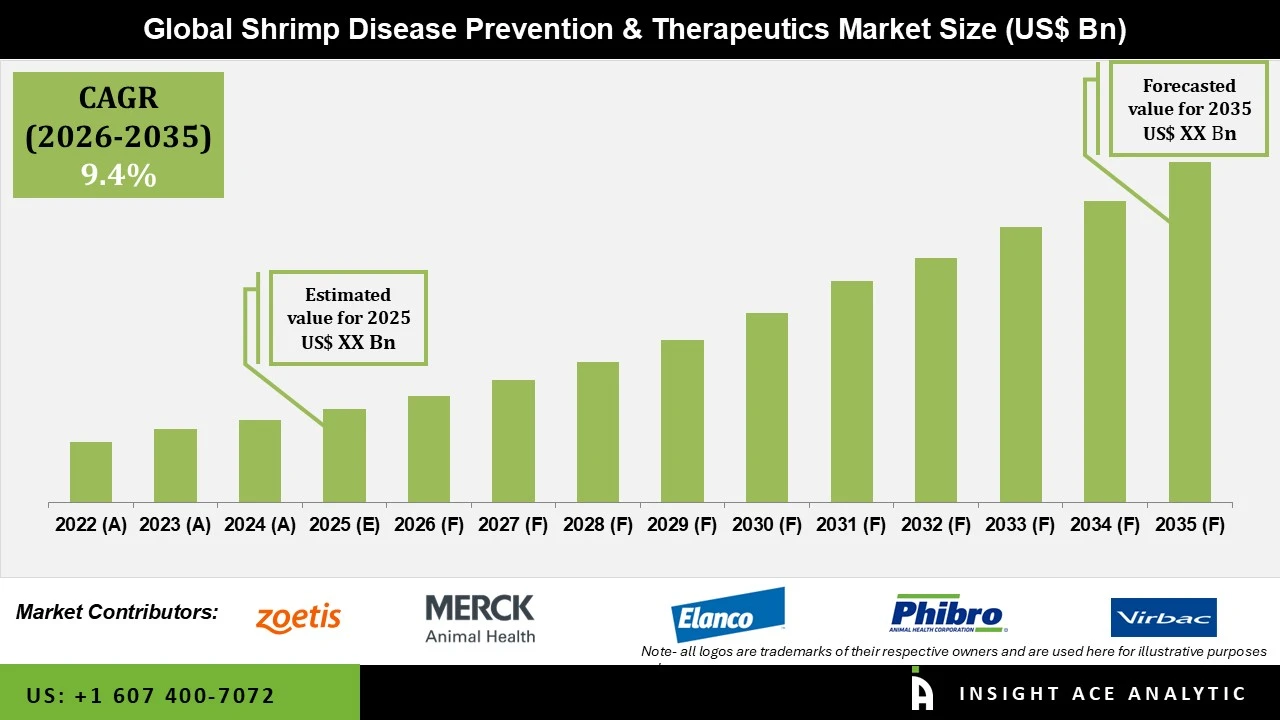

Shrimp Disease Prevention and Therapeutics Market is estimated to grow at a 9.4% CAGR during the forecast period for 2026 to 2035.

