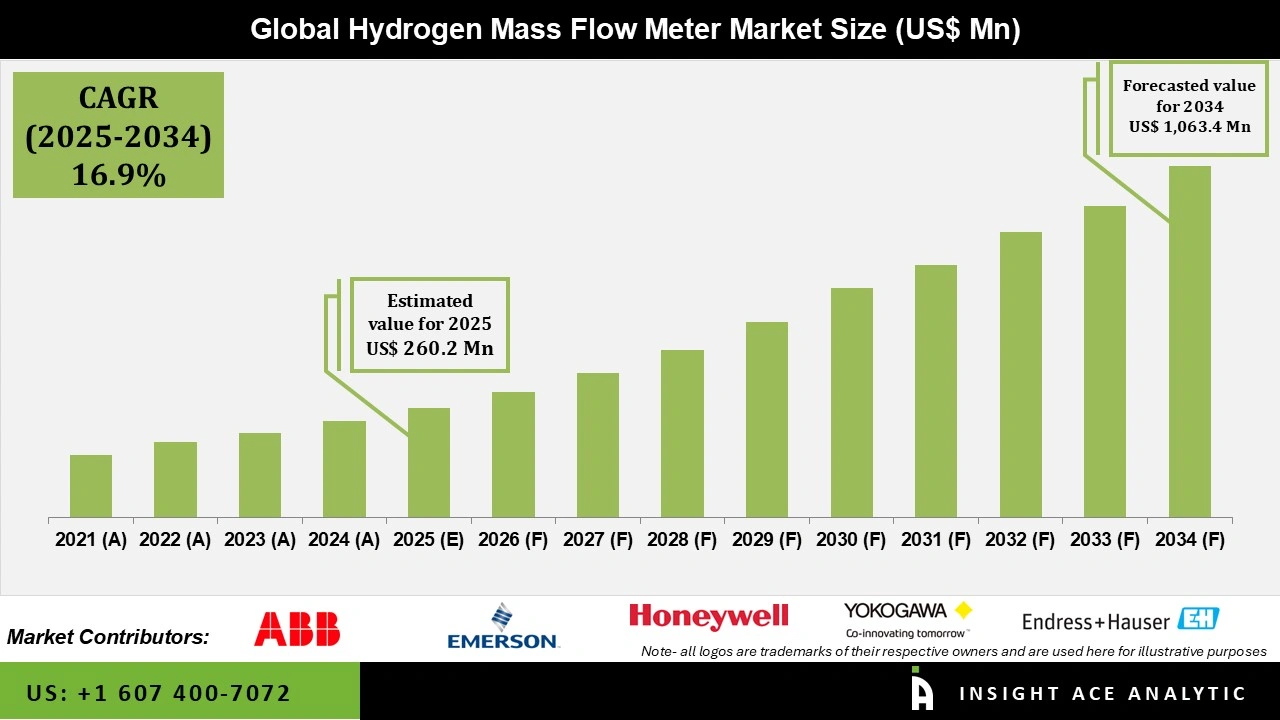

Hydrogen Mass Flow Meter Market Size is valued at US$ 260.2 Mn in 2024 and is predicted to reach US$ 1,063.4 Mn by the year 2034 at an 16.9% CAGR during the forecast period for 2025-2034.

Hydrogen mass flow meters measure how much hydrogen gas flows through a system, giving accurate readings regardless of temperature or pressure changes. They work in labs, factories, and hydrogen refueling stations where precise measurement is critical. These meters use advanced technology like Coriolis or thermal sensors to achieve high accuracy (±0.2%). The market is rapidly evolving due to the global shift to clean energy and increasing hydrogen use in cars, power plants, and chemical production.

Rising investments in hydrogen infrastructure drive market growth. Governments and companies are building refueling stations, storage tanks, and large electrolyzer plants for green hydrogen. Accurate flow measurement ensures safety, efficiency, and compliance with regulations. Fuel cell vehicles and industrial applications need reliable meters for high-pressure operations. Strong government support and net-zero targets worldwide are accelerating adoption.

