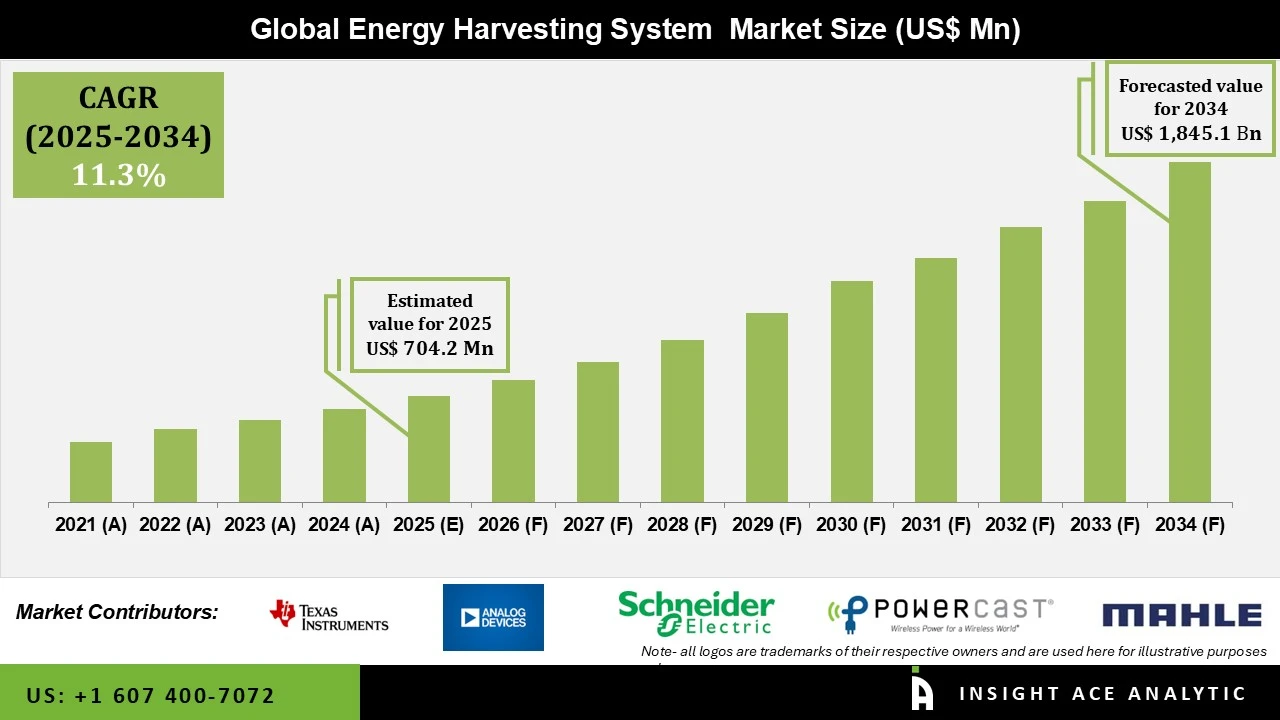

Energy Harvesting System Market Size is valued at USD 704.2 Mn in 2025 and is predicted to reach USD 1,845.1 Mn by the year 2034 at a 11.3% CAGR during the forecast period for 2025 to 2034.

