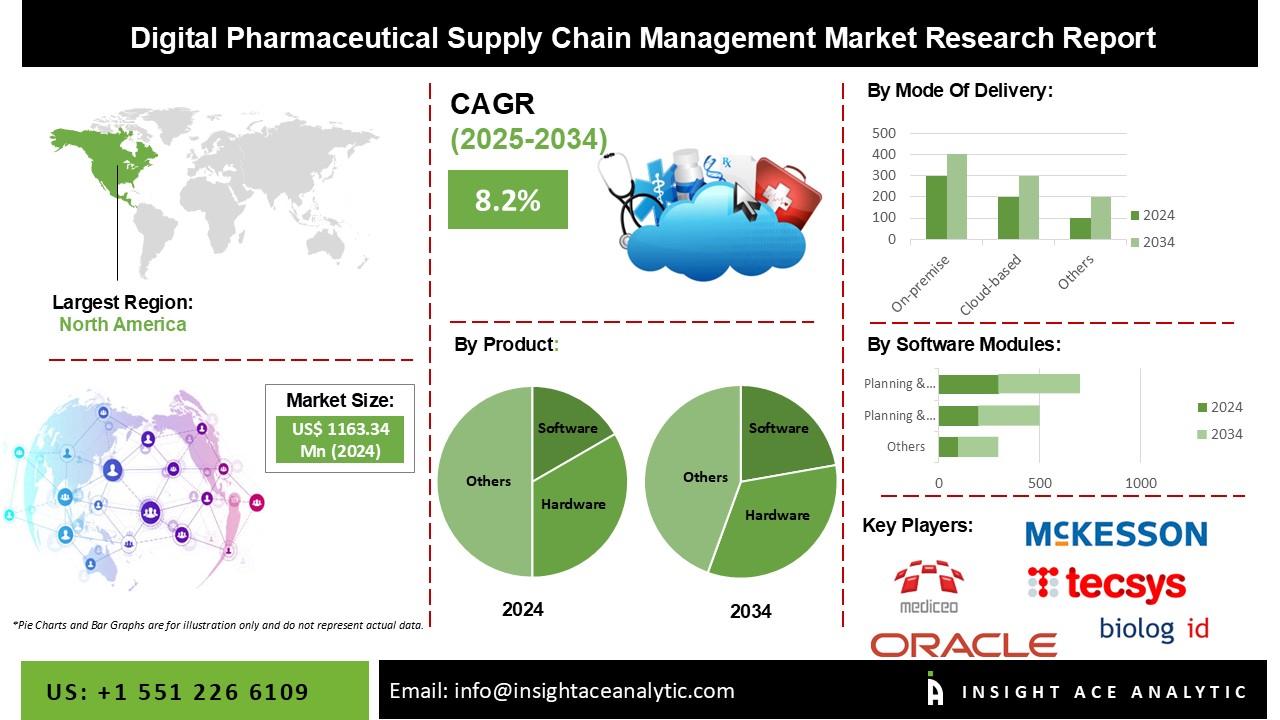

Digital Pharmaceutical Supply Chain Management Market Size is valued at USD 1163.34 million in 2024 and is predicted to reach USD 2534.55 million by the year 2034 at an 8.2% CAGR during the forecast period for 2025-2034.

Key Insights:

Especially in terms of streamlining supply chain operations, digital transformation has become a critical component of the pharmaceutical sector. Technology is being used by a number of creative entrepreneurs in India to improve the effectiveness, transparency, and security of the pharmaceutical supply chain. Some of the top startups in India that are advancing digital transformation in the pharmaceutical supply chain are highlighted in this listicle.

Applications of the digitalized system, such as artificial intelligence-powered pharmaceutical supply chain technologies, can help businesses overcome a variety of obstacles. For instance, businesses can use artificial intelligence tools to analyze data from various sources to detect trends and anomalies, enabling more accurate demand forecasts and improved inventory control. Merck KGaA's use of a data-driven strategy to improve demand forecasting in their supply chain operations is one such example. By widely using this strategy, Merck significantly improved the forecast accuracy for 90% of their products. Using data from Merck's enterprise resource planning system, Aera's AI algorithms can estimate demand quickly and precisely while taking location and volume into account.

Over the forecast period, the market expansion is anticipated to be aided by manufacturers and providers adopting mobile-based healthcare SCM solutions at a faster rate. SCM solutions now cannot function without mobile apps. Due to mobile applications that support GPS, SCM for logistic organisations in developed and developing nations has gotten simpler. These applications track vehicles using mobile devices and sensors, improving overall SCM visibility.

The Digital Pharmaceutical Supply Chain Management market is segmented on the basis of product, mode of delivery, and Software Modules. Based on product, the market is segmented as Software, Hardware, and Services. The mode of delivery include Cloud-based, Web-based, and On -premises segments. Software Modules segment includes Software Modules Planning & Analytics, Procurement, Manufacturing, Logistics, and Inventory management.

Due to its applications in the digital pharmaceutical supply chain management market, the software category held the greatest market share of 39.7% in 2022. During the projected period, software is anticipated to increase at the fastest rate. One of the main drivers of the market is the growing use of software like SaaS, which may provide next-generation cloud computing applications like enterprise resource planning and supply chain management.

Over the projected period, cloud-based deployment is anticipated to increase at the quickest rate. Its expansion can be due to expanding adoption, cost effectiveness, and desire for user-friendly technologies. The category is anticipated to continue to grow as cloud computing usage among healthcare providers to manage inventory and procurement data increases.

The North American Digital Pharmaceutical Supply Chain Management market is expected to register highest market share in terms of revenue in the near future. Due to the rising use of technologically advanced solutions in nations like U.S. and Canada as well as mobile-based healthcare supply chain management systems.

Key Developments:

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1163.34 Mn |

| Revenue Forecast In 2034 | USD 1163.34 Mn |

| Growth Rate CAGR | CAGR of 8.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By product and mode of delivery, Software Modules. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Sap, Oracle Corporation, McKesson Corporation, Tecsys; Jump Technologies, Inc., Infor Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Pharmaceutical Supply Chain Management Market By Product -

Digital Pharmaceutical Supply Chain Management Market By Mode of Delivery-

Digital Pharmaceutical Supply Chain Management Market By Software Modules-

Digital Pharmaceutical Supply Chain Management Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.