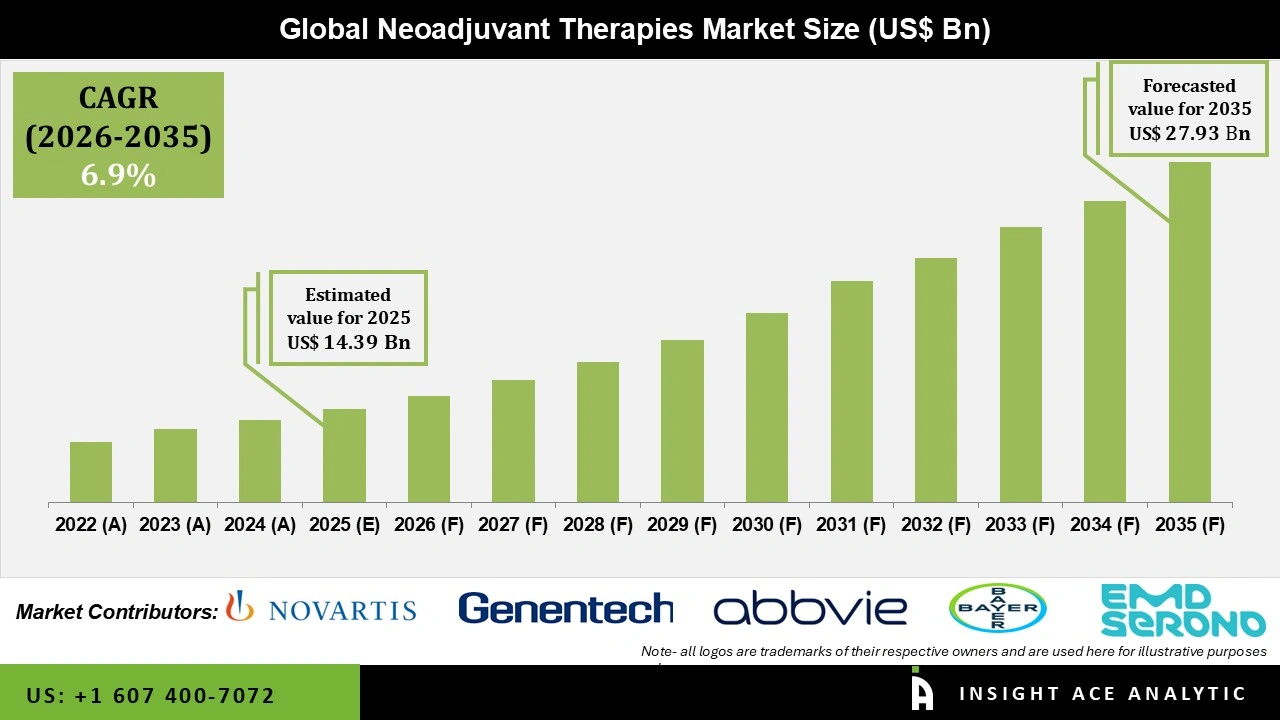

Global Neoadjuvant Therapies Market Size is valued at USD 14.39 Bn in 2025 and is predicted to reach USD 27.93 Bn by the year 2035 at a 6.9% CAGR during the forecast period for 2026 to 2035.

