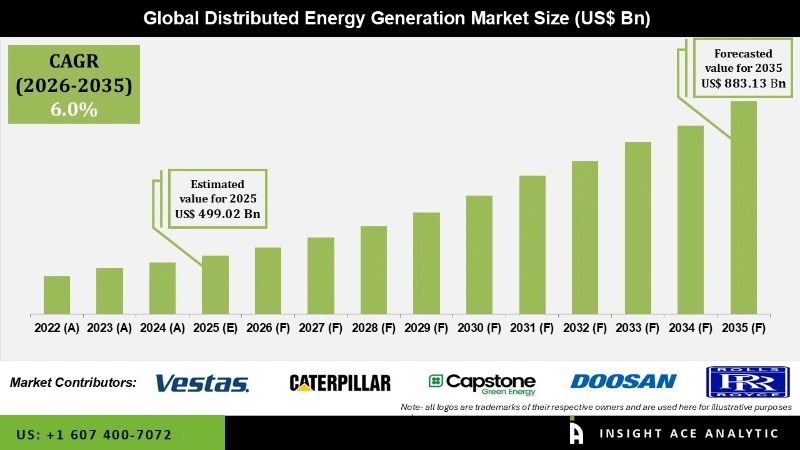

The Distributed Energy Generation Market Size is valued at USD 499.02 Bn in 2025 and is predicted to reach USD 883.13 Bn by the year 2035 at an 6.0% CAGR during the forecast period for 2026 to 2035.

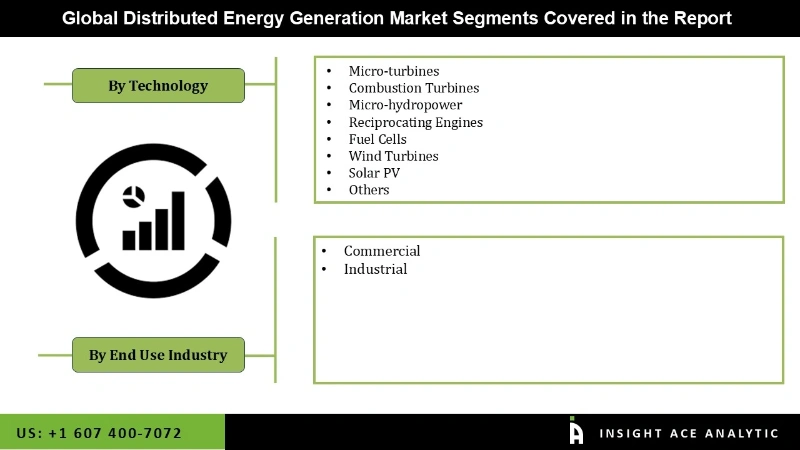

Distributed Energy Generation Market, Share & Trends Analysis Report, By Technology (Micro-turbines, Combustion Turbines, Micro-hydropower, Reciprocating Engines, Fuel Cells, Wind Turbines, Solar PV, Others), By End-use Industries (Commercial, Industrial), By Region, and Segment Forecasts, 2026 to 2035.

Distributed Energy Generation (DEG) refers to electricity production systems close to the point of use, rather than centralized power plants. It typically involves smaller, modular energy sources like solar panels, wind turbines, fuel cells, and small natural gas generators that generate power locally instead of relying on a large grid. This decentralized approach has gained popularity for providing reliable, often renewable energy with reduced transmission loss and greater resilience against power disruptions. Distributed energy systems boost energy security and resilience, especially during natural disasters or grid failures, by reducing dependence on centralized plants. Many of these sources, such as solar and wind, are renewable and produce less pollution, supporting environmental sustainability. Their modular design allows for easy scaling based on local energy needs, making them suitable for both urban and remote areas.

Distributed generation allows energy to be produced from a variety of sources, including biomass, reciprocating engines, wind, solar, and turbines, providing flexibility in energy production. One key advantage of distributed generation is its ability to deliver power in isolated locations without the need for long-distance electrical transmission systems. Microgrids collect energy from multiple sources, using only what is necessary and feeding any surplus back into the grid, with excess energy stored in batteries for later use, especially valuable in off-grid settings.

Despite this, as awareness of alternative energy options increases, the market continues to grow, driven by the environmental benefits and lower costs of distributed generation compared to traditional energy sources. With the global population growing and more people living in urban areas, there is an increasing demand for reliable and sustainable energy sources. DEG technologies are particularly beneficial in urban areas, where they can reduce grid congestion and improve energy efficiency. Demand is also rising due to technological advancements and improvements in user-friendliness, supporting the expansion of the global distributed generation market

The Distributed Energy Generation Market is segmented based on technology, and end-use industries. Based on the technology, the market is divided into micro-turbines, combustion turbines, micro-hydropower, reciprocating engines, fuel cells, wind turbines, solar PV, and others. Based on the end-use industries., the market is divided into Commercial and industrial.

