infectious Diseases, Immunology & Autoimmune Diseases, and Others. According to the end-user, the market is categorised into Contract Research Organizations, Pharmaceutical & Biotechnology Companies, and Others.

The Biomarker Testing Services category is expected to hold a major global market share in 2021. Its important significance in targeted therapeutics and precision medicine, particularly in oncology and immunology studies, is the reason for its expansion. The need for patient stratification and drug efficacy evaluation services has increased dramatically due to the growing use of biomarkers in these processes.

The Phase III segment held a dominant position in the clinical trial central laboratory services market because of its vital role in assessing the safety and efficacy of drugs prior to regulatory approval. Due to the extensive laboratory testing, large patient populations, and strict regulatory criteria involved in these trials, there is a strong demand for central lab services. Pharmaceutical corporations further contribute to their market domination by allocating the majority of their clinical research funds to Phase III studies.

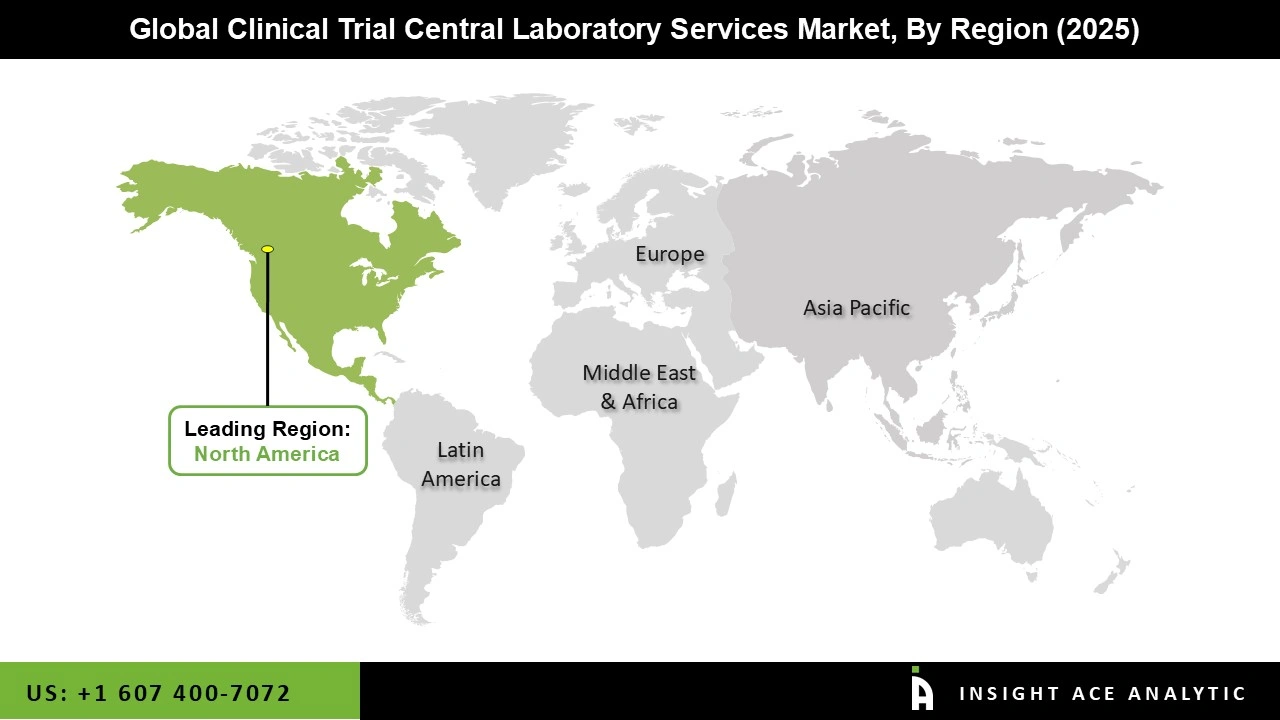

The North American Clinical Trial Central Laboratory Services market is expected to report the most increased market share in revenue in the near future due to its substantial R&D investments, strong clinical research infrastructure, and the presence of leading pharmaceutical and biotechnology companies.Strict regulations, including FDA regulations, in the area increased the demand for excellent central laboratory services.

Additionally, advanced laboratory services are essential for pathology, pharmacokinetics analysis, and biomarker testing at a wide network of research institutes and CROs in the US. In addition, Asia Pacific is projected to grow rapidly in the global Clinical Trial Central Laboratory Services market. The increasing number of clinical trials in nations like China, India, and Japan is the reason for the region's expansion. Large patient populations and cost-effective research are the goals of international pharmaceutical corporations' investments in the area. The increased emphasis on biosimilars, regenerative medicine, and oncology studies further fuels the need for biomarker testing and genetic analysis in the central labs.

The key players in the Clinical Trial Central Laboratory Services market have shifted their focus toward technological advancement and higher demand for them. They are initiating significant strategies such as mergers and joint ventures of major and domestic players to expand their selection of products and raise their global market footprint. Some of the major key players in the Clinical Trial Central Laboratory Services market are Labcorp, ICON plc, Eurofins Scientific, Thermo Fisher Scientific Inc., Medpace, Q² Solutions, Syneos Health, Charles River Laboratories, SGS, and LabConnect.

In February 2025, LabConnect partnered with Sapio Sciences to deploy a Laboratory Information Management System (LIMS). By simplifying sample tracking and improving data management within LabConnect's operations, this partnership seeks to modernize intricate research workflows further digitally.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 4.44 Billion |

| Revenue Forecast In 2035 | USD 12.46 Billion |

| Growth Rate CAGR | CAGR of 11.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Services, Phase, Indication, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Labcorp, ICON plc, Eurofins Scientific, Thermo Fisher Scientific Inc., Medpace, Q² Solutions, Syneos Health, Charles River Laboratories, SGS, and LabConnect |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Biomarker Testing Services

• Sample Collection and Processing

• Microbiology Services

• Anatomic Pathology/Histology

• Genomic and Molecular Testing

• Pharmacokinetics/Pharmacodynamics (PK/PD)

• Logistics & Sample Management

• Data Management & Reporting

• Others

• Phase I

• Phase II

• Phase III

• Phase IV

• Oncology

• Cardiology

• Neurology

• Infectious Diseases

• Immunology & Autoimmune Diseases

• Others

• Pharmaceutical and Biotechnology Companies

• Contract Research Organizations

• Others

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.