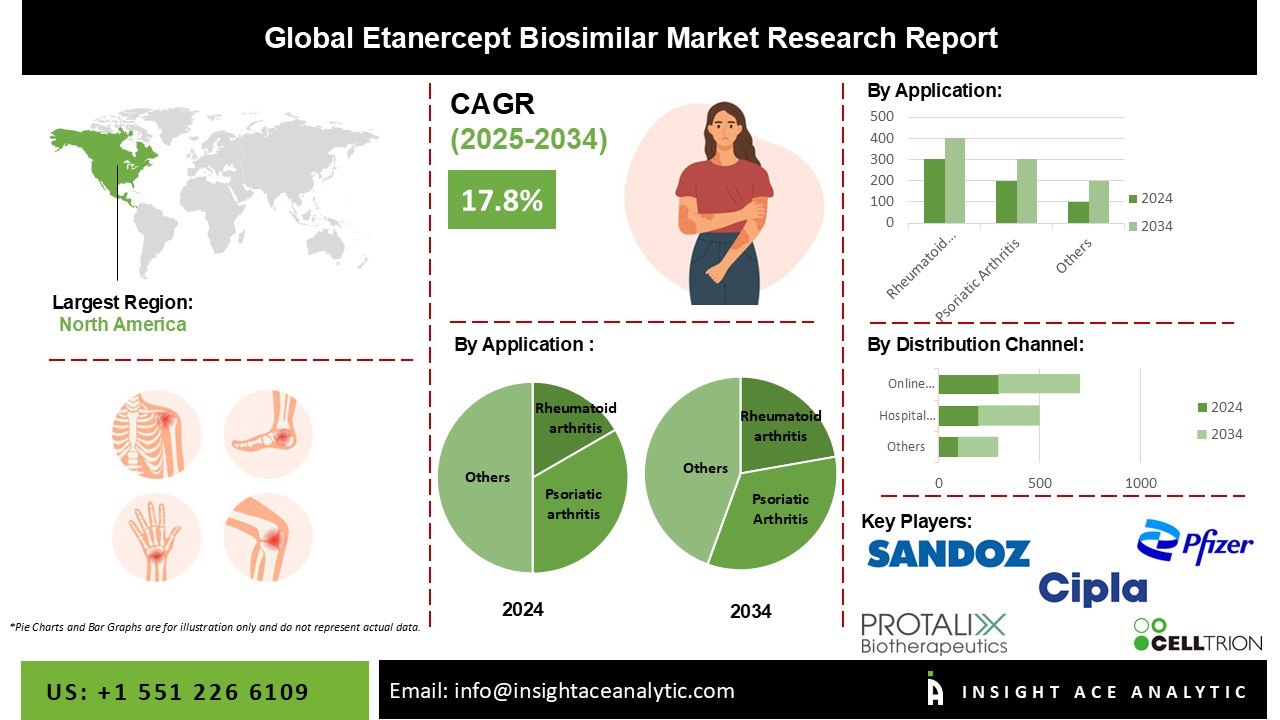

The Etanercept Biosimilar Market Size is valued at XX Million in 2024 and is predicted to reach XX Million by the year 2034 at an 17.8% CAGR during the forecast period for 2025-2034.

