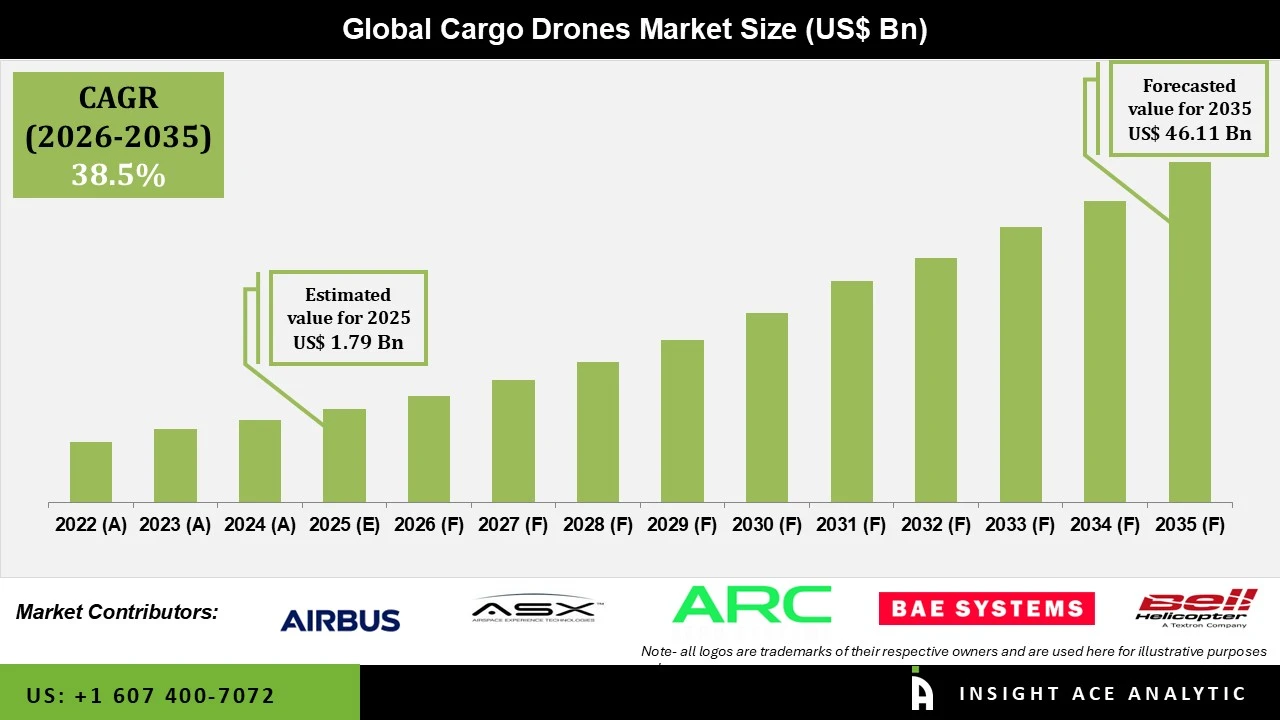

Cargo Drones Market Size is valued at USD 1.79 Billion in 2025 and is predicted to reach USD 46.11 Billion by the year 2035 at a 38.5% CAGR during the forecast period for 2026 to 2035.

