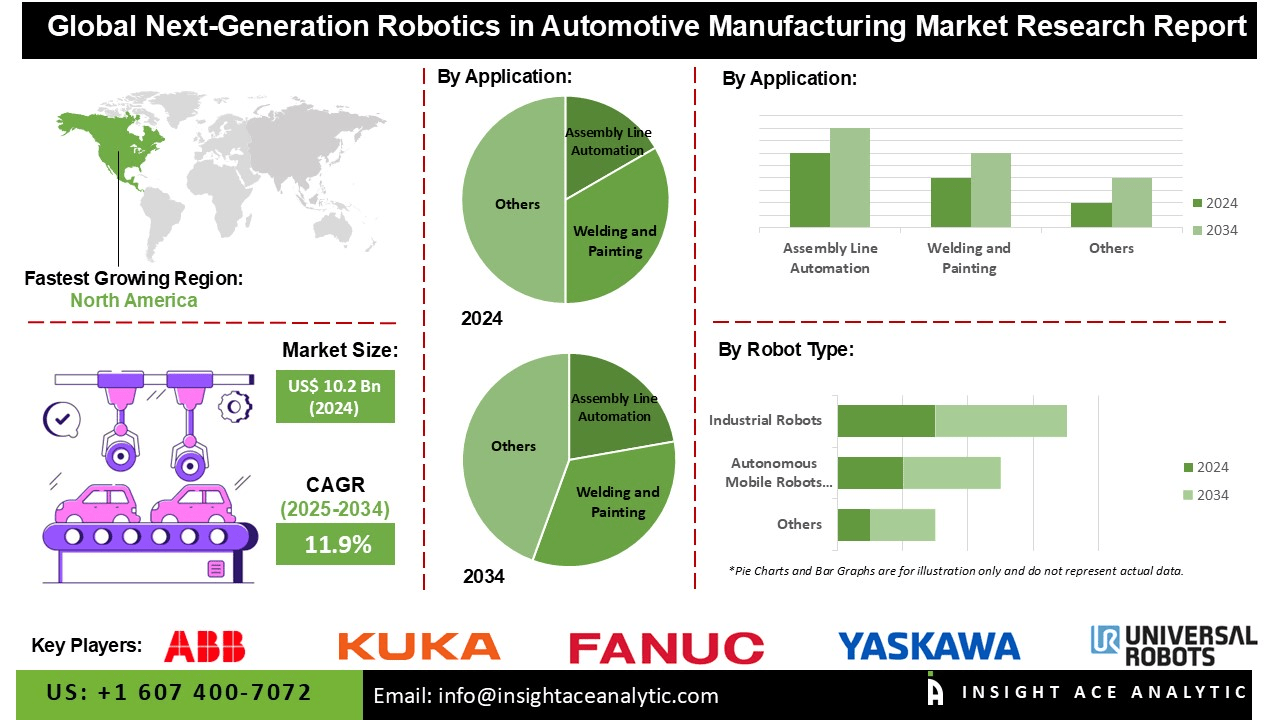

Next-Generation Robotics in Automotive Manufacturing Market Size is valued at US$ 10.2 Bn in 2024 and is predicted to reach US$ 30.1 Bn by the year 2034 at an 11.9% CAGR during the forecast period for 2025-2034.

Next-generation robotics play a role in welding, painting, assembly, material handling, and quality inspection within the automotive sector. Collaborative robots (cobots) can work beside humans safely as the human worker configures a part, or works on flexible assembly tasks. AI-enabled vision systems will scan and inspect automotive components and identify defects or assembly zone issues in real time.

Autonomous mobile robots (AMRs) can also assist with in-plant logistics and more efficiently move inventory around the plant. Robotics are also seeing greater applications in EV production for battery assembly, wiring, and precision handling of components. The global market for next-generation robotics in automotive manufacturing is expanding as the demand for automation, electric vehicles, flexible production, artificial intelligence integration, better efficiency, accuracy, safety, and the adoption of smart factories amidst Industry 4.0 increases.

The next-generation robotics in automotive manufacturing market is being driven by the increase in demand for automation and electric vehicles. Increase demand for automation and electric vehicles commands market growth due to advanced, flexible, and precise robotic systems for elaborate assembly, battery manufacture, and scalable, efficient automotive manufacturing processes are necessary. However, high upfront capital investment, the challenges of integration into existing technology , and the continued shortage of skilled workers are barriers facing the growth of the next-generation robotics in automotive manufacturing market. Over the forecast period, the next-generation robotics in automotive manufacturing market will experience opportunities for growth by technological advancements specifically in the area of collaborative robotics and autonomous systems.

