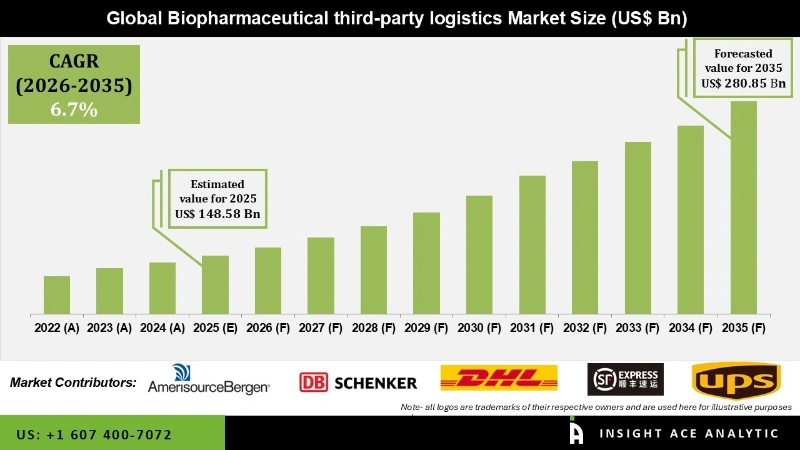

Global Biopharmaceutical Third-Party Logistics Market Size is valued at USD 148.58 Bn in 2025 and is predicted to reach USD 280.85 Bn by the year 2035 at an 6.7% CAGR during the forecast period for 2026 to 2035.

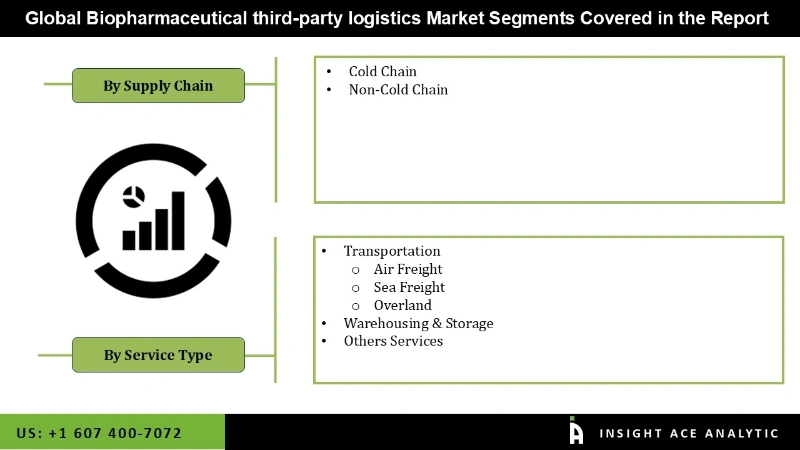

Biopharmaceutical Third-Party Logistics Market Size, Share & Trends Analysis Report by Supply Chain (Cold Chain, Non-cold Chain), By Service Type (Transportation, Warehousing & Storage), Region And Segment Forecasts, 2026 to 2035.

Third-party logistics (3PL) for the biopharmaceutical industry describes the logistical support provided to pharmaceutical firms by unaffiliated businesses. For instance, it involves filling orders, keeping track of the inventory of the goods using a warehouse management system, and receiving medications consisting of tiny molecules into the warehouse. For instance, by reducing unnecessary overhead costs, ensuring continuous product supply, optimizing transportation, and increasing the organization's general efficiency, 3PL helps pharmaceutical and medical institutions maintain logistics for the distribution of medical medicines.

The pharmaceutical industry's tremendous rise is largely to blame for the market's optimistic outlook. The market is also increasing due to the rising trend among medical businesses to outsource logistics to increase their distribution network. Some of the major drivers propelling the market include the rising trend of outsourcing logistics, the concentration of pharmaceutical manufacturers on their distribution network due to its strong sales statistics, and an increase in the number of biosimilar launches. The COVID-19 pandemic had a substantial effect on market expansion.

Additionally, Celcius Logistics debuted its Hyper-Local temperature-controlled delivery services for food and pharmaceutical orders in November 2022. Over the past few years, the demand for outsourcing transportation services has seen a noticeable increase. Giant pharmaceutical corporations' overhead has decreased due to outsourcing the transportation services for transporting pharmaceutical medications. To further encourage lean management and using six sigma in their business operations, the major biopharma corporations are either consenting to or outsourcing to 3PL service providers.

The Biopharmaceutical third-party logistics market is segmented on the basis of supply chain and service type.Supply chain segments includes Cold Chain and Non-Cold Chain. The market is segmented by service type into Transportation, Warehousing & Storage, and Others.

In 2022, the warehousing and storage industry dominated the market, generating more than 43.30% of the total revenue. The increasing demand for 3PL services from the pharmaceutical and healthcare sectors is to blame for this. The life sciences industry is using 3PL services to lower overhead expenditures and operating costs.

Over the forecast period, the cold chain segment is anticipated to post the quickest CAGR. This is primarily due to the increase in demand for biologics, a novel class of pharmaceuticals that has shown rapid growth in recent years. Aside from biologics, the market has witnessed the emergence of various types of precision medicine inventions, such as biomarker testing, cellular therapies, specific vaccines, blood products, and regenerative medicine in the form of stem cells. These drugs require both temperature- and time-controlled distribution.

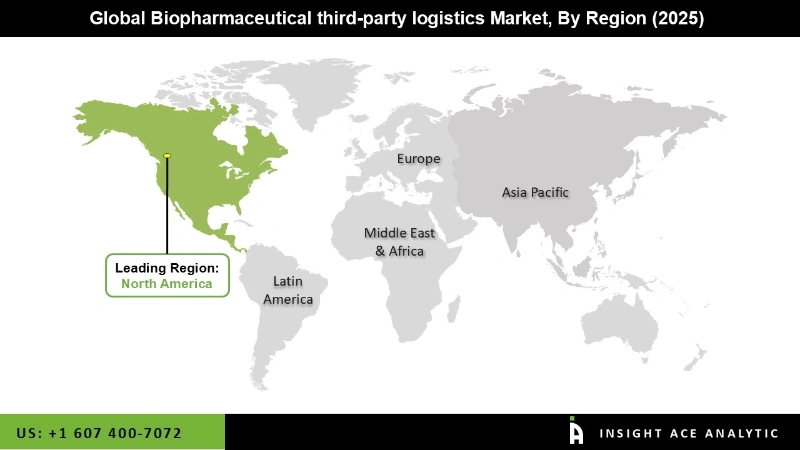

With a market share of about 39.1% and 119.8 billion dollars in revenue, North America emerged as the largest market for worldwide third-party logistics for biopharmaceuticals. This industry's fundamental engine of growth is the increased import and export of pharmaceutical chemicals, drugs, biologics, vaccines, and other related goods.

In addition to having high medical expenses, this area has the highest adoption of cutting-edge technologies overall. Because of this, North American pharmaceutical companies rely more and more on 3PL service providers to enhance storage and shipping, fueling the region's overall growth. However, the Asia-Pacific market remains second due to increased investment in R&D and an increase in the number of diagnoses of rare illnesses in the region; the Asia-Pacific market is anticipated to grow at the quickest CAGR. It is anticipated that this element will improve pharmaceutical product sales as well as their import and export.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 148.58 Bn |

| Revenue Forecast In 2035 | USD 280.85 Bn |

| Growth Rate CAGR | CAGR of 6.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2022-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Supply Chain And Service Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | DHL International GmbH, SF Express, United Parcel Service of America Inc., AmerisourceBergen Corp., DB Schenker, Kuehne and Nagel, Kerry Logistics Network Ltd., and Agility. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.