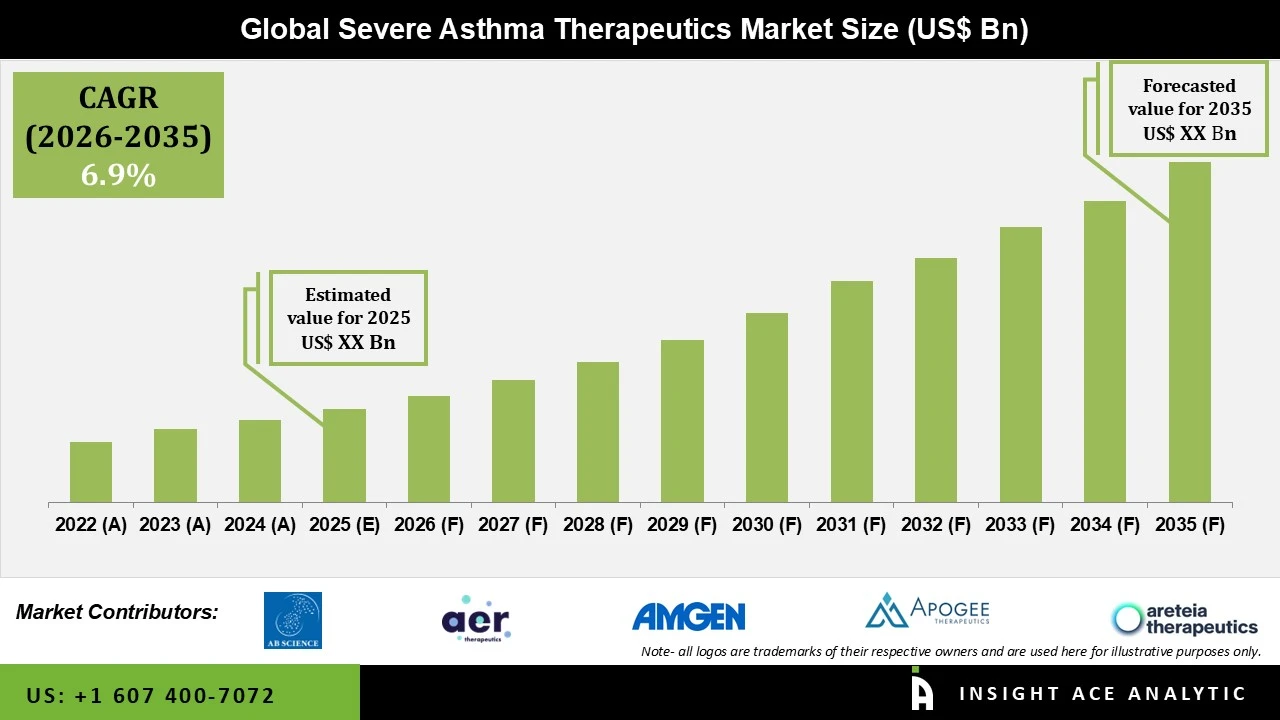

Severe Asthma Therapeutics Products Market Size is predicted to grow at a 6.9% CAGR during the forecast period for 2026 to 2035.