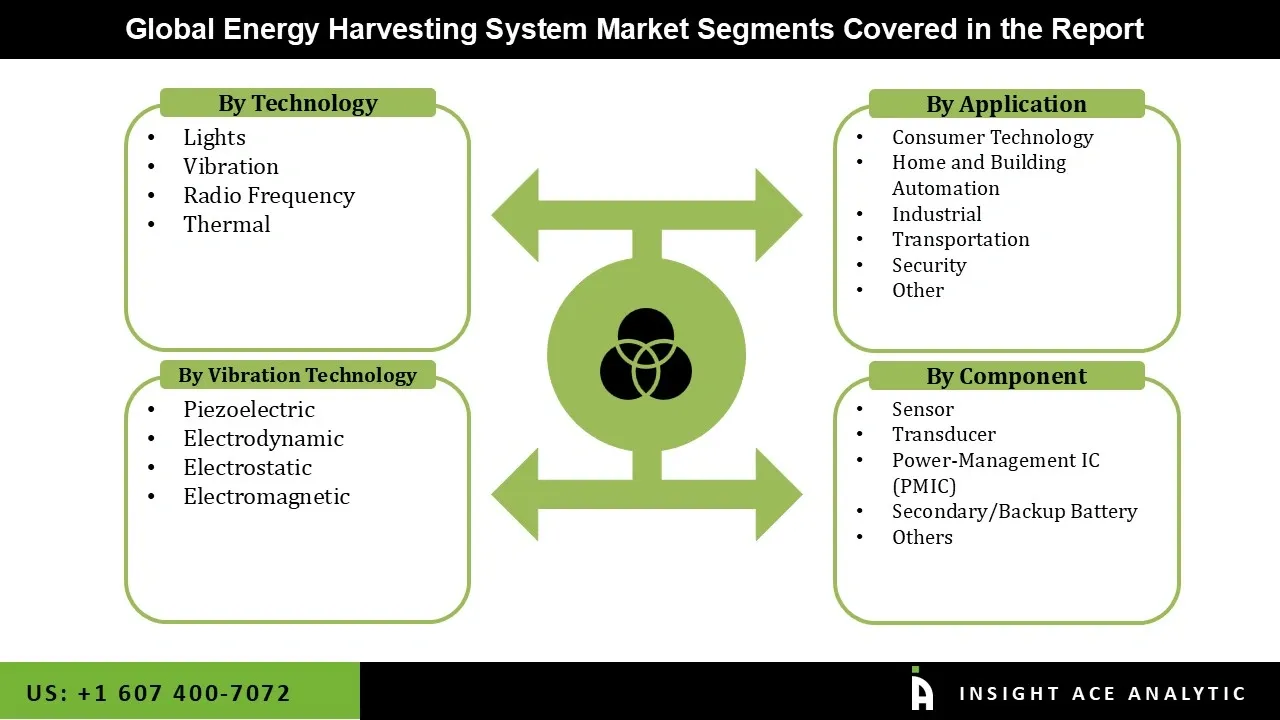

Energy Harvesting System Market Size, Share & Trends Analysis Distribution by Component (Sensor, Transducer, Secondary/Backup Battery, Power-Management IC (PMIC), and Others), Technology (Lights, Thermal, Radio Frequency, and Vibration), Vibration Technology (Piezoelectric, Electrostatic, Electrodynamic, and Electromagnetic), Application (Transportation, Consumer Technology, Industrial, Security, Home and Building Automation, Others), and Segment Forecasts, 2025 to 2034

Energy harvesting systems are quickly developing technologies that collect and transform ambient energy from the surroundings, including solar thermal, kinetic, and electromagnetic energy, into electrical energy that may be used. These systems are extremely useful for encouraging sustainability and cutting down on energy waste because they are made to power electronic gadgets without the need for traditional batteries or grid electricity.

Energy harvesting is frequently used to fuel wireless sensor networks, wearable technology, medical equipment, remote monitoring systems, transportation infrastructure, and smart cities. The increased need for renewable energy solutions, improvements in low-power electronics, and growing IoT (Internet of Things) applications have all contributed to the continuous rise of the global energy harvesting system market.

The need for energy is rising due to population expansion, and improvements in sensor-based energy harvesting systems and energy-efficient parts are boosting the global energy harvesting system market growth. Furthermore, a sizable portion of the energy present in the environment is wasted, either directly or indirectly.

Therefore, the worldwide energy harvesting system market's revenue growth is also being driven by the systems' capacity to capture and transform this lost energy into electrical energy for usage in autonomous electronic devices or circuits. Additionally, technological developments in solar, thermoelectric, and piezoelectric energy harvesting technologies, as well as a growing focus on energy efficiency, are propelling the energy harvesting system market expansion.

In addition, the energy harvesting systems are quite safe and effective. They also require very little upkeep. The sales of the global Energy Harvesting System market are extended by the growing use of wireless sensors due to enhanced automation in homes and greater use of green technologies. Moreover, the global market for energy harvesting systems is likely to grow due to the continuous trend of gathering renewable or natural energy sources.

