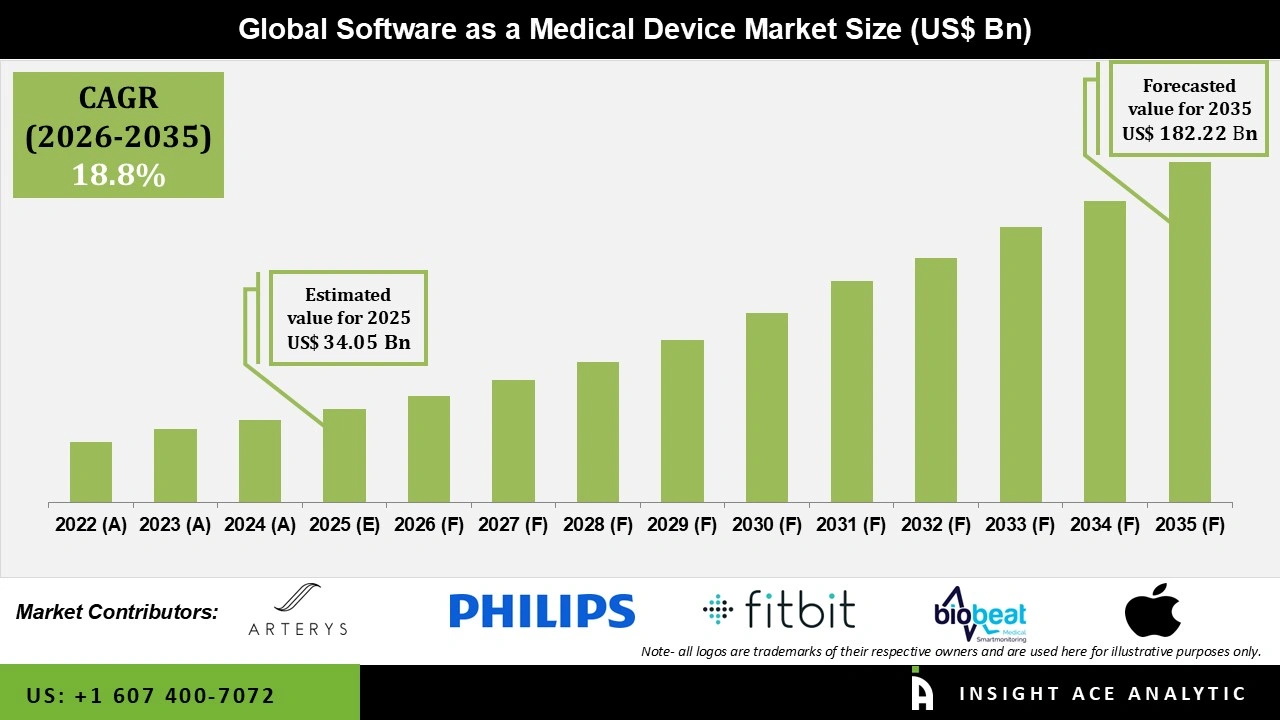

Global Software as a Medical Device Market Size is valued at USD 34.05 Bn in 2025 and is predicted to reach USD 182.22 Bn by the year 2035 at a 18.8% CAGR during the forecast period for 2026 to 2035.

