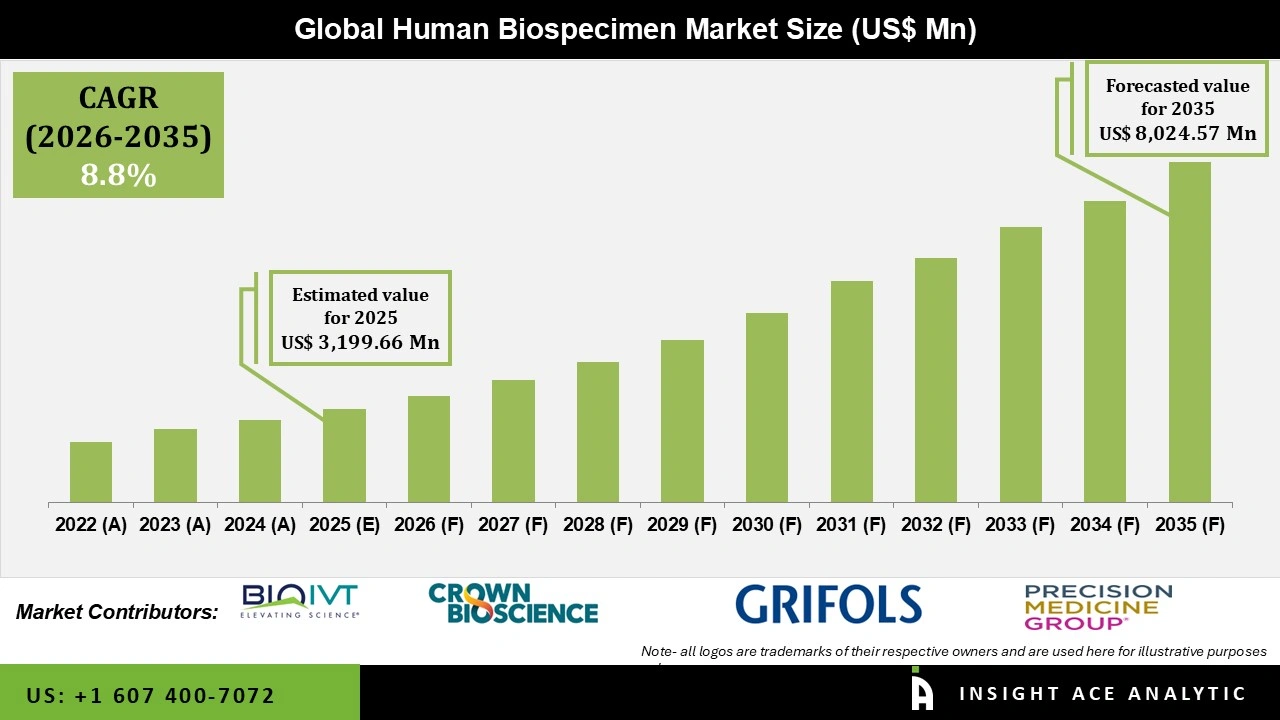

Global Human Biospecimen Market Size is valued at USD 3,199.66 Mn in 2025 and is predicted to reach USD 8,024.57 Mn by the year 2035 at a 8.8% CAGR during the forecast period for 2026 to 2035.

