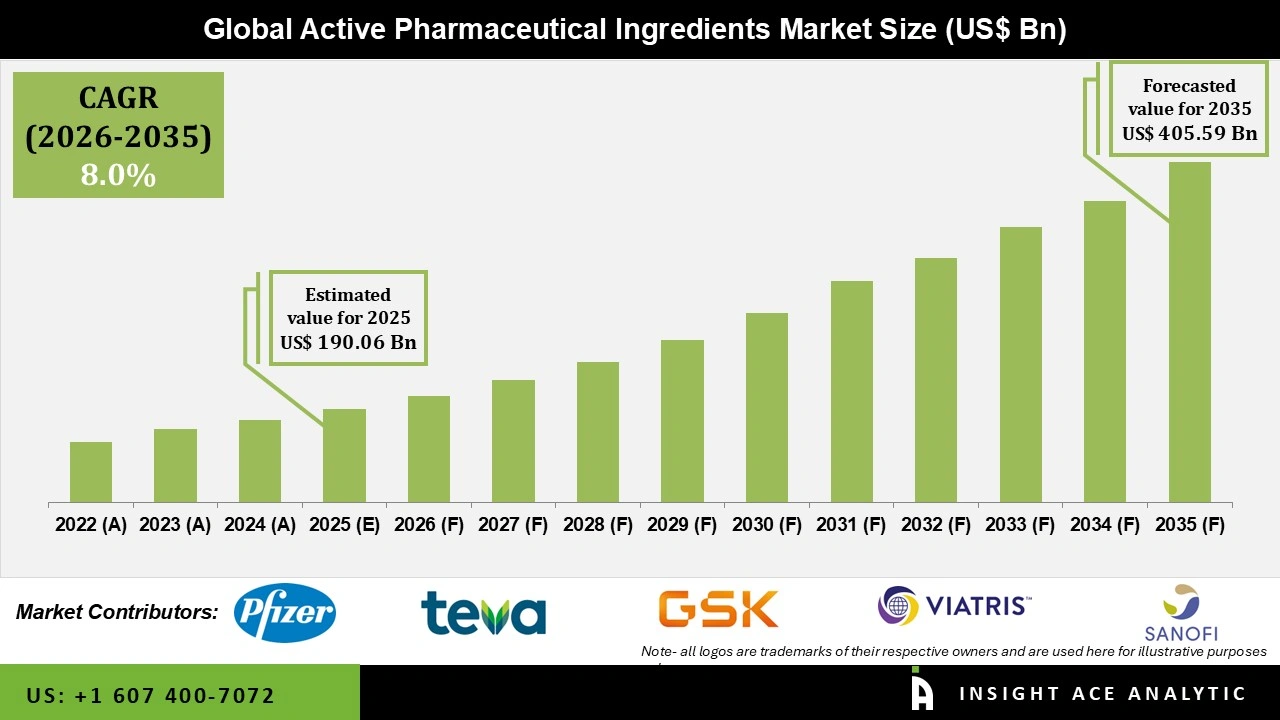

Global Active Pharmaceutical Ingredients Market Size is valued at USD 190.06 Billion in 2025 and is predicted to reach USD 405.59 Billion by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