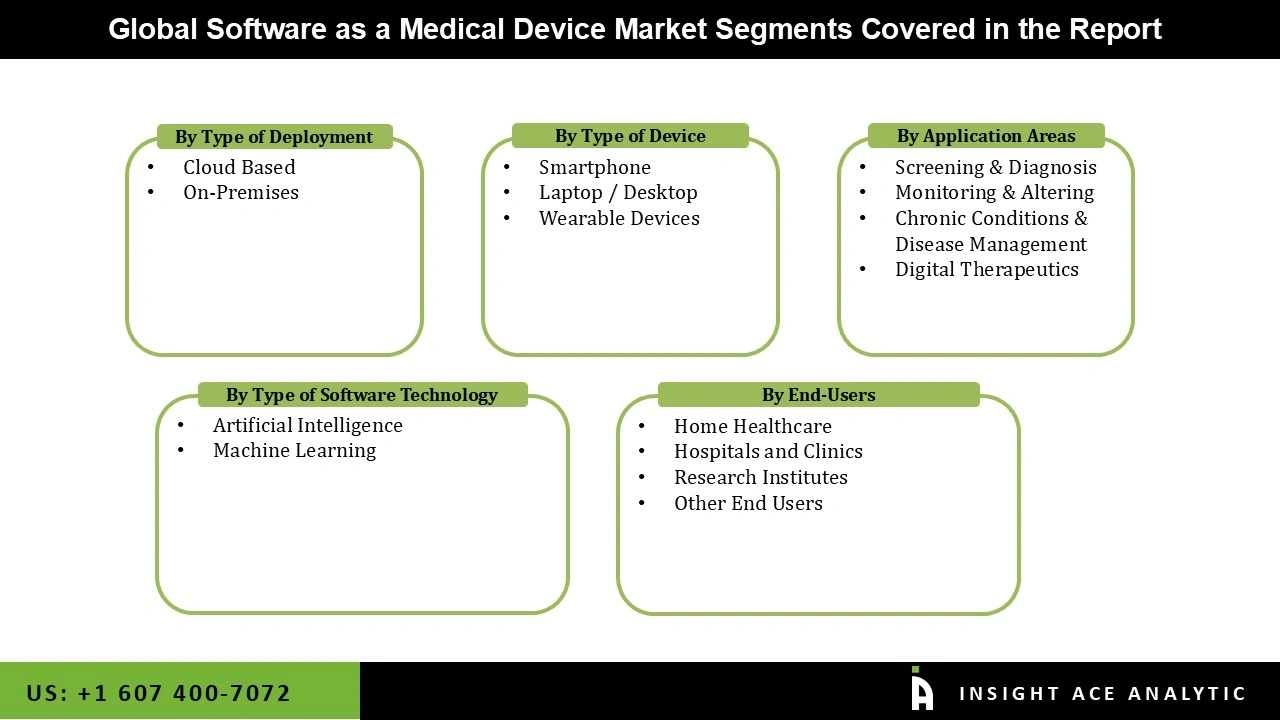

Software as a Medical Device Market Size, Share & Trends Analysis by Deployment Type (Cloud-Based and On-Premises), Device Type (Smartphones, Wearable Devices, and Laptop / Desktops), Application (Screening & Diagnosis, Chronic Conditions & Disease Management, Monitoring & Altering, and Digital Therapeutics), Software Technology (Artificial Intelligence and Machine Learning), End-user (Hospitals and Clinics, Home Healthcare, Research Institutes, and Others), By Region and Segment Forecasts, 2026 to 2035.

Software designed for one or more medical uses that may function on its own without being a component of any hardware medical equipment is referred to as software-as-a-medical device (SaMD). Applications of SaMD include health condition monitoring, diagnosis, and treatment. It can perform its medical function without being integrated into a physical medical device because it runs on general-purpose computing systems. It can operate across a range of platforms, including cloud-based systems and mobile apps, thereby improving accessibility and usability in healthcare environments. The expansion of virtual care, software-driven diagnostics, cloud healthcare platforms, outcome-based reimbursement, and hospital software modernisation are all factors contributing to the software-as-a-medical device market's growth throughout the projection period.

The rising prevalence of chronic illnesses, which underscores the need for SaMD solutions to help medical professionals treat patients appropriately, is another significant factor driving market growth. For instance, the WHO estimates that 41 million people die from chronic illnesses every year. The increased blood pressure, obesity, and hyperglycemia are metabolic risk factors that account for the majority of deaths in this significant group. The WHO has also recommended focusing on preventive strategies such as early detection, prompt screening, and efficient treatment to address the rising burden of chronic illnesses. Additionally, due to the rising demand for SaMD solutions from both patients and healthcare professionals, the software-as-a-medical device market has grown dramatically.