The growth trajectory of the global Energy Harvesting System market is also being impacted by major players that are concentrating on expanding their product range in order to further boost their market presence. However, because of the many functions they carry out, such as integrating equipment, setting up energy scavenging devices, and evaluating real-time data, energy harvesting systems can be costly. Thus, this is anticipated to limit the energy harvesting system market expansion over the forecast period.

• ABB

• EnOcean GmbH

• Bionic Power, Inc.

• Analog Devices, Inc.

• Cymbet

• Mahle GmbH

• STMicroelectronics

• Powercast Corp.

• Schneider Electric

• Texas Instruments, Inc.

The energy harvesting system market is propelled by the increasing focus on sustainable and renewable energy solutions. The businesses and industries are looking for alternative energy sources as environmental concerns and regulatory demands to lower carbon footprints grow. By catching ambient energy such as solar, thermal, and kinetic energy to power low-energy devices, an energy harvesting system offers a workable option. It helps the shift to cleaner energy sources and is in line with international efforts toward sustainable practices.

The energy harvesting system is being more widely used in a variety of industries due to the need for sustainable solutions. For instance, EnOcean has created a self-powered wireless switch that doesn't require batteries by harnessing energy from the ambient light. Energy-efficient lighting control systems are made possible by the technology, which has been installed in more than a million smart buildings.

Compared to traditional battery-powered solutions, technologies in the energy harvesting system market sometimes require specific materials and cutting-edge semiconductor components, which raise costs. It is difficult to integrate these systems into current chemical and industrial infrastructures; sensors, controllers, and communication modules must be redesigned. The retrofitting of energy harvesting systems into hazardous locations requires stringent testing and certification, which raises prices even more for chemical facilities where safety and dependability are crucial.

Additionally, unit prices for specialized applications are still high since economies of scale have not yet been completely realized. Manufacturers and consumers are hesitant as a result, particularly in cost-sensitive areas like consumer electronics and emerging nations. This is anticipated to limit the energy harvesting system market expansion over the forecast period.

The transducer category held the largest share in the energy harvesting system market in 2024 because the use of electromechanical transducers to collect vibration energy has increased. Transducers are mostly utilized in energy harvesting systems to transform mechanical (vibration) energy from the surrounding environment into electrical energy.

Furthermore, a number of technologies, including piezoelectric, photovoltaic, radio frequency, electromagnetic, and thermoelectric, are used in the creation of transducers. It is common practice to install piezoelectric transducers beneath railroad and road pavements. These transducers generate power from the vibrations produced by passing cars. Additionally, industrial gas pipes and steam pipeline distribution systems include solid-state thermoelectric transducers, which allow for the extraction of a large amount of thermal energy. The demand for transducers in energy harvesting systems is expected to be driven by these applications throughout the projected period.

In 2024, the Home and Building Automation category dominated the Energy Harvesting System market. This dominance is attributed to the growing usage of smart technologies in homes and businesses, where energy harvesting is utilized in wireless sensors and devices for energy management, lighting control, HVAC systems, and security monitoring.

Additionally, the integration of energy harvesting systems in this industry has accelerated due to favourable government incentives for smart building technology and growing awareness of sustainability and energy saving. The appeal of energy-harvesting solutions in building and home automation applications is further increased by the capacity to install autonomous sensors that function without the need for external power or battery replacements.