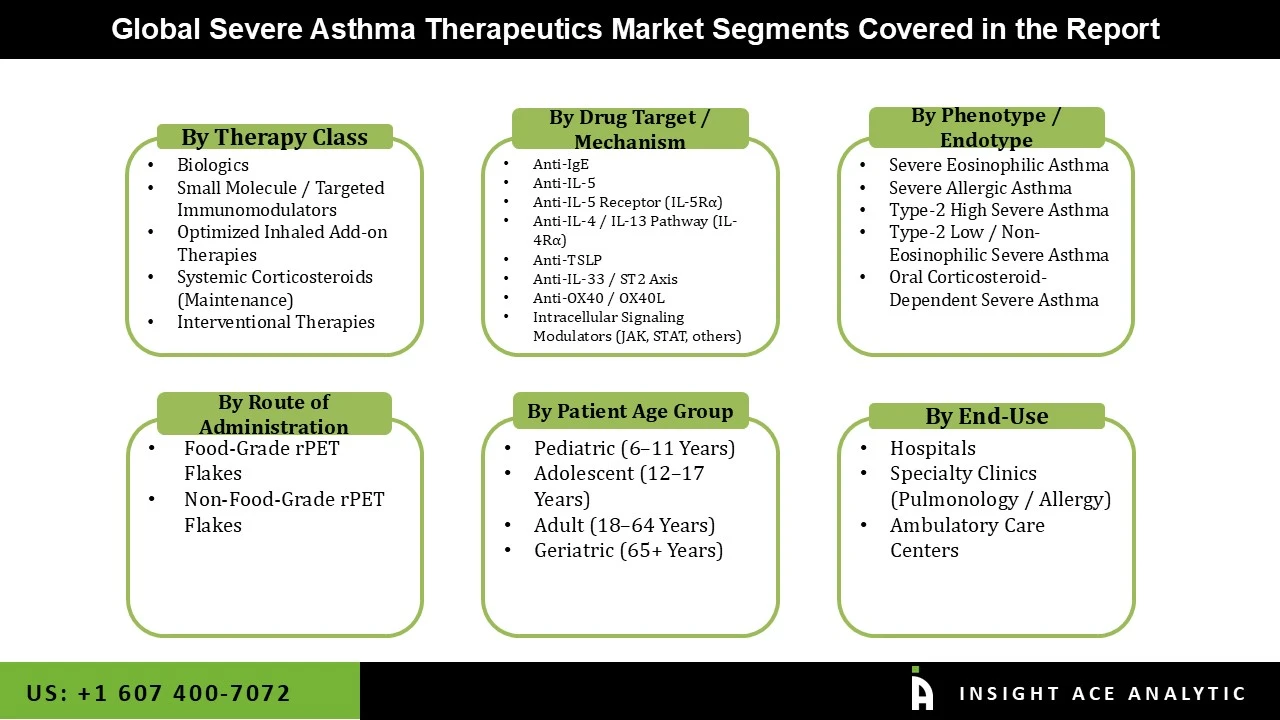

Severe Asthma Therapeutics Products Market Size, Share & Trends Analysis Distribution by Therapy Class (Biologics, Small Molecule / Targeted Immunomodulators, Optimized Inhaled Add-on Therapies, Systemic Corticosteroids (Maintenance), Interventional Therapies), By Drug Target / Mechanism (Anti-IgE, Anti-IL-5, Anti-IL-5 Receptor (IL-5Rα), Anti-IL-4 / IL-13 Pathway (IL-4Rα), Anti-TSLP, Anti-IL-33 / ST2 Axis, Anti-OX40 / OX40L, Intracellular Signaling Modulators (JAK, STAT, others)), By Phenotype / Endotype (Severe Eosinophilic Asthma, Severe Allergic Asthma, Type-2 High Severe Asthma, Type-2 Low / Non-Eosinophilic Severe Asthma, Oral Corticosteroid-Dependent Severe Asthma), By Route of Administration (Subcutaneous, Intravenous, Inhaled, Oral), By Patient Age Group (Pediatric (6–11 Years), Adolescent (12–17 Years), Adult (18–64 Years), Geriatric (65+ Years)), By End User (Hospitals, Specialty Clinics (Pulmonology / Allergy), Ambulatory Care Centers) and Segment Forecasts, 2026 to 2035

The severe asthma therapeutics market comprises pharmaceuticals and biologics developed for the treatment of severe asthma, a chronic inflammatory respiratory disease characterized by persistent symptoms, frequent exacerbations, and a poor response to conventional inhaled corticosteroids and bronchodilators. Although severe asthma is a relatively small patient population, it is a major contributor to healthcare expenditure, hospitalization, and disease-related morbidity because of its complex immune pathophysiology. Severe asthma therapeutics are mainly biologics, monoclonal antibodies, and targeted small molecules that target the major inflammatory pathways of IgE, IL-5, and IL-4/IL-13, with the goal of decreasing exacerbations, improving lung function, improving symptoms, and allowing corticosteroid sparing. These are increasingly used in hospital outpatient clinics and speciality pulmonology and allergy practices, often employing biomarker-driven patient stratification and precision medicine strategies.

Severe asthma therapeutics market growth is fueled by the increasing incidence of severe and uncontrolled asthma, exposure to environmental and lifestyle-related risk factors, and the growing use of targeted biologic therapies with enhanced efficacy and safety profiles. Breakthroughs in immunology and precision diagnostics have also facilitated personalized treatment approaches, propelling adoption among eligible patients. Nevertheless, market growth is constrained by the high prices of biologic therapies, hindering accessibility in cost-sensitive and emerging markets, as well as by difficulties in precise diagnosis and phenotyping of severe asthma patients, which impede the initiation of targeted therapy.

