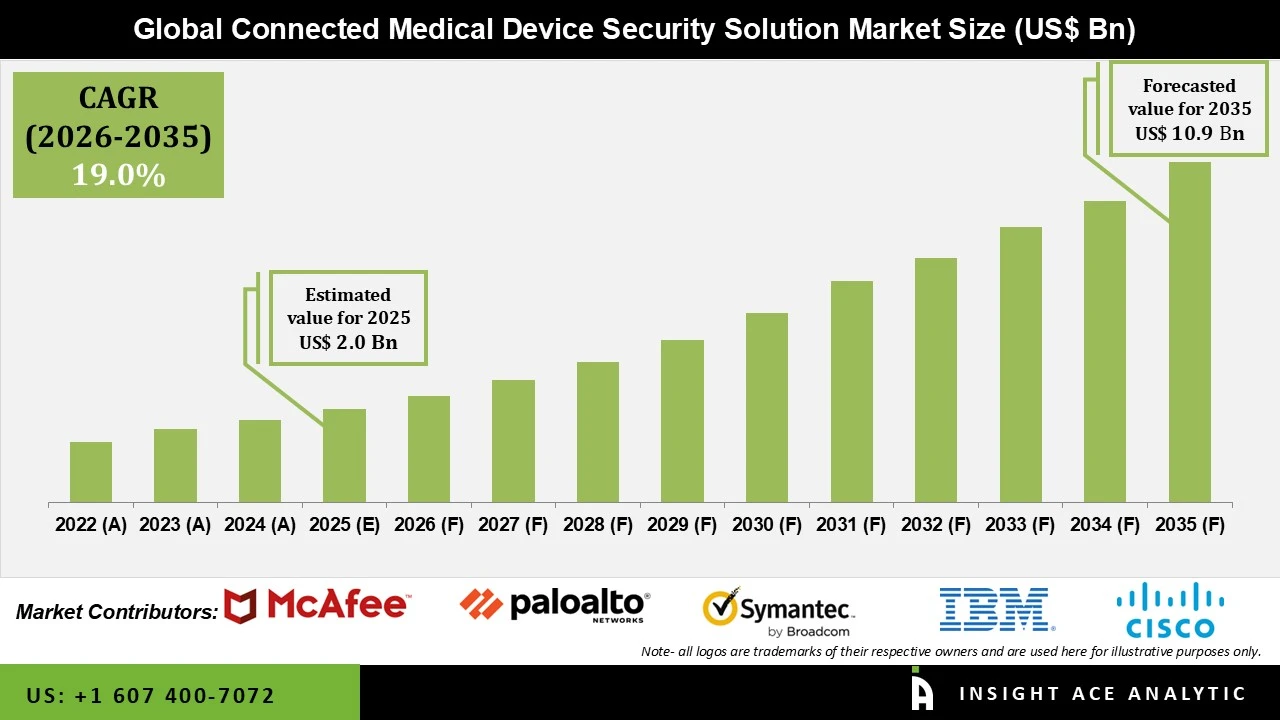

Connected Medical Device Security Solution Market Size is valued at USD 2.0 Bn in 2025 and is predicted to reach USD 10.9 Bn by the year 2035 at a 19.0% CAGR during the forecast period for 2026 to 2035.

