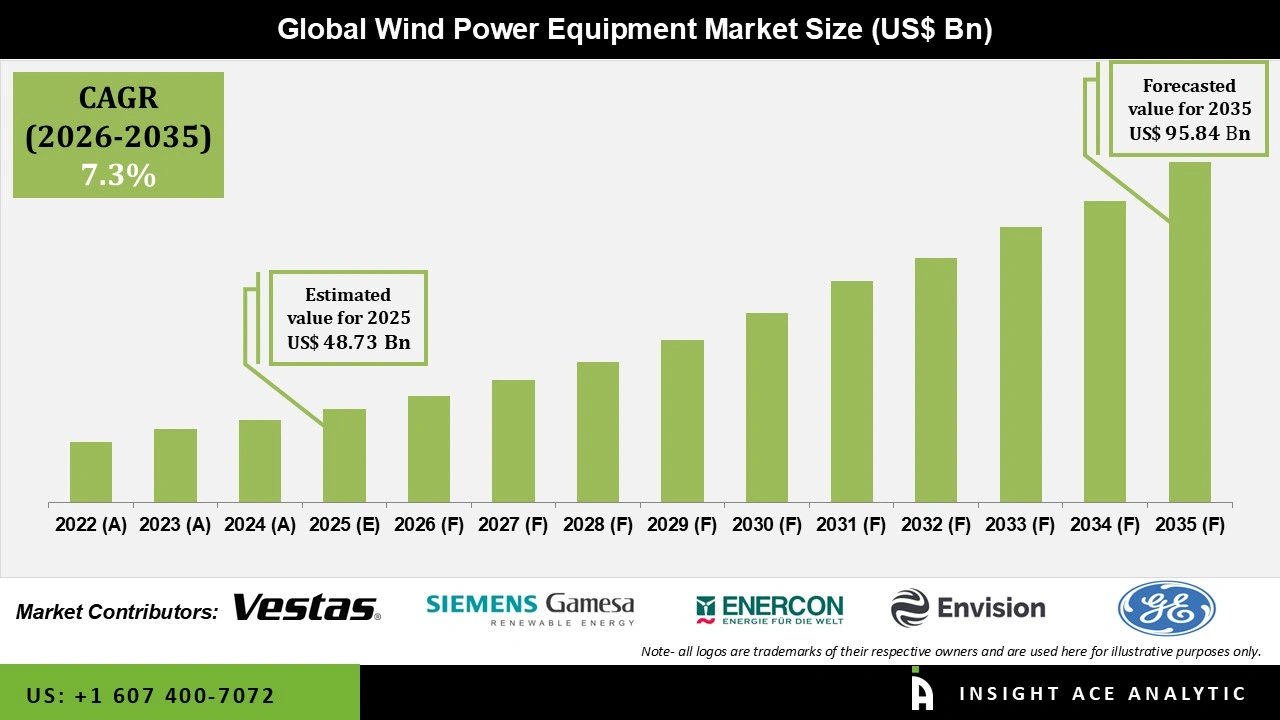

Global Wind Power Equipment Market Size is valued at USD 48.73 Bn in 2025 and is predicted to reach USD 95.84 Bn by the year 2035 at a 7.3% CAGR during the forecast period for 2026 to 2035.