• AB Science

• AER Therapeutics

• Amgen

• Apogee Therapeutics

• Areteia Therapeutics

• AstraZeneca

• Bio-Thera Solutions

• Biosion

• CSPC ZhongQi Pharmaceutical Technology

• Generate:Biomedicines

• GlaxoSmithKline (GSK)

• Incyte

• Insmed

• Kinaset Therapeutics

• Kymera Therapeutics

• Lanier Biotherapeutics

• Novartis

• Oneness Biotech

• Regeneron Pharmaceuticals

• Roche

• Sanofi

• Suzhou Connect Biopharmaceuticals

• Teva Pharmaceutical Industries

• Upstream Bio

The key driving factor for the severe asthma therapeutics market is the rising use of targeted biologic therapies in severe and uncontrolled asthma. Biologics targeting major inflammatory pathways such as IgE, IL-5, and IL-4/IL-13 have shown improved clinical efficacy in lowering exacerbation events, improving lung function, and improving quality of life in patients who remain poorly responsive to conventional inhaled therapies. The rising acceptance among clinicians, expanding therapeutic use, and relevance to the concept of precision medicine have made biologics the key driving factor for the market.

The most significant challenge in the severe asthma therapeutics market is the high price of biologic therapies. The advanced biologics and targeted therapies are quite costly, and hence, there are reimbursement issues, and the adoption is limited, especially in the price-sensitive markets. Moreover, the requirement of long-term therapy, administration by specialists, and monitoring adds to the cost, thus restricting the market penetration.

Biologics lead the growth in the market due to their targeted approach to the major inflammatory pathways (IgE, IL-5, IL-4/IL-13), their superiority in efficacy in reducing exacerbations, and their use in the management of patients with severe, uncontrolled asthma who remain refractory to conventional therapies. The growing pipeline of biologics, the rising number of approvals, and the rising trend of phenotype-based and precision medicine strategies further make this segment the major growth driver in the market, outperforming small molecules, optimized inhaled add-on therapies, maintenance systemic corticosteroids, and interventional therapies.

The Anti-IL-5 and Anti-IL-5 Receptor (IL-5Rα) segment holds the fastest-growing area within the severe asthma therapeutics market. This segment growth is principally driven by strong demand from patients with severe eosinophilic asthma and consistently positive treatment outcomes. These therapies have gained widespread adoption due to demonstrated clinical effectiveness, high levels of physician confidence, and increasing real-world utilisation across eligible patient populations. Expanded reimbursement access and the introduction of clearer treatment guidelines have further supported overall market growth. Consequently, IL-5–targeted therapies are expected to grow significantly compared to newer biologic classes such as Anti-TSLP and Anti-IL-33, supported by earlier market entry, stronger physician familiarity, broader patient eligibility, and more established reimbursement coverage.