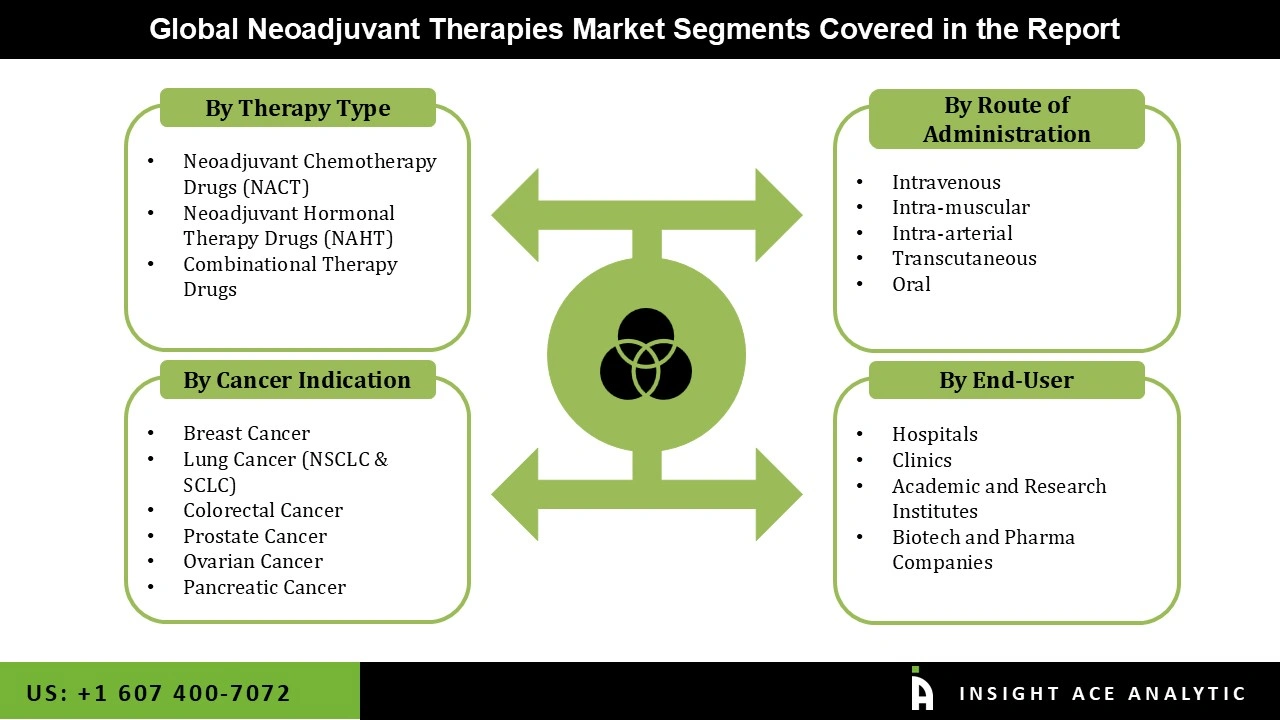

Neoadjuvant Therapies Market Size, Share & Trends Analysis Distribution by Type (Neoadjuvant Hormonal Therapy Drugs (NAHT), Neoadjuvant Chemotherapy Drugs (NACT), and Combinational Therapy Drugs), Route of Administration (Oral, Intravenous, Intra-muscular, Intra-arterial, and Transcutaneous), Indication (Lung Cancer (NSCLC & SCLC), Breast Cancer, Ovarian Cancer, Colorectal Cancer, Pancreatic Cancer, and Prostate Cancer), End-user (Hospitals, Clinics, Biotech and Pharma Companies, Academic and Research Institutes), and Segment Forecasts, 2026 to 2035.

Neoadjuvant therapies are treatments administered before the primary intervention most often surgery to shrink tumors, downstage the disease, and improve the chances of successful surgical removal. In oncology, they are commonly used to make tumors smaller and more operable, increase the likelihood of complete resection with clear margins, and sometimes enable less invasive procedures (such as breast-conserving surgery instead of mastectomy). Depending on the cancer type, stage, and molecular characteristics, neoadjuvant approaches may include chemotherapy, radiation therapy, targeted therapies, immunotherapy, hormone therapy, or combinations of these.

Beyond reducing tumour size, neoadjuvant treatment serves as a real-time biological test: the degree of tumour response observed at surgery (complete, partial, or minimal pathological response) provides important prognostic information and often guides decisions about the type and intensity of subsequent adjuvant therapy. This sequencing strategy has become standard care in several solid tumors—particularly breast cancer, rectal cancer, esophageal cancer, gastric cancer, head and neck cancers, and selected cases of non-small cell lung cancer and bladder cancer—where clinical trials have shown benefits in local control, reduced risk of distant recurrence, and, in some settings, improved overall survival compared with immediate surgery alone.

The healthcare professionals are increasingly using neoadjuvant therapy options to decrease tumours, enhance surgical results, and lower recurrence rates as the incidence of solid tumours, including breast, lung, colorectal, and others, continues to grow. Neoadjuvant therapies' capacity to evaluate tumour response before surgery facilitates more individualised treatment planning by enabling physicians to adjust postoperative tactics in response to pathological response. Additionally, improvements in immunotherapies and targeted therapies have markedly increased pathological full response rates, boosting oncologists' trust in preoperative treatment plans and hastening their incorporation into accepted clinical practices. Furthermore, the market for neoadjuvant therapies is being driven by research and development efforts for the treatment of breast cancer.

