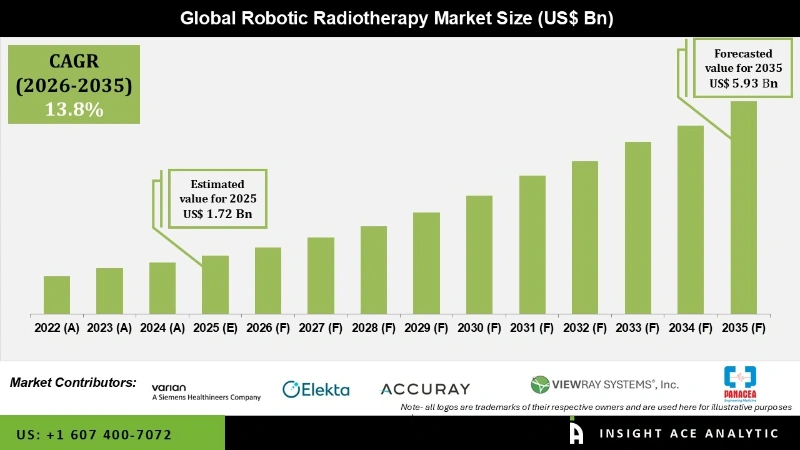

Robotic Radiotherapy Market Size was valued at USD 1.72 Bn in 2025 and is predicted to reach USD 5.93 Bn by 2035 at a 13.8% CAGR during the forecast period for 2026 to 2035.

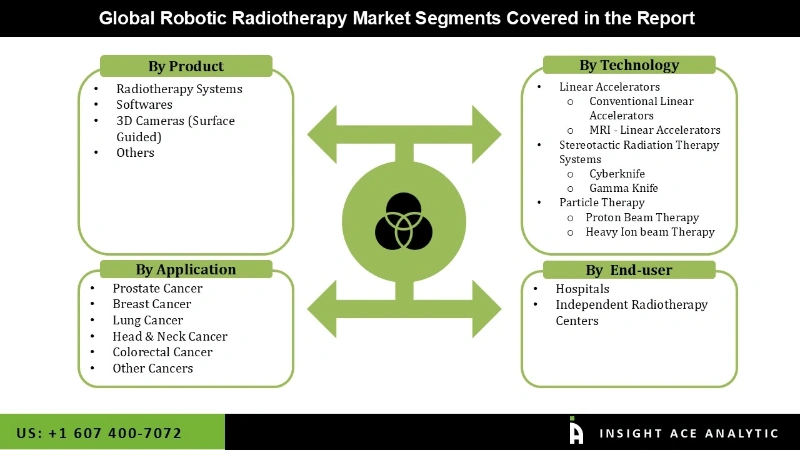

Robotic Radiotherapy Market Size, Share & Trends Analysis Report, Product (Radiotherapy System, Software, 3D Camera, Others), Technology (Linear Accelators, Steriotactic Radiation Therapy, Particle Therapy), Application (Prostate Cancer, Breast Cancer, Lung Cancer, Head and Neck Cancer, Colorectal Cancer, and Other Cancers.), End-User (Hospitals, Independent Radiotherapy Centres), By Region, Forecasts, 2026 to 2035.

Radiosurgery and Radiotherapy Robotics are innovative methods in the field of radiation oncology that utilize robotic systems to deliver precise radiation therapy treatments to patients. These technologies are transforming the way treatments are administered by improving accuracy, efficiency, and patient comfort. The radiosurgery technique involves the precise delivery of highly focused radiation beams to treat tumors or abnormalities in the body.

On the other hand, radiotherapy robotics utilizes robotic systems to administer radiation therapy with exceptional precision. Both of these approaches represent cutting-edge advancements in oncology, providing patients with highly effective and targeted treatments for cancer and other medical conditions. As a result of the advancements in technology, these systems offer reproducibility in patient positioning and the ability to deliver radiation from various directions while synchronizing with the patient's respiration-induced target motion. This technology is now being proposed as a new local treatment option that can be completed in less than one week, showing promising results.

The COVID-19 pandemic has significantly impacted the Robotic Radiotherapy Market. Initially, there was a slowdown in installations and equipment purchases due to disrupted supply chains and budget constraints in healthcare facilities. However, as the pandemic progressed, there was an increased interest in robotic radiotherapy solutions as they minimize human contact and enable remote treatment planning and monitoring, thereby reducing infection risks. It has led to a gradual recovery in the market, with a growing focus on advanced robotic radiotherapy technologies.

