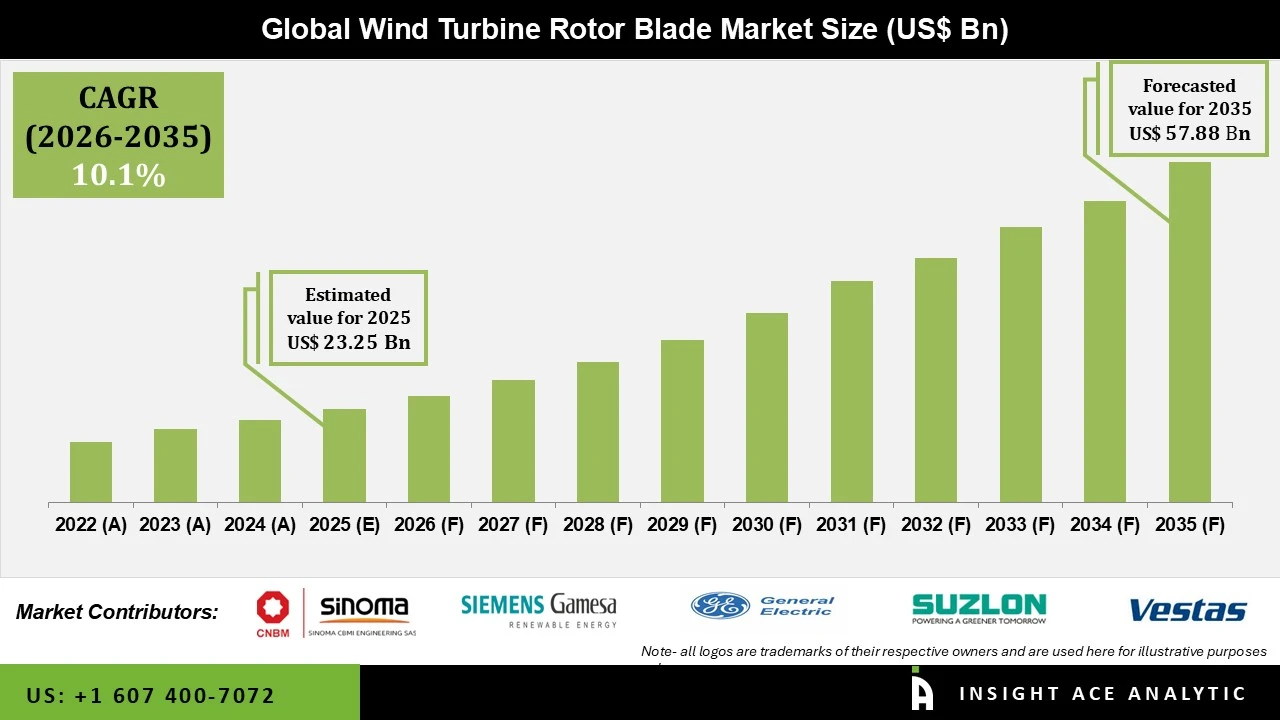

Wind Turbine Rotor Blade Market Size is valued at USD 23.25 billion in 2025 and is predicted to reach USD 57.88 billion by the year 2035 at a 10.1% CAGR during the forecast period of 2026 to 2035.

