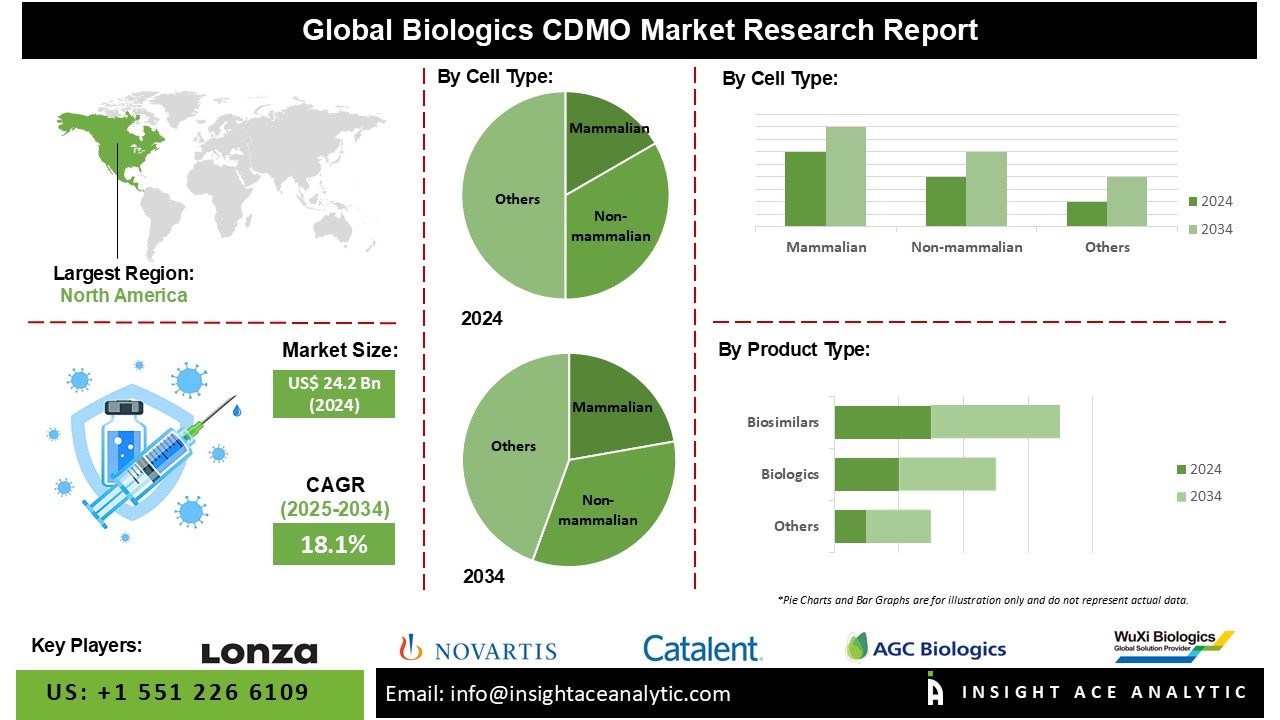

Biologics CDMO Market Size is valued at USD 24.2 Bn in 2024 and is predicted to reach USD 125.5 Bn by the year 2034 at a 18.1% CAGR during the forecast period for 2025 to 2034.

Biologics CDMO Market Size, Share & Trends Analysis Report By Cell Type (Mammalian, Non-mammalian), By Product Type (Biologics (Monoclonal Antibodies, Recombinant Proteins, Antisense and Molecular Therapy, Vaccines, Other Biologics, Biosimilars), By Region, And By Segment Forecasts, 2025 to 2034

Key Industry Insights & Findings from the report:

Biologics Contract Development and Manufacturing Organisations (CDMOs) are essential in developing and manufacturing biopharmaceuticals, also known as biologics. These organisations provide specialised services to biopharmaceutical businesses, assisting them from the early stages of drug discovery to commercial manufacturing. Several variables influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market's growth and development. These factors represent rising biologics demand, advances in biopharmaceutical technology, and the changing landscape of the pharmaceutical and biotechnology industry. The rising prevalence of complicated disorders, combined with the efficacy of biologics in treating various ailments, has increased the demand for biopharmaceuticals.

However, the COVID-19 pandemic has already had an impact on the pharmaceutical and biopharmaceutical industries, especially the Biologics CDMO (Contract Development and Manufacturing Organisation) market. The epidemic disrupted global supply chains, affecting raw materials and essential components used in biologics development. CDMOs encountered logistical, transportation, and procurement problems that hampered their ability to sustain flawless operations.

The Biologics CDMO Market is segmented on the basis of cell type and product type. According to cell type, the market is segmented as Mammalian and Non-mammalian. The product type segment includes Biologics and Biosimilars. By biologics, the market is segmented into monoclonal antibodies, recombinant proteins, antioxidant and molecular therapy, vaccines, and other biologics.

The Mammalian category is expected to hold a major share of the global Biologics CDMO Market in 2024. Various variables influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market for mammalian cell-based processes, reflecting the increasing demand for biologics manufactured utilising mammalian cell cultures. Mammalian cells are frequently utilised to produce complicated biopharmaceuticals (monoclonal antibodies and recombinant proteins).

The growing pipeline of biopharmaceuticals, particularly those involving large and complicated compounds, needs synthesis in mammalian cell cultures. CDMOs that specialise in mammalian cell-based processes are well-positioned to help with the development and production of these sophisticated therapies.

The monoclonal antibodies segment is likely to grow rapidly in the global Biologics CDMO Market. Several factors influence the Biologics Contract Development and Manufacturing Organisation (CDMO) market, focusing on monoclonal antibodies (mAbs), reflecting the increasing need for mAb-based therapeutics. Monoclonal antibodies are commonly utilised to treat cancer, autoimmune disorders, and infectious diseases and other similar diseases. The development of several monoclonal antibody platforms, including classic and next-generation formats, broadens therapeutic intervention choices.

The North American Biologics CDMO Market is expected to record the maximum market share in revenue in the near future due to the existence of two major economies, notably the United States and Canada. The United States has one of the world's largest pharmaceutical sectors, accounting for a sizable portion of market sales. The increasing prevalence of chronic diseases, population ageing, and the increased requirement for evidence-based practice are all factors that have contributed to the strong need for clinical trials in the United States.

In recent years, the location of clinical trials has migrated from academic medical centres to community-based practises to worldwide venues in various countries. Moreover, the Asia Pacific biopharmaceutical sector is expanding rapidly, owing to rising healthcare costs, the frequency of chronic diseases, and scientific developments. This expansion presents the potential for Biologics CDMOs to support biologics development and manufacture.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 24.2 Bn |

| Revenue Forecast In 2034 | USD 125.5 Bn |

| Growth Rate CAGR | CAGR of 18.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Cell Type, Product Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Boehringer Ingelheim Group, Lonza Group, Samsung Biologics, NOVARTIS AG, Toyobo Co. Limited, Parexel International Corporation, Catalent Inc., Binex Co. Limited, AGC Biologics, AbbVie Contract Manufacturing, JRS Pharma, Fujifilm Diosynth Biotechnologies USA Inc., Wuxi Biologics and Others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biologics CDMO Market By Cell Type-

Biologics CDMO Market By Product Type-

Biologics CDMO Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.