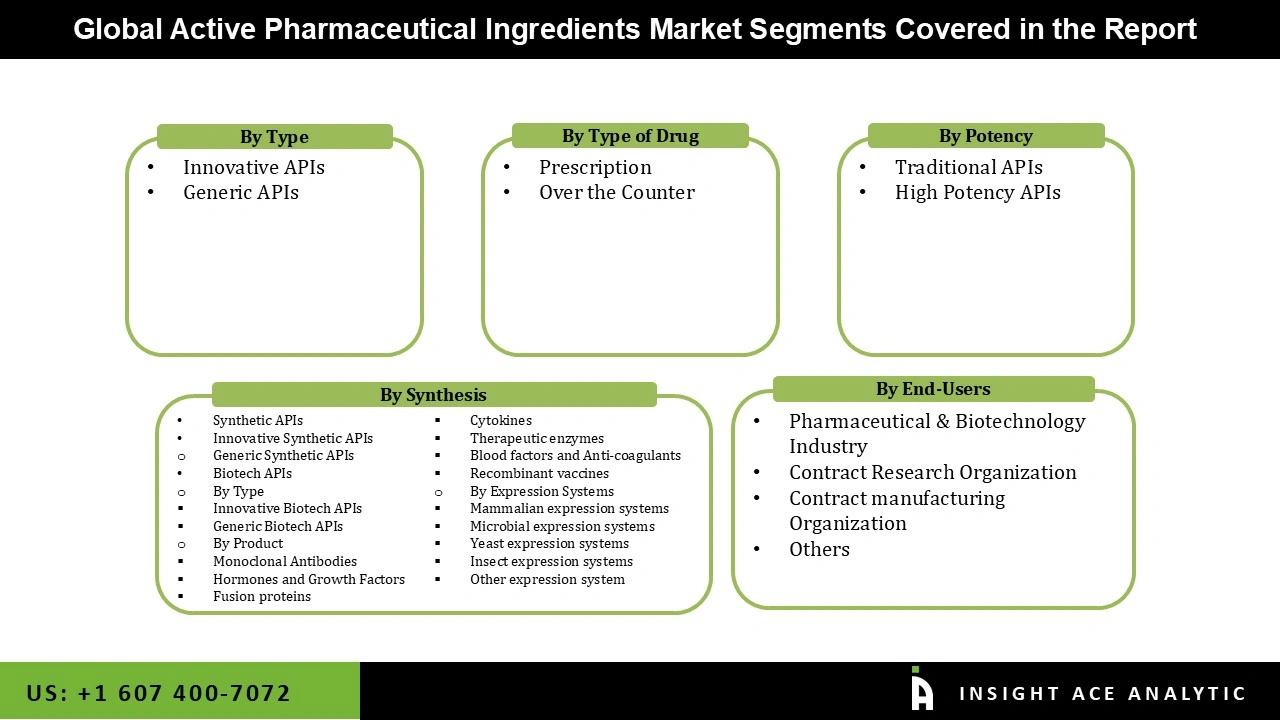

Active Pharmaceutical Ingredients Market Size, Share & Trends Analysis Report, By Type (Innovative APIs Generic APIs), By Type of Drug (Prescription, Over the Counter), By Potency (Traditional APIs, High Potency APIs) By Region, Forecasts, 2026 to 2035

Improvements in the production of active pharmaceutical ingredients (APIs) and the rise in chronic diseases, such as cancer and cardiovascular conditions, are responsible for the growth. In addition to altering geopolitical conditions, supportive government regulations for API production are accelerating market expansion.

Due to COVID-19's supply chain disruption, the API market is witnessing significant changes. Due to geopolitical circumstances and the desire to lessen reliance on China for API products, nations like India are favored over China for exporting API. The governments of numerous countries have also developed policies and provided incentives to encourage the production of API.

The global APIs market benefited from the COVID-19 pandemic. The pharmaceutical sector was key in treating COVID-19 symptoms such as high fever, cough, and cold. The active pharmaceutical components market expanded during the pandemic due to the pharma sector's increased prominence. After the COVID-19 outbreak was classified as a pandemic by the World Health Organization, a wide range of renowned pharmaceutical and biopharmaceutical businesses and fresh startups rushed up to develop treatments for the virus.

The active pharmaceutical ingredients market is segmented by type, synthesis, type of drug, potency, therapeutic applications, end-user. Based on type, the market is segmented into innovative APIs and generic APIs, the market is segmented by synthesis into synthetic APIs and biotech APIs, the market is segmented on the basis of type of drugs into prescription and over the counter, the market is segmented on the basis of potency into traditional APIs and high potency APIs, on the basis of therapeutic applications market is segmented into communicable diseases, oncology, diabetes, cardiovascular diseases, respiratory diseases, pain management and others therapeutic application, on the basis of end-user the market is segmented into pharmaceutical & biotechnology industry, contract research organization, contract manufacturing organization, Others.

Inventive APIs controlled the majority. Increased R&D initiatives for the creation of innovative drugs and helpful government laws are credited with this expansion. Numerous innovative items are currently being developed as a consequence of intensive research in this area and are anticipated to be on sale throughout the projected period. It is anticipated that new players in this sector will fuel market expansion.