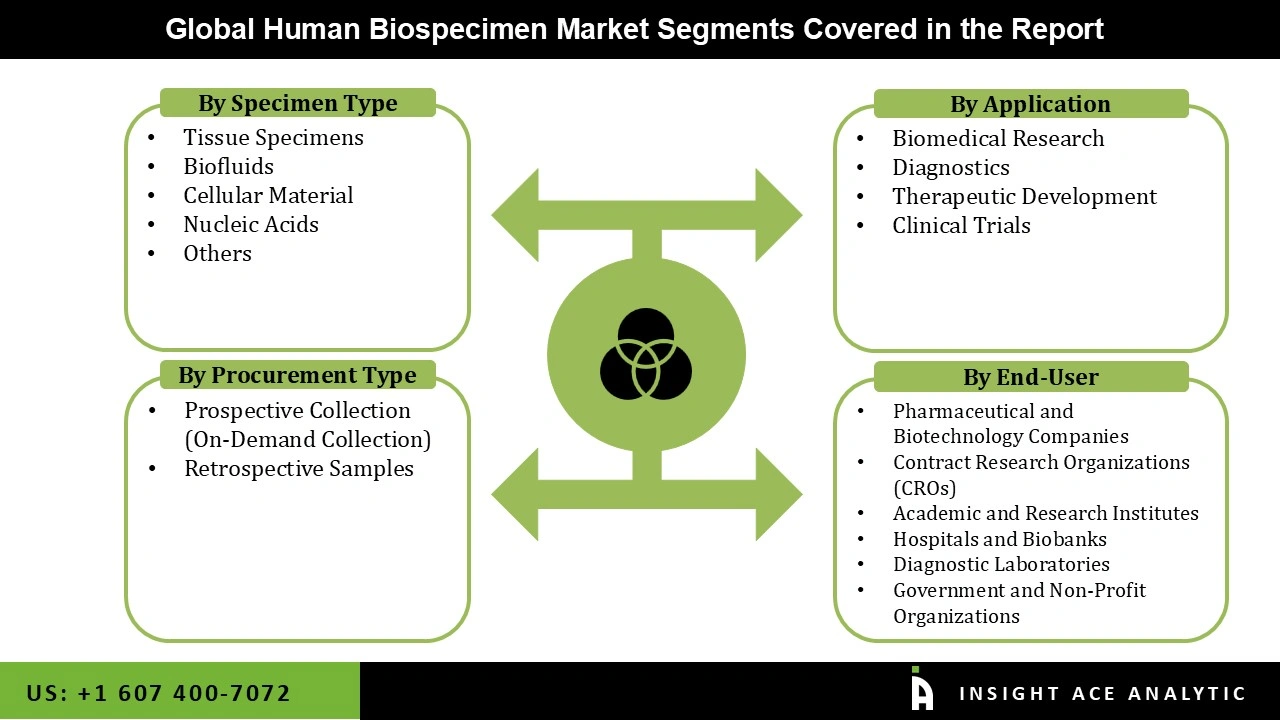

Human Biospecimen Market Size, Share & Trends Analysis Distribution by Specimen Type (Tissue Specimens, Nucleic Acids, Cellular Material, Biofluids, and Others), Procurement Type (Retrospective Samples and Prospective Collection (On-Demand Collection)), End-user (Hospitals and Biobanks, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, Contract Research Organizations (CROs), Government and Non-Profit Organizations, Academic and Research Institutes), and Segment Forecasts, 2026 to 2035

A human biospecimen is any biological sample collected from the human body for medical research, disease diagnosis, drug development, or clinical studies. These samples include blood, plasma, serum, urine, cerebrospinal fluid (CSF), tissues (fresh-frozen or FFPE), primary cells, peripheral blood mononuclear cells (PBMCs), leukopaks, DNA, RNA, proteins, and other biofluids or cellular products. Biospecimens are carefully collected from both healthy donors and patients, processed, stored, and annotated under strict ethical, legal, and quality standards (informed consent, IRB approval, chain-of-custody, and pre-analytical controls). They are preserved in biobanks and supplied to pharmaceutical companies, contract research organizations (CROs), academic researchers, and diagnostic developers to

support cancer research, biomarker discovery, precision medicine, and therapeutic development.

The need for early disease diagnosis and medication discovery is one of the many factors driving the growth of the worldwide human biospecimen market. The necessity for new clinical trials and the creation of cutting-edge treatments has grown due to the rising incidence of chronic and uncommon diseases. The comprehensive biospecimens are also necessary to support early disease diagnosis and the creation of novel medications and treatment options due to the growing demand for tailored medications. Furthermore, there are many chances for creative solutions in the developing industry due to the growing need for high-quality biospecimens in drug development. By offering a substantial understanding of illness mechanisms and the creation of innovative medications and therapies, the human biospecimen is essential to research and development.

