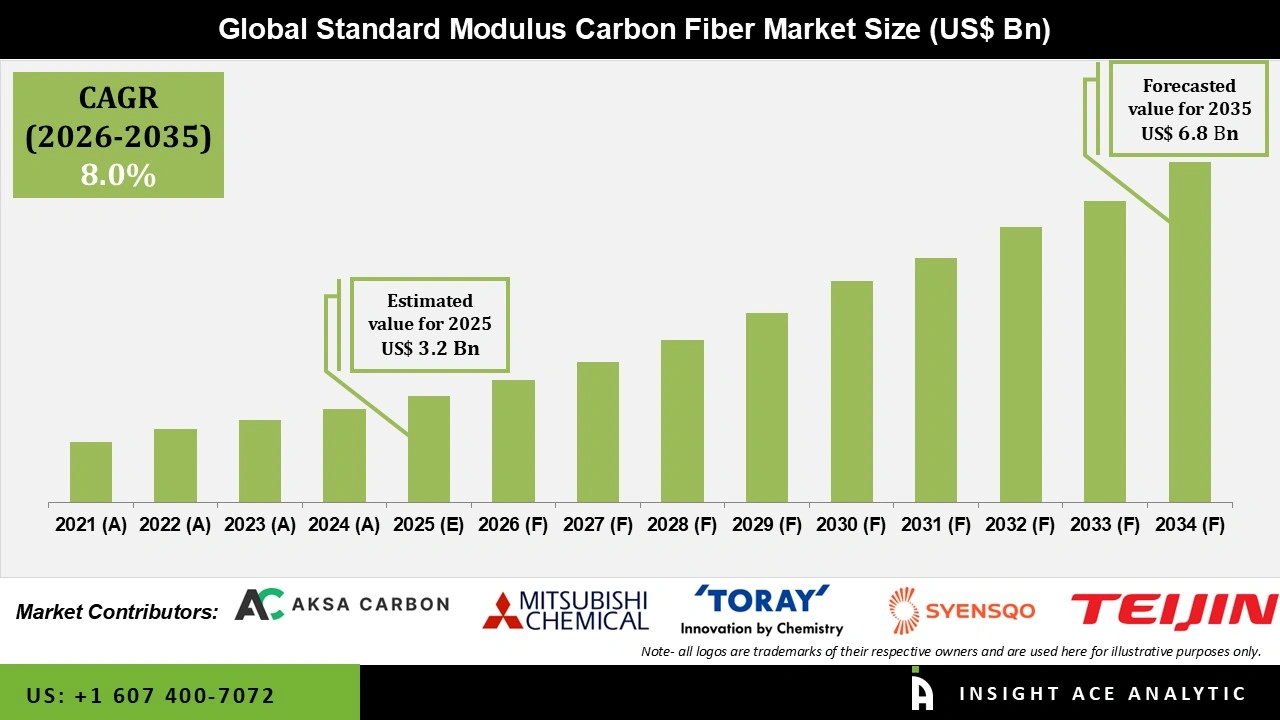

Global Standard Modulus Carbon Fiber Market Size is valued at USD 3.2 Bn in 2025 and is predicted to reach USD 6.8 Bn by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

