Glacial Acrylic Acid Market Size is valued at 2.6 billion in 2024 and is predicted to reach 3.6 million by the year 2034 at a 3.3% CAGR during the forecast period of 2025-2034.

Key Industry Insights & Findings from the Report:

Glacial acrylic acid (GAA) is a crystalline, odorless liquid with a strong smell. It reacts quickly. CH2=CHCO2H is the chemical formula for it. Propene is oxidized catalytically to generate GAA. Creating infant diapers, feminine grooming, and personal care products primarily uses superabsorbent polymers.

The GAA market is therefore growing as a result of the increase in consumption of polypropylene fibers in hygiene products and personal care products. Several factors are driving the expansion of the global glacial acrylic acid market, including a rise in the production of protective coatings, gelling agents, adhesives & sealants, and extensive usage of GAA as a chemical feedstock. This is due to GAA's ability to waste.

Additionally, the dwindling petroleum reserves, fluctuating propylene prices, and the availability of materials are expected to restrain the market. The market is expected to be constrained during the forecast period by the fluctuation of propylene prices and the low level of awareness and acceptability of GAA in emerging countries.

Furthermore, it is estimated that the growing SAP presence in niche markets, including adult incontinence, water treatment additives, and radiation-treated coatings, would be crucial to the expansion of the acrylic acid market over the projected decade. Moreover, the market is also anticipated to benefit from an increase in the manufacturing of adhesives & sealants, surface coatings, and surfactants in various emerging nations.

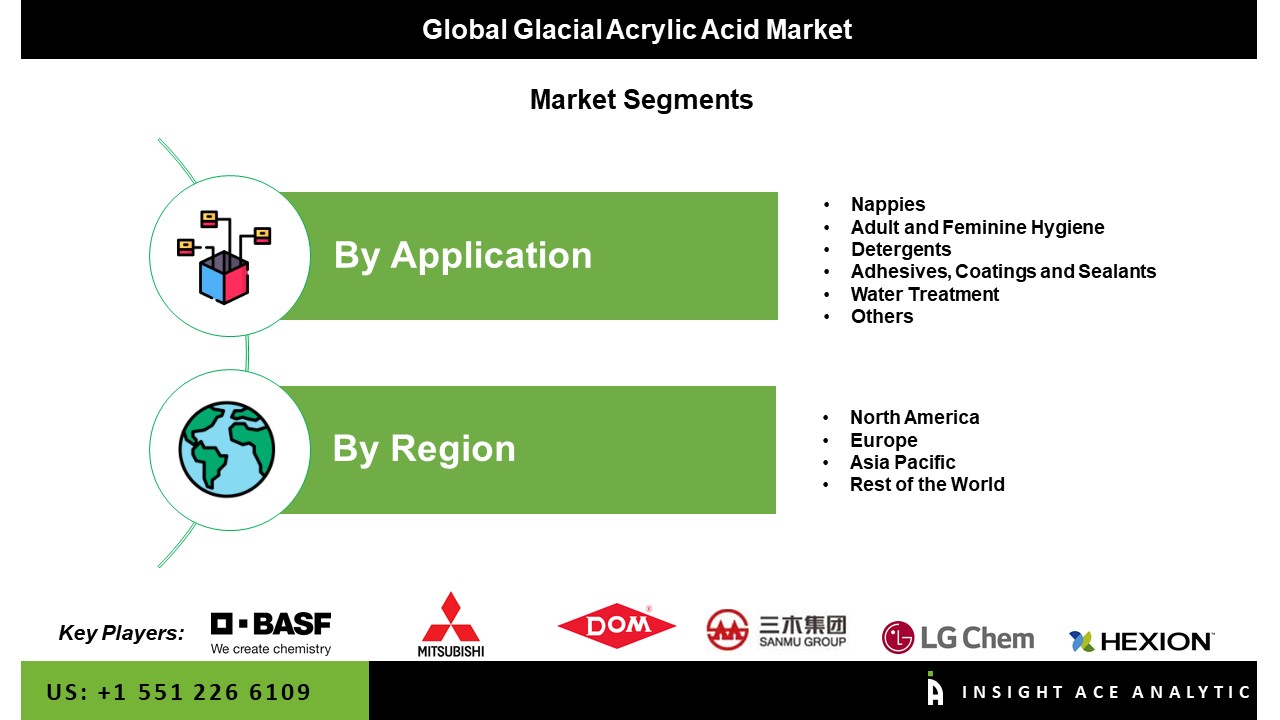

The glacial acrylic acid market is segmented based on applications. Based on applications, the market is segmented as nappies, adult and feminine hygiene, detergents, adhesives, coatings and sealants, water treatment and others.

The nappies category will hold a significant share of the global glacial acrylic acid market in 2024. Glacial acrylic acid is used in waterproof polymers in biodegradable newborn diapers. Sectionally, polyacrylates are polymeric polymers because they can hold 100 times more liquid than their weight. The usage of polyurethanes (pads, diapers, and hygiene products) is anticipated to increase due to increased hygiene awareness among all population groups, which could increase acrylic acid use throughout the expected period.

The North American glacial acrylic acid market is expected to register the highest market share in revenue shortly. The demand for adult urinary products is anticipated to rise as the senior population increases in the United States and Canada. This will probably lead to an increase in GAA production shortly. A large newborn population and rising disposable income, which result in more spending on hygiene and cleanliness care, are blamed for the country's need for personal hygiene goods. As a result, the acrylic acid market is projected to grow over the projection period. In addition, Asia Pacific is projected to proliferate in the global glacial acrylic acid market. The growing demand for baby diapers in developing nations like South Korea and China has boosted the need for superabsorbent polymers (SAPs). Glacial acrylic acid is also widely utilized in various sectors, such as textile chemicals, sealants, coatings, masonry, water treatment, detergents, leatherette solutions, and adhesives.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 2.6 million |

| Revenue forecast in 2034 | USD 3.6 million |

| Growth rate CAGR | CAGR of 3.3% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Kiloton and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Arkema, BASF SE, Dow Inc, Evonik Industries, Exxon Mobil Corporation , Formosa Plastics Corporation, Hexion Inc., LG Chem, Mitsubishi Chemical Holdings Corporation, Myriant Corporation, Nippon Shokubai Co Ltd, Novomer Inc, PJSC Sibur Holding , Sanmu Group, Shandong Kaitai Petrochemical Co., Ltd. , Shanghai Huayi Acrylic Acid Co. Ltd, Shell Chemicals, SHOKUBAI CO. LTD, SIBUR, Taixing Jurong Chemical Co Ltd, The Lubrizol Corporation |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Glacial acrylic acid Market By Application

Glacial acrylic acid Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.