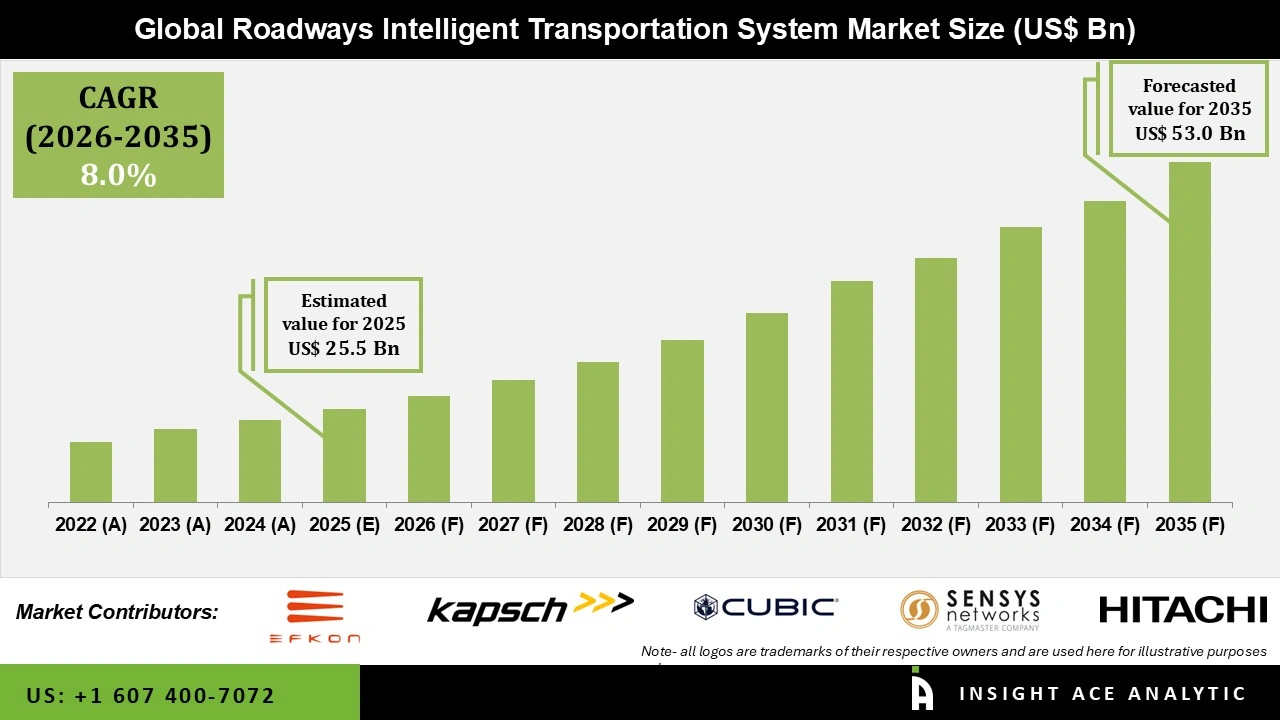

Global Roadways Intelligent Transportation System Market Size is valued at USD 25.5 Bn in 2025 and is predicted to reach USD 53.0 Bn by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