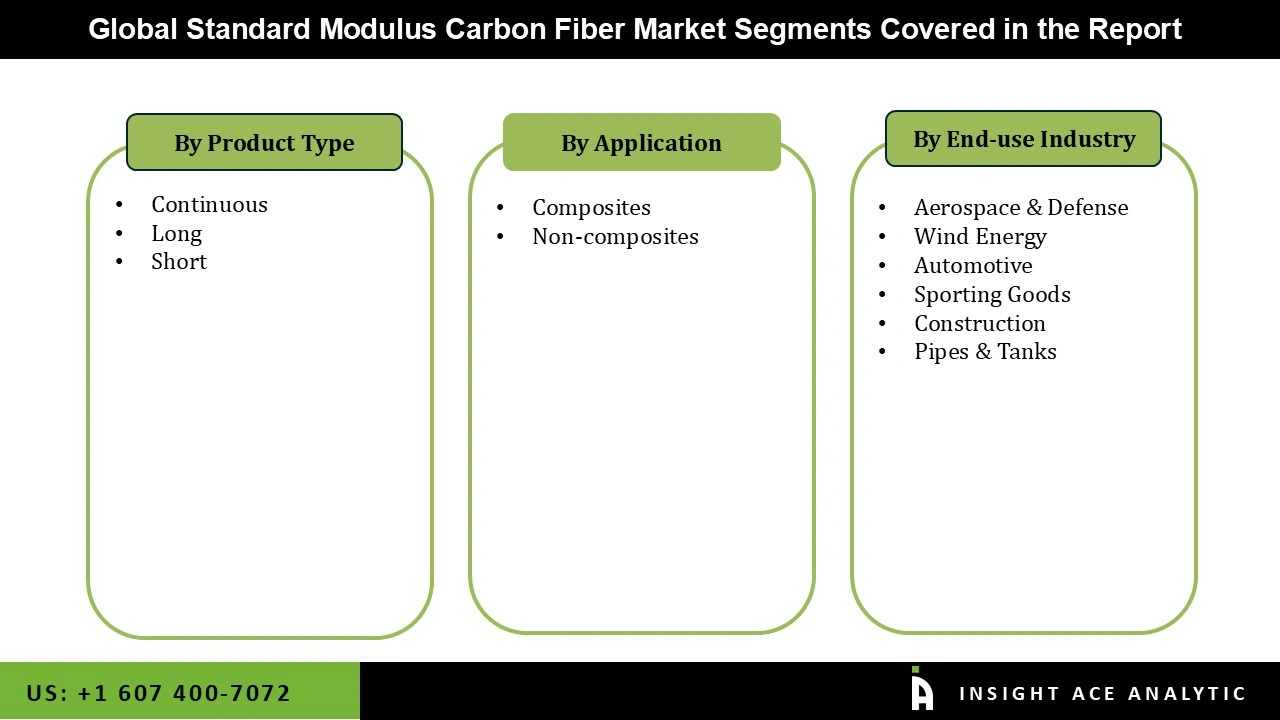

Standard Modulus Carbon Fiber Market Size, Share & Trends Analysis Distribution by Type (Continuous, Short, and Long), Application (Composites and Non-composites), End-user (Construction, Aerospace & Defense, Automotive, Wind Energy, Pipes & Tanks, Sporting Goods, and Others), Region and Segment Forecasts, 2026 to 2035.

Standard modulus carbon fiber is widely used in many industries because it has high tensile strength and moderate stiffness. With a typical tensile modulus of 230-240 GPa, it offers a good mix of stiffness, strength, and flexibility. Its strong strength-to-weight ratio, good fatigue resistance, and reasonable cost make it popular for large-scale uses. The market for standard modulus carbon fiber is growing as more industries look for lightweight, strong materials. Growth in the wind energy sector is also boosting demand, since wind turbine blades need to be both light and able to handle heavy loads.

The automotive and aerospace industries are major forces behind the growth of the standard modulus carbon fiber market. Manufacturers are looking for new materials that can lower weight without losing strength, as fuel efficiency and performance become more important. NASA reports that using carbon fiber in airplanes can cut weight by up to 20%, which saves a lot of fuel. The shift to electric vehicles in the auto industry is also increasing demand for lightweight materials. The International Energy Agency (IEA) expects the number of electric vehicles worldwide to reach 145 million by 2030, which will further boost demand. Using carbon fiber in car parts like chassis and body panels helps improve performance and meet pollution standards.

The standard modulus carbon fiber market is also growing because of new production technologies. Innovations like continuous fiber-reinforced thermoplastic composites and automated fiber placement (AFP) are making production cheaper and more efficient. Progress in recycling carbon fiber composites is helping address sustainability concerns and supports the circular economy. The European Commission's Circular Economy Action Plan, which promotes recycling and reusing resources, is expected to encourage wider use of carbon fiber. However, growth in this market faces some challenges. The complex manufacturing process and high initial investment needed for production facilities can make it hard for new companies to enter. Also, changes in raw material prices, especially for precursor fibers, can affect profit margins and market stability.

Driver

Growing Focus on Environmental Sustainability and Fuel Efficiency

The growing focus on environmental sustainability and fuel efficiency is one of the main drivers of growth in the standard modulus carbon fiber market. In order to improve fuel efficiency and lower carbon emissions, producers in the automotive and aerospace sectors are always searching for materials that can assist reduce vehicle weight. Because of its excellent strength-to-weight ratio, standard modulus carbon fiber successfully satisfies this criteria. Furthermore, since carbon fiber is used in the production of strong and lightweight turbine blades, the growth of the wind energy industry, which is fueled by the world's transition to renewable energy sources, further increases demand for standard modulus carbon fiber.

Restrain/Challenge

High Cost of Production of Standard Modulus Carbon Fiber Market

One major barrier to the standard modulus carbon fiber market's growth is its high production cost. This expense is mostly caused by intricate production procedures and costly precursor ingredients, which limit the material's use in more cost-sensitive applications. Although standard modulus carbon fiber market has outstanding performance advantages, its high cost prevents it from entering new markets, especially in sectors where material costs play a significant role in product development and customer price. Additionally, a lot of potential applications in industries like general industrial manufacturing and mainstream automotive remain mostly unexplored due to the existing cost structure, which hinders widespread integration and more rapid and expanding market growth.

The Continuous category held the largest share in the standard modulus carbon fiber industry in 2025 due to its extensive applicability in situations requiring consistent strength, robustness, and performance stability. In aerospace components, wind energy structures, pressure tanks, and high-performance automobile parts, continuous carbon fiber was primarily chosen because it permits load distribution over extended distances without interruption. Additionally, this segment's dominance was strengthened by its appropriateness for sophisticated manufacturing techniques like automated fiber placement, pultrusion, and filament winding, which are being used more and more to increase production efficiency and decrease material waste.