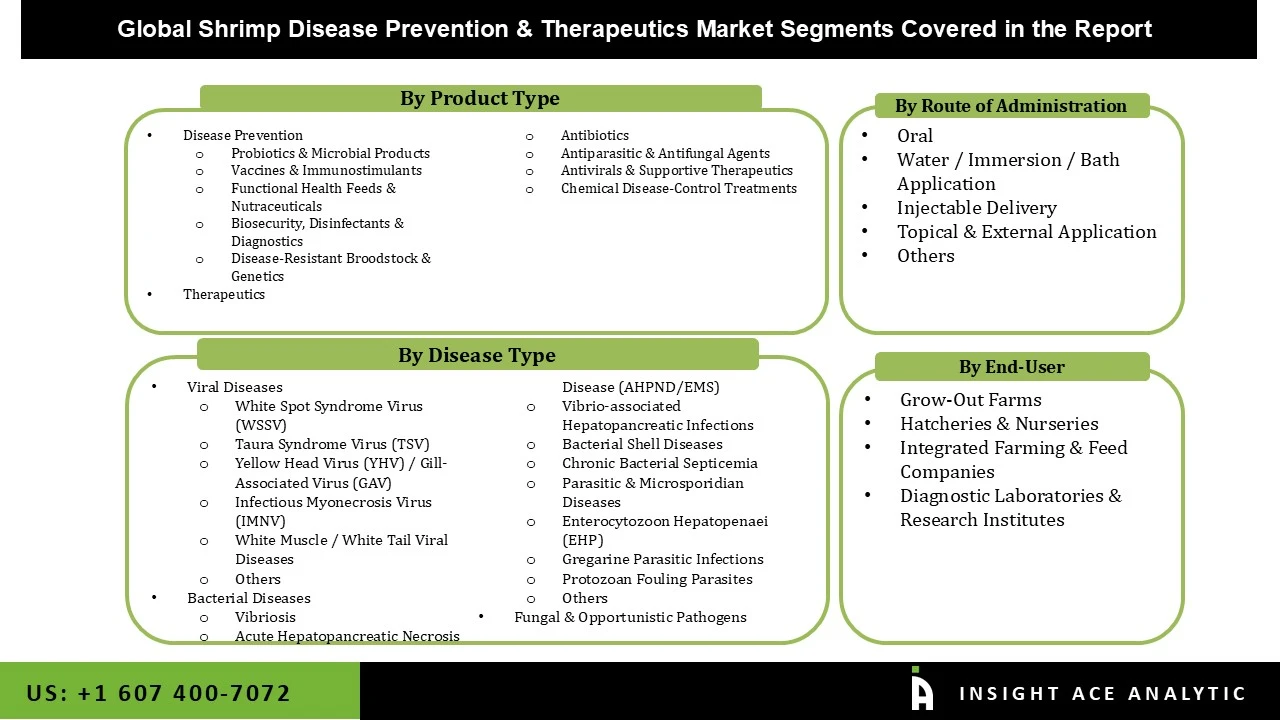

Shrimp Disease Prevention & Therapeutics Market Size, Share & Trends Analysis Distribution by Product Type (Disease Prevention (Probiotics & Microbial Products , Vaccines & Immunostimulants , Functional Health Feeds & Nutraceuticals, Biosecurity, Disinfectants & Diagnostics , Disease-Resistant Broodstock & Genetics), Therapeutics (Antibiotics, Antiparasitic & Antifungal Agents, Antivirals & Supportive Therapeutics, Chemical Disease-Control Treatments) By Disease Type (Viral Diseases, Bacterial Diseases, Parasitic & Microsporidian Diseases, Fungal & Opportunistic Pathogens), By End-user (Grow-Out Farms, Hatcheries & Nurseries, Integrated Farming & Feed Companies, Diagnostic Laboratories & Research Institute), Route of Administration (Oral, Water / Immersion / Bath Application, Injectable Delivery, Topical & External Application, Others) and Segment Forecasts, 2026 to 2035

Shrimp farming or aquaculture remains an essential part of the global aqua-industry because food security, rural jobs, and international trade are directly supported by this industry. But these are highly susceptible to a large number of diseases that are caused because of viruses, bacteria, fungal infections, protozoa, or stressful environments that may abruptly trigger mass deaths in these organisms, thereby resulting in substantial losses for aquaculture farms. Some serious infectious diseases affecting these organisms include viral diseases like WSSV (White Spot Syndrome Virus), YHV (Yellow Head Virus), IHHN (Infectious Hypodermal & Hematopoietic Necrosis), while AHPND (Acute Hepatopancreatic Necrosis Disease) is a bacterial disease. Uncontrolled, these diseases may result in the reduced growth, survival rate, or farm productivity of these organisms.