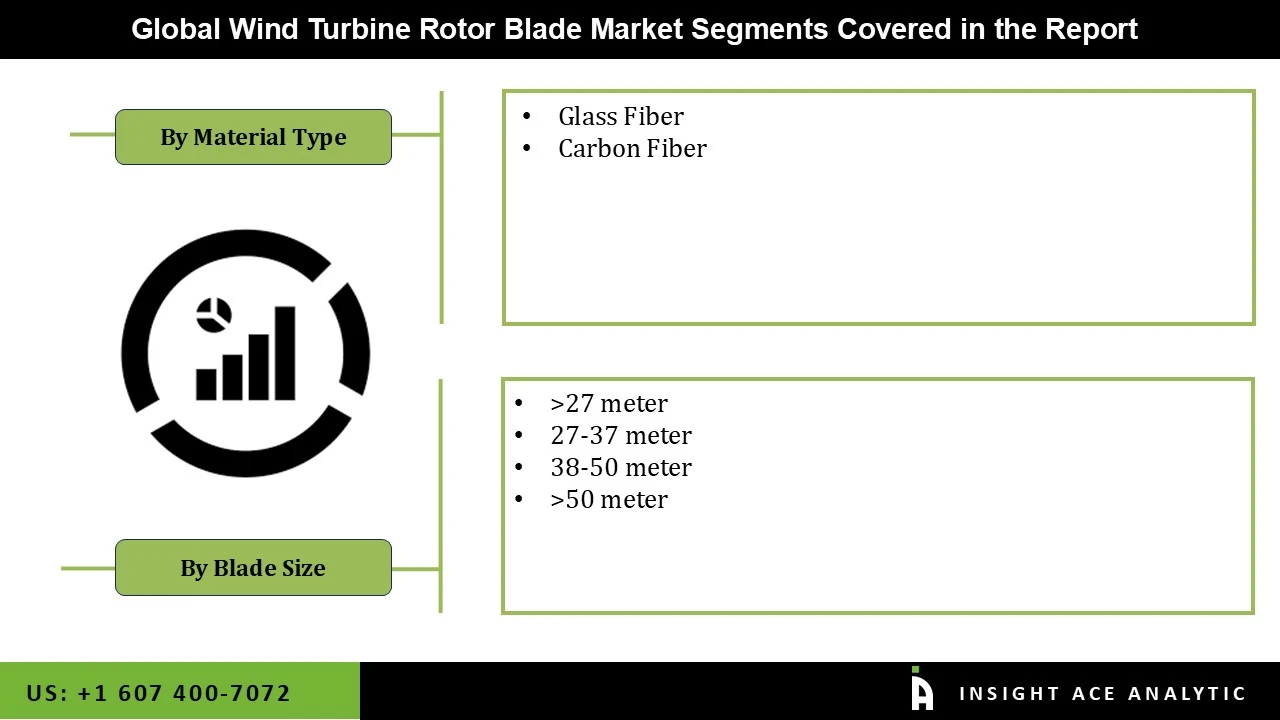

Wind Turbine Rotor Blade Market Size, Share & Trends Analysis Report By Material (Glass Fiber, Carbon Fiber), by Blade Size (<27 Meter, 27-37 Meter, 38-50 Meter, and >50 Meter), Region And Segment Forecasts, 2026 to 2035

Global product utilization has been augmented by the growing demand for alternative energy sources and the extensive use of wind energy power generation technology to maximize electricity production. The increasing depletion of petroleum-based resources and the growing demand for effective energy sources both lend support to this. As a result, governments are encouraging the installation of environmentally friendly assets like wind turbines to reduce carbon emissions, which is another element spurring economic growth. Additionally, the market is being supported by the rising use of various materials, including aluminum, wood, and polymers, to construct improved wind turbine rotor blades at affordable rates.

Additionally, developing product variants for aviation wing constructions aimed to increase operational effectiveness and using glass fiber-reinforced polymer and epoxy in wind turbine rotor blades are fostering market expansion. A favorable picture for the market is being created by other factors, including the continued installation of wind systems throughout offshore regions and strategic alliances amongst major firms to introduce lightweight, recyclable wind rotor blades.

The Wind Turbine Rotor Blade market is categorized based on material and blade size. Based on the material, the market is segmented as glass fiber and carbon fiber. By blade size, the market is segmented into >27 meters, 27-37 meters, 38-50 meters, and >50 meters.

For both land-based and offshore systems, carbon fiber is predominantly employed in the spar, or structural component, of wind blades longer than 45m/148ft. A narrower blade profile is possible while yet creating stiffer, lighter blades thanks to the increased stiffness and lower density of CF. According to Schell, switching from an all-glass blade to one with a carbon fiber-reinforced spar cap should result in a weight reduction of at least 20%. The properties of carbon will be especially advantageous for offshore wind systems, where the smallest turbines have a 3 MW rating.

Wind turbines can sweep more ground, catch more wind, and generate more power when their rotor diameters are larger. Even in locations with relatively slight wind, a turbine with longer blades will be able to catch more of the available wind than one with shorter blades. More areas could be available for wind development across the country if more wind could be captured at lower wind speeds.