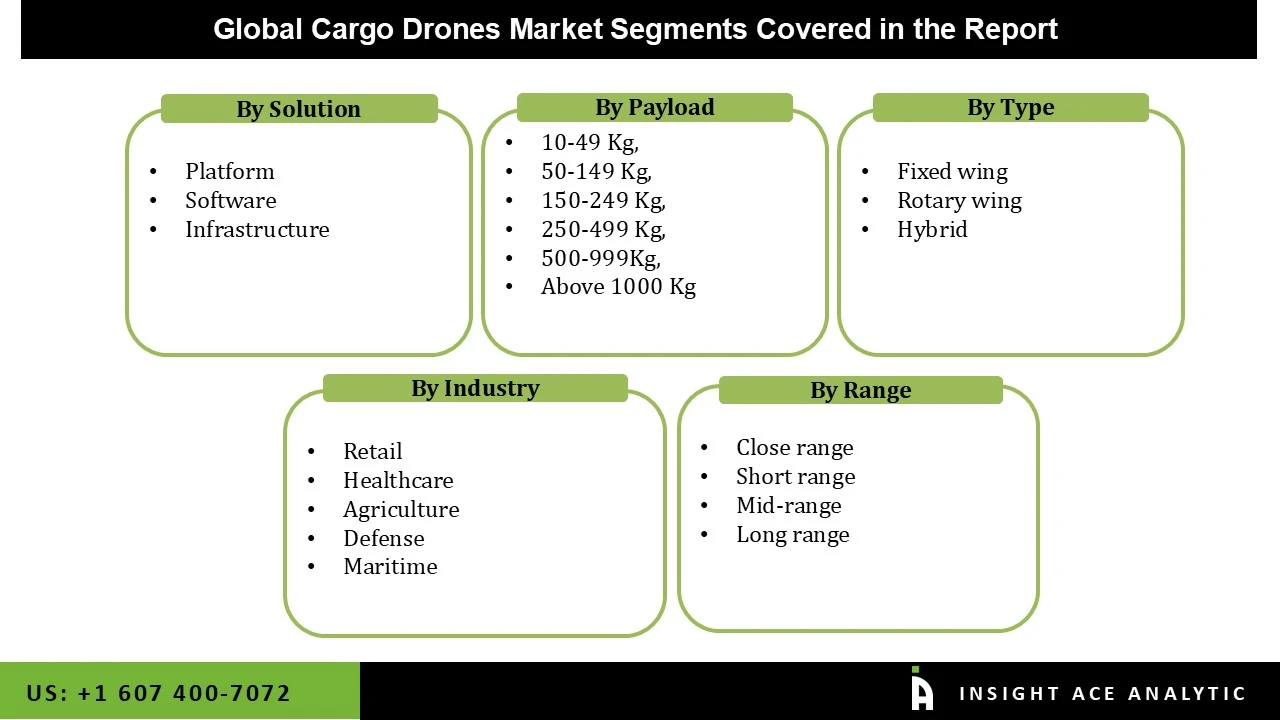

Cargo Drones Market Size, Share & Trends Analysis Report By Solution (Platform, Software, Infrastructure), Industry (Retail, Healthcare, Agriculture, Defense and Maritime), Range (Close-Range, Short-Range, Mid-Range, Long-Range), Payload, Type, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Drones are increasingly often employed in logistics management and transportation due to the quick evolution of technology. Many companies worldwide are using drones to handle their supply chain management systems. Drones are used for various purposes, including crop inspections, land surveying, mining activities, etc. Additionally, buyers are willing to pay more to have products delivered on the same day, suggesting growth in demand for quicker and more cost-effective delivery, especially in the e-commerce sector. The use and acceptance of drones in logistics and transportation will probably expand due to this demand.

Furthermore, drones for logistics and transportation are undergoing significant testing in several industries, including postal delivery, health insurance, the transfer of pharmaceuticals, including drugs, blood, organs, and machinery, as well as e-commerce, delivery services, and food delivery. This indicates that distribution using drones should cost 60% less. Drones are also simpler to control than ground-based vehicles as a fleet.

The Cargo Drones market is segmented by solution, industry, range, payload, and type. Based on the solution, the demand is segmented as platform, software, and infrastructure. By industry, the market is segmented into retail, healthcare, agriculture, defense, and maritime. By payload, the market is segmented as 10-49 Kg, 50-149 Kg, 150-249 Kg, 250-499 Kg, 500-999Kg, and above 1000 Kg. Based on range, the market is segmented as close-range, short-range, mid-range, and long-range. By type, the market is divided into fixed-wing, rotary-wing, and hybrid.

The retail and logistics sectors currently dominate the market. This trend is anticipated to continue during the forecast period as more retailers, e-commerce companies, last-mile delivery services, shore-to-ship drone operations, and postal organisations demand drones to deliver parcels and packages. Major e-commerce corporations, local postal agencies, and local governments are introducing drone delivery services to reduce the effort required to deliver goods and parcels to far-flung islands, mountainous regions, and towns. For instance, in October 2021, Royal Postal finished testing autonomous UAV flights between Kirkwall and North Ronaldsay with Windracers Ltd. The test was a component of the Kirkwall Airport-based Sustainable Aviation Test Environment (SATE) initiative.