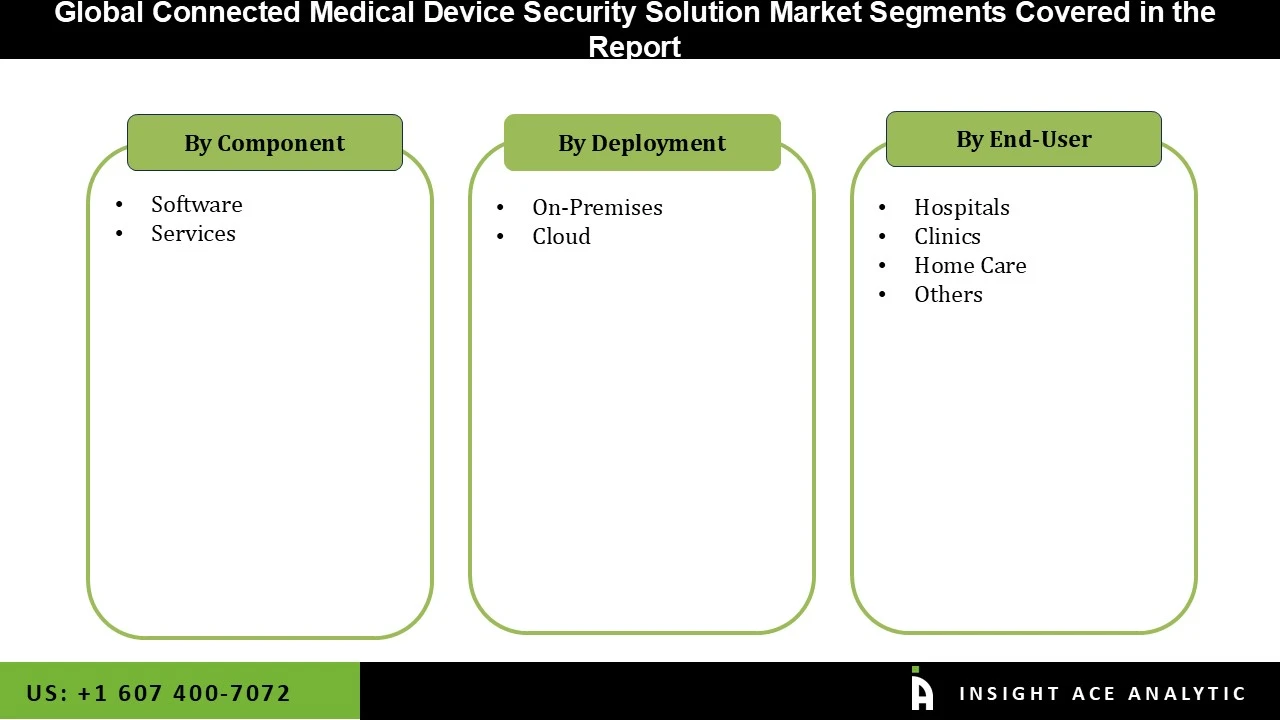

Connected Medical Device Security Solution Market Size, Share & Trends Analysis Distribution by Component (Software and Services), Deployment (On-Premises and Cloud), End-user (Hospitals, Clinics, Home Care, and Others), and Segment Forecasts, 2026 to 2035.

A connected medical device security solution is an all-inclusive collection of technologies and procedures intended to defend network-connected medical devices from wearable sensors, and patient monitors to imaging machines and infusion pumps against cyberattacks, unauthorised access, and other security threats. Connected medical devices pose special vulnerabilities that could jeopardize patient safety, privacy, and device operation if left unprotected, since they communicate across hospital networks, wireless systems, or the internet to support clinical processes and share sensitive health data. The expansion of the Internet of Medical Things (IoMT), the growing use of connected medical devices, and rising concerns about data breaches and cyberattacks targeting healthcare infrastructure are the main factors driving the growth of the connected medical device security solution market.

The connected medical device security solution market is expanding rapidly due to growing concerns about healthcare data security, as well as the industry's extensive use of connected devices and the Internet of Things (IoT). Strong security measures are required because the healthcare industry's reliance on digital technologies and networked equipment has increased data collection and exchange.

Additionally, Data theft, operational disruption, and compromised patient safety are among the serious hazards associated with the increasing integration of linked medical devices, such as MRI machines and infusion pumps, into patient care. The adoption of comprehensive security solutions is being accelerated by regulatory obligations such as GDPR in Europe and HIPAA in the US, which require healthcare firms to invest in safeguarding sensitive patient data and ensuring device integrity.

Furthermore, the connected medical device security solution market is benefiting from healthcare providers' increased awareness of the potential financial and reputational harm from cyberattacks, which is driving them to prioritise robust security frameworks. In addition, incorporating machine learning (ML) and artificial intelligence (AI) into security systems is among the most promising applications. AI-powered systems greatly improve threat detection and mitigation capabilities by analysing vast amounts of device data, identifying patterns suggestive of cyber threats, and automating incident response. Moreover, the growth of telehealth and remote patient monitoring is giving security providers new opportunities to develop solutions tailored to dispersed healthcare settings, ensuring the security of patient information and device integrity outside conventional clinical settings.