Furthermore, the neoadjuvant therapies market is being supported by the increasing trend toward precision medicine and biomarker-driven therapy selection. Accurate determination of hormone receptor status, HER2 expression, and genetic alterations is made possible by improved diagnostic technology and molecular testing, which aid in customising neoadjuvant regimens for particular patient groups. Pharmaceutical firms' growing investments in R&D, combined with a robust pipeline of combination medicines that include immunotherapy, chemotherapy, and hormonal drugs, are enabling more therapeutic options in the pre-surgical context. Moreover, the global neoadjuvant therapies market is also growing steadily due to factors such as improved access to oncology care, increased awareness of early cancer detection, and growing healthcare infrastructure, especially through advanced hospital networks and specialised cancer centres.

Driver

Growing Use of Neoadjuvant Regimens Based on Immunotherapy

The growing use of immunotherapy and targeted medicines in pre-operative cancer treatment regimens is a key factor propelling the neoadjuvant therapies market. With the advent of immune checkpoint inhibitors like PD-1 and PD-L1 inhibitors, which have shown enhanced pathological complete response (pCR) rates in malignancies including breast, lung, and melanoma, the neoadjuvant setting which has historically been dominated by chemotherapy has quickly changed. In addition to reducing tumor size prior to surgery, these treatments also boost systemic immune responses, which may lower the chance of recurrence. Updated clinical guidelines and increased regulatory authorization for neoadjuvant usage in particular cancer subtypes are the results of their clinical trial success. Additionally, with oncology moving more and more toward precision medicine and biomarker-based treatment choices, drug companies are making significant investments in combination regimens that improve efficacy while preserving controllable safety profiles.

Restrain/Challenge

High Medical Care and Limited Access

The high expense of combination regimens and advanced biologics is a major barrier to the neoadjuvant therapies market. Because of the extensive clinical trials, complicated research processes, and biologic manufacturing requirements, immunotherapies and targeted medications utilized in the neoadjuvant setting are frequently costly. Together with chemotherapy or other targeted treatments, the total cost of treatment rises significantly, burdening individuals and healthcare systems financially. Additionally, the patients' access to these cutting-edge treatments is hampered in many low- and middle-income nations by inadequate healthcare infrastructure and limited reimbursement coverage. The adoption may be delayed, even in developed nations, by payer examination of cost-effectiveness and long-term results.

The Neoadjuvant Hormonal Therapy Drugs (NAHT) category held the largest share in the Neoadjuvant Therapies market in 2025, motivated by its known involvement in malignancies that are hormone receptor-positive, especially those of the breast and prostate. NAHT is frequently utilised to reduce tumour size before surgery in individuals with androgen-sensitive or estrogen receptor (ER)-positive tumours, allowing for breast-conserving surgery and enhancing surgical results. Additionally, growing knowledge of biomarker-driven treatment selection and developments in endocrine therapy combinations, including the combination of hormonal drugs with CDK4/6 inhibitors, are enhancing clinical efficacy and broadening indications in the neoadjuvant context.

In 2025, the breast cancer category dominated the Neoadjuvant Therapies market. Since hormonal neoadjuvants (like tamoxifen and aromatase inhibitors), chemotherapy, and HER2-targeted treatments (like trastuzumab and pertuzumab) are so widely used, neoadjuvant therapies are particularly crucial in breast cancer. The neoadjuvant therapies have been demonstrated to increase overall survival and lower the chance of recurrence in early-stage, hormone receptor-positive breast cancers. Additionally, the neoadjuvant therapies market is expanding due to increased molecular subtyping, widespread breast cancer incidence, and easier access to genetic testing.