The term "hybrid flight" refers to the drones' ability to combine both VTOL (Vertical Takeoff and Landing) and traditional flight, also known as fixed-wing flight. These aeroplanes are far more adaptable than those of their rivals due to this feature.

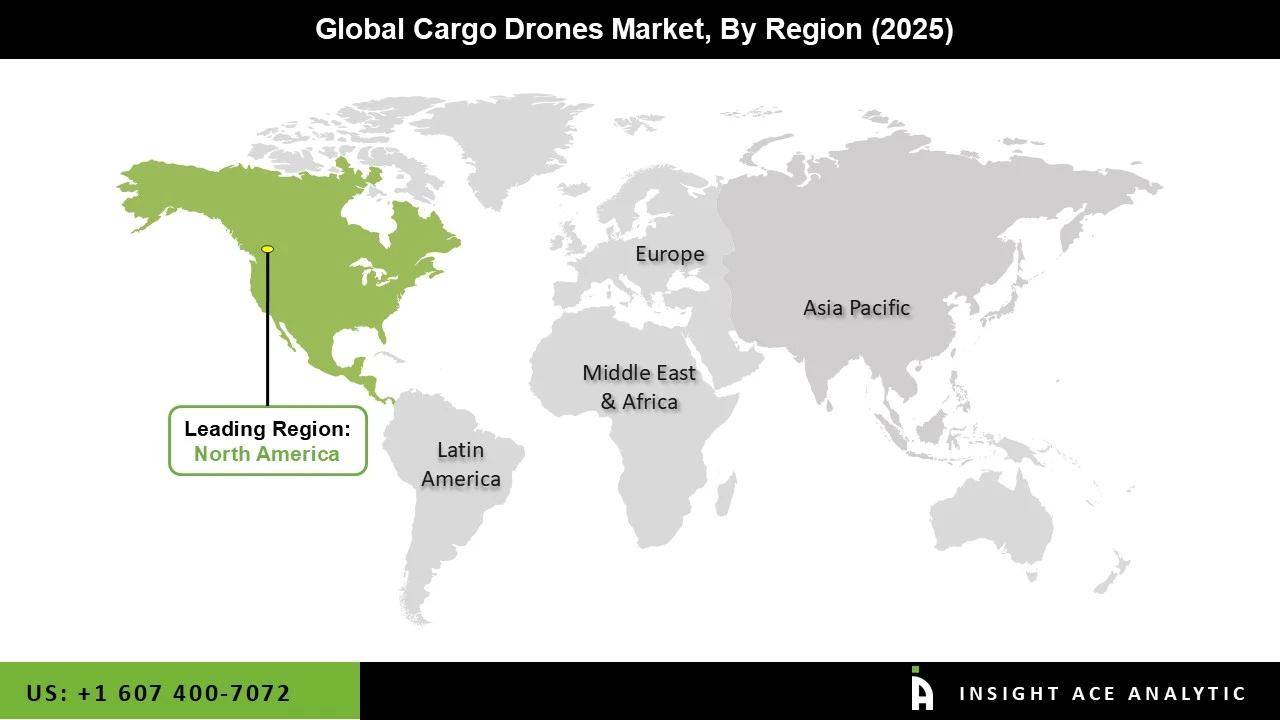

The region with the highest growth is anticipated to be Asia-Pacific. The region's expansion of drone delivery operations is being fueled by the countries' shifting regulatory environments and growing public support for commercial drone operations. Due to expanding drone delivery operations by significant e-commerce companies such as JD.com and Alibaba Group, China is the largest market for delivery drones. The People's Republic of China's State Post Bureau recently released a new Standard for Express Delivery Service by Unmanned Aircraft (Standard), effective in January 2021. To enhance last-mile delivery and encourage the growth of intelligent aerial logistics in the urban air mobility (UAM) sector, EHang, JD.com, and ZTO Express established The Standard.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 1.79 Billion |

| Revenue forecast in 2035 | USD 46.11 Billion |

| Growth rate CAGR | CAGR of 38.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Solution, Industry, Range, Payload, And Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Flying Basket, Natilus, ARC Aerosystems, Dronamics, H3 Dynamics, Kaman Corporation, and Sabrewing Aircraft Company. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cargo Drones Market By Solution-

Cargo Drones Market By Payload-

Cargo Drones Market By Type-

Cargo Drones Market By Industry-

Cargo Drones Market By Range-

Cargo Drones Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.