In addition, the expansion of the software-as-a-medical device market in the healthcare industry has been significantly fueled by technological developments like artificial intelligence (AI). AI integration in the medical software sector, such as SaMD, facilitates disease management by enabling quick, accurate diagnosis and effective treatment options. Furthermore, government agencies' recent campaigns to support software and new technologies for medical care are gaining traction. Government initiatives in cybersecurity and regulations pertaining to digital health are anticipated to have a favorable impact on the software-as-a-medical device market expansion. The use of software-as-a-medical-device is expected to increase as patients increasingly depend on digital health solutions. However, it is projected that the growing frequency of cybercrime and inadequate cybersecurity measures will erode user confidence, which will hinder the software-as-a-medical device market.

Driver

Rising Incidence of Chronic Illnesses

The software-as-a-medical device (SaMD) market is projected to grow as the prevalence of chronic illnesses increases. Unhealthy lifestyle choices, including smoking, poor diet, and physical inactivity, increase the risk of chronic conditions such as diabetes, heart disease, and obesity. SaMD facilitates the management of these diseases by enabling continuous monitoring of patient health indicators and early detection of complications. Through individualised insights and support for remote care, SaMD improves treatment outcomes and reduces hospital admissions. For example, in June 2025, 3,615,330 individuals registered with a general practitioner in the United Kingdom were diagnosed with non-diabetic hyperglycemia or pre-diabetes in 2023, representing an 18% increase from 3,065,825 cases in 2022, according to the National Health Service. Consequently, the rising incidence of chronic illnesses is a key driver of SaMD market expansion.

Restrain/Challenge

Data Privacy and Regulatory Compliance

The data privacy and regulatory compliance provide major growth challenges in the software-as-a-medical device market. These solutions are susceptible to cyber risks, unauthorised access, and data breaches because they handle sensitive health data and mostly rely on cloud infrastructure. For instance, adoption has slowed in some areas due to claims of privacy violations utilising wearable-integrated platforms and health apps, which have alarmed both consumers and healthcare providers. To protect patient trust, secure data transfer, encryption, and storage are essential. Companies must navigate intricate and dynamic regulatory pathways, such as the EU's Medical Device Regulation (MDR) or the U.S. FDA's SaMD Pre-Cert Program, which require strict clinical validation, empirical data, and post-market surveillance to ensure compliance. Both the time and expense of product development may increase as a result.

The Laptop / Desktops category held the largest share in the Software-as-a-Medical Device market in 2025. The main drivers of this expansion during the projection period are expanding access to healthcare and rising desire for individualised care. Healthcare professionals now increasingly depend on technology to deliver care, driven by the growth of telemedicine and remote patient monitoring. They enable medical personnel to interact with patients, consult with other healthcare experts in real time, and access medical records. Additionally, they enable patients to engage in telemedicine visits, obtain medical information, and share it with healthcare providers. Furthermore, using Laptop / Desktops in the software-as-a-medical device market allows medical professionals to treat patients in underserved or rural areas.

In 2025, the Screening & Diagnosis category dominated the Software-as-a-Medical Device market due to the vital role these applications play in early diagnosis and treatment of various medical conditions. They use large databases and sophisticated algorithms to evaluate medical data, allowing for prompt and precise diagnosis. These applications range from straightforward instruments for monitoring important indicators to sophisticated algorithms that can decipher radiological pictures. Additionally, the demand for these applications is being driven by the rising incidence of chronic diseases and the expanding need for effective diagnostic solutions. Their dominant market position is also a result of the ease and affordability of using software for screening and diagnosis, rather than conventional techniques. The importance of these applications is expected to grow over the course of the forecast period as healthcare continues to become more digital.

