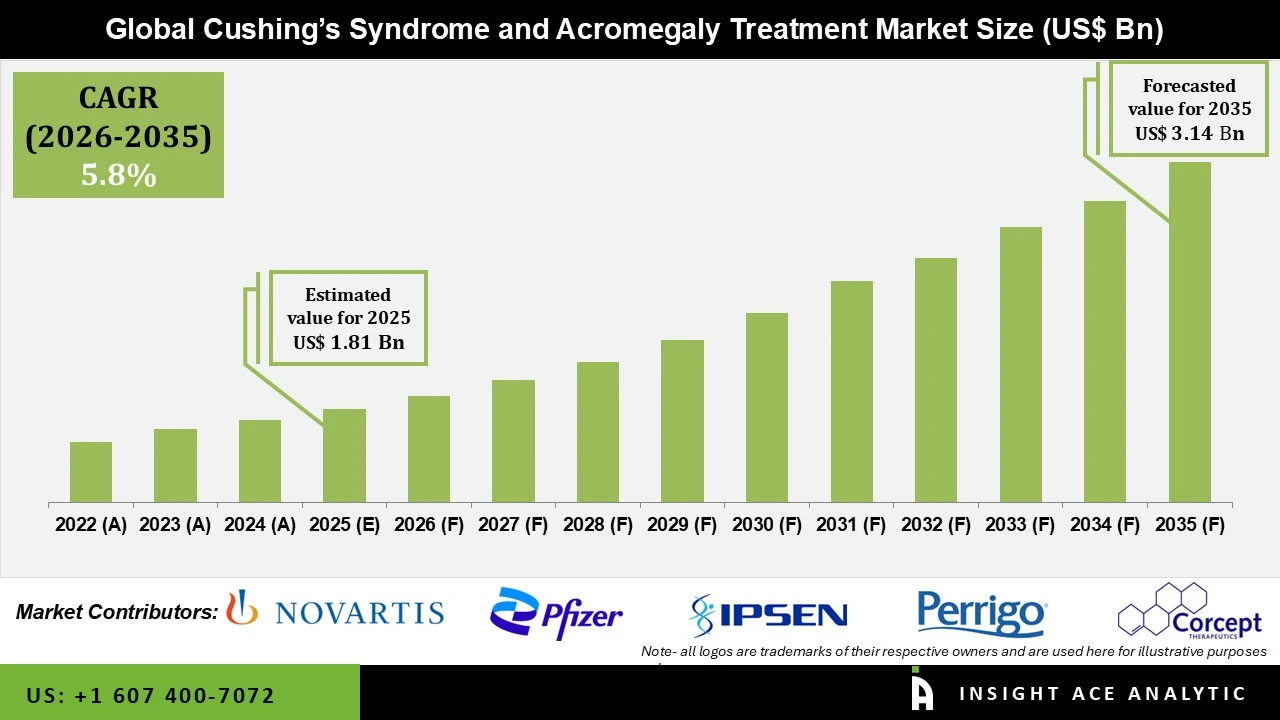

Cushings Syndrome and Acromegaly Treatment Market Size is valued at USD 1.81 Bn in 2025 and is predicted to reach USD 3.14 Bn by the year 2035 at a 5.8% CAGR during the forecast period for 2026 to 2035.

