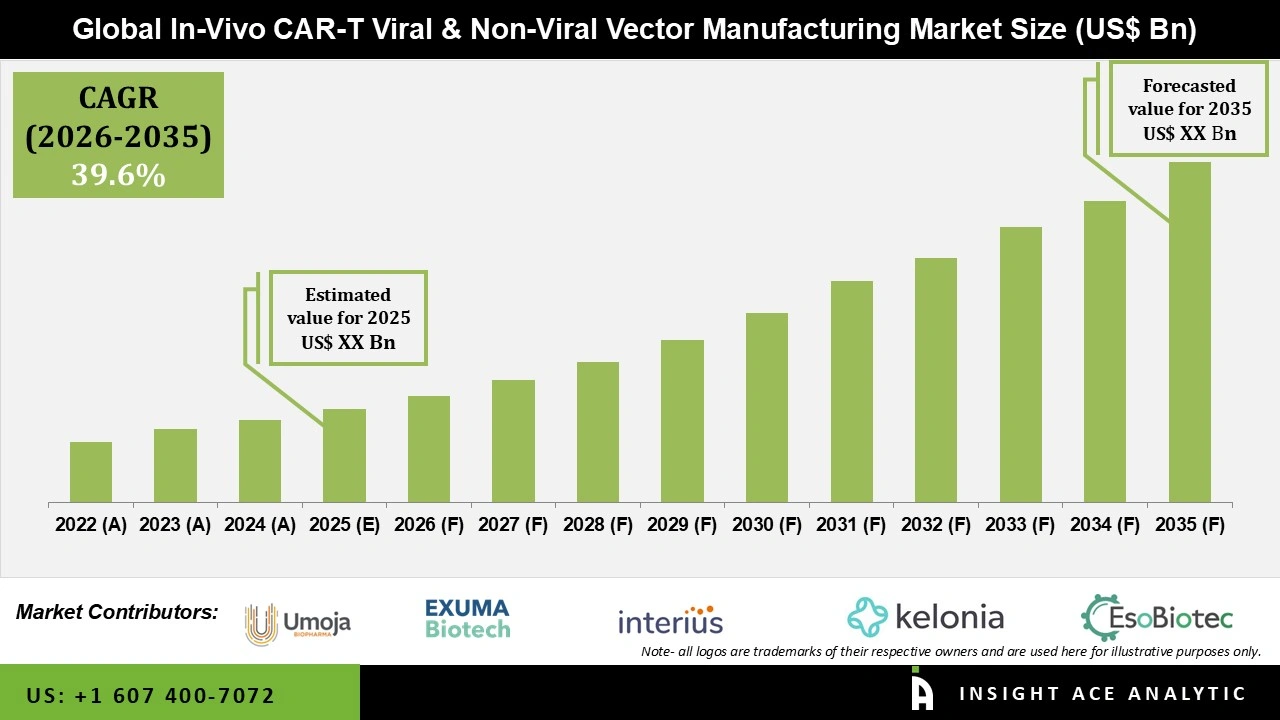

Global In-Vivo CAR-T Viral & Non-Viral Vector Manufacturing Market Size is predicted to grow at a 39.6% CAGR during the forecast period for 2026 to 2035.