Based on the technology, the market is divided into micro-turbines, combustion turbines, micro-hydropower, reciprocating engines, fuel cells, wind turbines, solar PV, and others. Among these, Solar energy is widely available across most regions, making it a feasible option for both residential and commercial users. Solar PV costs have decreased significantly over the years, making it more affordable for both large-scale and small-scale installations. Solar PV provides a clean, renewable energy source, which aligns with global efforts to reduce carbon emissions and move towards sustainable energy systems. Many governments offer subsidies, tax credits, and incentives to promote the adoption of solar PV, further boosting its market share.

Many governments offer financial incentives, subsidies, tax credits, and favorable policies to promote solar PV installation. In some regions, net metering policies allow consumers to sell excess solar power back to the grid, creating an additional revenue stream and further incentivizing adoption. With increasing global focus on reducing greenhouse gas emissions and combating climate change, solar PV is seen as a clean, renewable alternative that supports sustainability goals. As countries aim to meet their environmental targets, the shift toward solar PV is likely to accelerate.

Based on the end-use industries., the market is divided into Commercial and industrial. Among these, Industrial facilities typically have large, continuous energy requirements, making distributed generation solutions cost-effective and reliable for meeting these demands. Many industries invest in combined heat and power (CHP) systems, fuel cells, and even solar PV to achieve both electricity and thermal energy efficiency. Industrial operations are highly sensitive to power disruptions. Distributed generation systems, such as microgrids, provide energy security and allow industries to maintain continuous operations during grid outages. Industrial facilities often use a combination of generation types, like micro-turbines, reciprocating engines, and solar PV, creating a resilient hybrid system that further reduces costs and enhances operational reliability.

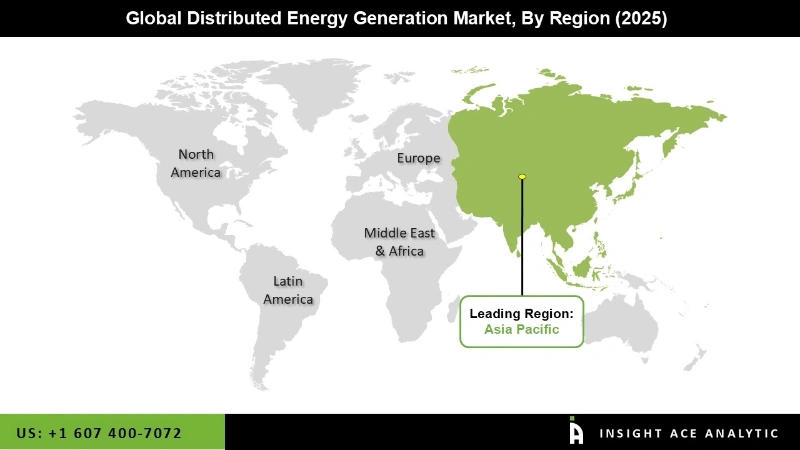

Many Asia-Pacific countries have implemented favorable policies, incentives, and subsidies to encourage the adoption of distributed generation, especially solar PV and wind, as they aim to diversify their energy sources and reduce reliance on fossil fuels. China, Japan, South Korea, and India, among others, have set ambitious renewable energy targets and are committed to reducing greenhouse gas emissions, positioning distributed generation as a key strategy for achieving these goals. Rapid urbanization, industrialization, and economic growth in countries like China, India, and Southeast Asian nations are driving significant increases in energy demand, which distributed generation can help meet efficiently.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 499.02 Bn |

| Revenue Forecast In 2035 | USD 883.13 Bn |

| Growth Rate CAGR | CAGR of 6.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive Market structure, growth prospects, and trends |

| Segments Covered | By Technology, and End-use Industries |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Vestas, Caterpillar, Capstone Green Energy Corporation, Doosan Corporation, Toyota, Turbine and Systems, Rolls-Royce Plc, General Electric, Mitsubishi Electric Corporation, Schneider Electric, Siemens Ag, Ballard Power Systems Inc., Suzlon Energy Ltd., Vestas Wind Systems A/S, ENERCON GmbH, First Solar, Sharp Corporation, Tesla Inc., NextEra Energy, Inc., Canadian Solar Inc., SunPower Corporation |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Distributed Energy Generation Market- By Technology

Global Distributed Energy Generation Market- By End-use Industries

Global Distributed Energy Generation Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.