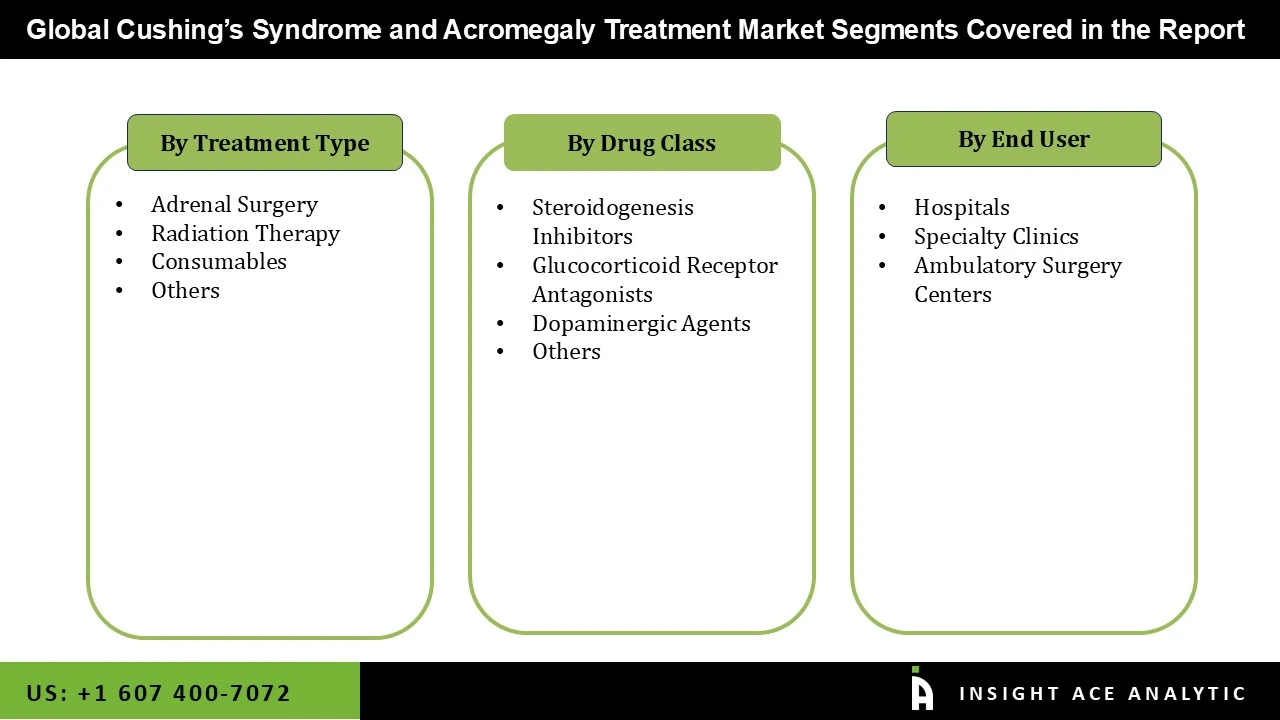

Cushings Syndrome and Acromegaly Treatment Market Size, Share & Trends Analysis Distribution by Drug Class (Dopaminergic Agents, Glucocorticoid Receptor Antagonists, Steroidogenesis Inhibitors, and Others), Treatment Type (Radiation Therapy, Adrenal Surgery, Consumables, and Others), End-user (Hospitals, Specialty Clinics, and Ambulatory Surgery Centers), and Segment Forecasts, 2026 to 2035

Cushing's syndrome and acromegaly are rare but serious endocrine disorders caused by excessive hormone production from the pituitary or adrenal glands. Cushing's syndrome results from prolonged high cortisol levels, most often due to pituitary adenomas (Cushing's disease), adrenal tumors, or long-term cortico steroid use, while acromegaly stems from excess growth hormone, almost always from a benign pituitary tumor after puberty. Both conditions lead to significant morbidity, including diabetes, hypertension, cardiovascular disease, osteoporosis, joint pain, and profound physical changes (moon face, central obesity, and skin thinning in Cushing's; enlarged hands, feet, jaw, and forehead in acromegaly).

Diagnosis relies on hormone level testing (cortisol, ACTH, growth hormone, IGF-1), suppression/stimulation tests, and imaging (MRI/CT), while treatment typically involves surgery (transsphenoidal pituitary resection or adrenalectomy), radiotherapy, and medical therapies (e.g., pasireotide, cabergoline, ketoconazole for Cushing's; somatostatin analogs like octreotide/lanreotide, pegvisomant, or dopamine agonists for acromegaly) to normalize hormone levels, control symptoms, and prevent complications. Early intervention is critical to improving quality of life and reducing long-term risks.

The growing awareness of Cushing's syndrome and acromegaly, and early diagnosis are the main factors propelling the market growth. Additionally, there is a greater need for therapeutic options because the aging population is more susceptible to hormonal abnormalities. The treatment methods have also changed as a result of novel medication therapy. For instance, growth hormone receptor antagonists and somatostatin analogs are causing a stir in the treatment of achromegaly. Furthermore, the improving investments from pharmaceutical companies seeking to create successful therapeutics are also supporting the Cushing's syndrome and acromegaly treatment market, propelling growth and improving patient treatment options.