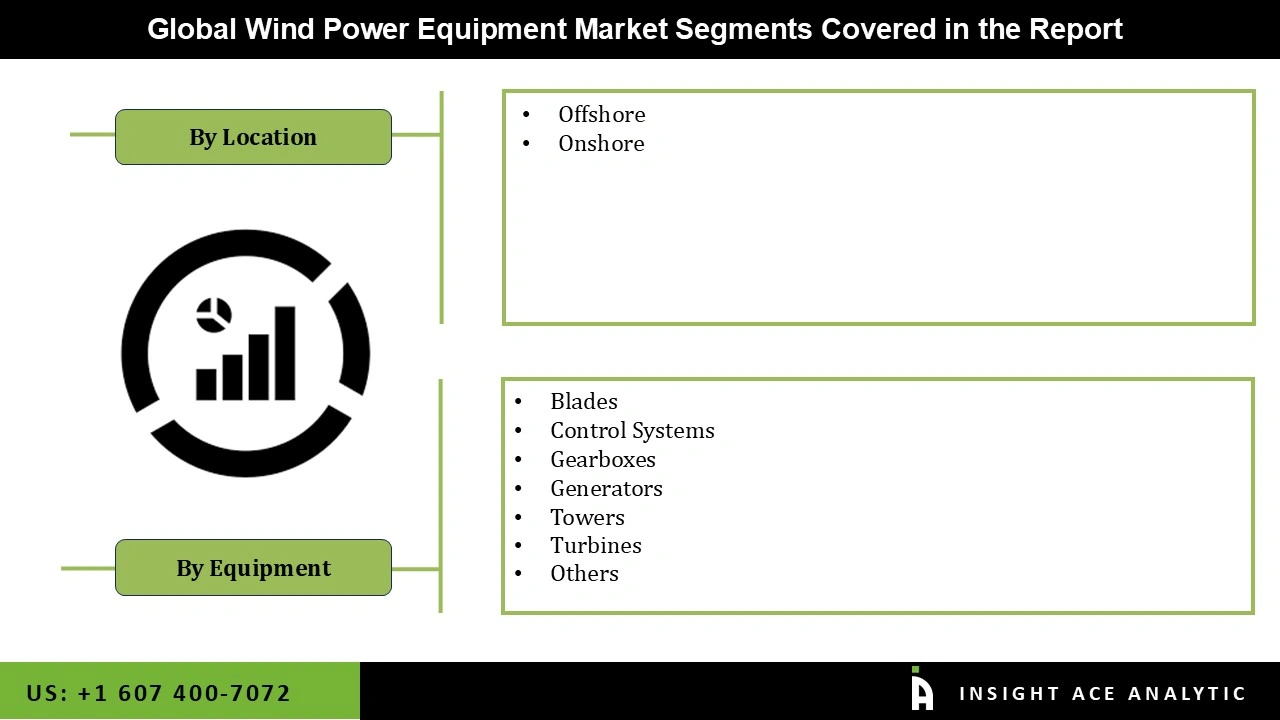

Wind Power Equipment Market Size, Share & Trends Analysis Distribution by Equipment (Generators, Blades, Towers, Gearboxes, Control Systems, Turbines, and Others), Location (Onshore and Offshore), and Segment Forecasts, 2026 to 2035.

Wind power equipment is the entire collection of electrical, mechanical, and electronic components that convert the kinetic energy of moving air into usable electrical energy. The wind turbine is the main component of the system; it consists of rotor blades that harness wind energy, a hub and nacelle that house the generator and gearbox, and a tall tower that elevates the turbine to higher elevations where wind speeds are more reliable and stronger. The turbine's orientation and blade angle are adjusted by supporting equipment, such as yaw and pitch control systems, to optimize performance and prevent damage during strong winds. The need for renewable energy sources and the replacement of conventional sources have led to stable expansion of the wind power equipment market and a significant increase in wind energy production.

The wind power equipment market is primarily driven by falling wind energy costs and rising investments in the wind power industry. Additionally, sophisticated turbine components, including rotor blades, nacelles, gearboxes, generators, towers, and pitch systems, would be needed to meet the rising demand for wind energy. The market participants have been forced by this to increase their investment in creating fresh and creative product offerings. Numerous producers of wind turbine components are striving to offer cutting-edge products to meet the growing demands of their customers. Moreover, the wind power sector is increasingly adopting smart technologies for turbine maintenance and operation. The increasing prevalence of digital twins, predictive maintenance systems, and IoT-enabled sensors in wind farms enables operators to optimize energy production and track turbine performance in real-time. The wind power equipment market’s shift to more economical and efficient operations will only accelerate this trend.

