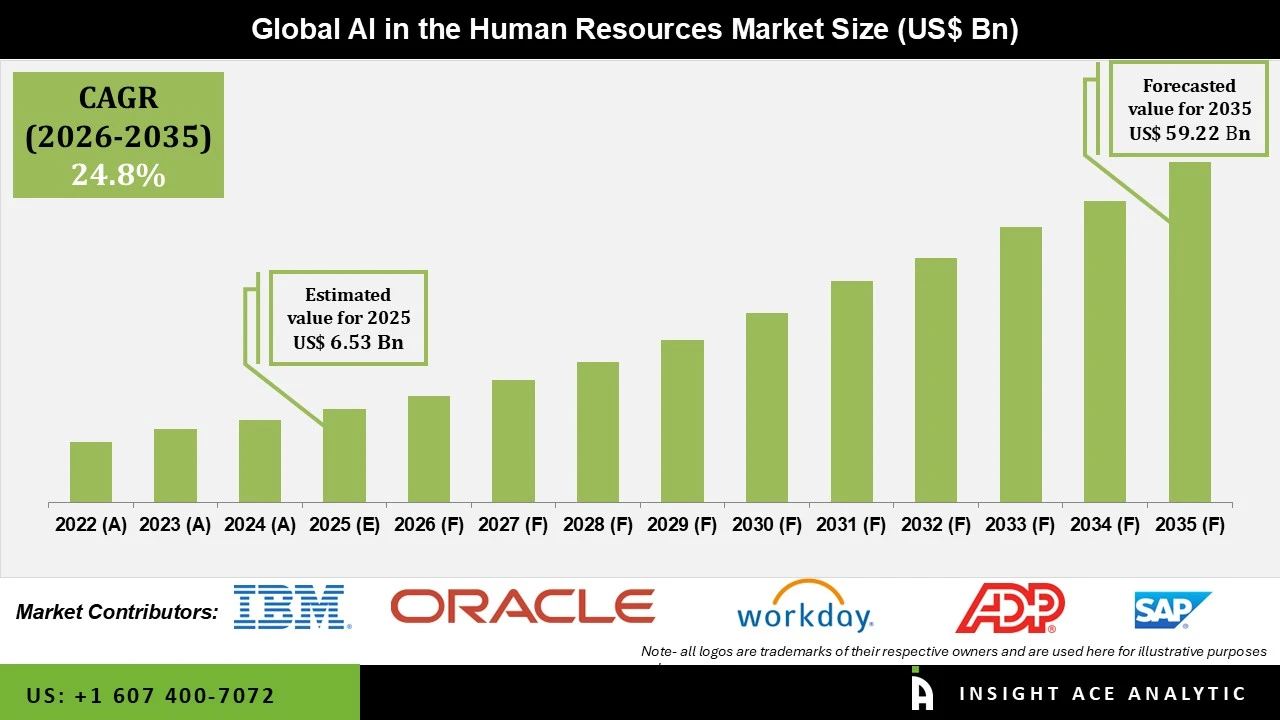

AI in Human Resources Market Size is valued at USD 6.53 billion in 2025 and is predicted to reach USD 59.22 billion by the year 2035 at a 24.8% CAGR during the forecast period for 2026 to 2035.