• GE Healthcare

• Philips Healthcare

• Cisco Systems

• IBM

• McAfee

• Forescout Technologies

• Cynerio

• Medigate (Claroty)

• Armis Security

• Fortinet

• Trend Micro

• Palo Alto Networks

• Symantec (Broadcom)

• CloudWave

• Asimily

• Sectra

• Check Point Software Technologies

• CloudPassage

• ClearDATA

• Zscaler

• Others

The exponential growth in the use of connected medical devices in healthcare settings is a key driver of the connected medical device security solution market. IoMT devices are being used by clinics, hospitals, and home healthcare providers to improve patient monitoring, optimize processes, and facilitate real-time data sharing. However, increased interconnectedness puts vital medical equipment at risk from cyberattacks, and strong security measures are essential. The need for sophisticated security systems designed for medical settings is being further driven by the incorporation of AI and machine learning for threat detection and response. Globally, investment in comprehensive security frameworks is increasing as healthcare businesses place a higher priority on patient safety and data integrity.

The majority of small clinics cannot afford the high-tech security features for medical devices, such as AI-enhanced detection or zero-trust segmentation, despite advances in technology over the past few years. In low- and middle-income economies, costs are further increased because import duties and tariffs make goods unaffordable for vast numbers of people in critical need. Millions of individuals are left without a much-needed answer, and expansion potential is actually limited by the fact that such trends are being hindered by pricing. The failure of local production, legislative changes, or more sophisticated pricing tactics to address the problem will only hinder the expansion of the connected medical device security solution market and increase concerns about accessibility in developing economies.

The on-premise category held the largest share in the Connected Medical Device Security Solution market in 2025. Large healthcare enterprises with complex IT environments and strict data sovereignty regulations continue to rely on on-premises security solutions. These solutions are appropriate for companies with specialized IT and cybersecurity teams because they provide more control over data storage, security regulations, and system integration. Moreover, on-premises installations can be difficult for healthcare providers with limited resources because they sometimes require a sizable initial outlay, continuous maintenance, and specialized knowledge. Thus, these factors are expected to boost the growth of the connected medical device security solution market.

In 2025, the hospitals category dominated the Connected Medical Device Security Solution market, driven by these gadgets' growing connectivity and their crucial role in patient care. Hospital networks are rapidly integrating critical devices into hospital operations, such as imaging systems, surgical tools, and patient monitoring equipment. Furthermore, healthcare facilities are prioritising their cybersecurity procedures due to increased emphasis on patient safety and regulatory requirements to secure this equipment. In addition, the need for a connected medical device security solution to safeguard these devices is expected to sustain this market's dominance as hospitals continue to implement cutting-edge technologies.