Green hydrogen production offers the biggest growth potential. Massive electrolyzer projects require advanced meters that handle high-purity hydrogen and connect to digital monitoring systems. Smart meters with IoT integration for real-time data and predictive maintenance will dominate. Asia-Pacific (China, Japan, South Korea) and Europe lead investments, while North America builds refueling networks. As technology costs drop, these meters will become standard across the entire hydrogen supply chain.

Some of the Key Players in the Hydrogen Mass Flow Meter Market:

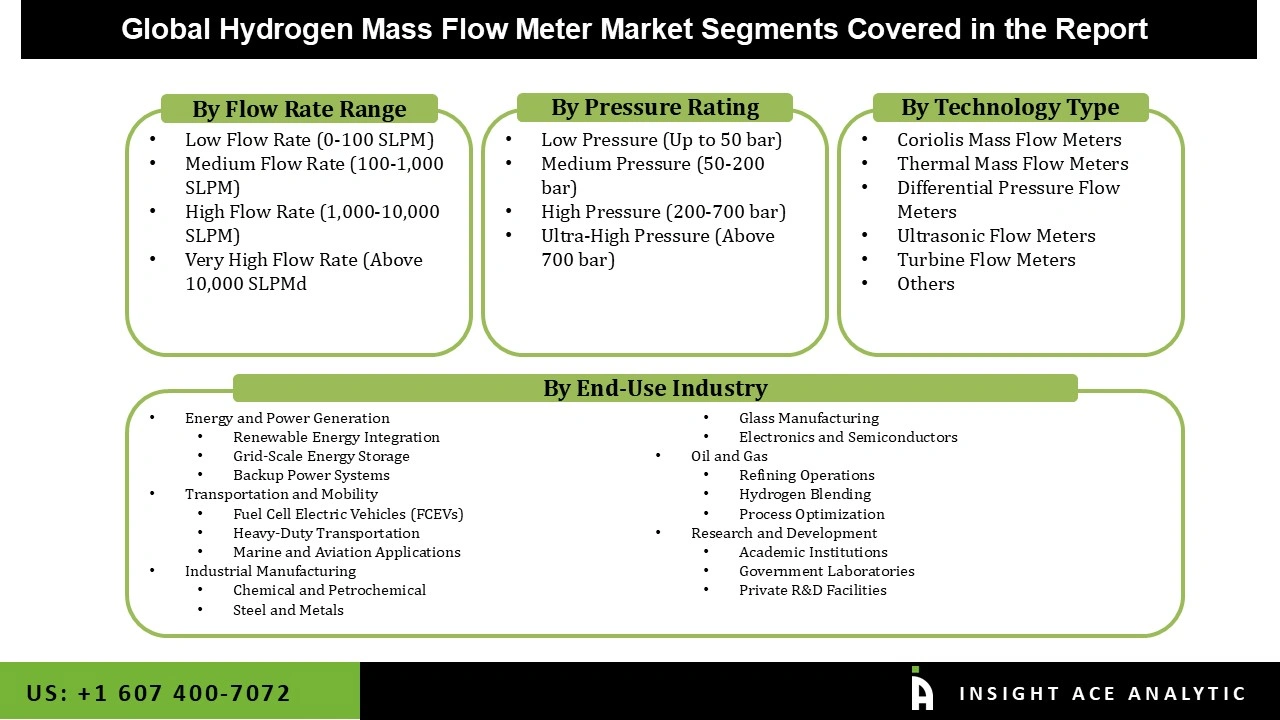

The hydrogen mass flow meter market is segmented by flow rate range, pressure rating, technology type, and end-use industry. By flow rate range, the market is segmented into low flow rate (0-100 SLPM), medium flow rate (100-1,000 SLPM), high flow rate (1,000-10,000 SLPM), and very high flow rate (above 10,000 SLPM). By pressure rating, the market is segmented into low pressure (up to 50 bar), medium pressure (50-200 bar), high pressure (200-700 bar), and ultra-high pressure (above 700 bar). By technology type, the market is segmented into Coriolis mass flow meters, ultrasonic flow meters, thermal mass flow meters, turbine flow meters, differential pressure flow meters, and others.