Will the Aerospace & Defense Segment Continue to Grow at the Highest Rate in the Standard Modulus Carbon Fiber Market?

In 2025, the aerospace & defense category dominated the standard modulus carbon fiber market. The need for strong, lightweight materials is critical in the aerospace and defense industries. Standard modulus carbon fiber is widely used in the production of airplane parts, including the fuselage, wings, and tail sections, where lowering weight directly improves performance and fuel efficiency. Additionally, the defense industry uses carbon fiber to create strong, lightweight parts that enhance military equipment's agility and operational effectiveness. Furthermore, ongoing investments in space programs, unmanned systems, and next-generation aircraft maintained consumption since carbon fiber allowed for extended service life and increased operational efficiency. The material's capacity to withstand high levels of stress and adhere to stringent safety regulations continued to be a crucial element supporting its dominant position in the standard modulus carbon fiber market.

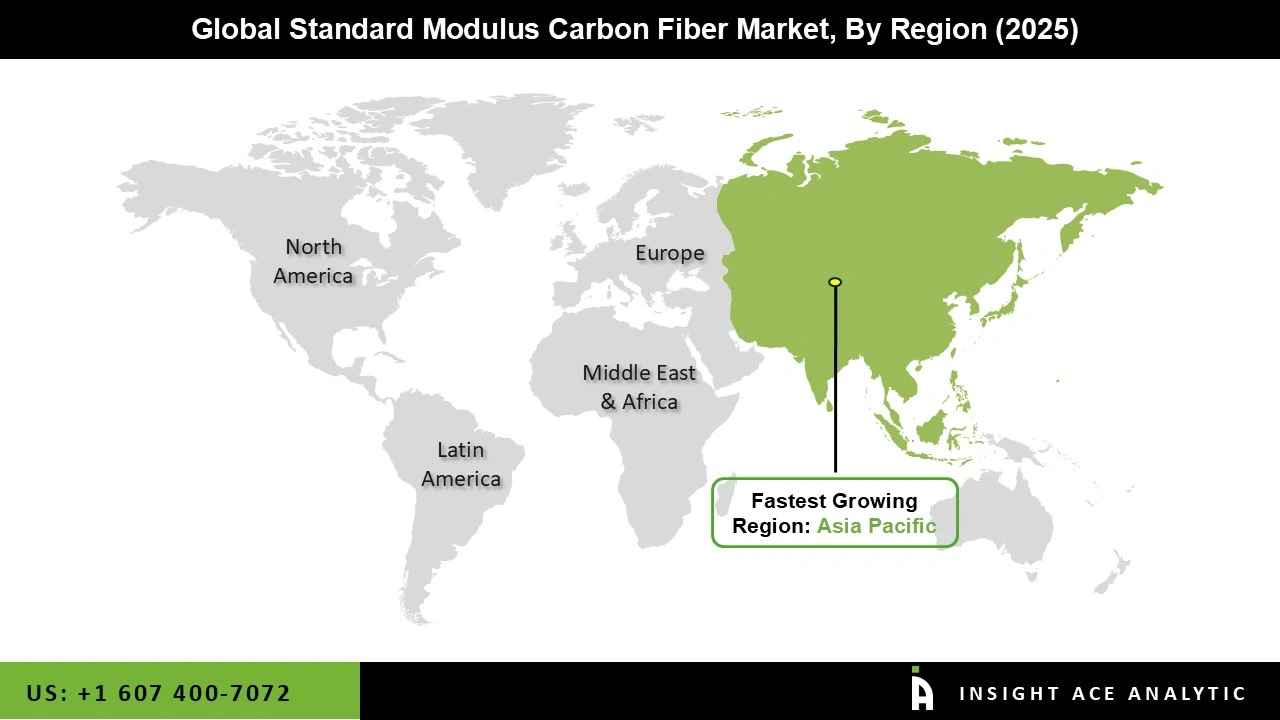

Asia Pacific is the fastest-growing market for standard modulus carbon fiber, driven by rapid industrialization and expanding manufacturing capabilities. Growth in aerospace and defense, particularly in China, Japan, and India, is increasing the use of carbon fiber in lightweight, high-strength aircraft components.

The automotive industry is adopting more carbon fiber to meet fuel efficiency and emission standards, as well as to support electric vehicle production. Investments in renewable energy, especially wind energy in China and Southeast Asia, are also raising demand for carbon fiber in wind turbine blades. Government support for advanced materials and infrastructure further accelerates this growth.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3.2 Bn |

| Revenue forecast in 2035 | USD 6.8 Bn |

| Growth Rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Toray Industries, Inc., Mitsubishi Chemical Carbon Fiber & Composites, Synesqo, Aksa Carbon, Hyosung Advanced Materials, Hexcel Corporation, SGL Carbon SE, Zhongfu Shenying Carbon Fiber Co., Ltd., and Teijin Limited |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.