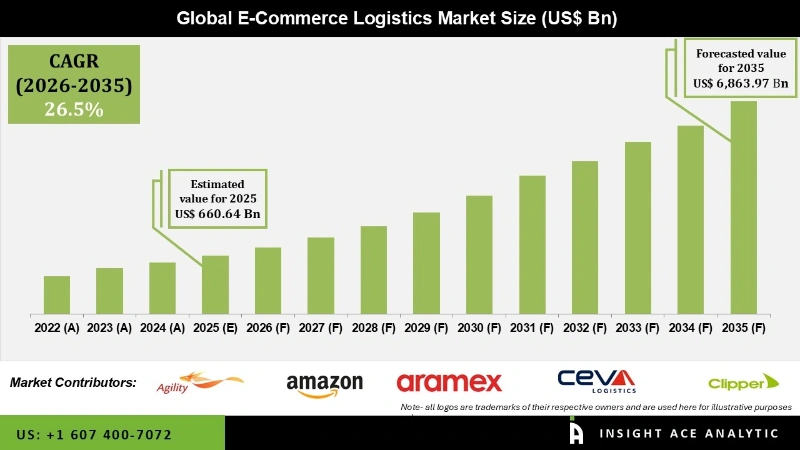

Global E-Commerce Logistics Market Size is valued at USD 660.64 Billion in 2025 and is predicted to reach USD 6,863.97 Billion by the year 2035 at a 26.5% CAGR during the forecast period for 2026 to 2035.

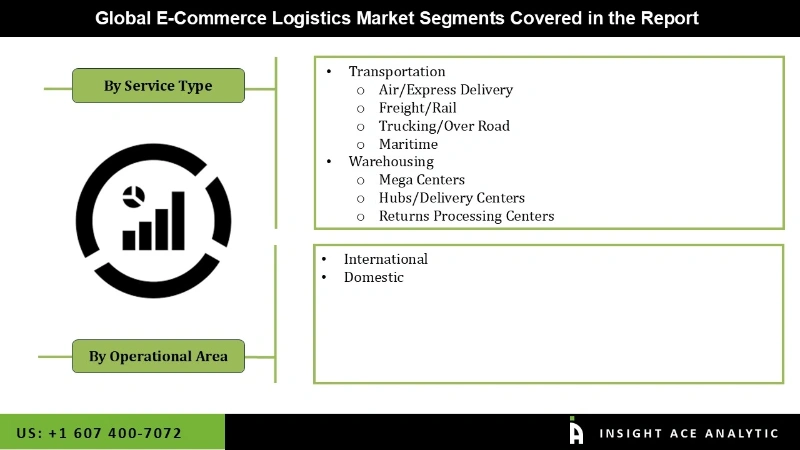

E-Commerce Logistics Market Size, Share & Trends Analysis Report By Service Type (Transportation And Warehousing) And Operational Area (International And Domestic)- Market Outlook And Industry Analysis 2026 to 2035.

Key Industry Insights & Findings from the Report:

With the emergence of e-commerce and online shopping, the demand for efficient and reliable logistics services to transport goods purchased online has grown significantly in recent years. There is also a growing focus on sustainable and eco-friendly logistics solutions, with companies exploring options such as electric vehicles, renewable energy, and carbon offsetting to reduce their environmental impact. Technological advances, such as automation, robotics, and artificial intelligence, are transforming the e-commerce logistics market position, making it more efficient and cost-effective. The growth of cross-border e-commerce is driving the need for more complex and sophisticated logistics solutions to handle the international movement of goods.

However, the e-commerce logistics industry has a significant environmental impact, with emissions from transportation and packaging contributing to climate change. As customers become more environmentally conscious, there is a growing need for sustainable logistics solutions, which may require additional investments and changes in operations.

The e-commerce logistics market is segmented based on service type and operational area. Based on service type, the market is categorized as transportation and warehousing. By operational area, the market is segmented into international and domestic.

Transportation will continue to dominate the e-commerce logistics market share in the foreseeable future. The growth of e-commerce has led to increased demand for transportation services, as more and more goods need to be transported from warehouses to customers' homes. Transportation is a critical component of the e-commerce logistics ecosystem, as it enables the delivery of goods to customers in a convenient and cost-effective manner. The logistics industry is constantly evolving to keep pace with the growth of e-commerce, and transportation companies are investing in technology and infrastructure to streamline their operations and meet the demands of online shoppers.

The domestic segment is projected to increase in the global e-commerce logistics market. Domestic e-commerce logistics refers to the movement and delivery of goods within a country from the seller's location to the customer's address. The dominance of domestic e-commerce logistics is due to several factors. Firstly, most e-commerce transactions are domestic, with customers buying products from local retailers or marketplaces. This means that most logistics activity focuses on domestic shipping and delivery.

The Asia Pacific, e-commerce logistics market, is expected to register the highest market share in revenue shortly. APAC is home to some of the largest e-commerce markets in the world, such as China, India, and Japan, and the region has seen significant growth in e-commerce sales in recent years. One of the main reasons for APAC's dominance in the e-commerce logistics market is the rapid adoption of digital technologies and the increasing number of online shoppers in the region. With a large and growing population, rising middle class, and increasing internet penetration, APAC has become a significant market for e-commerce companies investing heavily in logistics infrastructure to meet the demands of online shoppers.

Besides, North America has been a dominant force in the e-commerce industry, with a robust digital infrastructure and a large consumer base that is comfortable shopping online. As a result, the e-commerce logistics market development in North America has also been robust, with established players such as UPS, FedEx, and Amazon dominating the space.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 660.64 Billion |

| Revenue forecast in 2035 | USD 6,863.97 Billion |

| Growth rate CAGR | CAGR of 26.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Service Type And Operational Area |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | DHL International GmbH, Aramex International, FedEx Corporation, S.F. Express, Gati Limited, Amazon, Kenco Group, Inc., Ceva Holdings LLC, United Parcel Service, Inc., Clipper Logistics Plc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Service type

By Operational Area-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.