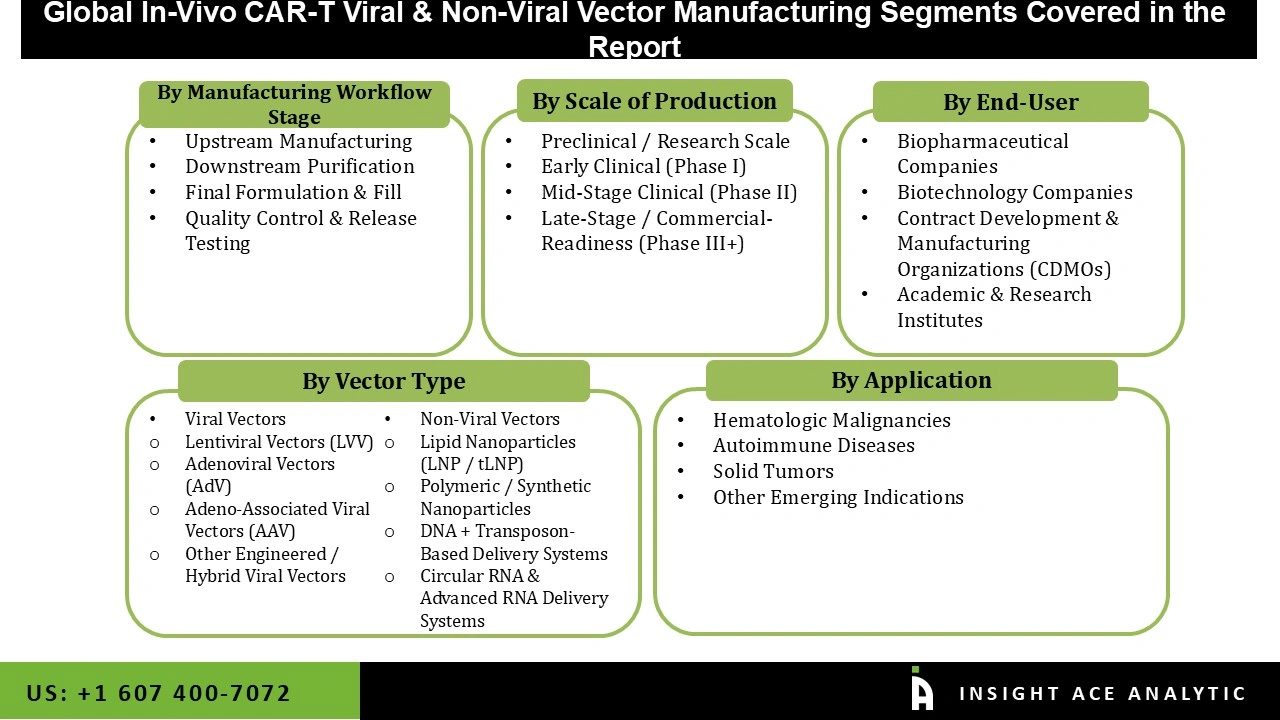

In-Vivo CAR-T Viral and Non-Viral Vector Manufacturing Market Size, Share & Trends Analysis Distribution by Vector Type (Viral Vectors (Lentiviral Vectors (LVV), Adenoviral Vectors (AdV), Adeno-Associated Viral Vectors (AAV), Other Engineered / Hybrid Viral Vectors), Non-Viral Vectors (Lipid Nanoparticles (LNP / tLNP), Polymeric / Synthetic Nanoparticles, DNA + Transposon-Based Delivery Systems, Circular RNA & Advanced RNA Delivery Systems)) By Manufacturing Workflow Stage (Upstream Manufacturing, Downstream Purification, Final Formulation & Fill, Quality Control & Release Testing), By Scale of Production (Preclinical / Research Scale, Early Clinical (Phase I), Mid-Stage Clinical (Phase II), Late-Stage / Commercial-Readiness (Phase III+)) By End-User, By Region and Segment Forecasts, 2026 to 2036

The In-Vivo CAR-T viral & non-viral vector manufacturing market refers to the production and distribution of viral and non-viral vectors, which are employed in the delivery of CAR-T cell therapies directly into the body (in-vivo). In contrast to conventional ex-vivo CAR-T cell therapies, which require the engineering of immune cells outside the body, in-vivo approaches employ vectors to genetically engineer T cells in the body, making manufacturing easier and possibly more accessible. The market is divided into two primary vector categories: viral vectors, including lentiviruses and adeno-associated viruses (AAVs), which are preferred for their high transduction efficiency and stable expression, and non-viral vectors, including lipid nanoparticles (LNPs), synthetic polymers, and transposases, which are preferred for their safety, scalability, and reduced immunogenicity.

The vectors generated are used in cancer immunotherapy, treatment of autoimmune diseases, management of infectious diseases, and gene editing and regenerative medicine as carriers for the CRISPR/Cas system. Market expansion is fuelled by the growing need for scalable CAR-T cell therapies and by improvements in vector engineering that enhance delivery efficiency and minimise off-target toxicity. Nevertheless, the complexity and cost of manufacturing, as well as safety and regulatory issues such as insertional mutagenesis and immunogenicity, remain major limitations to widespread use.

Viral Vector Manufacturers / Developers

Non-Viral Vector Manufacturers / Developers

CDMOs / Contract Vector Manufacturing Providers

Driver

Rising Demand for Scalable In Vivo CAR T Therapies

The market is primarily driven by the growing demand for scalable and accessible CAR T therapies. In vivo CAR T approaches simplify treatment by delivering CAR constructs directly into patients’ T cells, reducing the complexity, cost, and time associated with traditional ex vivo methods. Advances in vector engineering and the rising prevalence of cancer and chronic diseases further support market growth.

Restrain/Challenge

Manufacturing Complexity and Regulatory Hurdles

The primary challenge facing the In‑Vivo CAR‑T viral & non‑viral vector manufacturing market is the complexity and high cost of producing high-quality vectors at scale. The production of viral vectors such as lentiviruses and AAVs is a complex process that requires sophisticated bioprocessing infrastructure and expertise. Even non-viral vectors, which are safer and more easily producible, need sophisticated formulation and delivery systems for effective in-vivo targeting.

The viral vector segment is expected to drive the In‑Vivo CAR‑T viral & non‑viral vector manufacturing market due to its proven efficiency, clinical adoption, and ability to deliver durable therapeutic outcomes. Lentiviruses and AAVs have the ability to transduce T cells from patients efficiently in vivo, ensuring stable CAR expression and potent anti-tumor immune responses. Their success in both hematologic malignancies and solid tumors has made them the vectors of choice in clinical trials and commercial CAR-T therapies. Moreover, continuous advancements in vector design, scalability, and safety are improving their reliability and ease of use. Although non-viral vectors are being explored as a safer alternative, the viral vectors are likely to remain the major revenue-generating component, leading to the growth of the market because of their extensive clinical use and continued development of viral vector manufacturing infrastructure.

