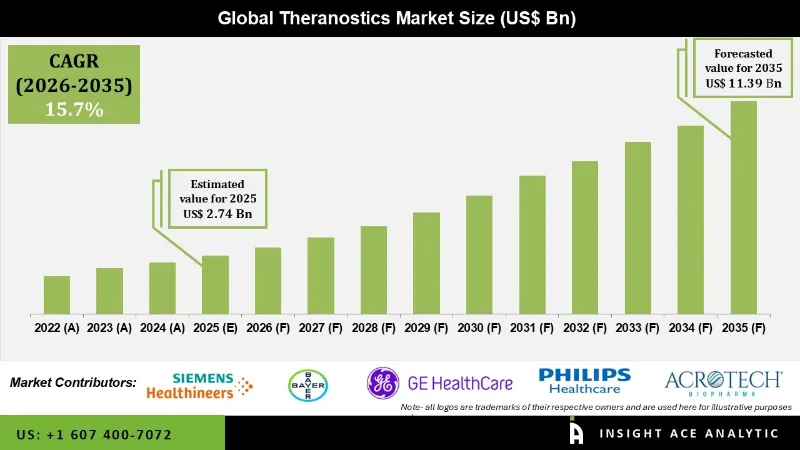

Theranostics market size is valued at USD 2.74 Bn in 2025 and is predicted to reach USD 11.39 Bn by the year 2035 at a 15.7% CAGR during the forecast period for 2026 to 2035.

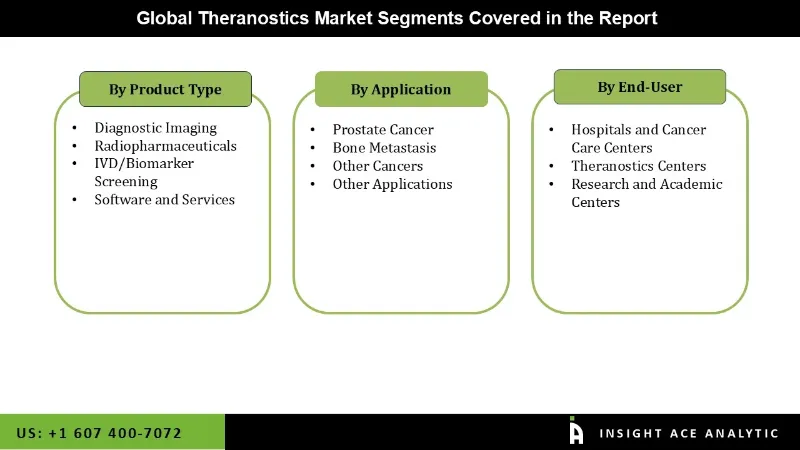

Theranostics Market Size, Share & Trends Analysis Report, By Product (Diagnostic imaging, Radiopharmaceuticals, Biomarker screening and Software), Application (Prostate Cancer, Bone Metastasis, Other Cancers, Other Application), End-user (Hospitals & Cancer Care Centers, Theranostics Centers, and Research & Academic Centers), By Region, Forecasts, 2026 to 2035

Theranostics Market Key Takeaways:

|

Theranostics refers to the practice of using two radioactive medications simultaneously, one for diagnosis and another for therapy, to treat the original tumor and any metastasized tumors. The term theranostics combines the word therapeutics and diagnostics or testing. Drug delivery, diagnosis, and monitoring of treatment response are three of the most common uses of theranostics in cancer treatment, and the field helps to consolidate these uses into a single agent. Combining imaging with molecular radiotherapy allows for pinpoint radiation therapy directed at receptors; positron emission tomography is used to detect tumors, and diagnostic imaging is used to determine whether cancer cells have target receptors. The worldwide theranostics market stands to gain the most from the increasing availability of cost-effective treatment options. A major factor impacting market demand is the rising prevalence of chronic disorders. Furthermore, the growing need for contemporary technology-based pharmaceutical production and the accompanying increase in funding for biotechnology research institutes will likely overshadow the industry's expansion.

However, the market growth is hampered by the Lack of awareness criteria for the safety and health of the theranostics market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high theranostics because Lack of training programs in healthcare institutions is causing a shortage of qualified doctors, which is subtly reducing demand in the worldwide theranostics industry. Additionally, the industry faces challenges from variables such as the high expense of installing and maintaining the equipment in laboratories and the government's strict restrictions for the clearance of new products.

The Theranostics Market is segmented based on product, application, and end user. Based on product, the market is segmented into diagnostic imaging, radiopharmaceuticals, IVD/biomarker, screening, and software and services. By application, the market is segmented into prostate cancer, bone metastasis, other cancers, and other applications. By end user, the market is segmented into hospitals & cancer care centers, theranostics centers, and research & academic centers.

The diagnostic imaging theranostics market is expected to hold a major global market share in 2022. Diagnostic imaging provides an exceptionally high degree of accuracy in detecting and diagnosing a wide range of medical disorders. Driving the category growth is the increasing usage of modern equipment that supports correct diagnosis and the availability of systems with improved sensitivity.

Hospitals and cancer care centers make up the bulk of acrylic acid ester usage because more and more people are learning about the benefits of the treatment, and hospitals are adopting it. This is mainly because hospitals are increasingly using new diagnostic imaging systems that have recently been approved and have increased functionality to better assist patient care, especially in countries like the US, Germany, the UK, China, and India.

The North American theranostics market is expected to register the highest market share in revenue in the near future. It can be attributed to the increasing number of investments backing theranostics' adoption and the rising prevalence of cancer. Creating the transportation centers and the rapid increase in the region's elderly population drive the market's expansion. In addition, Asia Pacific is projected to grow rapidly in the global theranostics market because of growing disposable money, cutting-edge product development, and healthcare spending.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.74 Bn |

| Revenue Forecast In 2035 | USD 11.39 Bn |

| Growth Rate CAGR | CAGR of 15.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Application, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Advanced Accelerator Applications, Bayer AG, GE Healthcare, Siemens Healthineers Ag, Cardinal Health, Philips Healthcare, Canon Inc, Curium, Lantheus, Northsatr, Medical Radioisotopes, Eckert & Ziegler, Pharmalogic, Eczacibasi -Monrol, Acrotech biopharma Inc. and Others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Theranostics Market- By Product

Theranostics Market- By Application

Theranostics Market- By End User

Theranostics Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.