By end-use industry, the market is segmented into transportation and mobility (heavy-duty transportation, fuel cell electric vehicles (FCEVs), marine and aviation applications), energy and power generation (grid-scale energy storage, renewable energy integration, backup power systems), oil and gas (refining operations, process optimization, hydrogen blending), industrial manufacturing (chemical and petrochemical, glass manufacturing, electronics and semiconductors, steel and metals), and research and development (government laboratories, academic institutions, private R&D facilities).

The highest demand is being seen for Coriolis flow meters due to their excellent accuracy, direct mass flow measurement, and low maintenance needs. These meters' capacity to handle low-density gases and deliver accurate readings even in the face of variable operating conditions makes them especially well-suited for hydrogen applications. Coriolis flow meters are widely used in sectors such as chemical processing and power generation, where process safety and dependability are critical, as they enable real-time hydrogen flow monitoring and control, thereby reducing the likelihood of leaks and process irregularities.

The Energy and Power Generation Segment by End-Use Industry is Growing at the Highest Rate in the Hydrogen Mass Flow Meter Market

The integration of hydrogen into power production, grid balancing, and energy storage applications is driving a surge in the use of hydrogen flow meters in the energy and power generation sector. Utilities are increasingly using hydrogen to balance supply and demand, store excess renewable energy, and reduce dependency on fossil fuels. Monitoring storage levels, controlling the injection of hydrogen into gas grids, and guaranteeing the secure operation of energy infrastructure all depend on precise flow measurement. The need for flow meters with sophisticated data analytics, remote monitoring, and predictive maintenance features is being further fueled by the shift to smart grids and digital utilities.