In addition, the need for superior biospecimens is being driven by an increased emphasis on furthering research and development. This demand is further increased by developments in biobanking technologies. Thus, driving the human biospecimen market expansion over the forecast period. However, the market for human biospecimens has significant growth constraints despite promising growth opportunities. The adoption may be hampered by the high expenses of biospecimen collection, processing, storage, and quality control, especially for smaller research institutions. Research reproducibility and reliability may also be impacted by problems with sample heterogeneity, irregular quality, and the absence of standard operating procedures. The logistical difficulties of maintaining cold-chain storage and transportation, as well as the scarcity of uncommon disease samples, also impede the human biospecimen market expansion.

Driver

Growing Emphasis on Personalized Medicine

One of the main factors driving the human biospecimen market is the growing emphasis on personalized medicine. The goal of personalized medicine is to make healthcare decisions and treatments unique to each patient based on their genetic, environmental, and lifestyle characteristics. This method requires a variety of human biospecimens to be available for both clinical and research purposes. For instance, the Personalized Medication Coalition estimates that by 2025, the personalized medication business will be worth USD 2 trillion. The creation of tailored medicines needs high-quality human biospecimens, which are the main drivers of this expansion in genomics and biotechnology. The human biospecimen demand is anticipated to increase in tandem with the growing adoption of customized medicine initiatives by pharmaceutical companies and healthcare providers.

Restrain/Challenge

High Operational and Infrastructure Costs

The high cost of sample collection, processing, storage, and ongoing maintenance is a major barrier to the market's expansion for human biospecimens. A substantial investment in specialized infrastructure, including ultra-low temperature freezers, liquid nitrogen storage systems, quality control labs, and sophisticated information management systems, is necessary for the establishment and operation of biobanks. Operational costs are further increased by qualified staff, ongoing monitoring, and strict adherence to quality standards. Budgetary constraints may prevent smaller research institutes and up-and-coming biopharmaceutical firms from obtaining or creating high-quality biospecimen resources.

The tissue specimens category held the largest share in the Human Biospecimen market in 2025 driven by the growing need for superior solid tissue samples in translational, genomics, and cancer research. Particularly for cancer and uncommon disorders, tissue specimens are essential for comprehending disease mechanisms, finding biomarkers, and confirming therapeutic targets. The significance of well-preserved tissue samples with thorough clinical annotation has increased due to the growing use of cutting-edge methods like immunohistochemistry, spatial transcriptomics, and next-generation sequencing. Additionally, the need for a variety of tissue types that represent various disease stages and patient populations has increased due to the growth of precision medicine and personalized therapeutics.

In 2025, the Pharmaceutical and Biotechnology Companies category dominated the Human Biospecimen market fueled by the growing need for superior human samples to aid in precision medicine research, medication discovery, and biomarker identification. These businesses are depending more and more on well-characterized biospecimens to validate therapeutic targets, better understand disease mechanisms, and evaluate therapy response early in the development process. The need for diverse and clinically annotated samples is further accelerated by the increased attention being paid to oncology, rare disorders, and tailored medicines. Furthermore, increasing R&D expenditures, strategic partnerships with biobanks, and developments in molecular and genomic technologies are improving the use of biospecimens in preclinical and clinical pipelines.