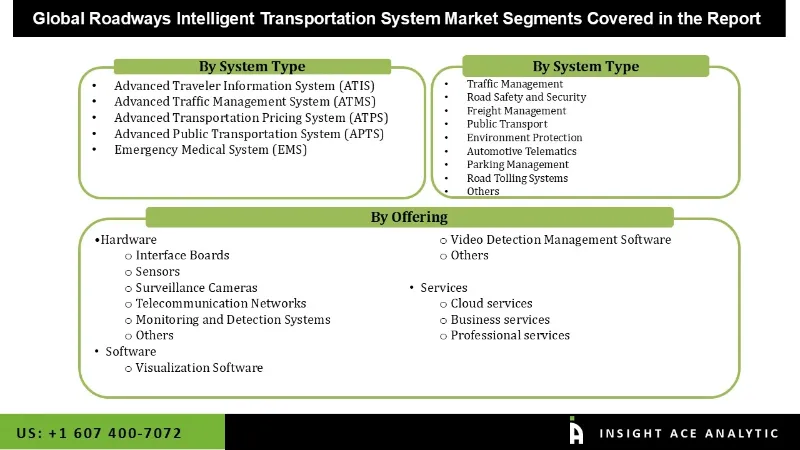

Roadways Intelligent Transportation System Market Size, Share & Trends Analysis Distribution by System Type (Services (Cloud Services, Professional Services, Business Services), Hardware (Surveillance Cameras, Sensors, Interface Boards, Telecommunication Networks, Monitoring and Detection Systems, Others), and Software (Visualization Software, Transit Management GPS Software, Video Detection Management Software, Others)), By Offering (Emergency Medical System (EMS), Advanced Traffic Management System (ATMS), Advanced Traveler Information System (ATIS), Advanced Public Transportation System (APTS), and Advanced Transportation Pricing System (ATPS)), By Application (Public Transport, Traffic Management, Freight Management, Road Safety and Security, Environment Protection, Road Tolling Systems, Automotive Telematics, Parking Management, and Others), and Segment Forecasts, 2026 to 2035

A roadway's Intelligent Transportation System (ITS) is a cutting-edge framework that enhances road transportation's sustainability, efficiency, and safety by utilising information and communication technology. It combines elements including sensors, cameras, GPS, traffic signals, and data analytics platforms to track, manage, and regulate traffic in real time. Traveller information services, electronic toll collection, adaptive signal control, incident detection, route guidance, and traffic congestion management are all made possible by ITS.

By enabling connected and autonomous vehicles, enhancing public transportation operations, and building a more dependable and user-friendly road transportation network, it also plays a crucial role in enabling smart cities. The roadways intelligent transportation system market is anticipated to increase quickly due to factors such as increasing urbanization, traffic congestion, government policies and programs, and the growth of public transit networks.

The roadways intelligent transportation system market is expanding rapidly due to the development of smart technology, increased urbanization, and the rising demand for environmentally friendly mobility options. These technologies use big data, IoT, and AI to increase safety, ease traffic, and improve transportation efficiency. Furthermore, the increase in traffic and traffic fatalities is another aspect propelling the roadways intelligent transportation system market. For instance, the number of traftransportation fic deaths in the United States rose by 7% in the first quarter of 2022 over the same period last year. To overcome these obstacles, sophisticated solutions like intelligent traffic management and collision avoidance technologies are essential. Moreover, to improve traffic and lower pollution, governments all around the world make significant investments in these systems.

The demand for ITS in traffic and mobility management is being driven by the global focus on smart city initiatives, which presents considerable prospects for the roadways intelligent transportation system market expansion. Additionally, there is a surge in investments in smart mobility technologies. To improve user comfort and maximize network efficiency, businesses are creating cutting-edge solutions like automated toll collection, real-time traffic monitoring, and integrated ticketing systems.

Despite the expansion, the global roadways intelligent transportation system market is limited by constraints such as costly initial expenditures and interoperability and integration challenges. ITS necessitates large financial investments in software integration, communication networks, and infrastructure. The budget constraints impede the implementation of roadways intelligent transportation system in developing countries.

• Siemens AG

• Garmin Ltd.

• EFKON GmbH

• Kapsch TrafficCom

• TomTom International BV

• Sensys Networks, Inc.

• Teledyne FLIR LLC (Teledyne Technologies Incorporated)

• Hitachi, Ltd.

• Iteris, Inc.

• Cubic Corporation

The roadways intelligent transportation system market is anticipated to expand in the future due to the increasing number of vehicles on the road. The number of vehicles on the road is rising as a result of population growth, urbanization, economic development, and more access to personal transportation. This could lead to traffic issues. By lowering traffic congestion, the use of intelligent transportation systems will contribute to improving traffic efficiency and lowering traffic problems.

For instance, in January 2022, there were 20.7 million registered motor vehicles, a 2% increase from January 2021, according to the Department of Infrastructure, Transport, Regional Development, Communications, and the Arts, an Australian government department responsible for implementing Australian government policy and programs, in February 2024. Therefore, the roadways intelligent transportation system market is expanding due to the increasing number of cars on the road.