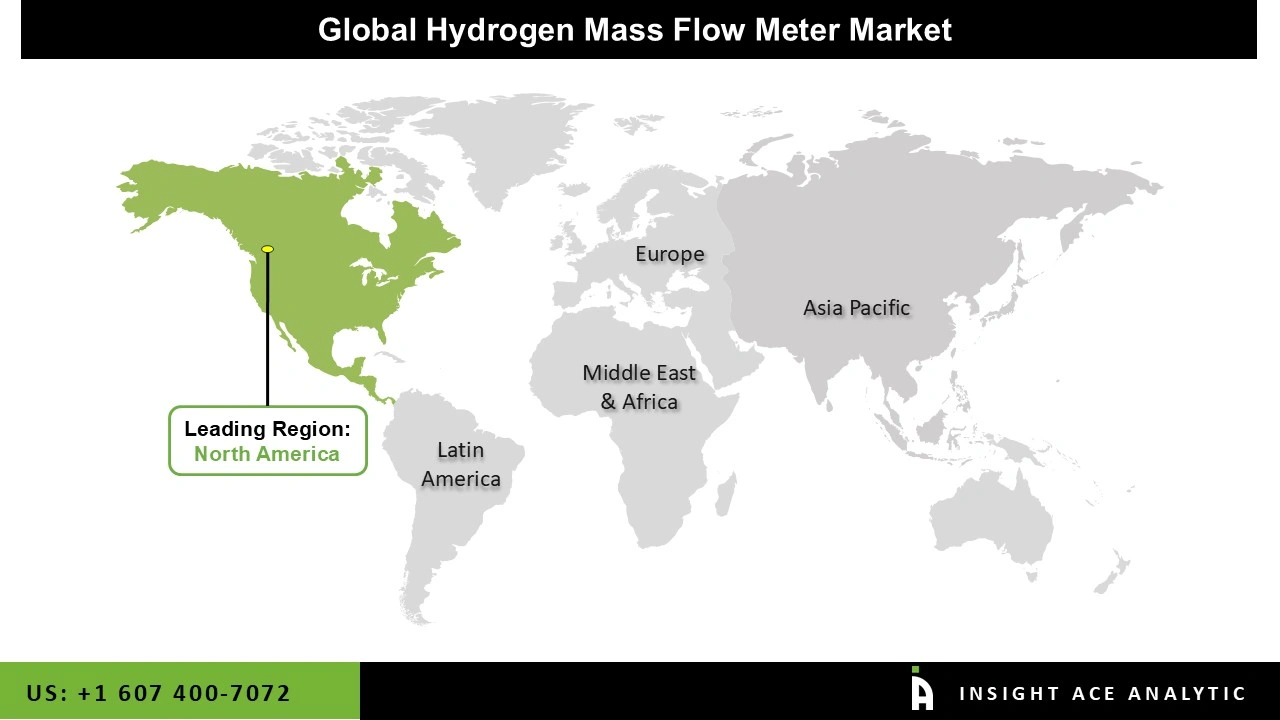

North America led the hydrogen mass flow meter market in 2024, with the United States driving growth. Strong investments in clean energy, a mature industrial base, and federal incentives like the Inflation Reduction Act fuel demand in automotive, power generation, and oil & gas sectors. Companies need precise flow meters for hydrogen production, refueling stations, and safety compliance. This robust infrastructure and regulatory support give North America the largest market share.

Asia-Pacific will grow the fastest in the hydrogen flow meter market through 2034. China, Japan, South Korea, and Australia lead with massive government policies and investments in hydrogen infrastructure. These countries dominate production, distribution, and usage, creating huge demand for advanced flow meters. Green hydrogen projects, rising fuel cell vehicle adoption, and energy security focus drive rapid expansion in the region.

· In March 2024, Siemens AG launched the Sitrans FX hydrogen-ready flowmeter for custody transfer and process applications. The new meter is specifically engineered for high-pressure hydrogen, featuring advanced diagnostics and a certified accuracy of ±0.5% to meet the stringent requirements for financial transactions and efficiency monitoring in green hydrogen production and refueling stations.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 260.2 Mn |

| Revenue Forecast In 2034 | USD 1,063.4 Mn |

| Growth Rate CAGR | CAGR of 16.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Flow Rate Range, By Pressure Rating, By Technology Type, By End-Use Industry, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Siemens AG, Emerson Electric Co. (Micro Motion), ABB Ltd., Yokogawa Electric Corporation, Alicat Scientific Inc., Honeywell International Inc., Krohne Group, Bronkhorst High-Tech B.V., Endress+Hauser Group, Brooks Instrument (ITW), Sierra Instruments Inc. MKS Instruments Inc., Axetris AG (Leister Group), Fluid Components International (FCI), TSI Incorporated, Sensirion AG, Teledyne Hastings Instruments, Sage Metering Inc., and Kurz Instruments Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Hydrogen Mass Flow Meter Market by Flow Rate Range-

· Low Flow Rate (0-100 SLPM)

· Medium Flow Rate (100-1,000 SLPM)

· High Flow Rate (1,000-10,000 SLPM)

· Very High Flow Rate (Above 10,000 SLPM)

Hydrogen Mass Flow Meter Market by Pressure Rating -

· Low Pressure (Up to 50 bar)

· Medium Pressure (50-200 bar)

· High Pressure (200-700 bar)

· Ultra-High Pressure (Above 700 bar)

Hydrogen Mass Flow Meter Market by Technology Type-

· Coriolis Mass Flow Meters

· Ultrasonic Flow Meters

· Thermal Mass Flow Meters

· Turbine Flow Meters

· Differential Pressure Flow Meters

· Others

Hydrogen Mass Flow Meter Market by End-Use Industry-

· Transportation and Mobility

o Heavy-Duty Transportation

o Fuel Cell Electric Vehicles (FCEVs)

o Marine and Aviation Applications

· Energy and Power Generation

o Grid-Scale Energy Storage

o Renewable Energy Integration

o Backup Power Systems

· Oil and Gas

o Refining Operations

o Process Optimization

o Hydrogen Blending

· Industrial Manufacturing

o Chemical and Petrochemical

o Glass Manufacturing

o Electronics and Semiconductors

o Steel and Metals

· Research and Development

o Government Laboratories

o Academic Institutions

o Private R&D Facilities

Hydrogen Mass Flow Meter Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.