The upstream manufacturing market is expanding at the fastest rate in the in-vivo CAR-T vector market. This phase, which involves cell culture, vector generation, and gene transfer, is a crucial step in scaling up the production of vectors to cater to the increasing demand for therapies. Improved bioreactors, cell lines, and production methods are making upstream manufacturing the driving force behind the market.

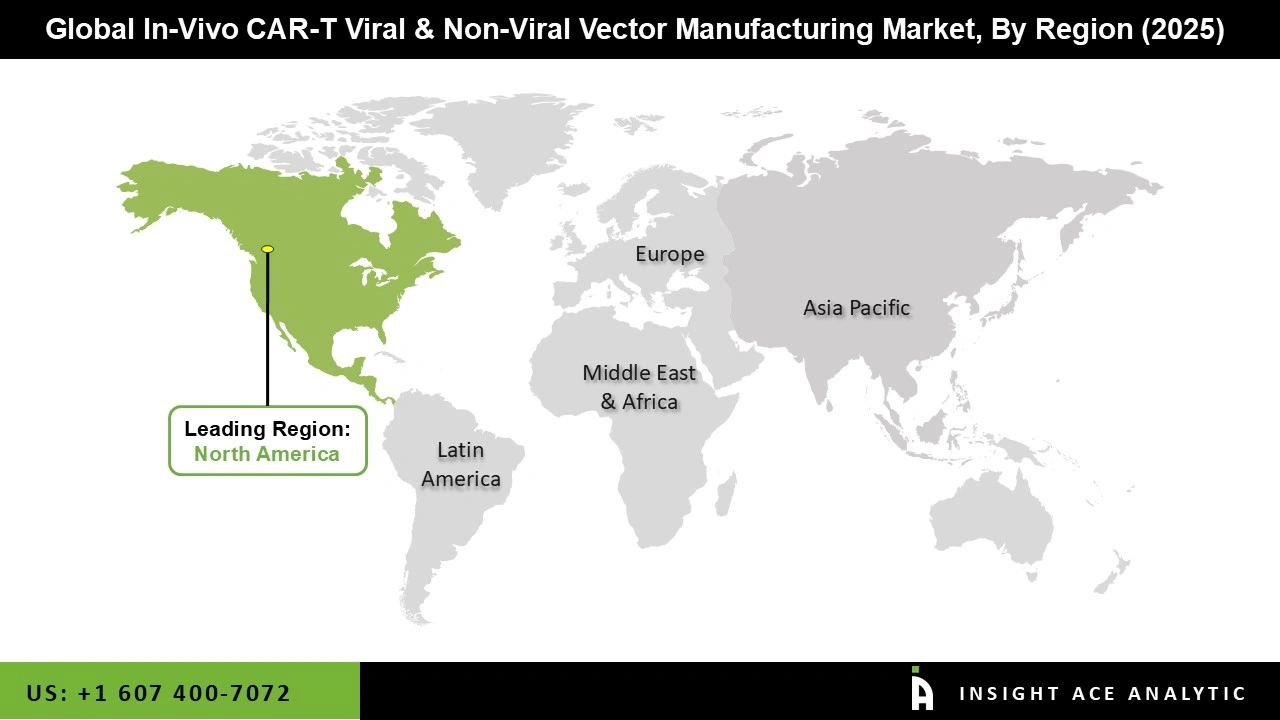

North America currently leads the in vivo CAR-T viral and non-viral vector manufacturing market due to the presence of a strong biopharma industry, well-developed infrastructure, and a rich R&D environment. The region is home to many CAR-T therapy developers, biotech firms, contract development organizations, and also has the maximum number of clinical trials being conducted.

Favorable government initiatives and investments have further fueled the development and commercialization of CAR-T therapies, making North America the leading contributor to the market.

August 2025 : ViroCell Biologics announced a manufacturing collaboration with AvenCell Therapeutics and successfully delivered a novel retroviral vector. The vector was used to produce AVC-203, an investigational CD19/CD20 dual-targeted CAR T therapy for B cell malignancies and autoimmune diseases.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 39.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Vector Type, Manufacturing Workflow Stage, Scale of Production, End-User, Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Umoja Biopharma, EXUMA Biotech, Interius BioTherapeutics, Kelonia Therapeutics, EsoBiotec, Vyriad, Vector BioMed, Vector BioPharma, Capstan Therapeutics, Ensoma, Myeloid Therapeutics, NanoCell Therapeutics, Orbital Therapeutics, GenEdit, Verve Therapeutics, Beam Therapeutics, Tessera Therapeutics, Lonza, Thermo Fisher Scientific, Catalent, Oxford BioMedica, AGC Biologics, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Cobra Biologics |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.