Installing infrastructure, sensors, and communication technology is one of the major upfront expenses associated with implementing roadways intelligent transportation systems. The adoption may be hampered by these high upfront costs, especially for smaller towns or regions with tighter budgets. Smooth integration may be hampered by the lack of compatibility and established protocols. The efficacy of a comprehensive transportation network may be limited by incompatibility problems that occur while trying to connect disparate systems. These characteristics are therefore anticipated to limit the roadways intelligent transportation system market growth significantly during the projection period.

The hardware category held the largest share in the Roadways Intelligent Transportation System market in 2024. The requirement for precise data gathering, real-time monitoring, and dependable connectivity across transportation networks is driving demand for sophisticated hardware solutions. Modern hardware is anticipated to continue to be widely adopted as cities make investments in modernizing their transportation infrastructure, especially in areas where smart city projects are still in progress. The market for roadways intelligent transportation systems has also grown as a result of technological developments in telecommunications systems and the growing use of sophisticated sensors in the railroad industry to improve safety.

In 2024, the Traffic Management category dominated the Roadways Intelligent Transportation System market. The foundation of roadways intelligent transportation system is traffic management software, which makes it easier to monitor and regulate traffic flow. These systems optimize signal timings, control traffic, and boost overall traffic efficiency by utilizing real-time data, sensors, and algorithms. In order to improve safety, efficiency, and sustainability, the market for roadways intelligent transportation system is essential to modernizing and optimizing transportation networks. It incorporates cutting-edge technology to gather, process, and distribute data in order to enhance the efficiency of transportation networks. It includes solutions for both hardware and software.

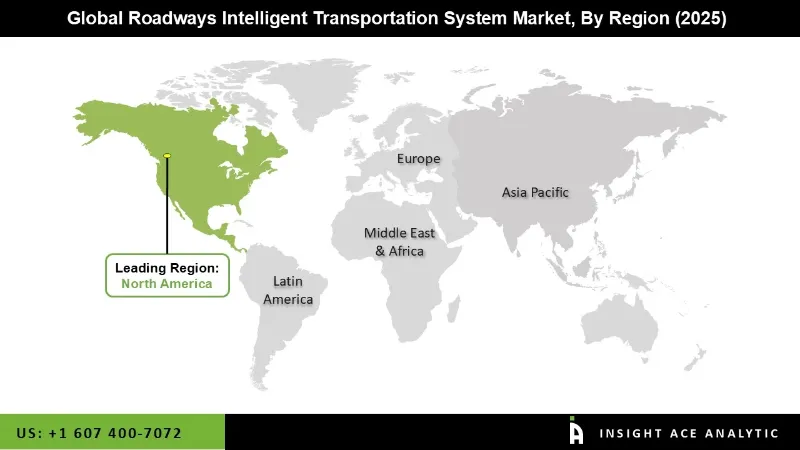

The Roadways Intelligent Transportation System market was dominated by the North America region in 2024. The desire to alleviate traffic congestion, increase road safety, and improve transportation efficiency has prompted the United States and Canada to be early adopters of roadways intelligent transportation systems.

Strong governmental backing, a well-established transportation network, and continuous R&D expenditures all assist the adoption of the intelligent transportation system in this region. Additionally, the construction of 5G networks and the use of connected and autonomous cars are driving the expansion of the roadways intelligent transportation system market in North America. It is anticipated that there would be a strong demand for sophisticated ITS solutions as states and cities continue to modernize their transportation networks.

• In January 2024: Garmin announced new industry-first features for its Automotive OEM Unified Cabin solutions at CES 2024, including personalized HMI theming, Cluster Theatre Mode for entertainment, and expanded use of cabin monitoring for driver distraction mitigation.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 25.5 Bn |

| Revenue forecast in 2035 | USD 53.0 Bn |

| Growth Rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | System Type, Offering, Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Siemens AG, Garmin Ltd., EFKON GmbH, Kapsch TrafficCom, TomTom International BV, Sensys Networks, Inc., Teledyne FLIR LLC (Teledyne Technologies Incorporated), Hitachi, Ltd., Iteris, Inc., and Cubic Corporation. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.