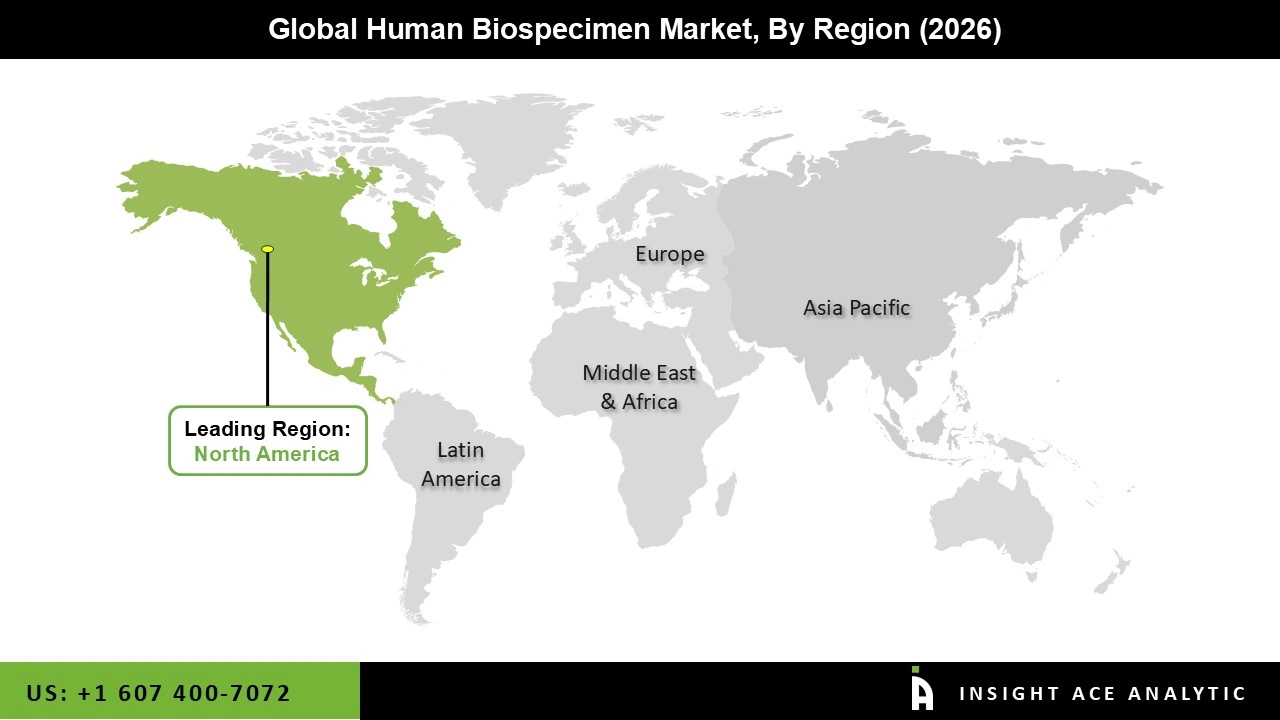

The Human Biospecimen market was dominated by North America region in 2025 because of its well-established biobanking networks, advanced healthcare infrastructure, and thriving biopharmaceutical industry. The gathering and preservation of human biospecimens for study are subject to strict laws and moral standards.

The expansion of the market in the area was supported by increased investments in biomedical research. Additionally, this region's market domination is fueled by its well-established infrastructure, which includes funding for innovative research and clearly defined laws. The market is dominated by the United States. There are significant market participants in the nation. Furthermore, the nation has a strong research infrastructure that fosters market expansion.

August 2025: Logical Biological and Bcell Design collaborated to create manufactured disease state plasma materials that mimic natural human biospecimens, guaranteeing high-performing and sustainable substitutes for research and diagnostic uses.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3,199.66 Mn |

| Revenue forecast in 2035 | USD 8,024.57 Mn |

| Growth Rate CAGR | CAGR of 8.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Specimen Type, Procurement Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BioIVT LLC., Crown Bioscience, iProcess Global Research Inc., ABS Bio, Inc., Precision Medicine Group, LLC, REPROCELL Inc., LifeNet Health LifeSciences, Logical Biological, Europa Biosite, Discovery Life Sciences, Boca Biolistics, LLC, ProteoGenex, US Biolab Corporation, Inc., Bay Biosciences, and Grifols, S.A. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.