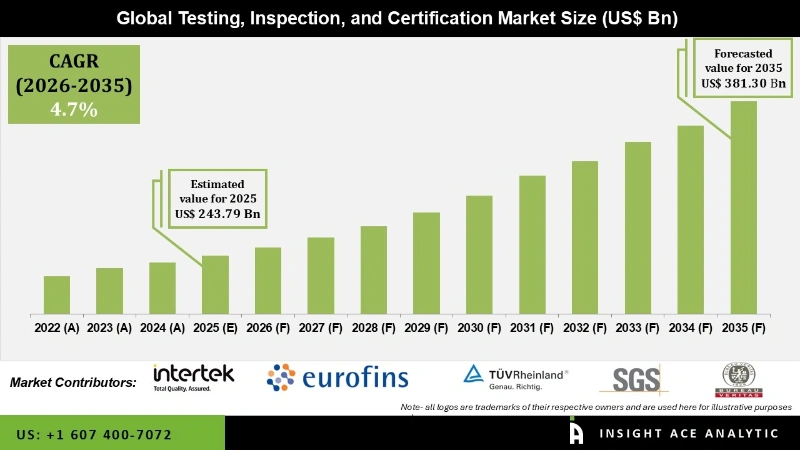

Global Testing, Inspection, And Certification Market Size is valued at USD 243.79 Billion in 2025 and is predicted to reach USD 381.3 Billion by the year 2035 at a 4.70% CAGR during the forecast period for 2026 to 2035.

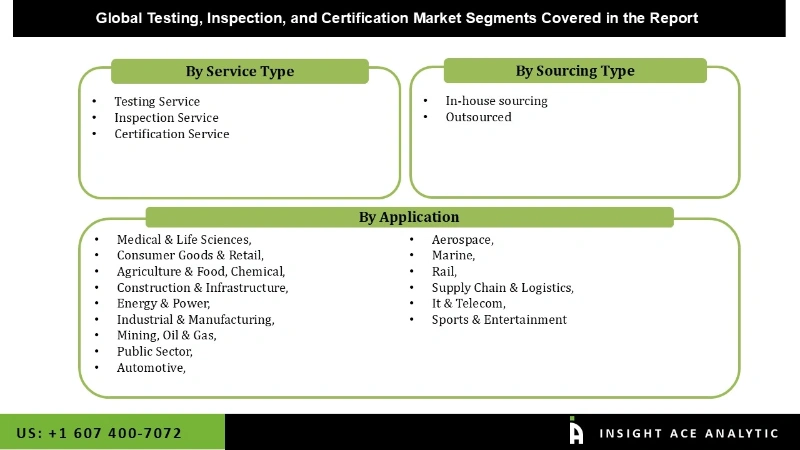

Testing, Inspection, and Certification Market Size, Share & Trends Analysis Report By Service Type (Testing, Inspection, And Certification Services), Sourcing Type (In-House Sourcing And Outsourcing), And Application (Medical & Life Sciences, Consumer Goods & Retail, Agriculture, Chemical), By Region, And Segment Forecasts, 2026 to 2035.

Testing, inspection, and certification (TIC) market expansion is encouraged by the growing demand from businesses and companies to engage in safe and effective TIC processes. Companies must obey secure and efficient testing and inspection methods to uphold the highest quality standards, guarantee high output, and achieve maximum efficiency.

Using TIC techniques allows businesses to streamline procedures by customizing their supply chain activities to serve their needs and preferences. For instance, Temasek, a Singapore-based investment company specializing in restructuring, growth capital, and divestment deals, announced the acquisition of Element Materials Technology in January 2022. Element Materials Technology is a well-known testing, inspection, and certification (TIC) service supplier. The investment represents a big deal in the TIC sector and a critical turning point in the group's growth.

The Testing, Inspection, and Certification market is segmented based on service type, sourcing type, and application. The market is segmented as testing, inspection, and certification services based on service type. The sourcing type segment includes in-house sourcing and outsourcing. By application, the market is segmented into medical & life sciences, consumer goods & retail, agriculture, chemical, construction & Infrastructure, energy & power, mining, oil & gas, public sector, automotive, aerospace, marine, industrial & Manufacturing, rail, supply chain & logistics, IT & Telecom, and sports & entertainment.

The testing services category is expected to hold a major share in the global Testing, Inspection, and Certification market in 2024. Due to the extensive usage of testing procedures in the Manufacturing, automotive, energy & utilities, oil & gas, and petroleum industries, the testing segment constituted the biggest revenue share. Product testing in the real world helps businesses maintain high standards and satisfy client demands. This is encouraging businesses from various sectors to invest more in operational expenses for testing equipment, fostering market expansion. For instance, Wallace Instruments, one of the manufacturers of testing apparatus for the rubber industry, announced the release of the WAC11 Mk5 Compression Stress Relaxometer, the company's Compression Stress Relaxometer's fifth generation, in November 2022.

Due to an increase in inspection operations conducted by businesses in the segment, the consumer goods and retail sector has seen a significant increase in revenue share. To provide their clients with the highest quality products, consumer goods companies must adhere to a number of quality norms and requirements. This makes it easier to implement comprehensive inspection systems that are very effective, providing the market with development potential. Furthermore, retail businesses must ensure customers have access to the best products and customer experiences, which will further increase the penetration of TIC services and technologies and support market expansion.

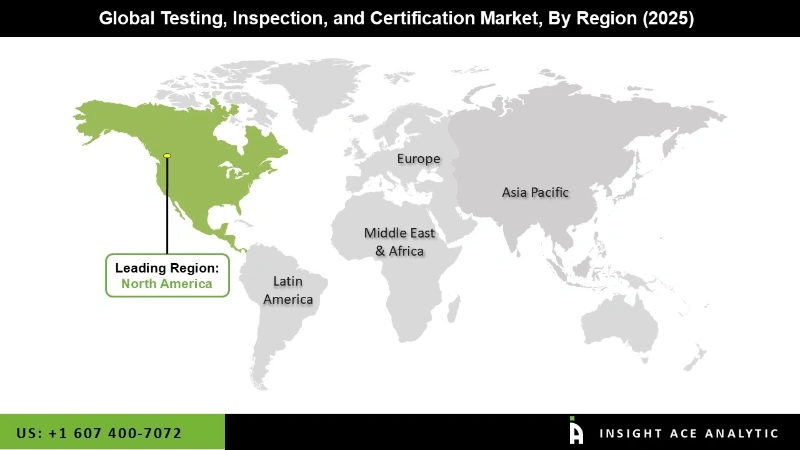

Asia Pacific led the global market. Rising economic development in nations like China, India, Japan, and South Korea is to blame for the large income share. This has increased the region's Manufacturing and industrial activities, providing the TIC industry with growth potential. Additionally, Singapore's fast-growing AI technology ecosystem supports software and programmes in a variety of ways, which supports the expansion of testing and inspection services for the TIC sector.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 243.79 Billion |

| Revenue forecast in 2035 | USD 381.3 Billion |

| Growth rate CAGR | CAGR of 4.70% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Service Type, Sourcing Type, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | SGS Group, Bureau Veritas, Intertek, TUV Nord, TUV SUD, Eurofins Scientific, TUV Rheinland, DEKRA SE, DNV GL, Applus+, ALS Limited, Llyod’s Register Group, MISTRAS, Element Materials Technology, Apave International, UL LLC, IRClass, QR Testing, TIC Sera, Hohenstein. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Testing, Inspection, and Certification Market By Service Type-

Testing, Inspection, and Certification Market By Sourcing Type-

Testing, Inspection, and Certification Market By Application-

Testing, Inspection, and Certification Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.