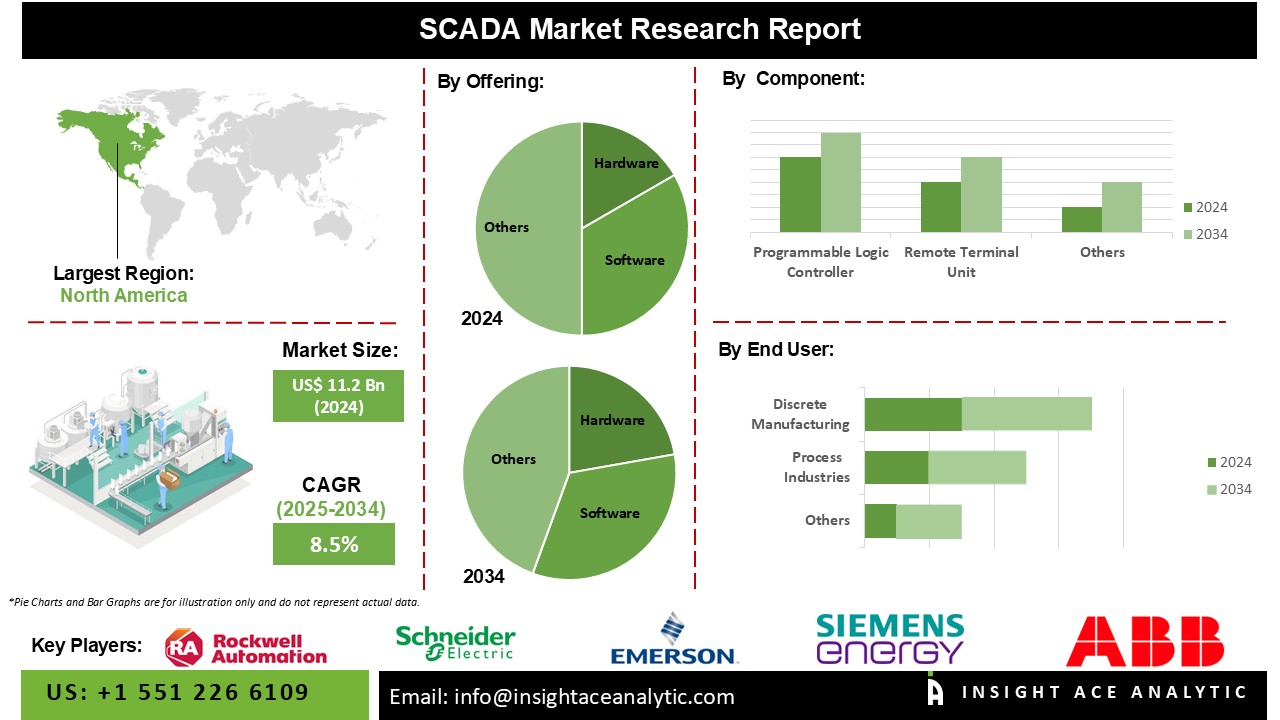

SCADA Market Size is valued at USD 11.2 billion in 2024 and is predicted to reach USD 25.0 billion by the year 2034 at a 8.5% CAGR during the forecast period for 2025-2034.

Tanks, generators, compressors and separators in an oil and gas plant are managed & controlled by a supervisory control and data acquisition (SCADA) system with the assistance of sensors distributed in a WSN. Using a WSN lowers the expenses involved in developing and deploying a sensor network and a communication network.

In comparison to wireless technology, wired technology is significantly more expensive because it necessitates the purchase of additional hardware, such as cables, routers, networking devices and network adapters. An industrial WSN measures and detects various characteristics, such as system pressure, temperature, flow, and level of systems, during in-plant operations. The usage of a WSN in a SCADA system allows for real-time data monitoring and control of processes.

The rising number of developments in wireless sensor networks, their noteworthy adoption in SCADA, and the use of 5G technology in industrial environments and big data analytics in SCADA systems have been extending profitable opportunities to the market players. Additionally, the growing preference for cloud-based over on-premises SCADA systems further expands the market reach. Wireless sensor networks are becoming increasingly popular (WSN). WSNs are employed in various industries, including oil & gas, water & wastewater treatment, and pharmaceuticals. In most cases, oil and gas facilities are located in distant places with challenging environmental conditions.

The SCADA market is segmented based on offering, component, and end-user. The offering segment includes hardware, software, and services. The component segment includes a programmable logic controller, remote terminal unit, and human-machine interface. By end-user, the market is segmented into process industries, discrete manufacturing, and utilities.

The market for inactivated vaccines is predicted to expand over the forecast period. Due to the increased use of RTU devices in various industrial processes, such as pressure tests and circulation pumps from a central location, to improve operational efficiency and control multiple methods, the remote terminal unit (RTU) segment has the most extensive supervisory control and data acquisition (SCADA) market size.

The market has been divided into three components based on offerings: software, hardware, and services. The growing need for services that offer data acquisition and supervisory automation control for end users with greater efficiency, increased dependability, and improved visibility is a crucial factor expediting the market's growth. The SCADA industry is anticipated to grow as a result of the rising demand for real-time data collection.

The Global SCADA Market is divided into four regions based on geography: North America, Europe, Asia Pacific, and the Rest of the World. In addition to other factors, North America has the most significant revenue share because of robust technological investment and stable power management. North America is anticipated to maintain its position as the world's largest economy during the anticipated period. Due to the rising demand for automation techniques in the oil and gas industry, Europe is anticipated to overtake North America as the second-largest revenue producer throughout the forecast period. The Asia-Pacific area is expected to expand significantly throughout the projection period, primarily due to increased government investment in automation for various industries.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 11.2 Bn |

| Revenue Forecast In 2034 | USD 25.0 Bn |

| Growth Rate CAGR | CAGR of 8.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, Component, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Rockwell Automation, Schneider Electric, Emerson Electric, Siemens, ABB, General Electric, Honeywell International, Omron, Yokogawa Electric, and others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Offering-

By Component-

By End-User-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.