The robotics radiotherapy market is segmented by product, technology, application, and end user. By product, the market is segmented into radiotherapy systems, software, 3D cameras (surface guided), and others. By application, the market is segmented into prostate cancer, breast cancer, lung cancer, head and neck cancer, colorectal cancer, and other cancers. By technology, market divided into linear accelerators, stereotactic radiation therapy systems and particle therapy. The end-user segmentation includes hospitals and independent radiotherapy centers.

The robotic radiotherapy market is segmented based on the product into radiotherapy systems, software, 3D cameras (surface guided), and others. The software segment accounted for the largest global robotic radiotherapy market share in 2023. Due to its crucial role in improving radiation treatments' accuracy, efficacy, and efficiency, the software sector held the highest share of the global robotic radiotherapy market. Sophisticated software programs are necessary to manage patient data, schedule and administer radiation doses precisely, integrate with imaging devices, and enhance therapy results overall. Continuous developments in software technology, such as machine learning and AI-driven algorithms, have also contributed significantly in this market segment's domination.

The lung cancer segment is witnessing growth at a rapid rate in the global robotic radiotherapy market due to several factors. Firstly, lung cancer is one of the most prevalent and deadly forms of cancer, driving the demand for advanced treatment options. According to American Cancer Society, lung cancer is predicted to affect 238,340 persons in 2023 (117,550 men and 120,790 women), of whom 127,070 will lose their lives to the illness. Secondly, robotic radiotherapy offers high precision and accuracy in targeting tumors, which is particularly important in lung cancer due to the close proximity of critical structures and the need to minimize damage to healthy tissues. Additionally, technological advancements in imaging and treatment planning have enhanced the effectiveness of robotic radiotherapy for lung cancer, further boosting its adoption and growth in this market segment.

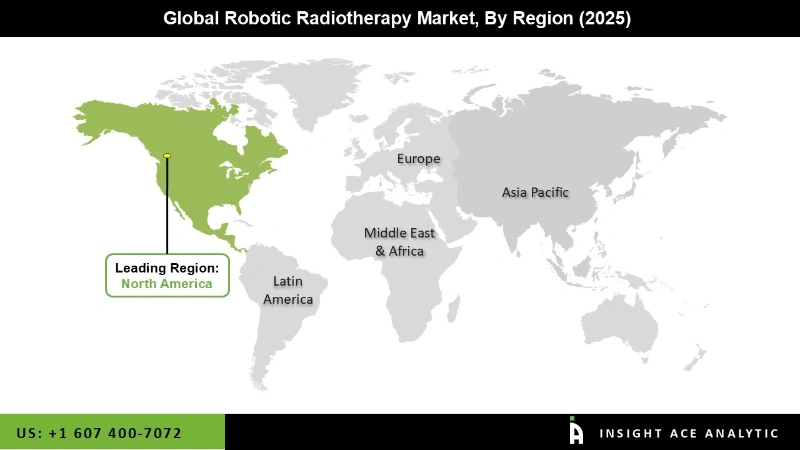

The North American robotics radiotherapy market is estimated to have the highest market growth share in terms of revenue in the near future. This can be attributed to the healthcare infrastructure, acceleration in the adoption of advanced technologies, as well as the presence of major key market players in the region. Additionally, high healthcare expenditure, favorable reimbursement policies, and increasing prevalence of cancer contribute to the market's growth in North America. Factors such as rising geriatric population, increasing cancer cases, and advancements in healthcare infrastructure are also responsible. Furthermore, government initiatives promoting the adoption of robotics in cancer treatment and favorable reimbursement policies are expected to boost the market's growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.72 Bn |

| Revenue Forecast In 2035 | USD 5.93 Bn |

| Growth Rate CAGR | CAGR of 13.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Technology, By Application, By End-user and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Varian Medical Systems, Inc., Elekta, Accuray Incorporated, ViewRay Technologies, Inc., Panacea Medical Technologies Pvt. Ltd., IBA Proton Therapy, Mevion Medical Systems, Hitachi, Ltd., Sumitomo Heavy Industries, Ltd., ProTom International, Optivus Proton Therapy, Inc., P-Cure, Provision Healthcare, LLC, Standard Imaging, Inc., Brainlab AG, C-RAD, RaySearch Laboratories, DosiSoft SA, MIM Software, Inc., Sun Nuclear Corporation, ScandiDos AB, Vision RT, CIVCO Radiotherapy, LAP GmbH Laser Applikationen, MVision AI, and Linatech, Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Robotic Radiotherapy Market- By Product

Robotic Radiotherapy Market- By Technology

Robotic Radiotherapy Market- By Application

Robotic Radiotherapy Market- By End-user

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.