In addition, improvements in diagnostic techniques make it possible to identify these disorders early, which promotes timely treatment initiation and improved patient outcomes. The expanding awareness initiatives also help to expand the Cushing's syndrome and acromegaly treatment market, enabling patients to get prompt medical care. New medicinal substances and technology developments are being introduced to the market, giving patients more treatment options and increasing treatment efficacy. Additionally, it is anticipated that new developments like precision medicine and combination therapy adoption will influence the Cushing's syndrome and acromegaly treatment market environment by better meeting the demands of individual patients and handling complicated cases.

• Novartis AG

• Ipsen Biopharmaceuticals, Inc.

• Perrigo Company plc

• Pfizer

• Corcept Therapeutics, Inc.

• ESTEVE

• Crinetics Pharmaceuticals, Inc.

• Sparrow Pharmaceuticals

• Xeris Pharmaceuticals, Inc.

• SteroTherapeutics

• Recordati Rare Diseases

• Others

One of the main factors propelling the growth of the Cushing's syndrome and acromegaly treatment market is the rising prevalence and better identification rates of these conditions. According to the American Association of Neurological Surgeons, for instance, 10–15 million people are impacted annually. More than 70% of instances of Cushing's disease in adults and roughly 60% to 70% of cases in children and adolescents are caused by pituitary adenomas. About 70% of all occurrences of Cushing's syndrome are in females, and the condition primarily affects adults between the ages of 20 and 50.

Despite the fact that these illnesses are considered rare endocrine disorders, increased awareness among medical professionals, improved availability to diagnostic imaging, and improved biochemical testing techniques have all contributed to a progressive increase in their reported occurrence. Additionally, the number of patients who can be treated has also increased due to the growing weight of associated risk factors, such as higher rates of pituitary tumor diagnosis and increased usage of long-term corticosteroid therapy. The demand for cutting-edge pharmaceutical treatments, surgical operations, and supporting therapies rises in tandem with rising diagnosis rates and the number of patients receiving ongoing monitoring and long-term care, which supports market expansion overall.

The high expense of long-term care in conjunction with the very limited patient base is a major barrier in Cushing's syndrome and acromegaly treatment market. Treatments for these disorders frequently entail ongoing hormone monitoring, specialist biologics, and surgery, which raises the cost of healthcare significantly. Due to the rarity of both conditions, there is a small patient base, which limits widespread commercialization and lowers manufacturer economies of scale. Additionally, the lack of endocrinologists and sophisticated diagnostic equipment in developing nations can postpone diagnosis and the start of treatment. Problems with reimbursement and affordability, especially in low- and middle-income nations, further impede the broad use of cutting-edge treatments, which limits the growth of the Cushing's syndrome and acromegaly treatment market.

The Adrenal Surgery category held the largest share in the Cushings Syndrome and Acromegaly Treatment market in 2025 propelled by the extensive clinical application of adrenalectomy, which provides quick and long-lasting cortisol stabilization and is the only effective treatment for adrenal-dependent Cushing's syndrome. Broad adoption across tertiary endocrine and surgical facilities is supported by its capacity to provide long-lasting hormone management, lower long-term problems, and deliver excellent cure rates. Its therapeutic appeal is further strengthened by ongoing developments in minimally invasive adrenal surgery, the growing availability of laparoscopic and robotic methods, and robust guideline recommendations. The dominance of adrenal surgery in the treatment of Cushing's syndrome worldwide is being further supported by increased perioperative safety data, growing surgical infrastructure, and rising diagnosis of adrenal tumors.

The Hospitals Segment is Growing at the Highest Rate in the Cushings Syndrome and Acromegaly Treatment Market

In 2025, the hospitals category dominated the Cushings Syndrome and Acromegaly Treatment market mainly due to a variety of operations and diagnostic procedures carried out in these facilities. The dominance of this segment is further evidenced by its control over this industry as a whole, as well as by its access to highly qualified surgeons and sophisticated diagnostic facilities. Additionally, strong hospital-based demand is influenced by multidisciplinary teams comprising neurosurgeons and endocrinologists, high patient inflow, and the integration of cutting-edge imaging and interventional technology. Furthermore, hospitals also have a major role in managing hormone regulation, screening for rare diseases, and conducting clinical studies to assess next-generation targeted treatments.