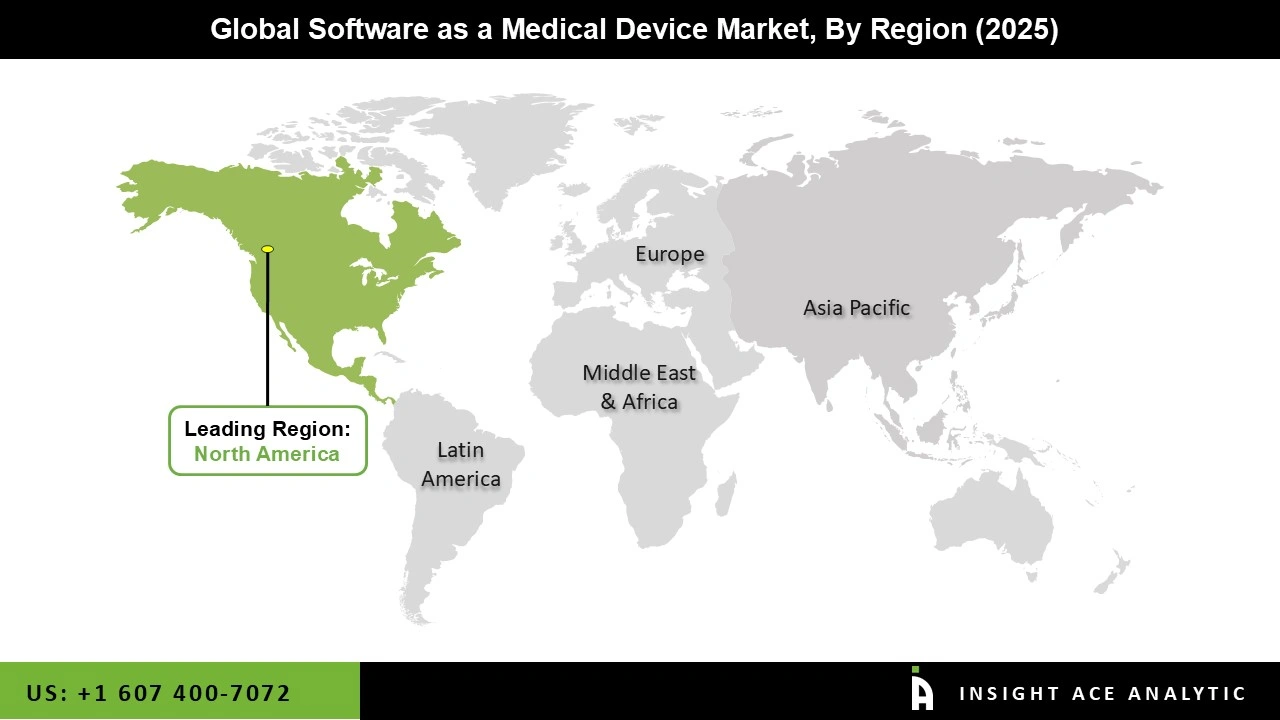

The Software-as-a-Medical Device market was dominated by North America region in 2025. Various factors have contributed to the expansion, including an aging population, an increase in the incidence of chronic diseases, a well-developed healthcare infrastructure, and an increase in the number of businesses operating in the area, including Qure.ai and Imagen Technologies, Inc.

Additionally, the area has continually concentrated on creating cutting-edge software-as-a-medical device solutions for a range of medical applications, which has increased the number of FDA approvals in the area. Furthermore, the software-as-a-medical device market is expected to grow in the upcoming years due to the SaMD solution's regional growth and the cooperation of the major players in the industry.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 34.05 Bn |

| Revenue forecast in 2035 | USD 182.22 Bn |

| Growth Rate CAGR | CAGR of 18.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Deployment Type, Device Type, Application, Software Technology, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Apple, Biobeats Medical, Mogrify, Imagen Technologies, iSchemaView (RAPID), Philips, Cambridge Cognition, Fitbit, IDx Technologies, Johnson & Johnson, MaxQ AI, Arterys, BenevolentAI (by Odyssey), Siemens Healthineers, Tietronix Software, PEAR Therapeutics, Roche, Qlarity Imaging (by Paragon Biosciences), S3 Connected Health, Samsung, and Velentium |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.