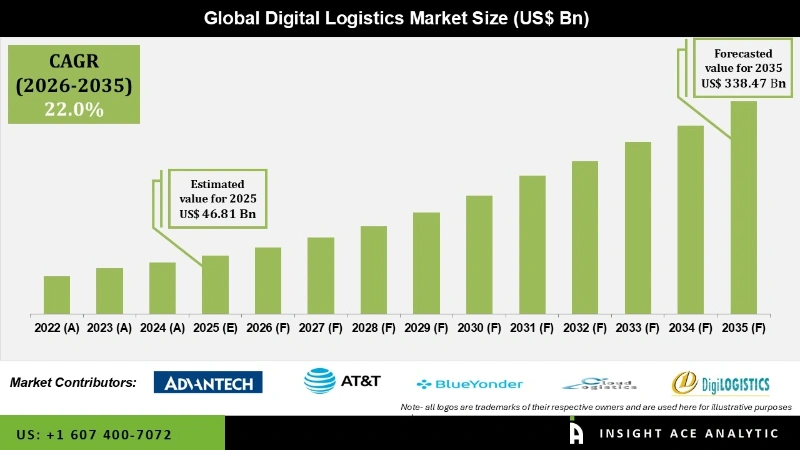

Global Digital Logistics Market Size is valued at USD 46.81 Bn in 2025 and is predicted to reach USD 338.47 Bn by the year 2035 at a 22.0% CAGR during the forecast period for 2026 to 2035.

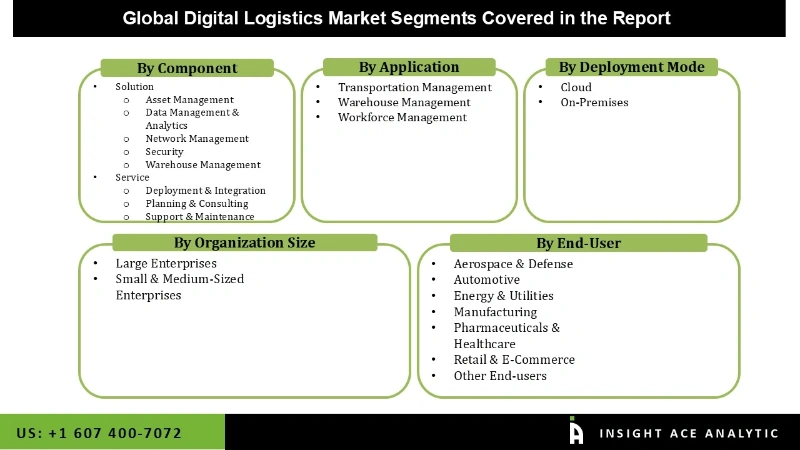

Digital Logistics Market Size, Share & Trends Analysis Report By Application (Warehouse Management, Transportation Management), Solution (Asset Management, Data Management & Analytics, Network Management, Security, Warehouse Management), Services (Deployment & Integration, Planning & Consulting, Support & Maintenance), Deployment Mode, Organization Size, End-user, By Region, And Segment Forecasts, 2026 to 2035.

Digital logistics refers to automating and digitizing procedures related to goods movement. Any routine logistical operation that relies on pen and paper and repetitive manual effort has the potential to be digitized and automated. The digital logistics industry is being driven by several elements, including the use of logistics apps, the enormous volume of data and enhanced service quality, and the rapid rise of IT solutions for businesses.

COVID-19 imposed enormous pressure on the global supply chain and logistics industry, resulting in a digital transformation influenced by new consumer behavior, unanticipated demand, supply delay, and movement restrictions. In consideration of the coronavirus pandemic, logistics companies have realized the significance of technological innovation and multichannel offerings. Customers demand novel digital tools and solutions that facilitate immediacy, accessibility, and self-service as a result of COVID-19, which has led to a significant increase in e-commerce. The growing E-commerce sector, widespread usage of cloud technology, and globalization of retail marketplaces are all offering enough prospects in digital logistics.

According to Logistics News, dealing with disasters such as the Covid-19 outbreak necessitates digital supply chains that employ artificial intelligence and allow for digital payments. However, the adoption of digital logistics goods is hampered by concerns about security, privacy, and a lack of IT infrastructure.