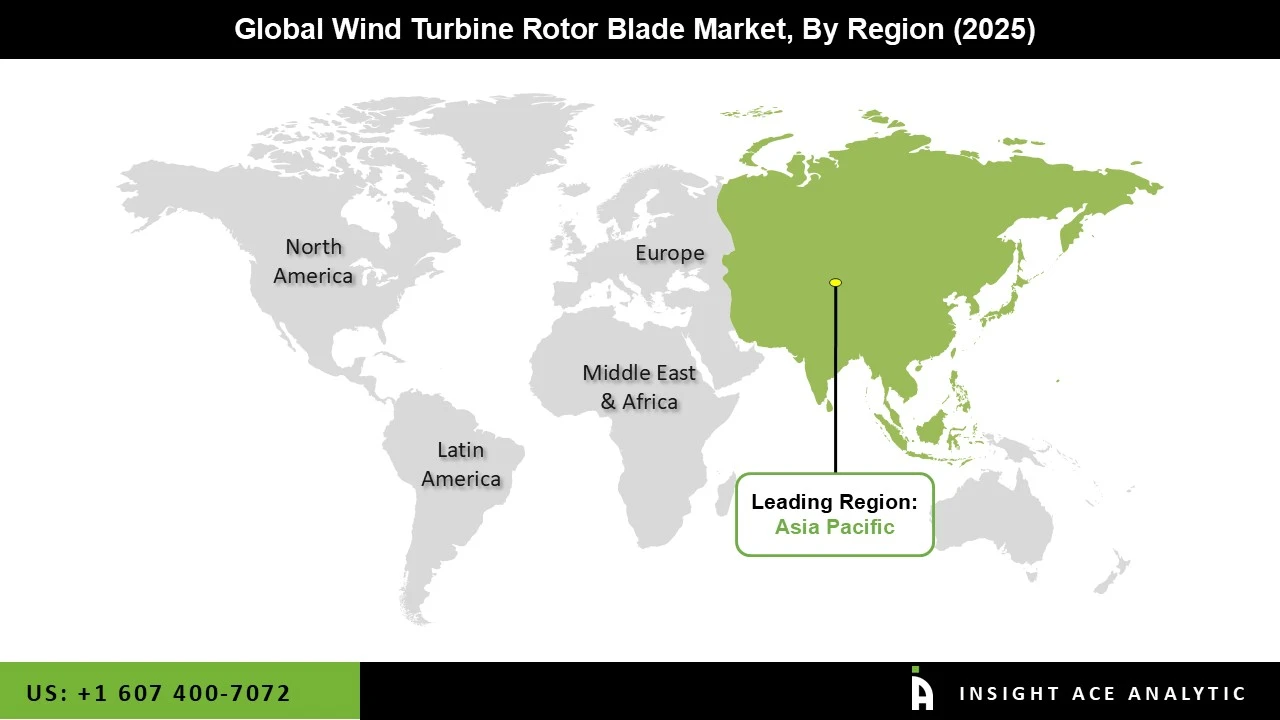

In the upcoming years, Asia Pacific is anticipated to dominate the market for wind turbine rotor blades. The main development engine for the market in the region is anticipated to be government initiatives and policies supporting the deployment of wind turbine rotor blades in marine applications. Due to the rising use of technologically developed wind turbines in nations like Germany and the UK and the favorable environmental conditions in these countries, Europe is anticipated to have significant development in the global wind turbine rotor blade market in the coming years. In the future, North America's wind turbine rotor blade market is anticipated to experience moderate expansion.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 23.25 Bn |

| Revenue Forecast In 2035 | USD 57.88 Bn |

| Growth Rate CAGR | CAGR of 10.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Material And Blade Size |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | China National Materials Company Limited (Sinoma), Gamesa S.A., General Electric Company, Siemens AG, Sinoi GMBH, Suzlon Energy Limited, Vestas Wind Systems A/S, Acciona, S.A, Enercon GMBH, Nordex S.E., Powerblades GMBH, and SGL Rotec GMBH & Co. KG (Carbon Rotec) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Wind Turbine Rotor Blade Market By Material-

Wind Turbine Rotor Blade Market By Blade Size-

Wind Turbine Rotor Blade Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.