Some of the Key Players in Next-Generation Robotics in Automotive Manufacturing Market:

· ABB

· KUKA AG

· FANUC America Corporation

· Yaskawa America, Inc.

· Universal Robots A/S

· Denso Robotics

· Kawasaki Heavy Industries, Ltd.

· Mitsubishi Electric Corporation

· Rockwell Automation

· Epson America, Inc.

· Boston Dynamics

· NVIDIA

· Hyundai Robotics

· Comau

The next-generation robotics in automotive manufacturing market is segmented by robot type, and application. By robot type, the market is segmented into autonomous mobile robots (AMRs), and industrial robots, and collaborative robots (Cobots). By application, the market is segmented into assembly line automation, welding and painting, and quality control and inspection.

The autonomous mobile robots (AMRs) segment led the next-generation robotics in automotive manufacturing market in 2024. This convergence is driven by their capacity to optimize in-plant logistics, transport materials, and perform just-in-time delivery along automotive assembly lines. In contrast with traditional automated guided vehicles (AGVs), AMRs maneuver in real-time through the production process leveraging AI and sensors, reduce reliance on human intervention, and are safer in the manufacturing plant.

Highly flexible, AMRs can be deployed in existing production layouts with little or no changes to the existing manufacturing infrastructure. AMRs will provide increased operational efficiency, decreased downtime, and enable scalable manufacturing – all of which are desirable when working with electric vehicle platforms and in high-mix production. Because of the growing need for a cost-effective, adaptable, and autonomous solution for materials handling, AMRs are becoming the preferred option for automotive manufacturers around the world.

Assembly Line Automation segment is dominate the market, because it meets the fundamental demands of automotive manufacturing by providing speed, precision, and consistency for high-volume production. Robotics integrated into the assembly lines can perform processes such as welding, painting, component fitting, and quality inspection with little errors, while also increasing throughput and decreasing labor costs.

Technology innovation including applications of AI, machine vision, and collaborative robots allow flexible, adaptive operations that can switch from building one vehicle model to another, and further, assist with the assembly of electric powertrains. The continuous demands for mass customization, faster production timelines, and compliance with the ever-strict regulatory demands for safety and quality are all factors driving the demand for robotics adoption into automotive assembly lines. Thus, automotive assembly line automation remains the mainstay of automotive robotics investment.

North America dominated the next-generation robotics in automotive manufacturing market in 2024. The United States is at the forefront of this expansion. This is due to sophisticated automotive infrastructure, initial acceptance of Industry 4.0 technologies, and high investment in AI and smart factory technologies. It has a strong presence of key automotive manufacturers, governmental incentive programs for automation, and established supply chain relationships to support larger scale implementation of intelligent robotics to increase productivity, accuracy, and safety throughout automotive manufacturing functions.

Moreover, the rapid industrialization, burgeoning automotive manufacturing, and increase in demand for electric vehicles in the Asia-Pacific area, the next-generation robotics in automotive manufacturing market is expanding at the strongest and fastest rate in this region. The acceptance of smart manufacturing has been aided by lower costs of robotics, supported by government incentives, and investment by international robotics players for quick automation. Rising labor costs and increasing need for efficient, flexible, and high-volume production lines will continue to drive market growth.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 10.2 Bn |

| Revenue Forecast In 2034 | USD 30.1 Bn |

| Growth Rate CAGR | CAGR of 11.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Robot Type, By Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | ABB, KUKA AG, FANUC America Corporation, Yaskawa America, Inc., Universal Robots A/S, Denso Robotics, Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, Rockwell Automation, Epson America, Inc., Boston Dynamics, NVIDIA, Hyundai Robotics, and Comau. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-Generation Robotics in Automotive Manufacturing Market by Robot Type-

· Autonomous Mobile Robots (AMRs)

· Industrial Robots

· Collaborative Robots (Cobots)

Next-Generation Robotics in Automotive Manufacturing Market by Application-

· Assembly Line Automation

· Welding and Painting

· Quality Control and Inspection

Next-Generation Robotics in Automotive Manufacturing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.