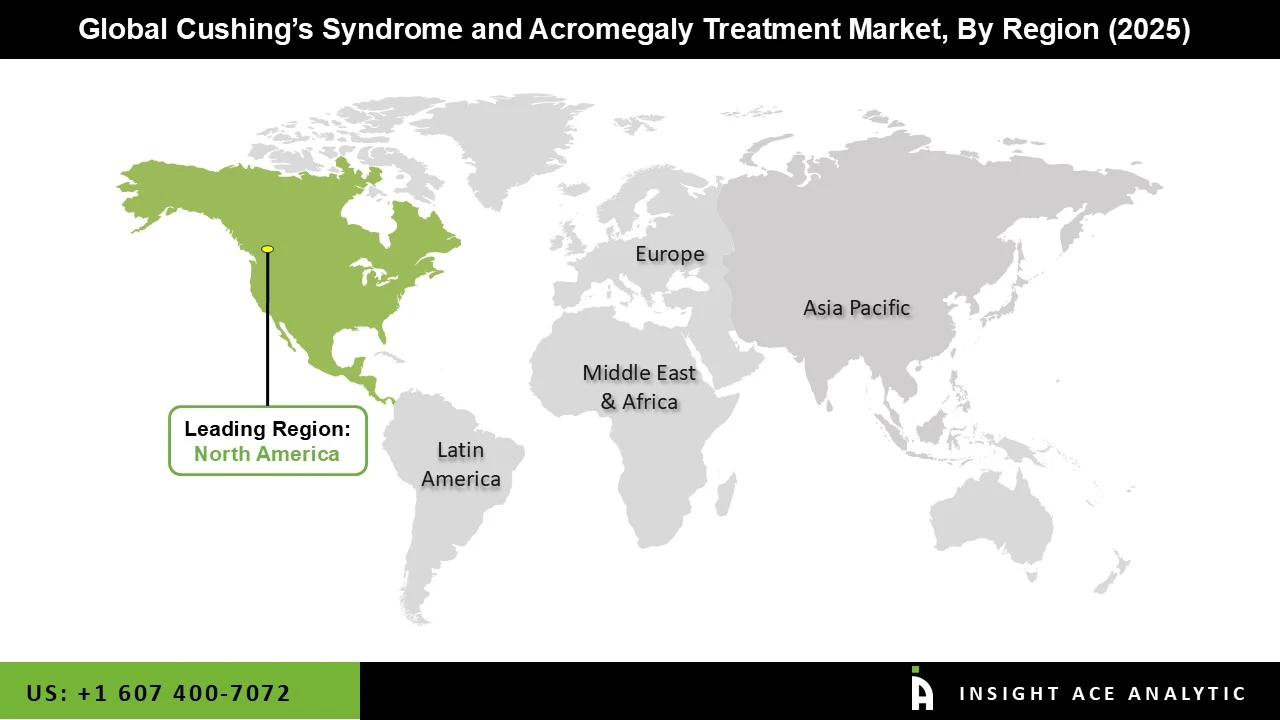

The Cushings Syndrome and Acromegaly Treatment market was dominated by North America region in 2025 driven by its robust endocrine disease management programs, sophisticated healthcare infrastructure, and extensive use of GH-receptor antagonists, steroidogenesis inhibitors, somatostatin analogs, and other tailored hormonal treatments. Due to the FDA's frequent approvals of new endocrine therapies, the existence of major biopharmaceutical producers, and the widespread partnerships between university research institutions, pituitary centers, and specialty hospitals, the United States leads the region. Additionally, the area benefits from robust reimbursement programs for uncommon endocrine disorders, a high preference among clinicians for advanced cortisol-lowering medications and long-acting hormonal injectables, and a growing uptake of next-generation oral medicines.

Furthermore, growing neuroendocrinology research centers and increased public awareness of pituitary tumor-related consequences are solidifying North America's long-term dominance in the global Cushing's syndrome and acromegaly treatment market.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 1.81 Bn |

| Revenue forecast in 2035 | USD 3.14 Bn |

| Growth Rate CAGR | CAGR of 5.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Drug Class, Treatment Type, Treatment Duration, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Novartis AG, Ipsen Biopharmaceuticals, Inc., Perrigo Company plc, Pfizer, Corcept Therapeutics, Inc., ESTEVE, Crinetics Pharmaceuticals, Inc., Sparrow Pharmaceuticals, Xeris Pharmaceuticals, Inc., SteroTherapeutics, Recordati Rare Diseases, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Dopaminergic Agents

• Glucocorticoid Receptor Antagonists

• Steroidogenesis Inhibitors

• Others

• Radiation Therapy

• Adrenal Surgery

• Consumables

• Others

• Hospitals

• Specialty Clinics

• Ambulatory Surgery Centers

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.