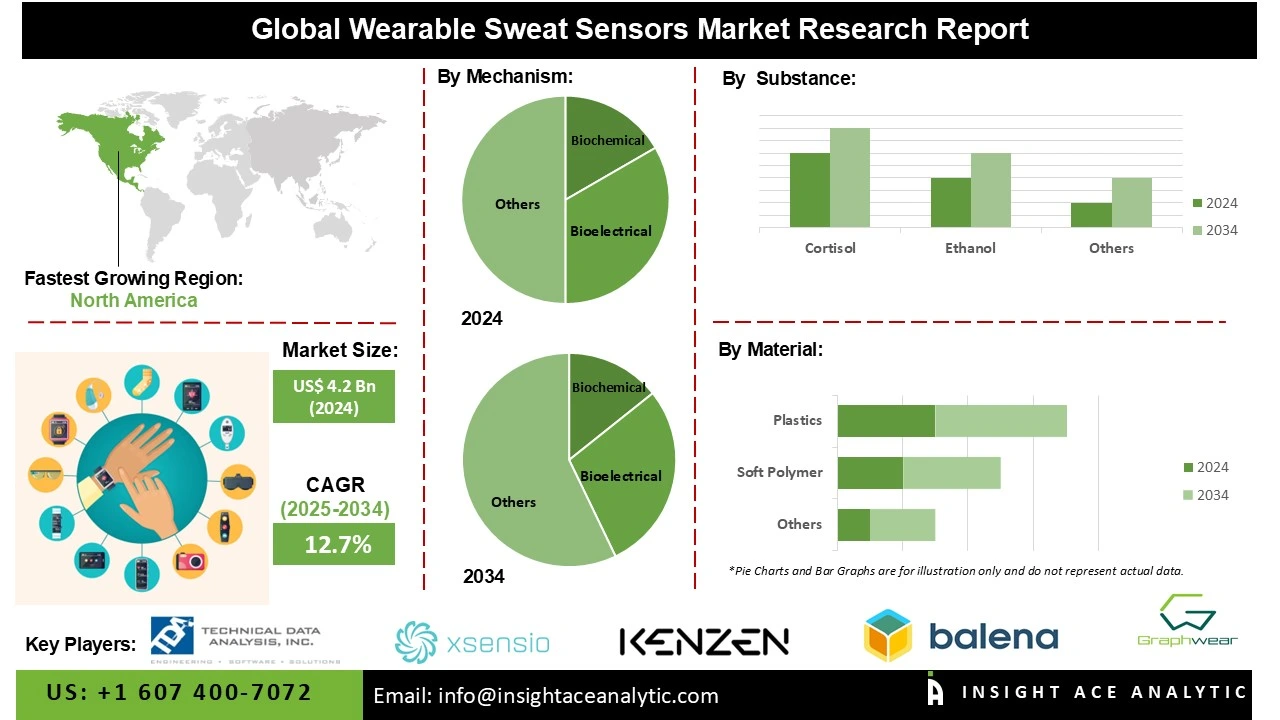

Global Wearable Sweat Sensors Market Size is valued at US$ 4.2 Bn in 2024 and is predicted to reach US$ 13.4 Bn by the year 2034 at an 12.7% CAGR during the forecast period for 2025-2034.

Wearable sweat sensors are non-invasive patches or bands that analyze sweat in real-time to monitor health biomarkers like electrolytes, glucose, and hormones. They provide immediate insights into hydration, athletic performance, and medical conditions by wirelessly transmitting data to a smartphone.

The wearable sweat sensors market is experiencing growth due to the rising demand for sports and performance monitoring. Athletes and fitness enthusiasts increasingly seek real-time, non-invasive insights into hydration, electrolyte balance, and lactate levels to expand endurance, recovery, and overall performance. Unlike traditional monitoring techniques, sweat sensors delivers continuous, personalized data during physical activity, enabling proactive adjustments in training and nutrition. The growing popularity of smart wearables and connected fitness devices further boosts adoption.

The wearable sweat sensors market is strongly driven by ongoing research and development efforts in the biomedical field, which are enhancing sensor accuracy, miniaturization, and real-time monitoring capabilities. Continuous innovations are enabling sweat sensors to detect biomarkers related to hydration, glucose, electrolytes, and stress, making them highly valuable for preventive healthcare and personalized medicine. Advancements in nanomaterials, flexible electronics, and wireless communication are also boosting device efficiency and comfort. As biomedical R&D increasingly emphasizes non-invasive diagnostic tools, wearable sweat sensors are gaining momentum as a promising alternative to traditional testing methods, supporting early disease detection and improved patient monitoring.

Some of the Key Players in the Wearable Sweat Sensors Market:

· Technical Data Analysis, Inc.

· Xsensio

· Kenzen

· Gatorade

· GraphWear Technologies

· Balena

· Epicore Biosystems

· Gatorade

· Eccrine Systems

· Nix Hydration Biosensor

· Zansors

The wearable sweat sensors market is segmented by mechanism, substance, material and By Region. By mechanism, the market is segmented into biochemical, and bioelectrical. By substance, the market is segmented into cortisol, ethanol, and others. By material, the market is segmented into soft polymer, plastics, and others.

In 2024, the cortisol segment is expected to drive the wearable sweat sensors market due to the rising focus on stress tracking. Cortisol levels in sweat provide a noninvasive way to monitor stress expand market. Growing demand for real-time health insights supports adoption. Athletes, patients, and wellness users seek continuous monitoring. Advances in biosensing materials expand sensor accuracy. Healthcare providers value early stress detection for treatment. Customer’s interest in personalized health data also fuels growth.

The wearable sweat sensors market is dominated by soft polymer due to the growing use of soft polymers, which provide flexibility, comfort, and biocompatibility for continuous skin contact. Such materials allow precise tracking of electrolytes, glucose, and hydration without irritation, ensuring their suitability for extended wear. Increasing need for non-invasive, real-time healthcare monitoring in fitness, sports, and personalized healthcare applications increasingly drives adoption, positioning soft polymer-based sweat sensors as a prominent wearable technology innovation.

North America dominates the market for Wearable Sweat Sensors due to region’s increasing health and fitness consciousness in the region, with consumers increasingly embracing non-invasive technology to track hydration, electrolyte balance, and metabolic activity. Increasing incidence of diseases, like diabetes and obesity, is driving the need for continuous and personalized health monitoring solutions. Rising presence of sophisticated wearable technology players and research institutions drives innovation and commercialization of biosensors based on sweat. Growing adoption of remote patient monitoring, backed by positive healthcare reimbursement policies and telehealth growth, further adds to market growth. The population in the region with a high level of technological awareness and heavy investment in digital health fuels adoption further.

Asia Pacific is the second-largest region in the market for wearable sweat sensors. This is attributed to growing demand for non-invasive healthcare monitoring devices that offer real-time biomarker feedback on electrolytes, glucose, and hydration is driving adoption. Growing incidence of lifestyle diseases, including obesity and diabetes, is driving demand for continuous monitoring solutions outside conventional clinical environments. Growing consumer interest in fitness, sports performance, and personalized healthcare fuels adoption. Supportive government initiatives for digital health innovation and rising investments in wearable technology startups also contribute

Wearable Sweat Sensors Market by Mechanism -

· Biochemical

· Bioelectrical

Wearable Sweat Sensors Market by Substance -

· Cortisol

· Ethanol

· Others

Wearable Sweat Sensors Market by Material-

· Soft Polymer

· Plastics

· Others

Wearable Sweat Sensors Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.