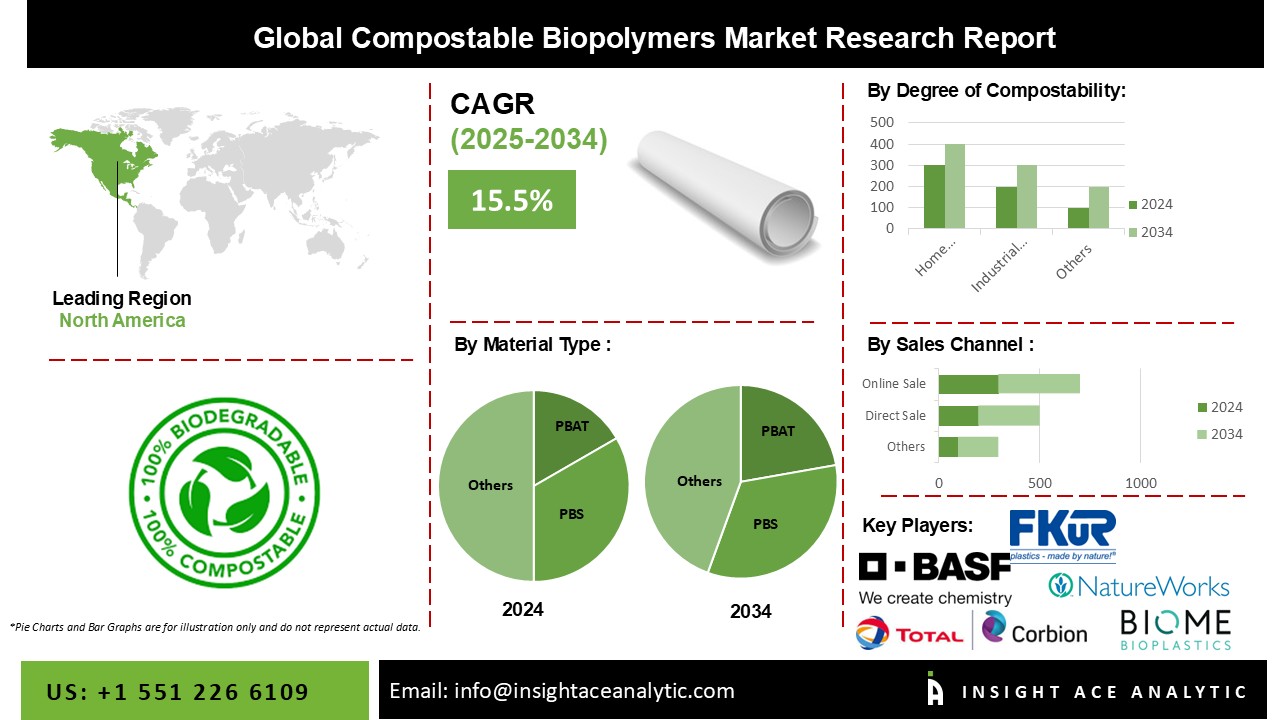

Compostable Biopolymers Market Size is predicted to witness a 15.5% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Compostable biopolymers are biodegradable plastics derived from natural sources such as corn starch, sugarcane, and potato starch. They are used to replace traditional plastics, which take years to degrade and frequently pollute the environment. The market for biodegradable biopolymers is a fast-expanding industry that is gaining popularity owing to its eco-friendliness and sustainability. Legislators are allowing the use of biodegradable polymers over traditional polymers to reduce carbon footprint. Several major automakers are now incorporating biopolymers into their vehicles; for example, Ford Motor Company is incorporating biopolymers for internal applications. Several factors are predicted to cause significant growth in the compostable biopolymers market in the coming years.

However, the COVID-19 pandemic has impacted the bioplastics and biopolymers market by disrupting supply chain and distribution networks, limiting industrial activities, and posing operational issues. Lockdown regulations all across the world hampered the transit of goods and the purchase of raw materials, and workforce shortages and restricted transport services hampered market growth even more.

The Compostable Biopolymers Market is segmented on the basis of material type, degree of compostability, sales channel, and end-use. Material type segment includes polybutylene adipate terephthalate, polybutylene succinate, polylactic acid, polyhydroxyalkanoate, starch blends, cellulose films, and others. The degree of compostability segment includes home compostable and industrial compostable. Sales channel segment includes direct sales, online sales, and distributors. The end-user segment includes food packaging, disposable cutlery, bags, mulch films, agricultural applications, and others.

The food packaging category is expected to hold a major share of the global Compostable Biopolymers Market in 2024. Packaging solutions based on bioplastics and biopolymers are increasingly being used to safeguard commodities during storage and transportation. These technologies provide better strength and durability while preventing breakage and contamination. They also have superior aesthetics and are utilized by brands for product branding and communicating product information to customers.

The food and beverage industries have boosted their use of bioplastics and biopolymers in packaging. Population expansion, rising consumer purchasing power, and a major increase in e-commerce are all factors driving this segment's growth. Businesses all around the world are taking steps to reduce packaging waste and control their carbon footprint by implementing ecologically friendly packaging solutions.

The polylactic acid segment is projected to grow at a rapid rate in the global compostable biopolymers market. The rising demand for biodegradable plastics has resulted in higher recycling and a reduction in waste production volume. Packaging, medical equipment, automotive, consumer products, construction, and textiles are key uses for the market, as are orthopedic devices, wound treatment, surgical sutures, and drug administration systems. These reasons are propelling market segment expansion.

Europe's Compostable Biopolymers Market is expected to register the most increased market share in terms of revenue in the near future. The increased use of bioplastics and biopolymers in automotive, packaging and consumer goods industries supports regional market growth. The rise in environmental concerns and the implementation of severe ecological legislation has increased customer preference for bio-based and biodegradable products.

The Asia Pacific region is expected to increase significantly during the predicted period. Economic expansion, urbanization, and industrialization have all raised demand for the region's sector. Increased population, increased consumer awareness, and growing demand for sustainable packaging solutions, particularly from the e-commerce industry, drive market growth.

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 15.5% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments Covered | By Material Type, Degree Of Compostability, Sales Channel, And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | NatureWorks LLC, BASF SE, Total Corbion PLA, Biome Bioplastics, FKuR Kunstsoff GmbH, Novamont S.p.A., Green Dot Bioplastics, TIPA, Cardia Bioplastics, and Danimer Scientific. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Compostable Biopolymers Market By Material Type-

Compostable Biopolymers Market By Degree of Compostability-

Compostable Biopolymers Market By Sales Channel-

Compostable Biopolymers Market By End-Use

Compostable Biopolymers Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.