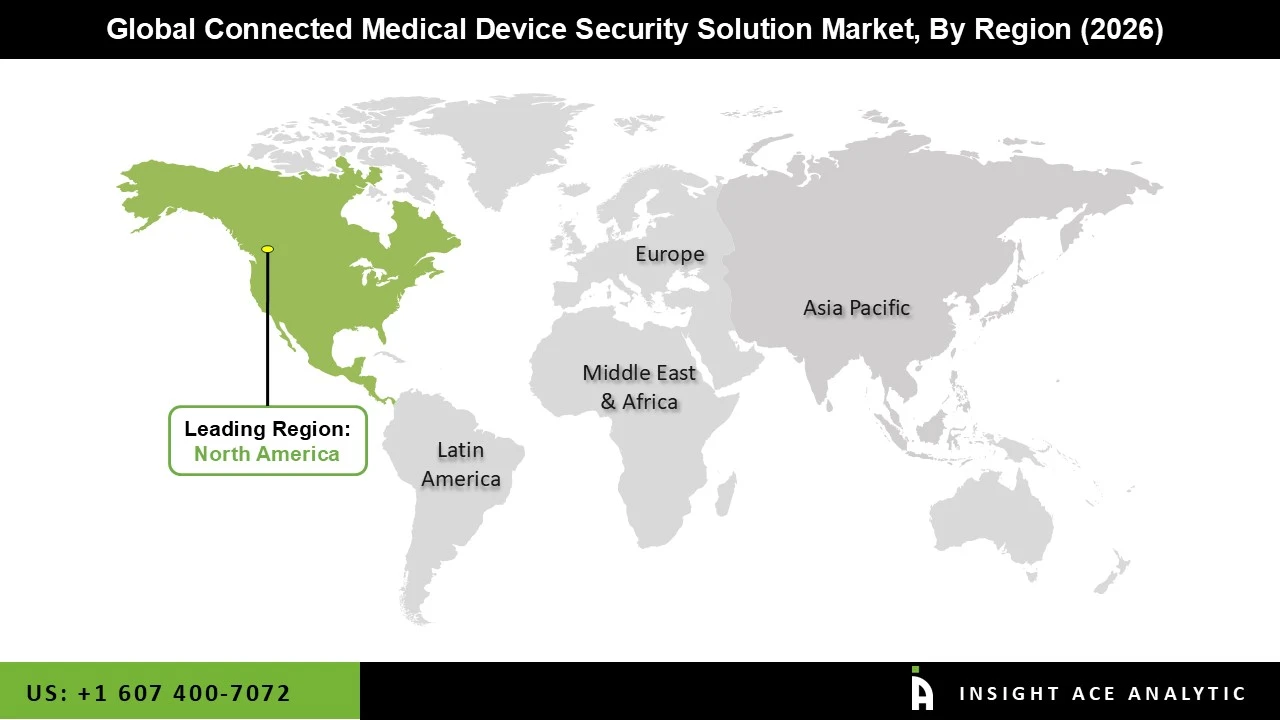

The Connected Medical Device Security Solution market was dominated by the North America region in 2025. The region's leadership is supported by proactive legislative actions, extensive use of connected medical device security solutions, and sophisticated healthcare IT infrastructure. Additionally, due to high-profile data breaches and the need to adhere to strict rules such as HIPAA and the FDA's cybersecurity standards, the United States, in particular, has seen substantial expenditures in healthcare cybersecurity. With a growing emphasis on protecting linked medical equipment in clinics, hospitals, and home healthcare settings, Canada is likewise making progress in the digitization of healthcare. Moreover, driven by continuous innovation, public-private collaborations, and the integration of AI and cloud-based security solutions, the North American connected medical device security solution market is anticipated to continue its robust growth trajectory.

• In June 2025, the HealthSec Cyber Expo 2025 set the stage for direct user feedback and purchasing activity. The event showcased advanced healthcare cybersecurity technologies, including blockchain audit trails, automated Managed Detection and Response (MDR), machine-learning–based device fingerprinting, and real-time compliance dashboards. These developments reflected the industry’s focus on automation, continuous compliance, and stronger security controls for regulated healthcare environments.

• In May 2025, Experis and ClearDATA collaborated to improve cloud security for healthcare organizations. Experis acquired reseller rights to ClearDATA’s CyberHealth™ Platform, which provided HIPAA-compliant Cloud Security Posture Management (CSPM) and MDR solutions across AWS, Microsoft Azure, and Google Cloud. The partnership aimed to reduce cyber risks, prevent data breaches, and support regulatory compliance as healthcare organizations expanded cloud adoption.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.0 Bn |

| Revenue forecast in 2035 | USD 10.9 Bn |

| Growth Rate CAGR | CAGR of 19.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Component, Deployment, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | GE Healthcare, Philips Healthcare, Cisco Systems, IBM, McAfee, Forescout Technologies, Cynerio, Medigate (Claroty), Armis Security, Fortinet, Trend Micro, Palo Alto Networks, Symantec (Broadcom), CloudWave, Asimily, Sectra, Check Point Software Technologies, CloudPassage, ClearDATA, Zscaler, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Software

• Services

• On-Premises

• Cloud

• Hospitals

• Clinics

• Home Care

• Others

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Mexico

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.