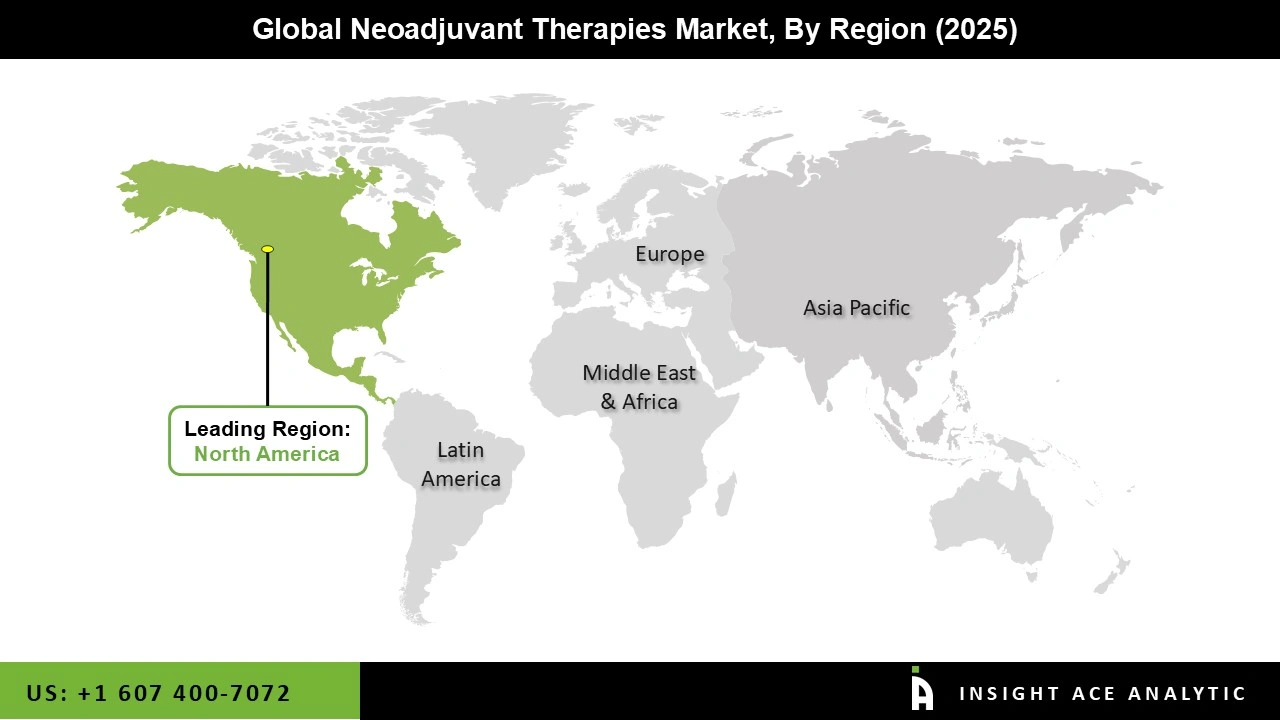

The Neoadjuvant Therapies market was dominated by the North America region in 2025 because top cancer centres have strongly adopted immuno-oncology and targeted medicines in their clinical practice. The United States has the largest use of neoadjuvant therapies due to its highly developed oncology infrastructure, advantageous payment policies, and easy access to FDA-approved medications.

Further increasing utilization rates are the ongoing trials for colorectal, lung, and breast malignancies that are being launched by major clinical research networks and oncology groups. Early intervention treatments are still being driven by rising rates of breast cancer and non-small cell lung cancer, while the commercialization of immune checkpoint inhibitors is boosting U.S. product sales. In addition, over the next several years, it is anticipated that ongoing government screening initiatives, particularly for breast and colorectal cancer, will raise early detection rates and hence enhance the uptake of neoadjuvant therapies.

• December 2025 : TABOSUN® and TYVY®, the world's first dual-immune-oncology neoadjuvant therapy, were licensed in China for patients with MSI-H/dMMR colon cancer. This marked a major improvement in pre-surgical treatment choices for this patient population.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 14.39 Bn |

| Revenue forecast in 2035 | USD 27.93 Bn |

| Growth Rate CAGR | CAGR of 6.90% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Route of Administration, Indication, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia; |

| Competitive Landscape | Novartis AG, Eli Lilly and Company, Merck & Co., Genentech, Inc., AbbVie Inc., EMD Serono, Inc., Bayer AG, Agios Pharmaceuticals, Inc., Bristol-Myers Squibb Company, Taiho Pharmaceutical Co., Ltd., and Janssen Pharmaceutical Companies |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.