Shrimp culture or aqua culture is still one of the important segments of the global aqua industry since food security, rural employment, and global trade are directly linked with the entire industry. However, these are extremely vulnerable to a huge number of diseases due to viruses, bacterial infections, fungus, protozoa, and hostile conditions that may suddenly cause a huge death toll among these organisms, which may directly lead to huge losses for the aqua culture industries. The important infectious diseases among these organisms and their classifications are given below: There are some dangerous infectious diseases among these organisms, namely viruses such as: WSSV (White Spot Syndrome Virus), YHV (Yellow Head Virus), and IHHN (Infectious Hypodermal and Hematopoietic Necrosis Virus); while AHPND (Acute Hepatopancreatic Necrosis Disease) is a bacterial one.

the Shrimp Disease Prevention & Therapeutics Market Companies

The major driver for the Shrimp Disease Prevention & Therapeutics market is the high frequency and severe economic impact of disease outbreaks in intensive shrimp farming. As the shrimp culture has gradually transitioned from low-density and extensive rearing systems towards high-density and intensive culture due to the ever-increasing global demands for shrimp, the threat of various viruses and bacteria infections such as WSSV and AHPND has significantly increased. Such occurrences have the tendency to lead to rapid and high mortality and economic losses within a short period, hence forcing the farmer to undertake measures for the prevention, detection, and treatment of the diseases. Thus, the need for the prevention and health management measures for the shrimp has become an integral and obligatory part of shrimp culture.

The key challenge in the Shrimp Disease Prevention & Therapeutics market today is that the solutions available for disease prevention and treatment of shrimp are not so effective and easily accessible, owing to the cost factor and restrictions imposed by statutory bodies. This includes the cost of using advanced diagnostics, biosecurity solutions, and innovative treatments, most of them not economically viable for small and medium-scale shrimp farmers, who account for the major chunk of the production in most parts of the world. On the other hand, the restrictions imposed on the use of antibiotics and chemicals due to the rising development of antimicrobial resistance, food safety, and concerns for the environment, greatly pose a constraint on treatments available in the market.

The segment of Disease Prevention is leading in the Shrimp Disease Prevention & Therapeutics market. This can be attributed to the increasing emphasis on biosecurity measures, probiotics, immunostimulants, functional feeds, and early diagnostics in prevention-based health management in shrimp aquaculture. Farmers are taking more interest in prevention rather than treatment methods to reduce mortality rates, decrease potential economic losses, and adhere to increasingly strict regulations with regard to antibiotic use. Because disease outbreaks can spread quickly in intensive farming, preventive solutions may be considered more cost-effective, sustainable, and reliable instead of therapeutics.

The Viral Diseases category is progressing at the fastest rate in the Shrimp Disease Prevention and Therapeutics industry. This is because viral shrimp diseases such as White Spot Syndrome Virus (WSSV), Yellow Head Virus (YHV), and IHHN have high incidence rates, easily spread from shrimp to shrimp, and also cause high shrimp fatalities. Once shrimp farming becomes economically successful and reaches an intensive scale globally, shrimp farmers feel that controlling viral shrimp diseases is their utmost priority, and therefore, this particular category of shrimp disease prevention and therapeutic products is also increasing at a fast rate.