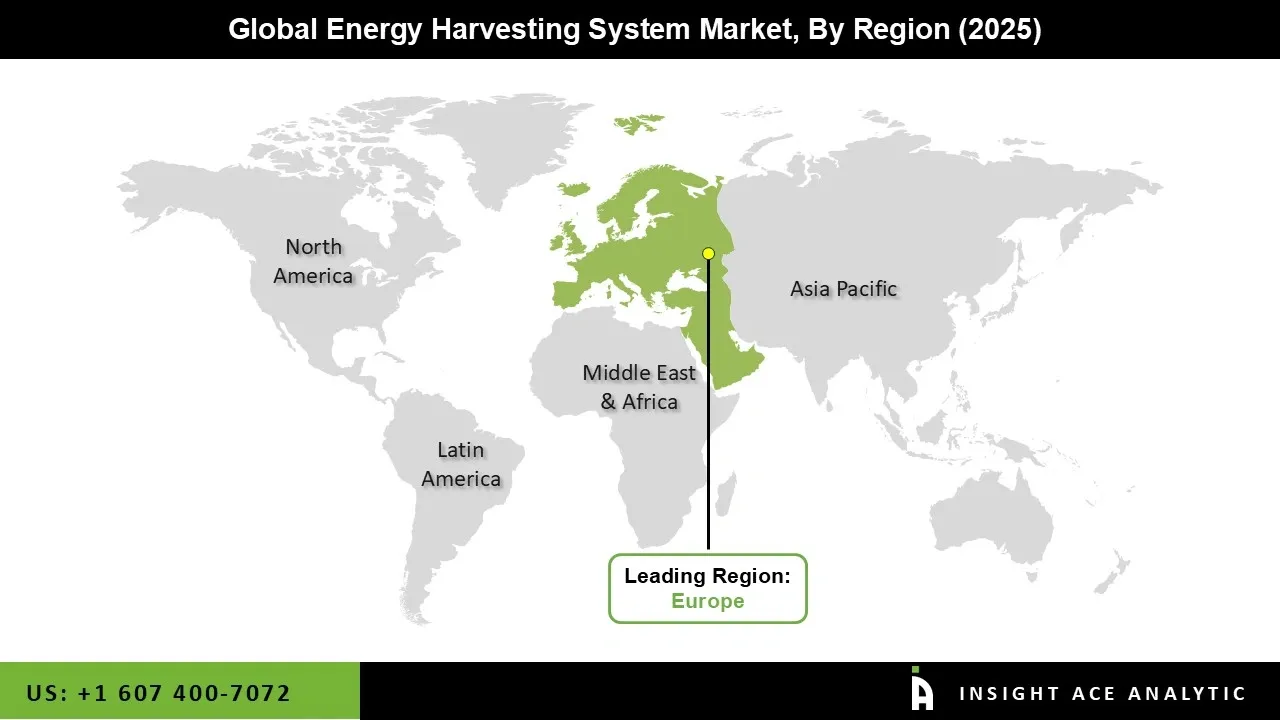

In 2024, the Europe region led the global Energy Harvesting System market. This leadership is driven by the European Union's stringent regulatory framework focused on energy efficiency and carbon neutrality, which has accelerated the adoption of sustainable technologies. Strong government mandates, such as the EU's Energy Efficiency Directive and funding for smart building initiatives, have made energy harvesting a standard component in new construction and industrial automation across member states.

The region's mature manufacturing sector, particularly in Germany and the Nordic countries, has also been an early and sophisticated adopter of energy-harvesting solutions for predictive maintenance and industrial IoT.

• March 2024: Bionic Power, Inc. was awarded a $5 million grant to create a new kinetic energy harvesting device. They will be able to extend their research and development into wearable technology that generates electrical power from body movement, thanks to this funding.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 704.2 Mn |

| Revenue forecast in 2034 | USD 1,845.1 Mn |

| Growth Rate CAGR | CAGR of 11.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Component, Technology, Vibration Technology, Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | ABB, EnOcean GmbH, Bionic Power, Inc., Analog Devices, Inc., Cymbet, Mahle GmbH, STMicroelectronics, Powercast Corp., Schneider Electric, and Texas Instruments, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Energy Harvesting System Market by Component-

• Sensor

• Transducer

• Secondary/Backup Battery

• Power-Management IC (PMIC)

• Others

Energy Harvesting System Market by Technology-

• Lights

• Thermal

• Radio Frequency

• Vibration

Energy Harvesting System Market by Vibration Technology-

• Piezoelectric

• Electrostatic

• Electrodynamic

• Electromagnetic

Energy Harvesting System Market by Application-

• Transportation

• Consumer Technology

• Industrial

• Security

• Home and Building Automation

• Others

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.