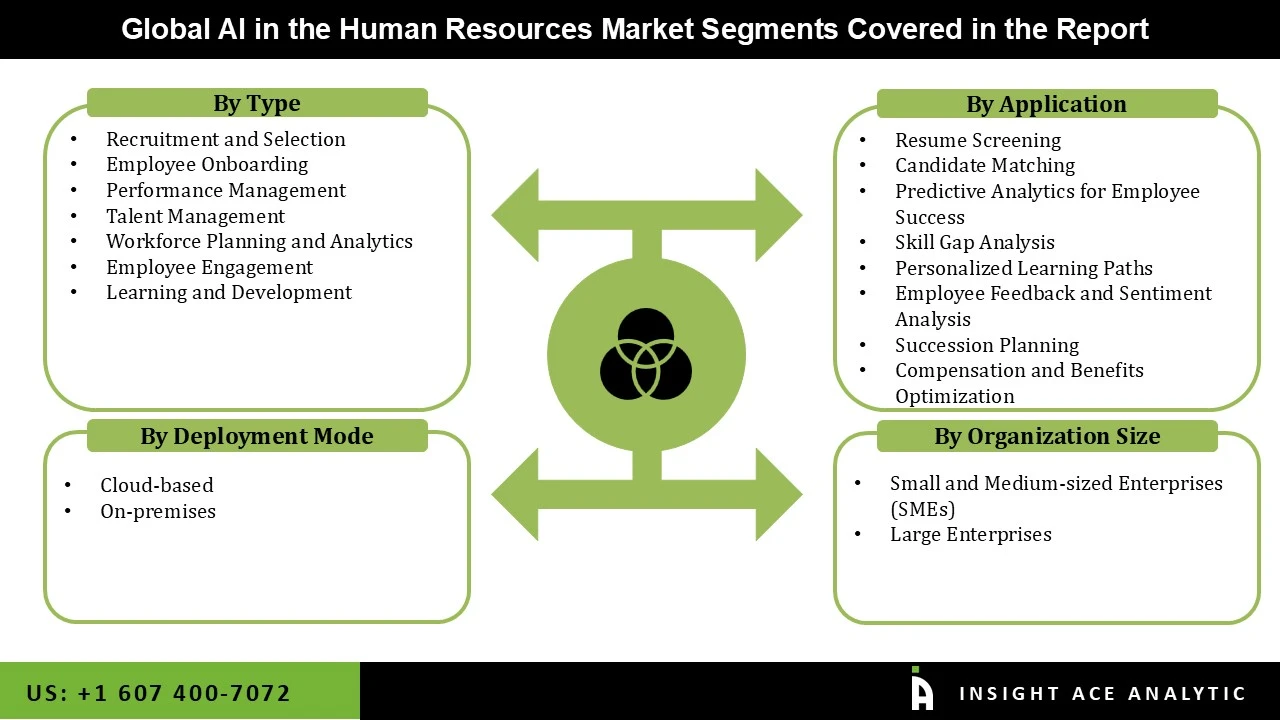

AI in Human Resources Market Size, Share & Trends Analysis Report By Type (Recruitment and Selection, Employee Onboarding, Performance Management, Talent Management, Workforce Planning and Analytics, Employee Engagement, Learning and Development), By Application, By Deployment Mode, By Organization Size, By Region, And By Segment Forecasts, 2026 to 2035

AI in Human Resources (HR) enhances efficiency by automating key processes like resume screening, candidate matching, and interview scheduling. AI-driven tools analyze job applications to identify top candidates and predict their success, reducing time-to-hire and human bias. In employee management, AI personalizes training, monitors performance, and provides real-time feedback. Workforce analytics powered by AI offers insights into engagement, turnover risks, and productivity trends.

However, the high cost of developing AI in the human resources sector is a significant market constraint. Additionally, market growth is further hindered by a need for more knowledge and familiarity with these technologies. Additionally, a number of factors are creating opportunities in the AI human resources market. These include more efficient recruitment through AI-driven talent matching, better workforce analytics for strategic decision-making, and more personalized employee experiences. Furthermore, AI can facilitate diversity and inclusion programs and assist in managing distant workers.

The AI in the human resources market is segmented based on type, application, deployment mode, and organization size. Based on type, the market is segmented into recruitment and selection, employee onboarding, performance management, talent management, workforce planning and analytics, employee engagement, and learning and development. By application, the market is segmented into resume screening, candidate matching, predictive analytics for employee success, skill gap analysis, personalized learning paths, employee feedback and sentiment analysis, succession planning, compensation, and benefits optimization. As per the deployment mode, the market is further segmented into cloud-based and on-premises. The organization size segment includes small and medium-sized enterprises (SMEs) and large enterprises.

Recruitment and selection is expected to hold a major global market share in 2023 in the AI in human resources market because AI can improve applicant matching, automate resume screening, and simplify interview processes. Widespread acceptance of AI in human resource tools in recruiting is driven by their ability to decrease hiring biases, improve decision-making using data-driven insights, and drastically reduce the time and expense associated with traditional recruitment approaches.

The cloud-based segment is growing because of its affordability, adaptability, and scalability. With simple access to AI technologies, businesses can reap the benefits without investing heavily in costly on-premise equipment. Cloud-based solutions allow human resource systems to be easily integrated, remote work to be supported, and real-time data analytics to be provided. Businesses are moving to them because of the increased security, frequent updates, and accessibility they offer.