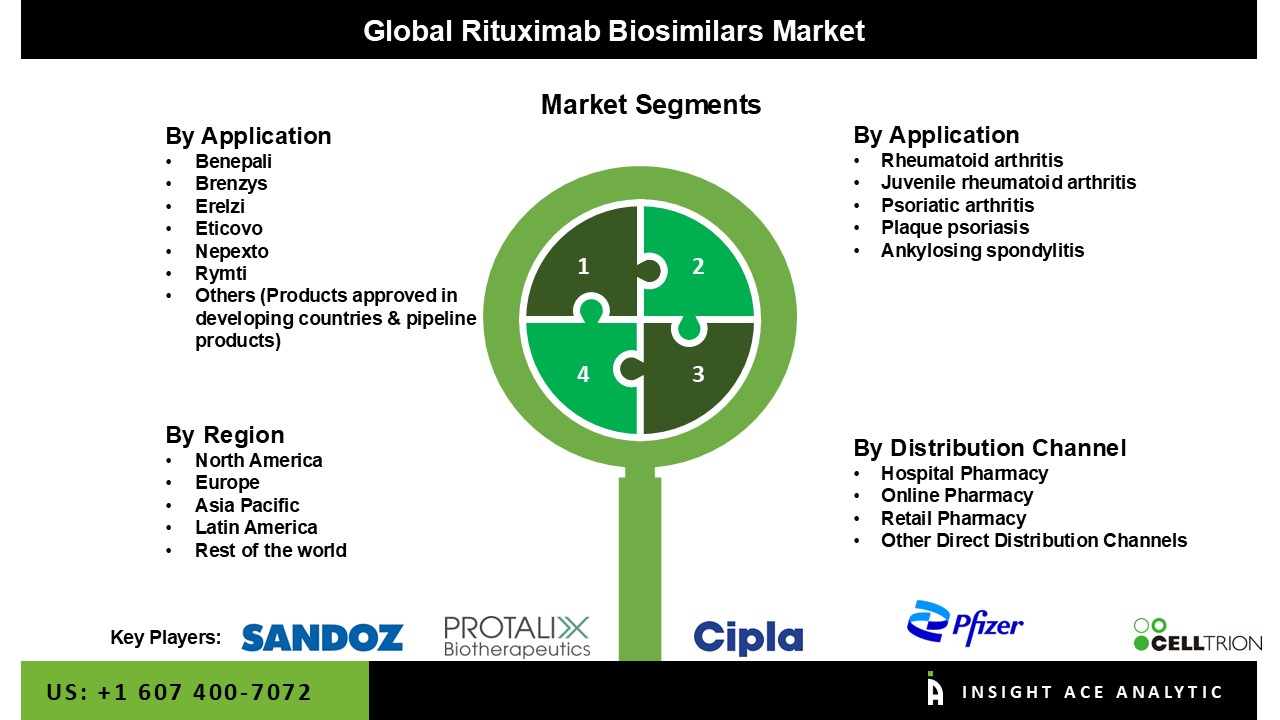

Etanercept is a tumor necrosis factor alpha (TNF-α) inhibitor, an important inflammatory disease mediator in various articular diseases. Etanercept was the first tumour necrosis factor-alpha (TNF-α) inhibitor approved for the treatment of rheumatoid arthritis. It is also approved for the treatment of juvenile rheumatoid arthritis, psoriatic arthritis, plaque psoriasis, and ankylosing spondylitis. Etanercept competitively inhibits the binding of TNF to cell surface receptors and thus makes TNF biologically inactive. By doing so, the drug inhibits the pro-inflammatory effects of TNF and thereby leads in a reduction of joint inflammation. Etanercept was developed and marketed by Amgen and Pfizer. The drug was approved by the U.S. Food Drug and Administration in November 1998. It was approved in Europe by European Medicines Agency in February 2000. It is marketed under the trade name of ‘Enbrel’.

Expiration of patent and near-term expiration of patent has led to the entry of biosimilar into the market. The patent of Enbrel is expired in Europe in August 2015 and will expire in the U.S. in November 2028. Biosimilar is defined as a type of biological product that is approved by respective regulatory bodies because of its clinical similarity to already approved biological products. Reducing treatment cost is the principal attraction factor for the growth of etanercept biosimilars market. Thus many of biosimilar of etanercept are currently approved and some are in development phase which are expected to come into the market during forecast period. Introduction to biosimilars, increase in incidence and prevalence rate of various articular diseases, and rising demand for cost effective alternatives are the factors boosted the growth of etanercept biosimilar market. However, stringent regulatory process for the approval of etanercept biosimilar and complicated manufacturing process are the major restrain factors for the growth of the etanercept biosimilar market.

The global etanercept biosimilar market is segmented on the basis of application, distribution channel and geography. Based on the application global etanercept biosimilar market is segmented into rheumatoid arthritis, juvenile rheumatoid arthritis, psoriatic arthritis, plaque psoriasis, and ankylosing spondylitis. Rheumatoid arthritis segment is expected to grow at higher pace during the forecast period owing to increasing incidence and prevalence rate. Based on distribution channel the global etanercept biosimilar market is segmented as hospital pharmacy, online pharmacy and others. Online pharmacy segment is expected to grow during forecast period due to increase in number of internet users and ease of use.

Geographically, the global etanercept biosimilar market has been segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In terms of revenue, Europe followed by Asia Pacific is major contributor for the global etanercept biosimilar market. This is because early patent expiry, entry of etanercept biosimilars, strong clinical pipeline, increasing research and drug development activities, presence of major players, and developing healthcare infrastructure propels the growth of the market in the region. Asia Pacific is promising revenue contributor which is expected to grow at rapid pace in upcoming year. Countries such as Japan, India and China are major contributors for this market. Huge population base in countries such as China and India offers tremendous market opportunities for the etanercept biosimilar market. North America is third major contributor for the market in forecast period and is expected to grow at rapid pace, due to presence of strong clinical pipeline.

| Report Attribute | Specifications |

| Market Size Value In 2022 | USD XX Million |

| Revenue Forecast In 2031 | USD XX Million |

| Growth Rate CAGR | CAGR of 17.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2023 to 2031 |

| Historic Year | 2019 to 2022 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Brand, By Applications, By Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Avesthagen, Cipla, LG Life Sciences, Protalix Biotherapeutics, BioXpress Therapeutics, Sandoz, Celltrion, Teva Pharmaceutical Industries, Pfizer, Samsung Bioepis, mAbxience, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Etanercept Biosimilar Market Outlook By Brand

Global Etanercept Biosimilar Market Outlook By Application

Global Etanercept Biosimilar Market Outlook By Distribution Channel

Global Etanercept Biosimilar Market Outlook By Region

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.