The Digital Logistics Market is segmented on the basis of component, Application, deployment mode, organization size, and End-user. Based on solution segments include asset management, warehouse management, data management & analytics, security, and network management. By service, the market is segmented into planning & consulting, deployment & integration, and support & maintenance.

The Application segment includes warehouse management, transportation management, and workforce management. By deployment mode, the market is segmented into cloud and on-premises. Organization size is segmented into large enterprises and small & medium-sized enterprises. The End-user segment includes retail & E-commerce, manufacturing, pharmaceuticals & healthcare, energy & utilities, aerospace & defense, automotive, and other End-users.

The retail & E-commerce category is expected to hold a major share of the global Digital Logistics Market in 2024. The introduction of online purchases and expanding Internet users propelled the e-commerce business's explosive expansion. Because of the rapid growth of e-commerce enterprises functioning in the logistics arena, there is an immediate need for them to operate more rapidly and effectively in order to meet tiny individual requests. Customers expect correct orders (notification), free returns, and same-hour or same-day delivery when they shop online.

The data management & analytics segment is projected to grow at a rapid rate in the global Digital Logistics Market due to lower company costs and is predicted to rise significantly during the forecast period. Data management and analytics can use GPS tracking software to determine who is driving unproductive routes or abusing a car. It will not only handle on-the-road issues but also provide a precise readout of the hours claimed by drivers. Data management and analytics are responsible for monitoring and controlling a company's technology (hardware, networks, communications, operating systems, and applications, among other things) to analyze its operation and performance and discover and alert about any errors.

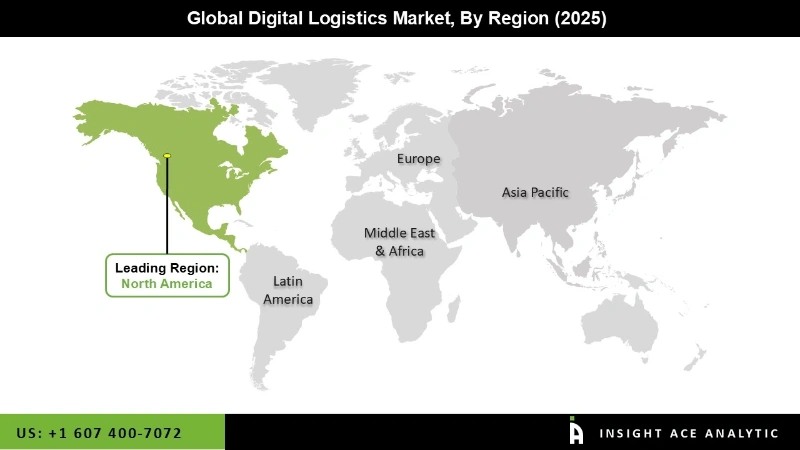

Among all regions, North America is projected to experience the most significant expansion. The growing e-commerce industry, increased adoption of cloud technology, and rapid technological advancements, such as digitalization in nations such as the United States and Canada, are driving the overall digital logistics market expansion in this region.

Asia Pacific Digital Logistics Market is also expected to register a notable market share in terms of revenue in the near future due to the presence of developed economies such as China, India, and the Philippines. Lower entry cost and risk, cost-effective expansion, access to the latest technology, and dynamic and innovative software features are all advantages of a logistic data system.

The logistics sector's contribution to India's economic development has grown, and a robust logistics sector is intended to help India's quest through government initiatives such as "Make in India." Furthermore, several significant players are seeking a consolidated production base. Because of the government's increased budgeted investment, enhanced infrastructure facilities, and tremendous access to global markets, the industry has seen considerable expansion. Because of its healthy economies, Asia-Pacific remains an industry growth engine.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 46.81 Bn |

| Revenue forecast in 2035 | USD 338.47 Bn |

| Growth rate CAGR | CAGR of 22.0 from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Component, Application, Deployment Mode, Organization Size, And End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | IBM, Oracle, SAP, AT&T, Intel, Infosys Limited, Honeywell, Eurotech SPA, HCL Technologies, Orbcomm Inc., Cloud Logistics, Freightgate Inc., Blue Yonder (Formerly Known as JDA Software), Digilogistics Technology Limited, Webexpress, Ramco Systems, Logisuite, Impinj, Intersec, ICAT Logistics, Magaya, Softlink, Samsung SDS, Hexaware, Tech Mahindra, and Advantech. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Component-

By Application-

By Deployment Mode-

By Organization Size-

By End-user-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.