In addition, the wind power equipment market is expanding due to stronger government regulations and incentives worldwide. Wind energy projects are expected to be promoted internationally as the demand for renewable energy grows and its environmental benefits become clearer. For instance, the Indian government is encouraging wind power projects in the nation by offering a number of financial advantages, such as accelerated depreciation benefits and a concessional customs duty exemption, on components of wind turbines. Furthermore, the wind power equipment market is expanding due to service providers' turnkey solutions, the benefits of floating wind technology, and technological breakthroughs. Additionally, the need for floating offshore wind power is being driven by increased awareness of renewable energy in many nations, which will accelerate the expansion of the wind power equipment market.

Driver

Growing Demand from the Onshore Wind Energy Sector

The onshore wind power sector has dominated the wind power equipment market and is anticipated to remain so for the foreseeable future. Wind energy from onshore locations has become one of the most valuable renewable energy sources globally in recent decades. The overall onshore installed wind power capacity as of 2022 was 842GW, an 8.8% increase over the previous year, according to Global Wind Report 2023. In 2022, China, the US, Germany, and India controlled the majority of the onshore wind power industry. Furthermore, because of improved turbine designs and economies of scale, lower capital expenditures, higher capacity factors brought about by equipment and wind power plant design advancements, and longer wind turbine production lives, the cost of onshore wind power generation has also drastically decreased. Therefore, it is anticipated that in the upcoming years, the number of wind power plants worldwide would rise due to factors such as a decrease in onshore wind CAPEX and favorable government policies and targets. During the projected period, this is anticipated to have a direct effect on the wind power equipment market.

Restrain/Challenge

High Operating and Capital Expenses

The high upfront and ongoing costs of wind power equipment are one of the main obstacles preventing wind energy from being widely used. The establishment of wind farms necessitates large upfront investments in infrastructure, technology, and turbines, especially for offshore sites. The offshore wind technologies have many obstacles to overcome, such as the requirement for buildings that can survive corrosion, erosion, and extreme ocean conditions. Furthermore, the financial strain goes beyond the initial setup; continuing operating expenses present serious difficulties. Budgets have become even more pressured due to rising material costs, particularly for steel used in turbine production. Additionally, these financial difficulties impact investors and project developers in addition to manufacturers. Due to financial uncertainty brought on by the high costs of wind energy projects, some have been postponed or cancelled.

The turbines category held the largest share in the wind power equipment market in 2025 as the primary component of wind energy generation is turbines, and the market is still being driven by the rising demand for renewable energy. Their dominance is anticipated to be further strengthened by the increase in wind energy installations worldwide as well as technological developments in turbine size, efficiency, and design. Additionally, growing investments in renewable energy infrastructure, which are aimed at increasing wind energy capacity globally, are driving the segment's rise. Another important factor in maintaining their market dominance is the need for bigger, more effective turbines. Wind energy remains a favored source as countries and businesses prioritize cutting carbon emissions, which supports the expansion of turbine demand and market share.

In 2025, the onshore category dominated the Wind Power Equipment market. Because onshore wind farms are less expensive to establish and maintain than offshore ones, they have been the dominant option for wind energy developers. Onshore wind farms are now a feasible and affordable choice for large-scale energy production due to the availability of land and advancements in turbine technology. Favorable government policies and rising investments in renewable energy infrastructure are also contributing factors to the expansion of onshore wind farms. Furthermore, onshore wind energy will continue to be the most popular alternative due to the growing emphasis on the adoption of renewable energy sources and the growth of wind farms in both developed and emerging economies.