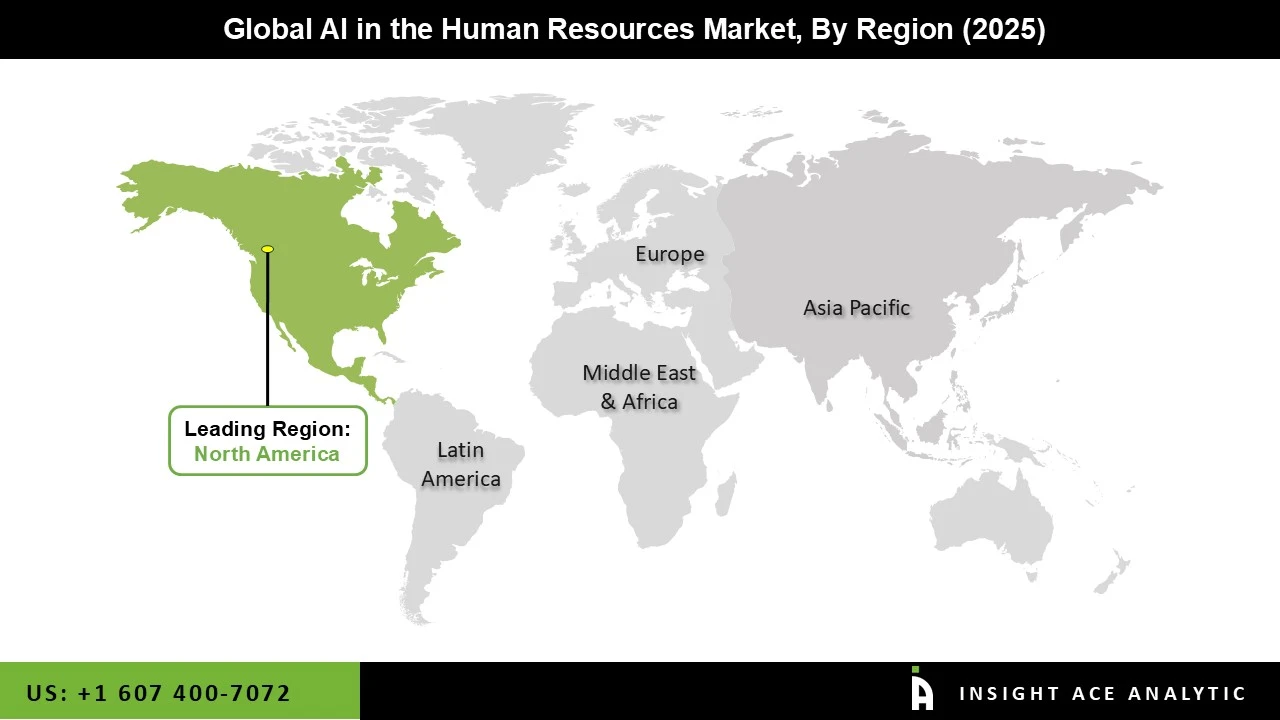

North American AI in the human resources market is expected to have the highest market share in revenue in the near future. This can be due to the region’s stringent regulations, focus on moral AI application, growing usage of AI to enhance decision-making and worker efficiency, and greater use of artificial intelligence driving operational efficiencies. In addition, the Asia Pacific is estimated to grow rapidly in the AI in human resources market because of the region’s investment in artificial intelligence solutions, its superior technology infrastructure, and its emphasis on data-driven human resource strategies to improve workforce efficiency and creativity, and improvements to the region’s infrastructure driven by artificial intelligence.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.53 Bn |

| Revenue Forecast In 2035 | USD 59.22 Bn |

| Growth Rate CAGR | CAGR of 24.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, Deployment Mode and Organization Size |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | IBM Corporation, Oracle Corporation, SAP SE, ADP, LLC, Workday, Inc., Ultimate Software Group, Inc., Cornerstone OnDemand, Inc., Kronos Incorporated, Ceridian HCM, Inc., Talentsoft, PeopleStrong HR Services Pvt. Ltd., Phenom People, Inc., Visier, Inc., Entelo, HireVue Inc., Textio, Brazen Technologies, AllyO, Pymetrics, Eightfold AI, ClearCompany, Jobvite, Inc., Greenhouse Software, Inc., Talview, Avature. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI in the Human Resources Market By Type-

AI in the Human Resources Market By Application-

AI in the Human Resources Market By Deployment Mode-

AI in the Human Resources Market By Organization Size-

AI in the Human Resources Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.