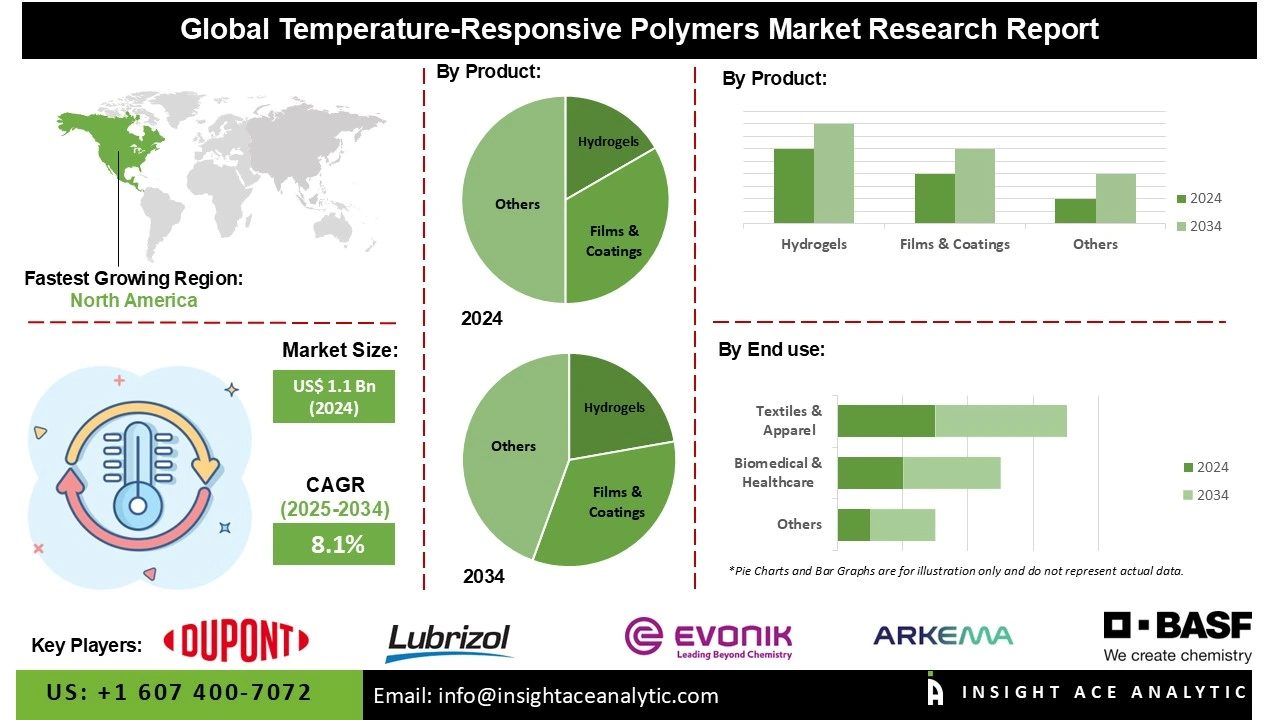

Global Temperature-Responsive Polymers Market Size is valued at US$ 1.1 Bn in 2024 and is predicted to reach US$ 2.3 Bn by the year 2034 at an 8.1% CAGR during the forecast period for 2025-2034.

Temperature-responsive polymers, sometimes referred to as thermoresponsive polymers, are perfect for drug delivery systems because they respond to temperature changes by changing their solubility, conformation, or viscosity. because poly(N-isopropylacrylamide) (PNIPAM) can change between hydrophilic and hydrophobic states at body temperature, it is frequently utilized in tissue engineering and controlled drug release.

Temperature-responsive polymers are utilized in smart packaging, controlled release of active ingredients, and formulation stabilization in products such as creams, lotions, and shampoos. The global market for temperature-responsive polymers is expanding due to the increasing demand for smart and stimuli-responsive materials in applications across the biomedical, drug delivery, and textile industries is driving market growth.

The expansion of the biotechnology and healthcare research sector is another element propelling the temperature-responsive polymers market. According to the journal Health Affairs, the average annual growth of National Health expenditures is expected to reach around 5.5% in year 2027 at U.S. However, high production and scale-up costs are some of the obstacles impeding the growth of the Temperature-responsive polymers sector. Over the course of the forecast period, opportunities for the temperature-responsive polymers market will be created by technological advancements and increasing research in smart materials.

Some of the Key Players in Temperature-Responsive Polymers Market:

· BASF SE

· DuPont

· The Lubrizol Corporation

· Evonik Industries AG

· Clariant AG

· Solvay S.A.

· Arkema

· Modern Polymers

· Shanghai Chemex

· CellSeed Inc.

· Matexcel

· Others

The temperature-responsive polymers market is segmented by product and end use. By product, the market is segmented hydrogels, films & coatings, fibers & textiles, additives & blends, and shape-memory components. By end use, the market is segmented into biomedical & healthcare, textiles & apparel, automotive & aerospace, electronics & consumer goods, and packaging & food.

The hydrogels segment led the temperature-responsive polymers market in 2024. Hydrogels are networks of three-dimensional polymers that react to temperature changes and are capable of absorbing and holding a lot of water. Volume phase transitions are common in temperature-responsive hydrogels; for example, they expand in water at lower temperatures and contract when heated above a particular threshold temperature. The growth of biomedical and healthcare applications, including targeted drug delivery, regenerative medicine, and smart wound care, is fueling the demand for hydrogels.

The biomedical & healthcare sector represents the largest and fastest-growing end-use segment, driven by the rising prevalence of chronic diseases, the increasing demand for precision therapies, and the advancement of minimally invasive treatment approaches. Growth is further supported by expanding investments in biocompatible materials and smart drug-delivery technologies. The adoption of temperature-responsive polymers that activate at physiological temperatures is also accelerating, as personalized medicine continues to gain traction and clinicians seek more controlled, patient-specific therapeutic outcomes.

North America dominated the temperature-responsive polymers market in 2024. The United States is at the forefront of this expansion. This is due to the high uptake of state-of-the-art biomedical technologies and a considerable focus on R&D. Innovation in temperature-responsive polymers for medication delivery, tissue scaffolds, and diagnostic devices is encouraged by the abundance of polymer research institutes and biotechnology centers, particularly in the United States. These polymers are used by pharmaceutical companies like Pfizer and Johnson & Johnson to create smart medical devices and controlled-release formulations, which help the industry grow.

The Asia-Pacific region is experiencing the strongest and fastest growth in the temperature-responsive polymers market, driven by rapid industrialization and increasing demand from the pharmaceutical, personal care, and biomedical sectors. Countries such as China, Japan, and India are investing heavily in R&D focused on smart materials and advanced polymer technologies, including hydrogels for drug delivery and temperature-sensitive coatings for cosmetic applications. Chinese pharmaceutical manufacturers, in particular, are adopting thermoresponsive polymers in controlled drug release systems to enhance therapeutic effectiveness. This combination of industrial expansion, innovation, and growing end-user demand continues to position Asia-Pacific as a key hub for market advancement.

Temperature-Responsive Polymers Market by Product

· Hydrogels

· Films & Coatings

· Fibers & Textiles

· Additives & Blends

· Shape-Memory Components

Temperature-Responsive Polymers Market by End Use

· Biomedical & Healthcare

· Textiles & Apparel

· Automotive & Aerospace

· Electronics & Consumer Goods

· Packaging & Food

Temperature-Responsive Polymers Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.