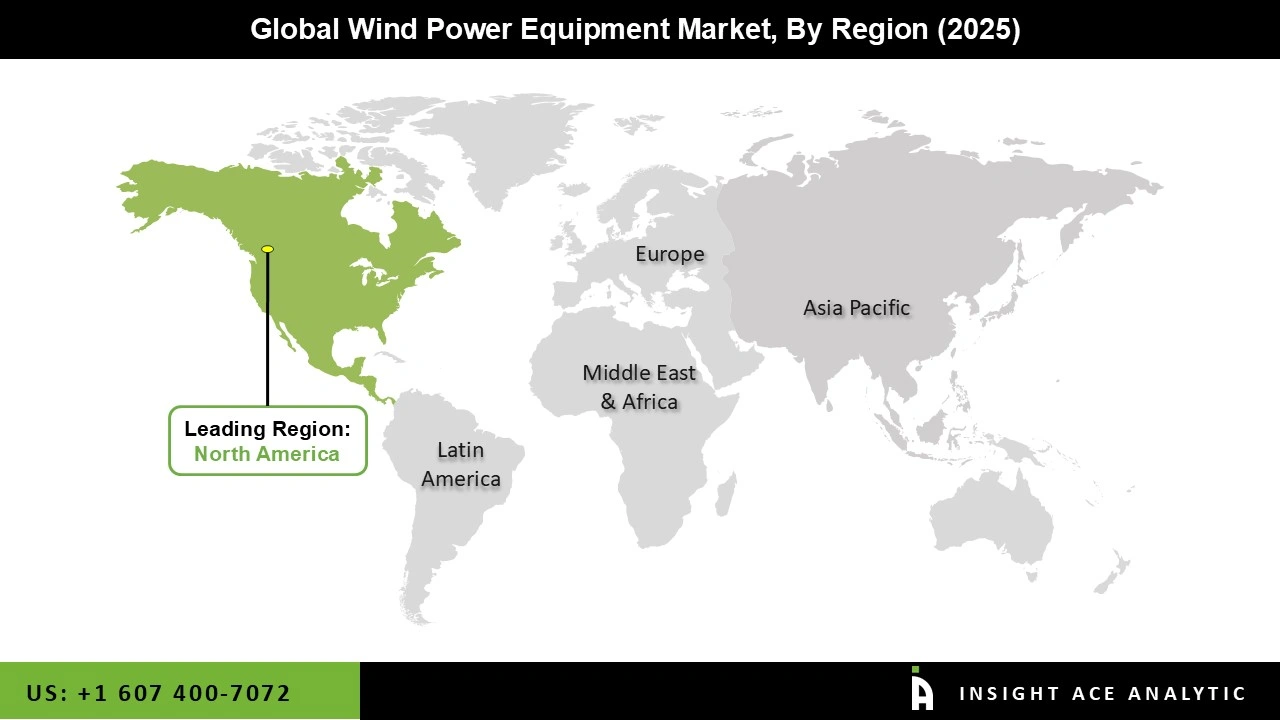

The Wind Power Equipment market was dominated by North America region in 2025 encouraged by renewable energy goals, encouraging government initiatives, and rising grid upgrade expenditures. The US dominates the regional wind power equipment market because of state-level renewable portfolio mandates and federal tax incentives like the Production Tax Credit (PTC), which incentivize utilities to increase wind capacity.

Furthermore, modern onshore wind turbines and associated equipment are being installed more quickly as clean energy sources gradually replace outdated fossil fuel power plants. Additionally, the East Coast is seeing a significant push toward offshore wind projects, which is driving up demand for subsea cables, high-capacity turbines, foundations, and grid connecting equipment.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 48.73 Bn |

| Revenue forecast in 2035 | USD 95.84 Bn |

| Growth Rate CAGR | CAGR of 7.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Equipment, Location, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Siemens Gamesa Renewable Energy, Vestas Wind Systems AS, Enercon GmbH, Senvion SA, Envision Energy, Guodian United Power Technology Company Limited, Nordex SE, General Electric Company, Xinjiang Goldwind Science & Technology Co., Ltd., and Ming Yang Wind Power Group Limited |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.