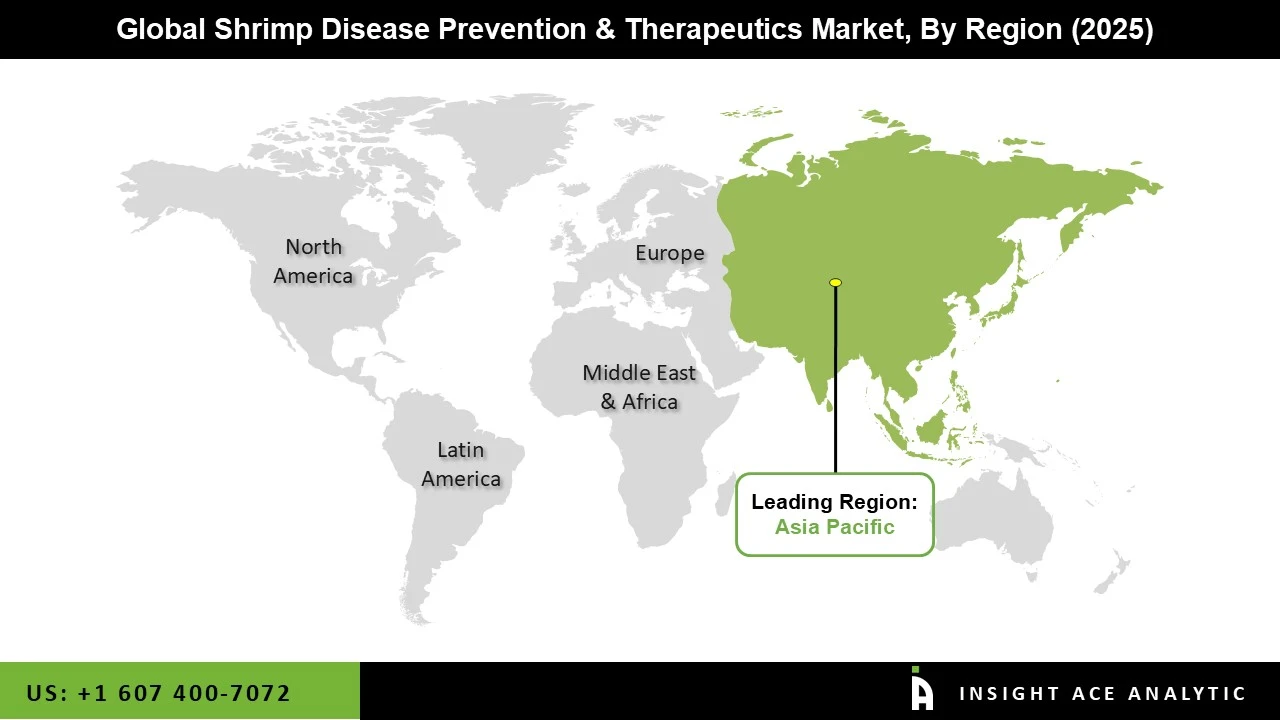

The Asia-Pacific dominated the Shrimp Disease Prevention & Therapies market. The dominance in the region was fueled by the large-scale shrimp production base in countries such as China, India, Vietnam, Indonesia, and Thailand, where shrimp farming can be considered intensive and prone to disease. Outbreaks in the region due to diseases, driven by increasing adoption for export and bio-security and health care solutions for prevention, contributed largely to the growth in the regional market.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 9.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2021 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Disease Type, Application, End-User, Route of Administration and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health Incorporated, Phibro Animal Health Corporation, Virbac S.A., Laboratorios HIPRA, S.A. (HIPRA), Benchmark Holdings plc (INVE Aquaculture & Benchmark Genetics), Skretting (Nutreco N.V.), Cargill Aqua Nutrition (Cargill, Incorporated), Grobest Group, Avanti Feeds Limited, Kemin Industries, Inc. (Kemin AquaScience), Organica Biotech Private Limited, Sanzyme Biologics Private Limited , ViAqua Therapeutics Ltd., Syndel Laboratories Ltd., Kyoto Biken Laboratories, Inc. , Vaxxinova International B.V., Nisseiken Co., Ltd. , Salem Microbes Private Limited, Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Disease Prevention

o Probiotics & Microbial Products

o Vaccines & Immunostimulants

o Functional Health Feeds & Nutraceuticals

o Biosecurity, Disinfectants & Diagnostics

o Disease-Resistant Broodstock & Genetics

• Therapeutics

o Antibiotics

o Antiparasitic & Antifungal Agents

o Antivirals & Supportive Therapeutics

o Chemical Disease-Control Treatments

• Viral Diseases

o White Spot Syndrome Virus (WSSV)

o Taura Syndrome Virus (TSV)

o Yellow Head Virus (YHV) / Gill-Associated Virus (GAV)

o Infectious Myonecrosis Virus (IMNV)

o White Muscle / White Tail Viral Diseases

o Others

• Bacterial Diseases

o Vibriosis

o Acute Hepatopancreatic Necrosis Disease (AHPND/EMS)

o Vibrio-associated Hepatopancreatic Infections

• Bacterial Shell Diseases

o Chronic Bacterial Septicemia

o Parasitic & Microsporidian Diseases

o Enterocytozoon Hepatopenaei (EHP)

o Gregarine Parasitic Infections

o Protozoan Fouling Parasites

o Others

• Fungal & Opportunistic Pathogens

• Oral

• Water / Immersion / Bath Application

• Injectable Delivery

• Topical & External Application

• Others

• Grow-Out Farms

• Hatcheries & Nurseries

• Integrated Farming & Feed Companies

• Diagnostic Laboratories & Research Institute

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• India

• Vietnam

• Indonesia

• Thailand

• Bangladesh

• Rest of Asia Pacific

Latin America-

• Brazil

• Mexico

• Ecuador

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.