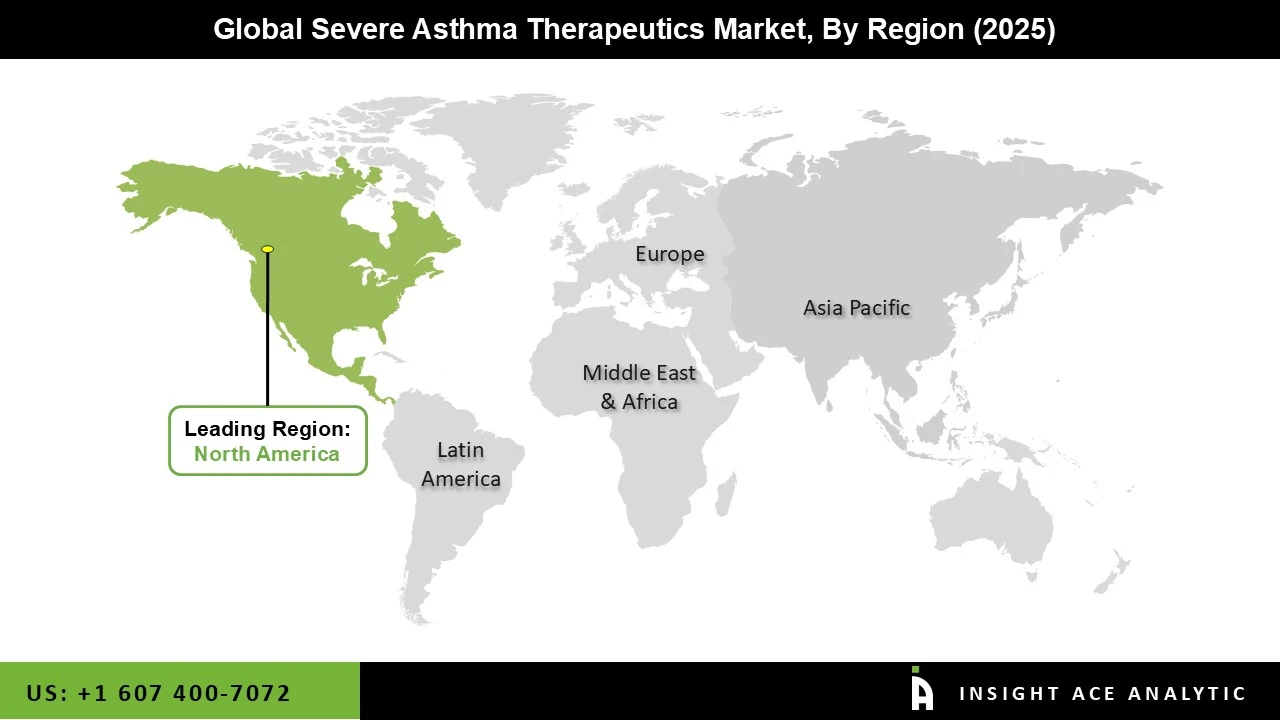

The severe asthma therapeutics market is led by North America due to the large number of patients suffering from severe and uncontrolled asthma, early adoption of innovative biologic therapies, and an established healthcare infrastructure. The region has favorable reimbursement systems in place, easy access to specialty care, and quick approvals for new biologic therapies targeting major inflammatory pathways. Furthermore, increased awareness of the disease, active clinical research, and the presence of key pharmaceutical companies have spurred the adoption of precision medicine therapies, making North America the leading market.

• January 2024: GSK acquired Aiolos Bio for $1.4 billion to strengthen its respiratory pipeline, including $1 billion upfront and up to $400 million in milestone payments. The acquisition added AIO-001, a long-acting anti-TSLP monoclonal antibody for severe asthma, positioned in the same therapeutic class as AstraZeneca’s Tezspire.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 6.9% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Therapy Class, By Drug Target / Mechanism, Phenotype / Endotype, Route of Administration, Patient Age Group, End User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | AB Science, AER Therapeutics, Amgen, Apogee Therapeutics, Areteia Therapeutics, AstraZeneca, Bio-Thera Solutions, Biosion, CSPC ZhongQi Pharmaceutical Technology, Generate:Biomedicines, GlaxoSmithKline (GSK), Incyte, Insmed, Kinaset Therapeutics, Kymera Therapeutics, Lanier Biotherapeutics, Novartis, Oneness Biotech, Regeneron Pharmaceuticals, Roche, Sanofi, Suzhou Connect Biopharmaceuticals, Teva Pharmaceutical Industries, Upstream Bio |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Biologics

• Small Molecule / Targeted Immunomodulators

• Optimized Inhaled Add-on Therapies

• Systemic Corticosteroids (Maintenance)

• Interventional Therapies

• Anti-IgE

• Anti-IL-5

• Anti-IL-5 Receptor (IL-5Rα)

• Anti-IL-4 / IL-13 Pathway (IL-4Rα)

• Anti-TSLP

• Anti-IL-33 / ST2 Axis

• Anti-OX40 / OX40L

• Intracellular Signaling Modulators (JAK, STAT, others)

• Severe Eosinophilic Asthma

• Severe Allergic Asthma

• Type-2 High Severe Asthma

• Type-2 Low / Non-Eosinophilic Severe Asthma

• Oral Corticosteroid-Dependent Severe Asthma

• Subcutaneous

• Intravenous

• Inhaled

• Oral

• Pediatric (6–11 Years)

• Adolescent (12–17 Years)

• Adult (18–64 Years)

• Geriatric (65+ Years)

• Hospitals

• Specialty Clinics (Pulmonology / Allergy)

• Ambulatory Care Centers

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.