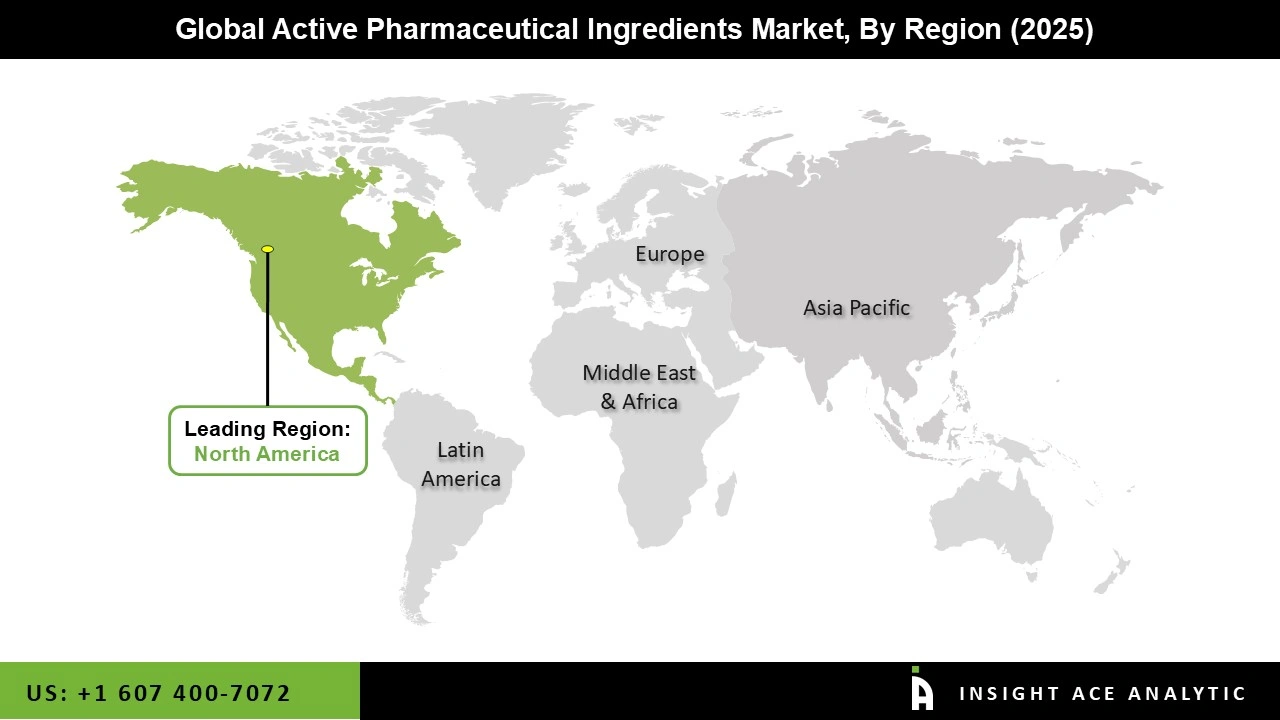

North America now dominates the market for active pharmaceutical components, which is anticipated to last a few more years. Due to rising disease rates and an ageing population, this area is anticipated to see a gain in market share in the future. The country had to import many APIs from other countries because of the country's severe COVID-19 outbreak, and domestic producers also had to ramp up production to meet the demand.

The majority of its API needs are satisfied by imports from Asian markets. According to US trade statistics, China and India account for roughly 75–80% of all APIs imported into the US since they have well-established production bases and a significant labour force that caters to the pharmaceutical industry. Recent political and trade initiatives of the US government to raise import levies and taxes are anticipated to increase operational expenses and put more pressure on manufacturers' pricing. In order to guarantee the supply of high-quality goods to the US market, the FDA has also raised the application costs for brand-new medicine approvals and increased the frequency of periodic inspections carried out at various offshore contract manufacturing facilities.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 190.06 Billion |

| Revenue forecast in 2035 | USD 405.59 Billion |

| Growth rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn,, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | By Type, By Synthesis, By Type of Drug, By Potency, By Therapeutic Application, By End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Pfizer Inc., Teva Pharmaceutical Industries Ltd., GSK PLC, Sanofi, Viatris Inc., Divi's Laboratories Limited, Sandoz Group AG, Boehringer Ingelheim International Gmbh, Sk Inc., Eli Lilly And Company, Merck Kgaa, Abbvie Inc., F. Hoffmann-La Roche Ltd., Astrazeneca, Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Cipla, Evonik Industries Ag, Hikma Pharmaceuticals Plc, BASF SE, Alembic Pharmaceuticals Limited |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.